This version of the form is not currently in use and is provided for reference only. Download this version of

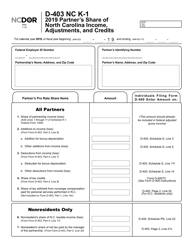

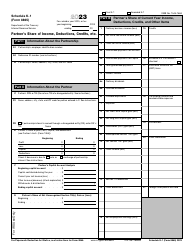

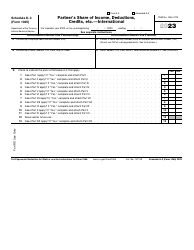

Form D-403 NC K-1

for the current year.

Form D-403 NC K-1 Partner's Share of North Carolina Income, Adjustments, and Credits - North Carolina

What Is Form D-403 NC K-1?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-403 NC K-1?

A: Form D-403 NC K-1 is a tax form that shows a partner's share of income, adjustments, and credits related to North Carolina state taxes.

Q: What is the purpose of Form D-403 NC K-1?

A: The purpose of Form D-403 NC K-1 is to report and allocate the income, deductions, and credits of a partnership or limited liability company (LLC) to its partners or members.

Q: Who needs to file Form D-403 NC K-1?

A: Form D-403 NC K-1 should be filed by all partners or members of a partnership or LLC that operates in North Carolina and wants to report their share of income, adjustments, and credits.

Q: What information is required to complete Form D-403 NC K-1?

A: To complete Form D-403 NC K-1, you will need information about the partnership or LLC's income, deductions, and credits. You may also need the partner's or member's Social Security number or taxpayer identification number.

Q: When is the deadline to file Form D-403 NC K-1?

A: Form D-403 NC K-1 should be filed by the due date of the partnership or LLC's North Carolina tax return, which is generally on or before April 15th of each year.

Q: Are there any penalties for not filing Form D-403 NC K-1?

A: Yes, there may be penalties for failing to file Form D-403 NC K-1 or for filing it late. It is important to file the form on time to avoid any penalties or interest charges.

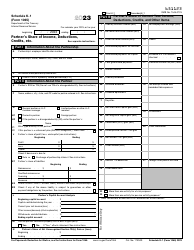

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

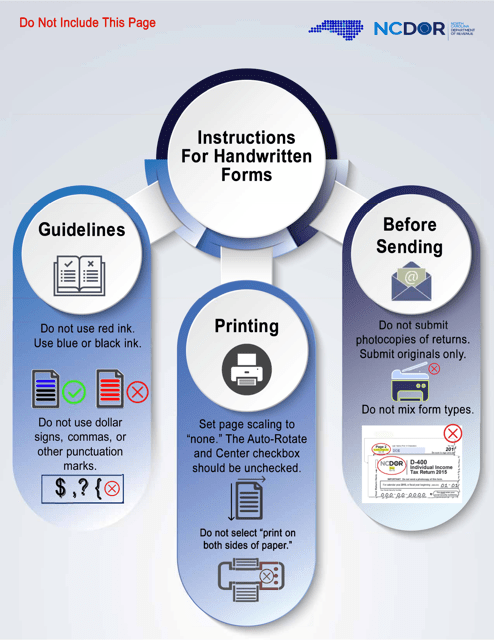

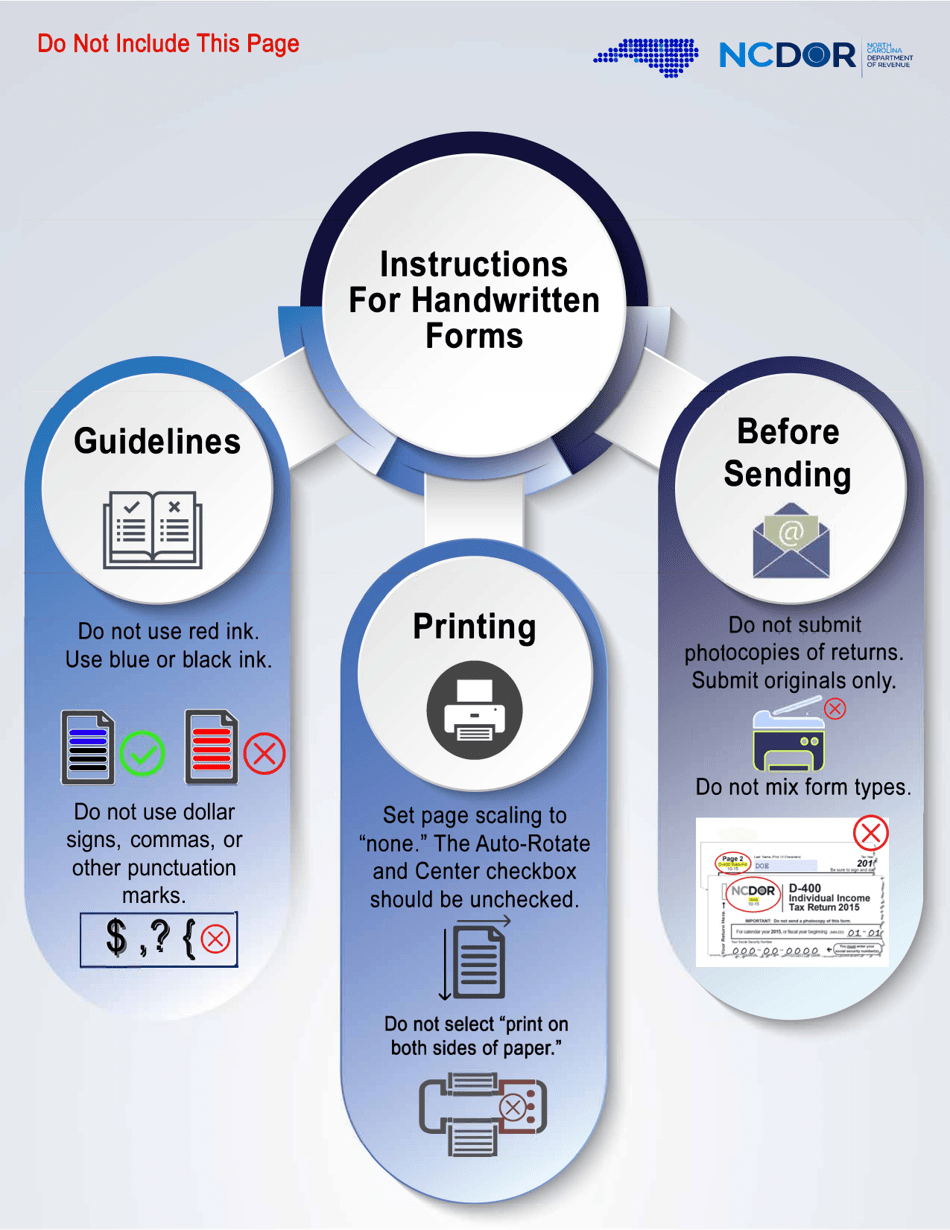

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form D-403 NC K-1 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.