This version of the form is not currently in use and is provided for reference only. Download this version of

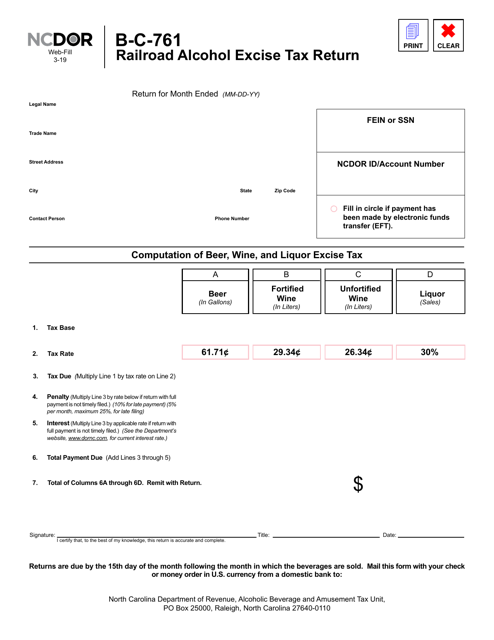

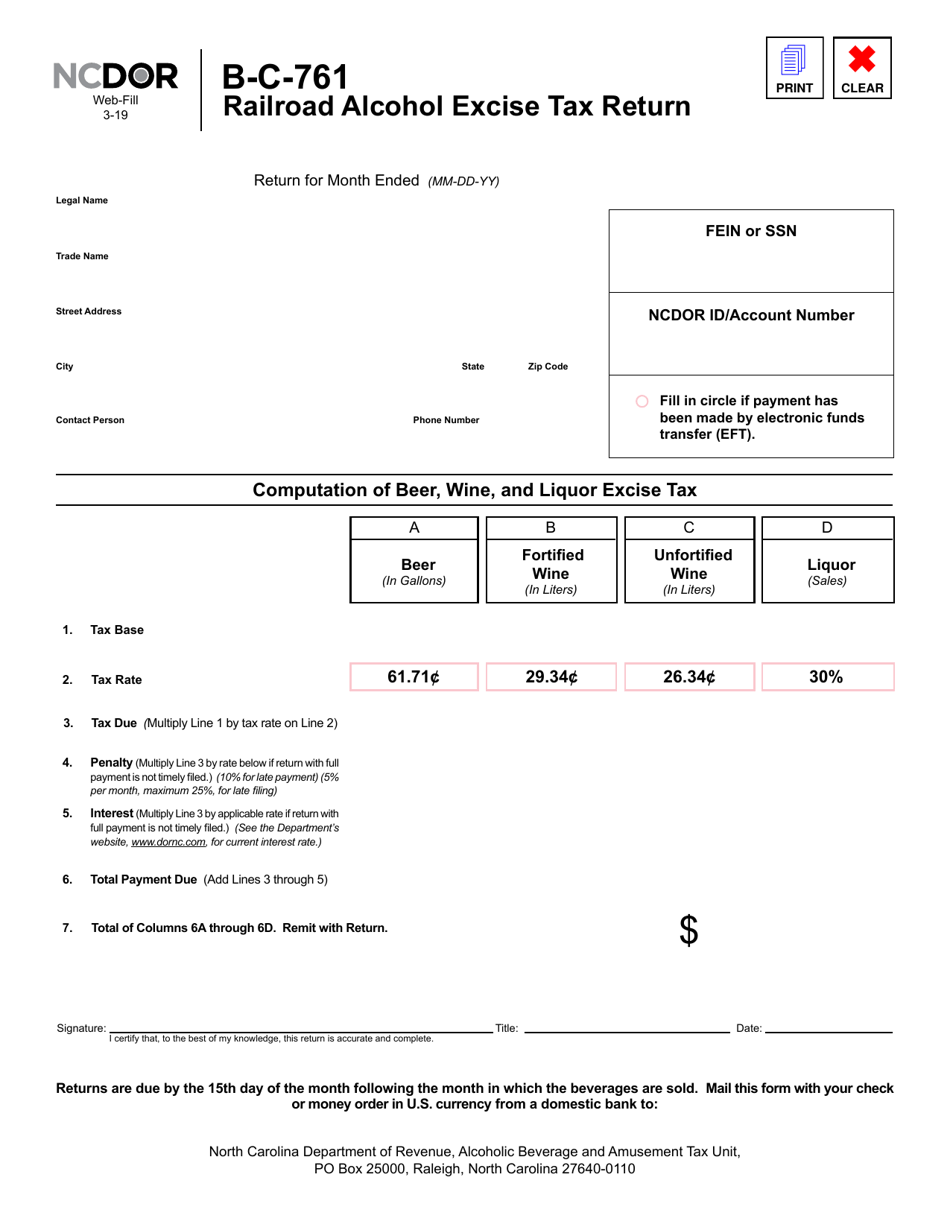

Form B-C-761

for the current year.

Form B-C-761 Railroad Alcohol Excise Tax Return - North Carolina

What Is Form B-C-761?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form B-C-761?

A: The Form B-C-761 is a Railroad Alcohol Excise Tax Return used in North Carolina.

Q: Who needs to file the Form B-C-761?

A: Railroad companies operating in North Carolina need to file the Form B-C-761.

Q: What is the purpose of the Form B-C-761?

A: The Form B-C-761 is used to report and pay alcohol excise taxes collected on railroad operations in North Carolina.

Q: When is the Form B-C-761 due?

A: The Form B-C-761 is due on a monthly basis, with the deadline falling on the 20th day of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing of the Form B-C-761?

A: Yes, there may be penalties for late or incorrect filing of the Form B-C-761. It is important to accurately report and submit the taxes on time.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B-C-761 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.