This version of the form is not currently in use and is provided for reference only. Download this version of

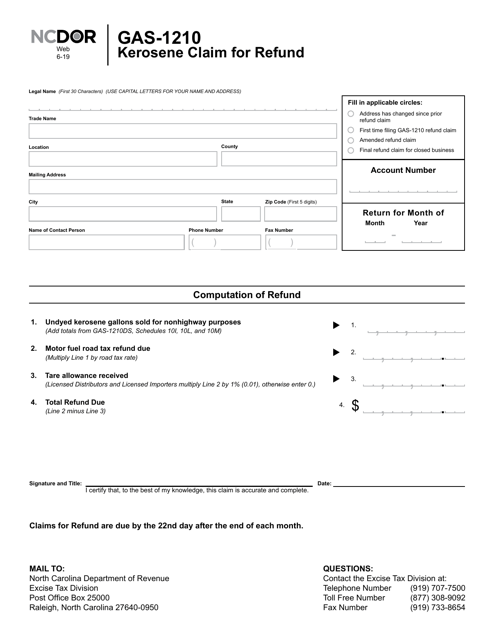

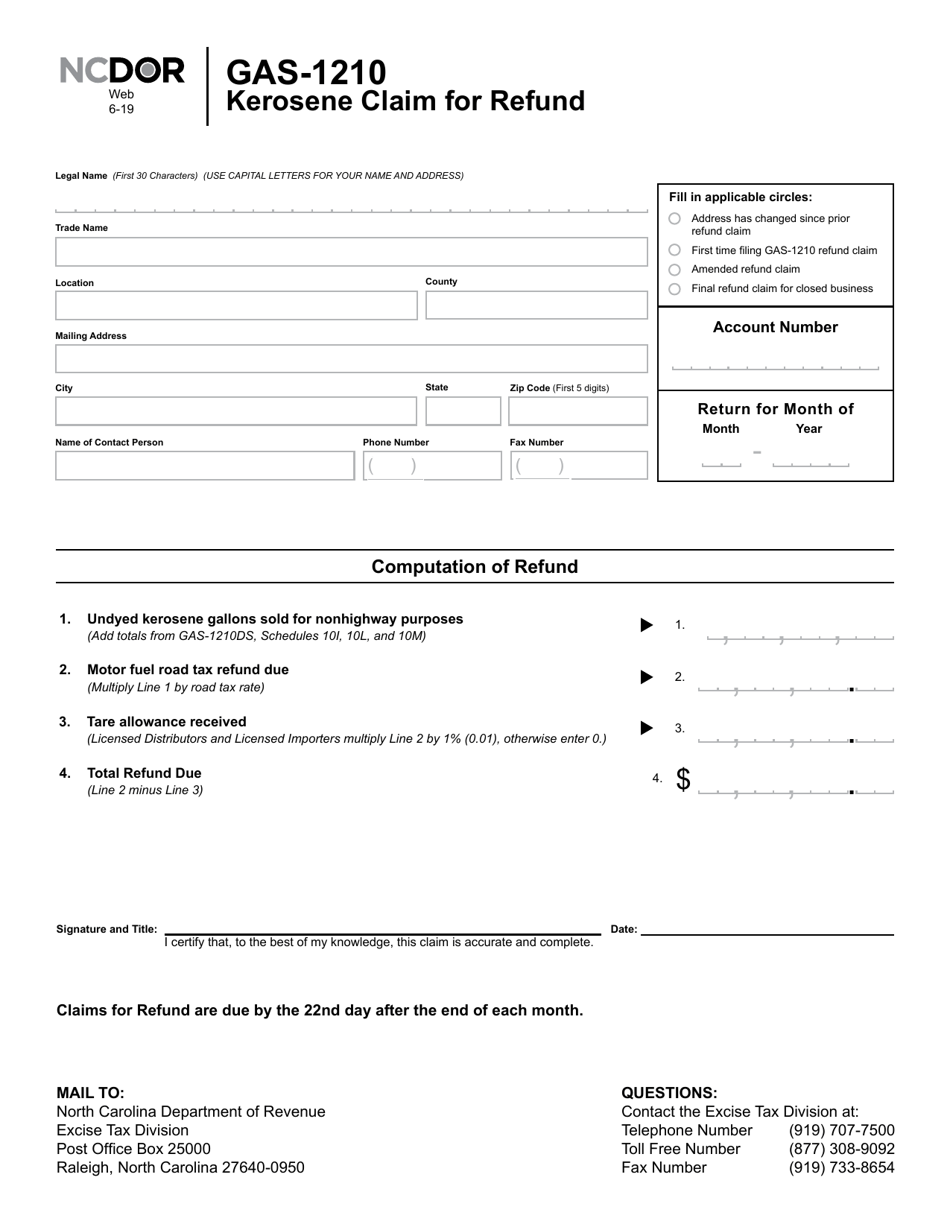

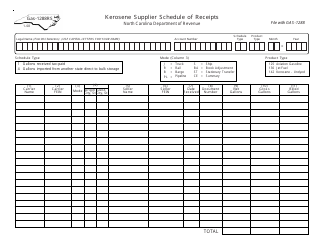

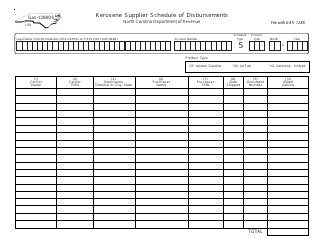

Form GAS-1210

for the current year.

Form GAS-1210 Kerosene Claim for Refund - North Carolina

What Is Form GAS-1210?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is GAS-1210?

A: GAS-1210 is a form used to file a claim for refund for kerosene in North Carolina.

Q: Who can use form GAS-1210?

A: Anyone who purchased kerosene in North Carolina and wants to claim a refund can use this form.

Q: What is the purpose of filing a claim for refund for kerosene?

A: The purpose is to receive a refund for the taxes paid on kerosene that is not used for highway purposes.

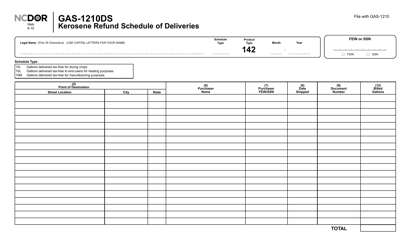

Q: What information is required to fill out form GAS-1210?

A: You will need to provide details such as the amount of kerosene purchased, the seller's name, and the reason for the claim.

Q: What is the deadline for filing form GAS-1210?

A: The form must be filed within three years from the date of purchase of the kerosene.

Q: How long does it take to receive a refund after filing form GAS-1210?

A: The processing time for refunds can vary, but it typically takes several weeks to receive a refund.

Q: Can I file a claim for refund for kerosene purchased in another state?

A: No, form GAS-1210 is specific to kerosene purchased in North Carolina.

Q: Are there any special requirements or restrictions for filing form GAS-1210?

A: Yes, make sure to read the instructions on the form carefully to ensure compliance with all requirements.

Q: Who can I contact for more information about form GAS-1210?

A: For more information, you can contact the North Carolina Department of Revenue.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1210 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.