This version of the form is not currently in use and is provided for reference only. Download this version of

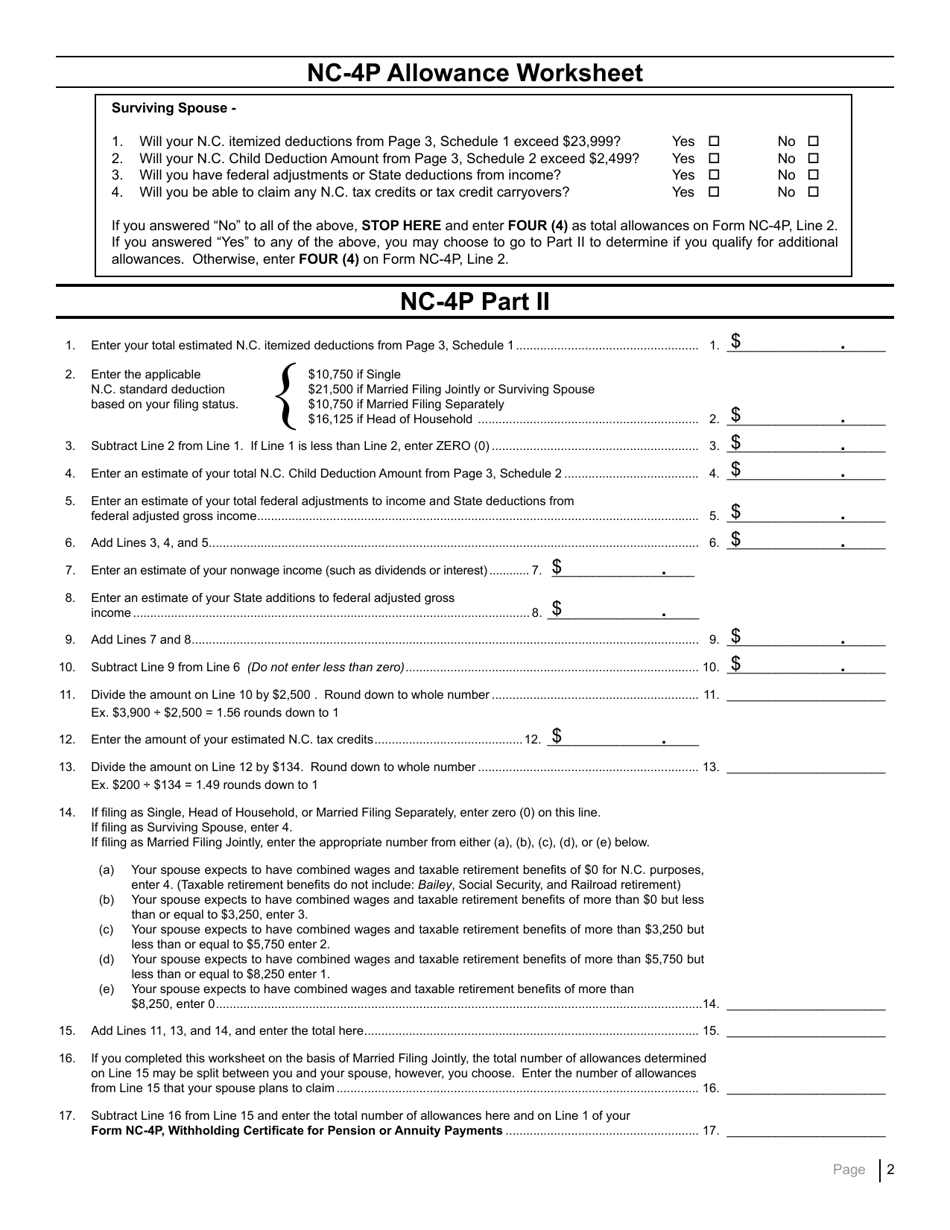

Form NC-4P

for the current year.

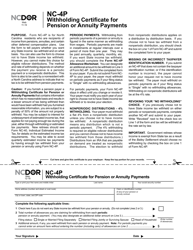

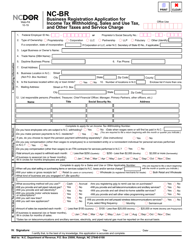

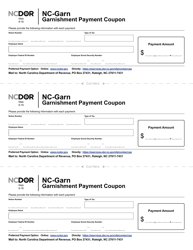

Form NC-4P Withholding Certificate for Pension or Annuity Payments - North Carolina

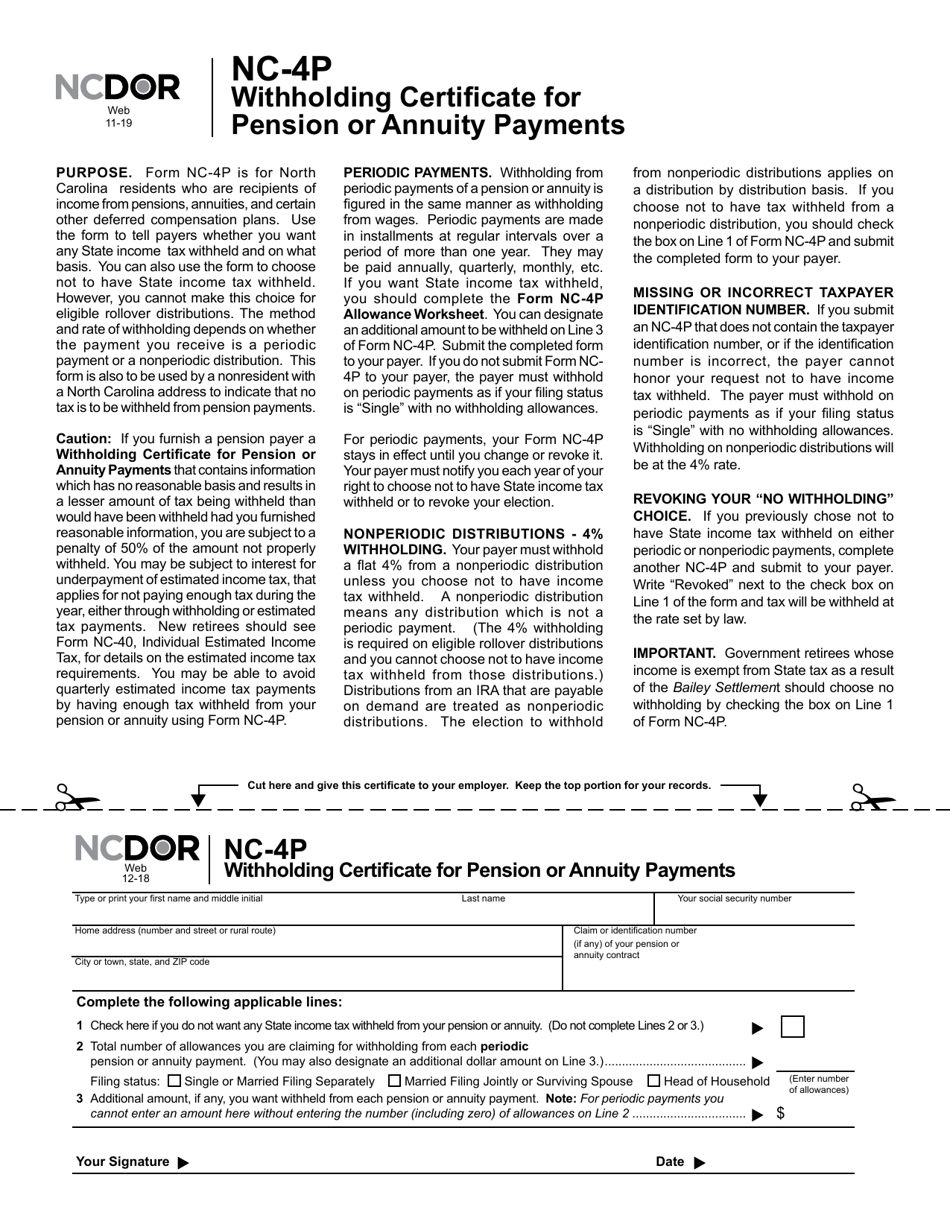

What Is Form NC-4P?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-4P?

A: Form NC-4P is a withholding certificate used for pension or annuity payments in North Carolina.

Q: Who needs to file Form NC-4P?

A: Individuals receiving pension or annuity payments in North Carolina may need to file Form NC-4P.

Q: What is the purpose of Form NC-4P?

A: The purpose of Form NC-4P is to determine the appropriate amount of income tax withholding for pension or annuity payments.

Q: Do I need to file Form NC-4P every year?

A: You may need to file Form NC-4P every year if there are changes to your income tax withholding status or if requested by the payer of your pension or annuity.

Q: When should I file Form NC-4P?

A: Form NC-4P should be filed as soon as possible after you begin receiving pension or annuity payments, or when changes to your income tax withholding status occur.

Q: Are there any penalties for not filing Form NC-4P?

A: Failure to file Form NC-4P could result in under-withholding of income taxes and may be subject to penalties and interest.

Q: Is Form NC-4P only for residents of North Carolina?

A: No, Form NC-4P is used by both residents and non-residents of North Carolina who receive pension or annuity payments in the state.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-4P by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.