This version of the form is not currently in use and is provided for reference only. Download this version of

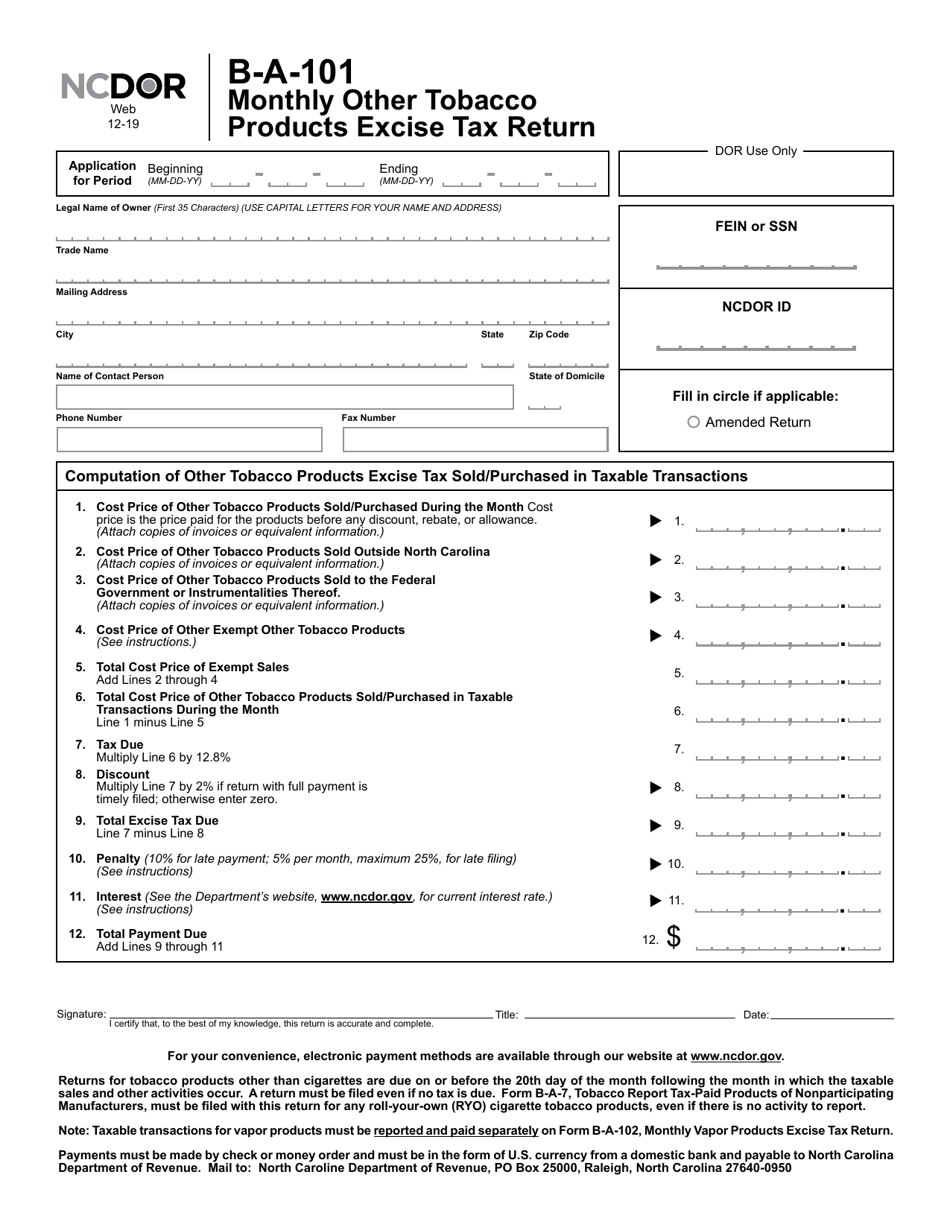

Form B-A-101

for the current year.

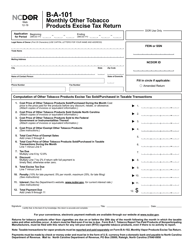

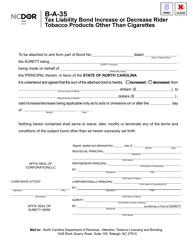

Form B-A-101 Monthly Other Tobacco Products Excise Tax Return - North Carolina

What Is Form B-A-101?

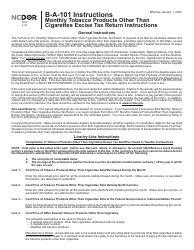

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form B-A-101?

A: Form B-A-101 is the Monthly Other Tobacco ProductsExcise Tax Return.

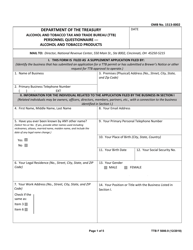

Q: Who needs to file Form B-A-101?

A: Any person engaged in the sale or distribution of other tobacco products in North Carolina needs to file Form B-A-101.

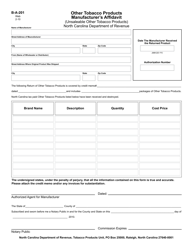

Q: What are other tobacco products?

A: Other tobacco products include cigars, smoking tobacco, smokeless tobacco, pipe tobacco, and any other product made of or containing tobacco, except cigarettes.

Q: When is Form B-A-101 due?

A: Form B-A-101 is due on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form B-A-101?

A: Yes, there are penalties for late filing, ranging from $50 to $5,000, depending on the amount of tax due and the number of late filings in a 12-month period.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

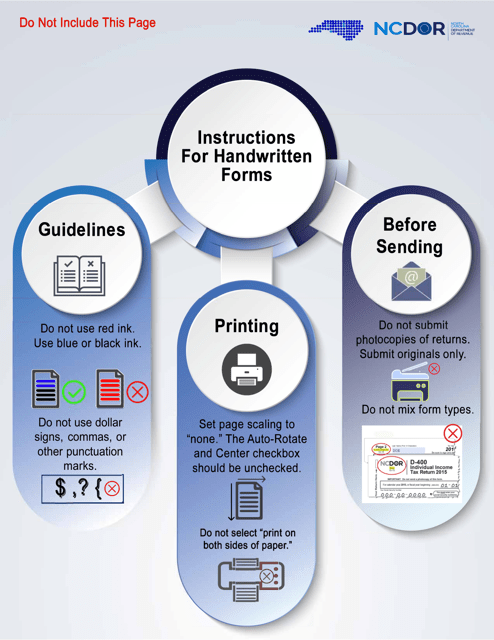

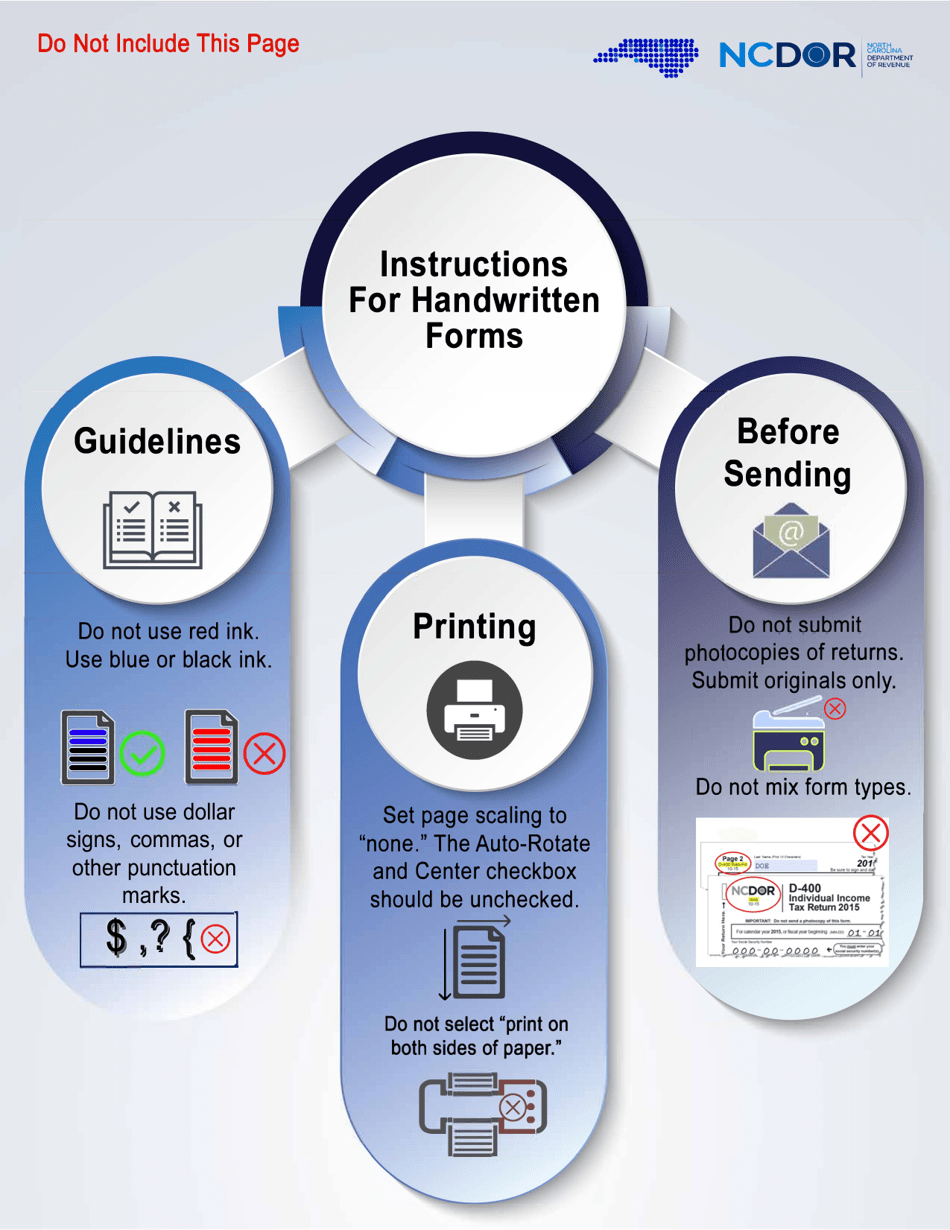

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-A-101 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.