This version of the form is not currently in use and is provided for reference only. Download this version of

Form E-588A

for the current year.

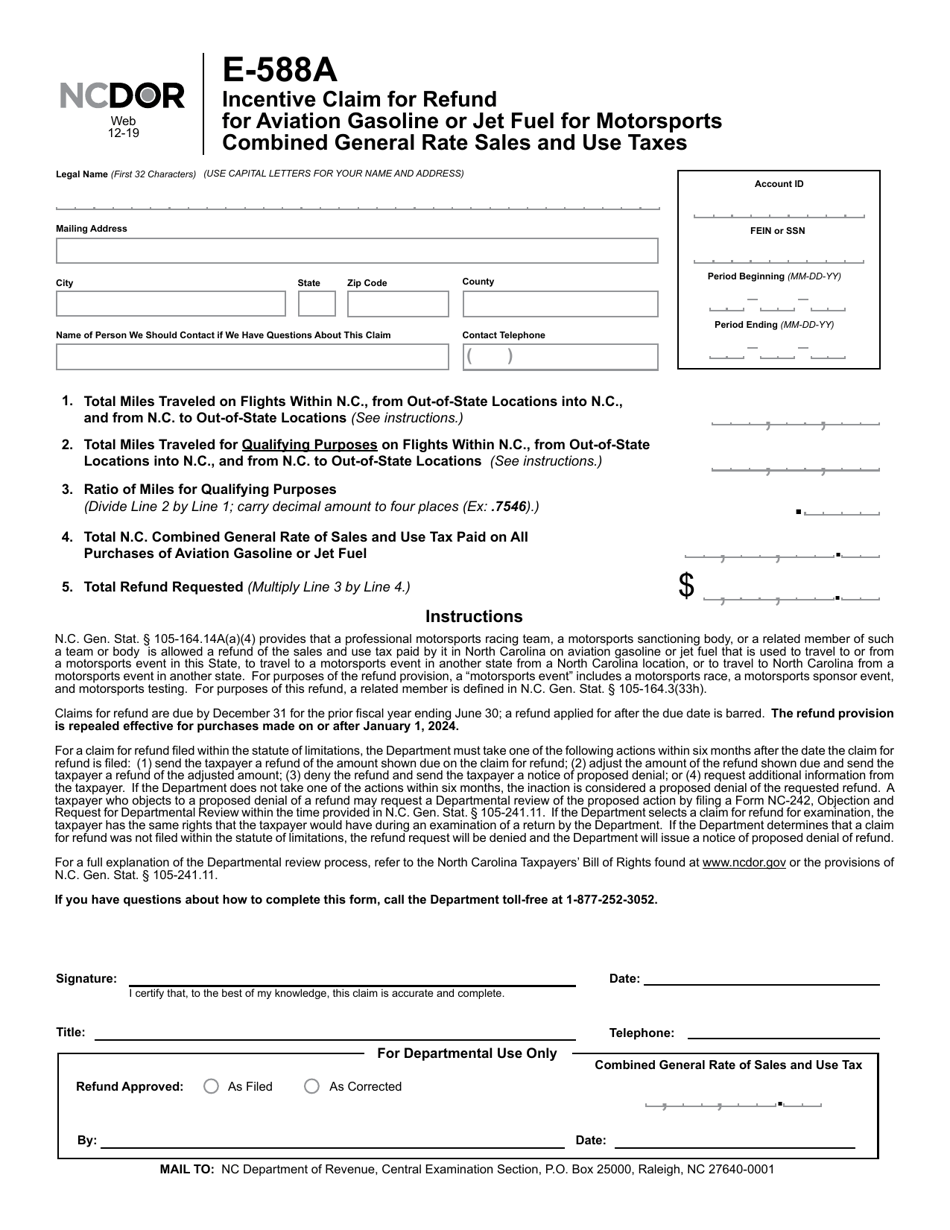

Form E-588A Incentive Claim for Refund for Aviation Gasoline or Jet Fuel for Motorsports Combined General Rate Sales and Use Taxes - North Carolina

What Is Form E-588A?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-588A?

A: Form E-588A is a specific form used in North Carolina to claim a refund for sales and use taxes paid on aviation gasoline or jet fuel for motorsports.

Q: Who can use Form E-588A?

A: Individuals or businesses involved in the motorsports industry in North Carolina can use Form E-588A to claim a refund for sales and use taxes paid on aviation gasoline or jet fuel.

Q: What is the purpose of Form E-588A?

A: The purpose of Form E-588A is to provide a way for individuals or businesses in the motorsports industry to receive a refund for sales and use taxes paid on aviation gasoline or jet fuel used for activities related to motorsports.

Q: What are the general rate sales and use taxes in North Carolina?

A: The general rate sales and use taxes in North Carolina refer to the standard sales and use tax rates applicable to most taxable transactions in the state.

Q: Is Form E-588A specific to North Carolina?

A: Yes, Form E-588A is specific to North Carolina and cannot be used in other states.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-588A by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.