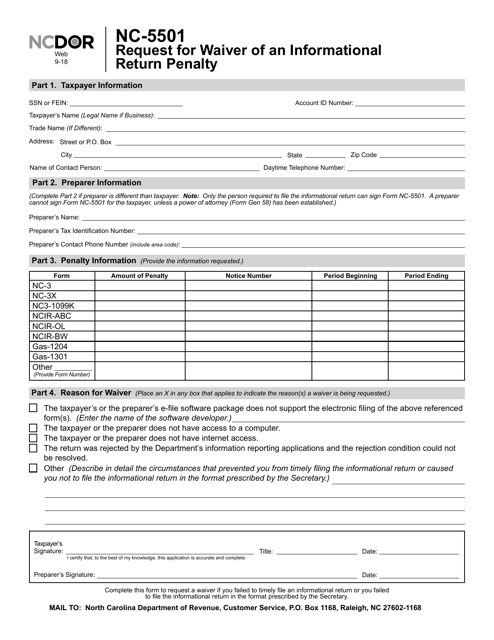

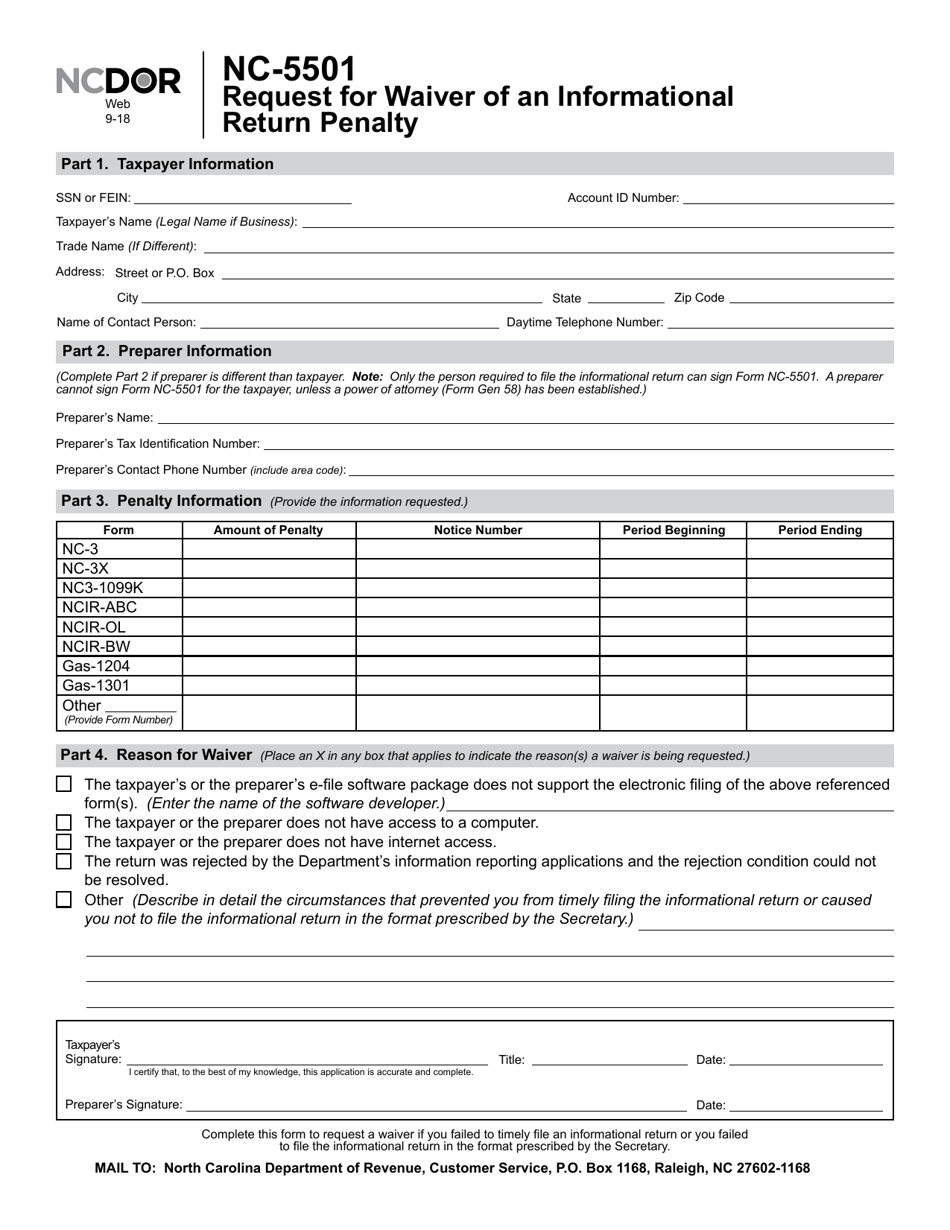

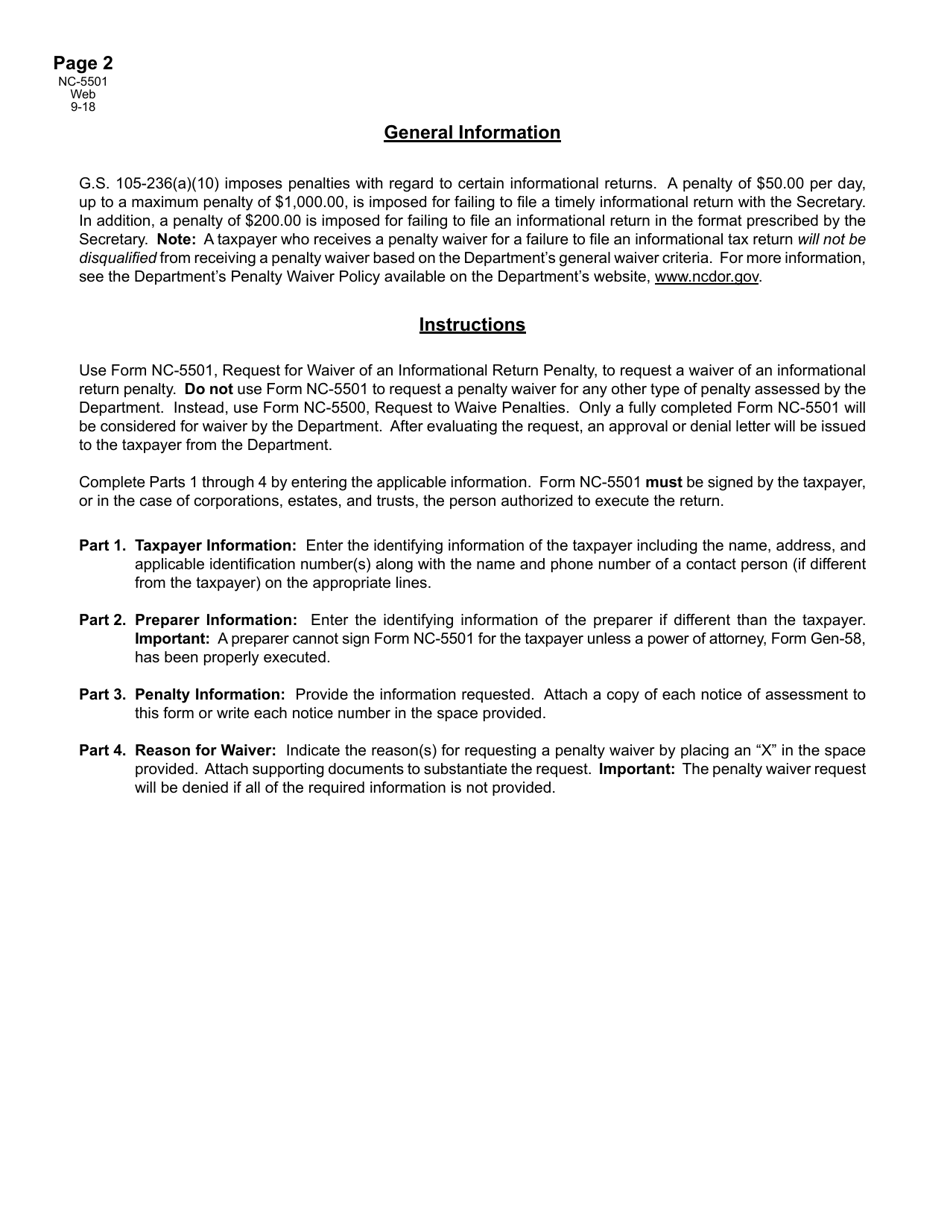

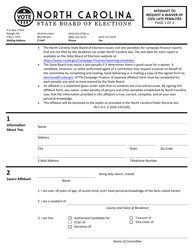

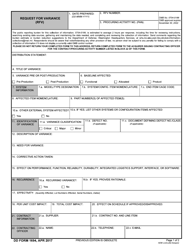

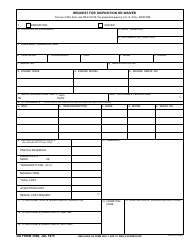

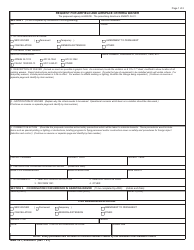

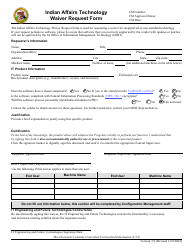

Request for Waiver of an Informational Return Penalty - North Carolina

Request for Waiver of an Informational Return Penalty is a legal document that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina.

FAQ

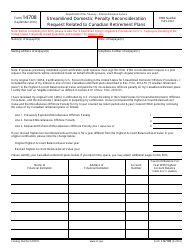

Q: What is a Request for Waiver of an Informational Return Penalty?

A: A Request for Waiver of an Informational Return Penalty is a form used in North Carolina to request the waiver of penalties imposed for failing to file an informational tax return.

Q: What is an informational tax return?

A: An informational tax return is a tax return that provides information about certain transactions or activities, but does not calculate tax liability.

Q: Why would someone need to request a waiver of an informational return penalty?

A: Someone may need to request a waiver if they failed to file an informational tax return and are facing penalties as a result.

Q: How can someone request a waiver of an informational return penalty in North Carolina?

A: To request a waiver, they need to complete and submit a Request for Waiver of an Informational Return Penalty form to the North Carolina Department of Revenue.

Q: Is there a deadline for submitting a request for waiver?

A: Yes, the request must be submitted within 30 days of receiving the penalty notice.

Form Details:

- Released on September 1, 2018;

- The latest edition currently provided by the North Carolina Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.