This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-403

for the current year.

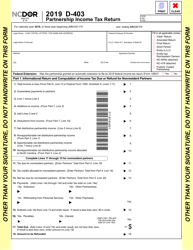

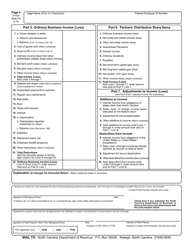

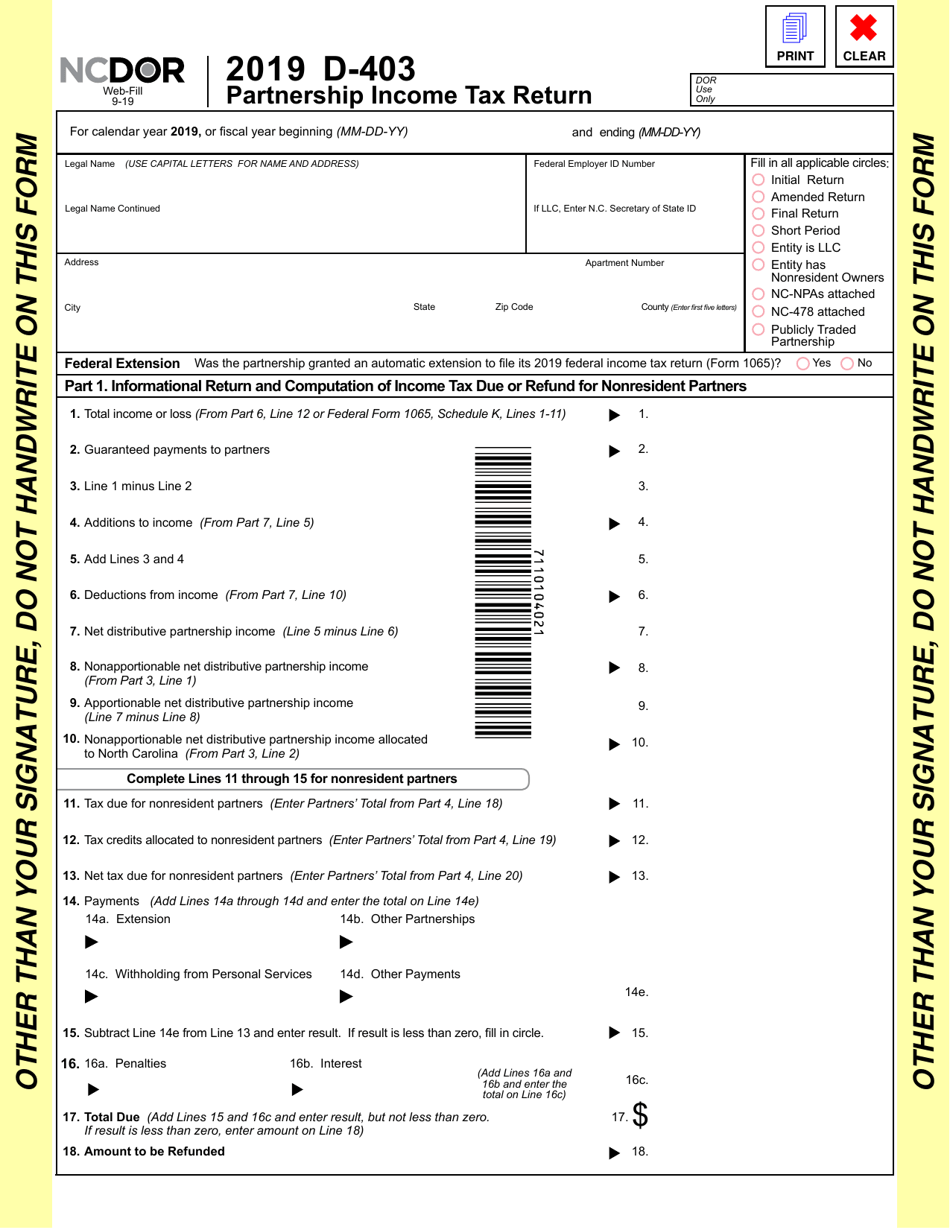

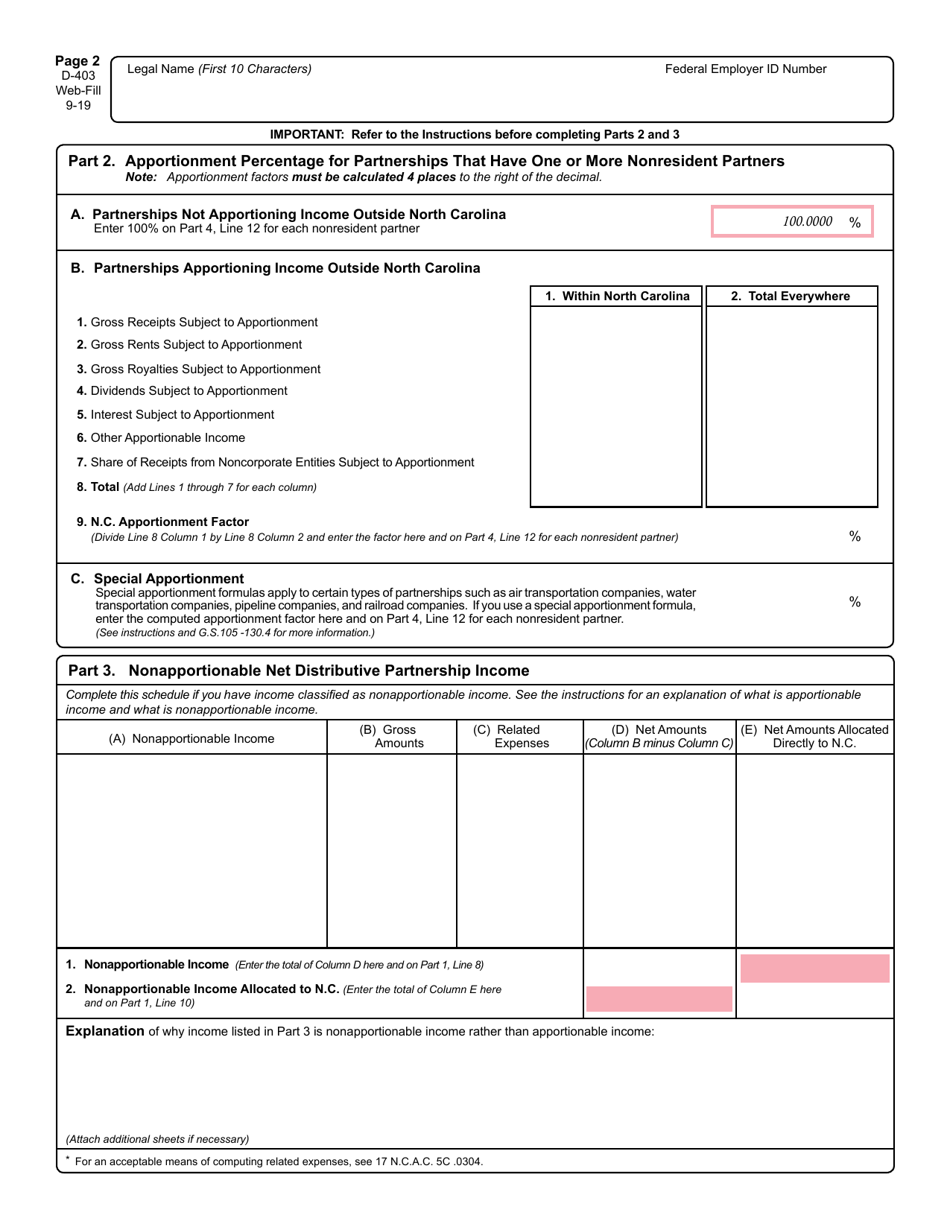

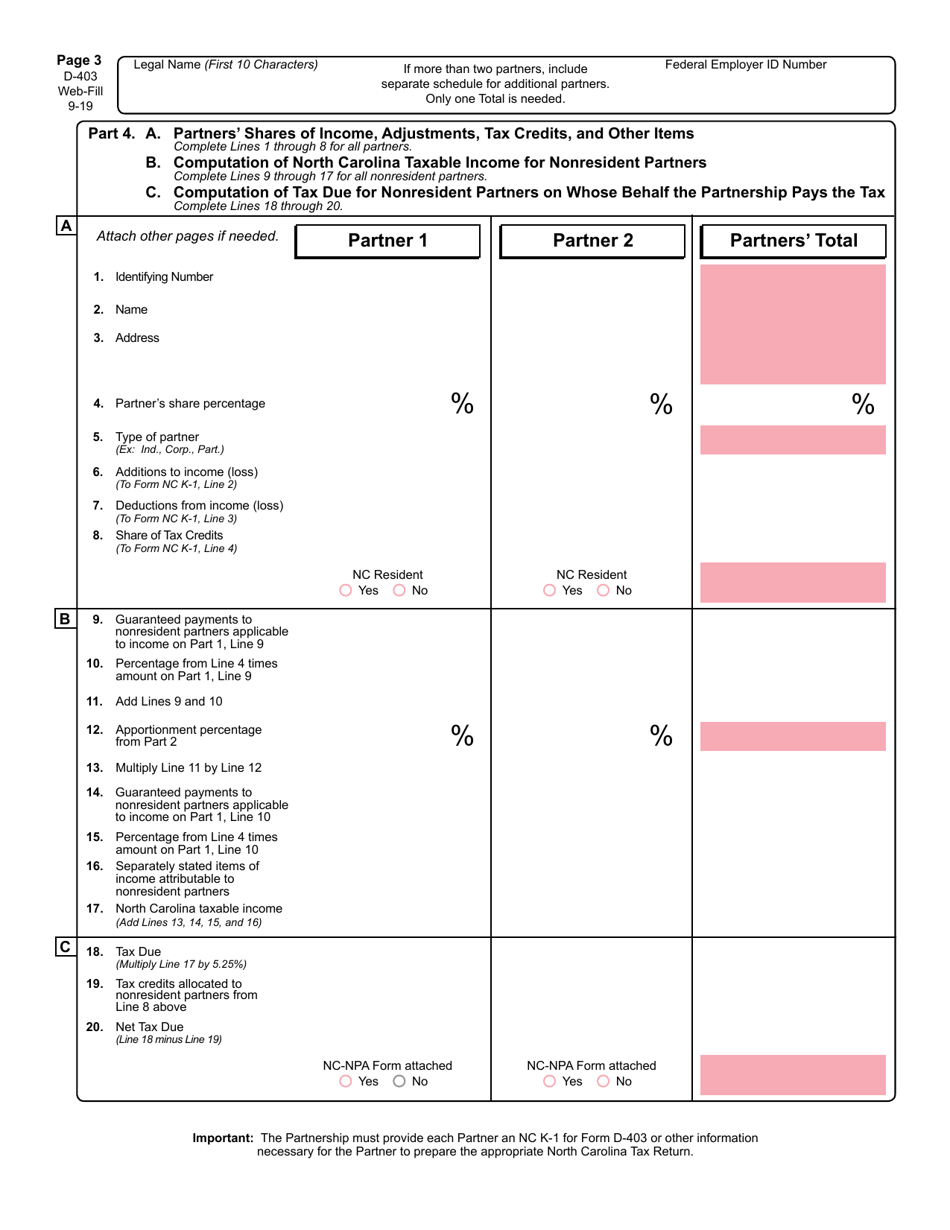

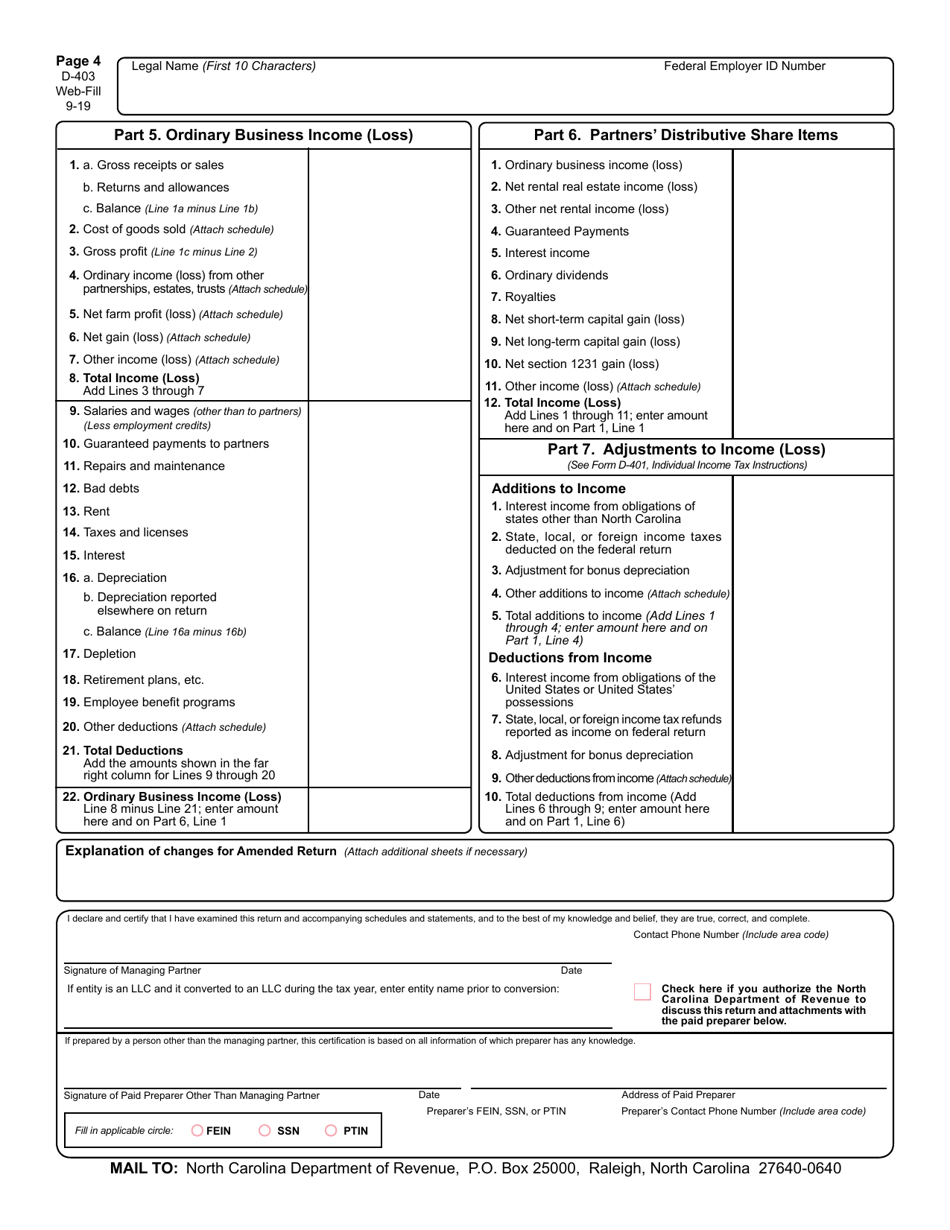

Form D-403 Partnership Income Tax Return - North Carolina

What Is Form D-403?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form D-403?

A: Form D-403 is the Partnership Income Tax Return for North Carolina.

Q: Who needs to file Form D-403?

A: Partnerships in North Carolina need to file Form D-403.

Q: What is the purpose of Form D-403?

A: The purpose of Form D-403 is to report partnership income and deductions for North Carolina.

Q: When is Form D-403 due?

A: Form D-403 is due on the 15th day of the fourth month after the close of the partnership's tax year.

Q: Are there any filing fees for Form D-403?

A: No, there are no filing fees for Form D-403 in North Carolina.

Q: Can Form D-403 be filed electronically?

A: Yes, Form D-403 can be filed electronically through the North Carolina Department of Revenue's eFile system.

Q: What penalties may apply for not filing Form D-403 on time?

A: Penalties may apply for late filing of Form D-403, including a late filing penalty and interest on any unpaid tax.

Q: Is there an extension available for filing Form D-403?

A: Yes, you can request an extension of time to file Form D-403 by filing Form D-410.

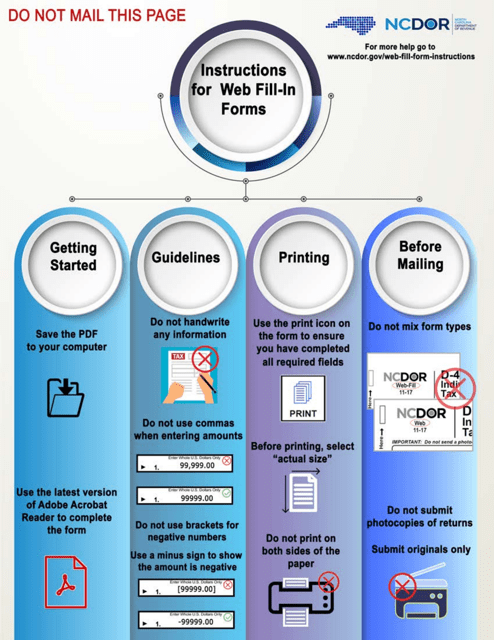

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

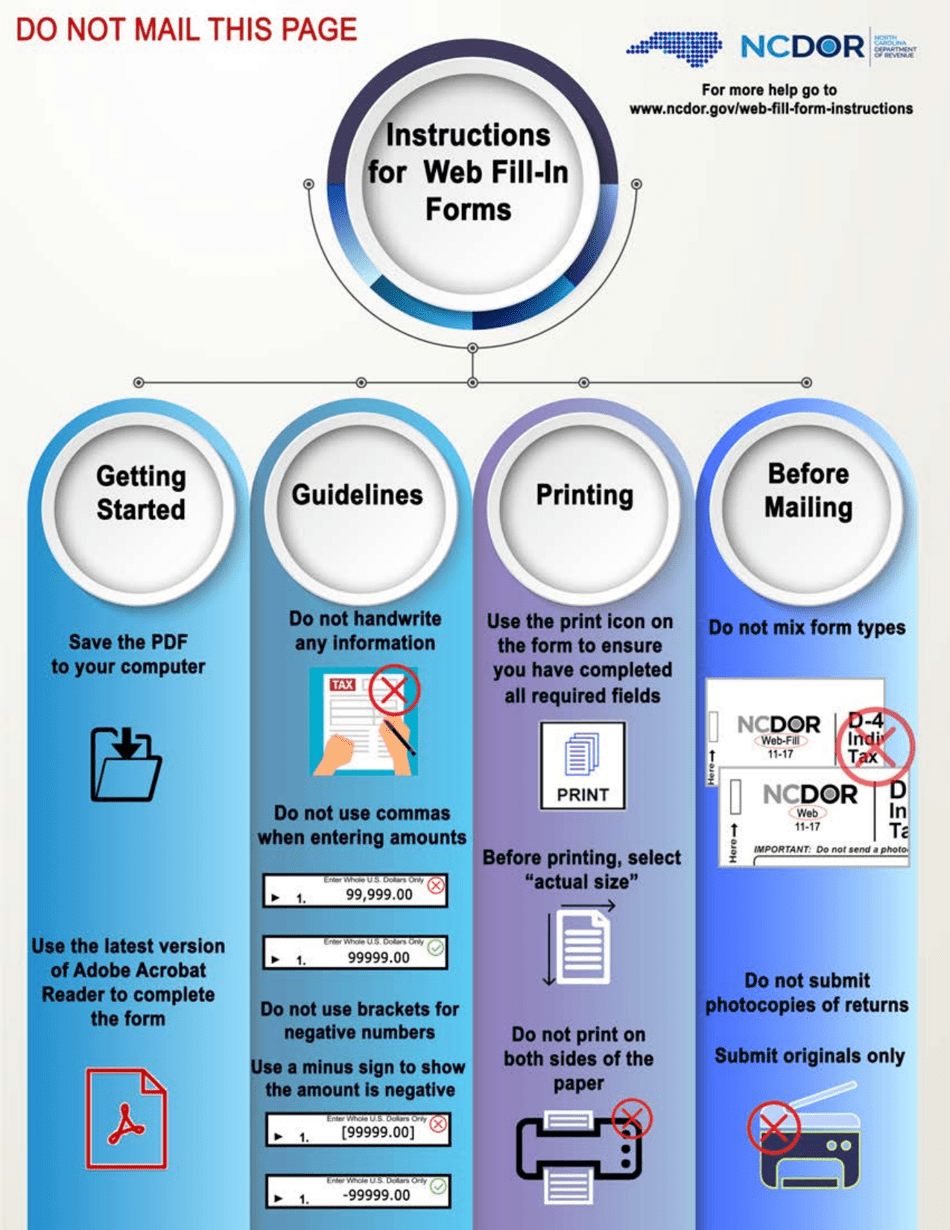

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-403 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.