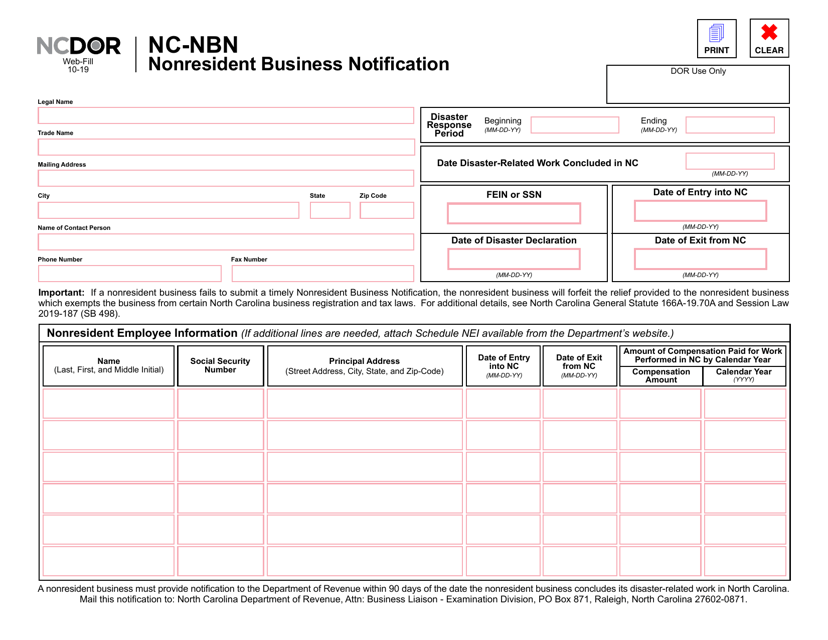

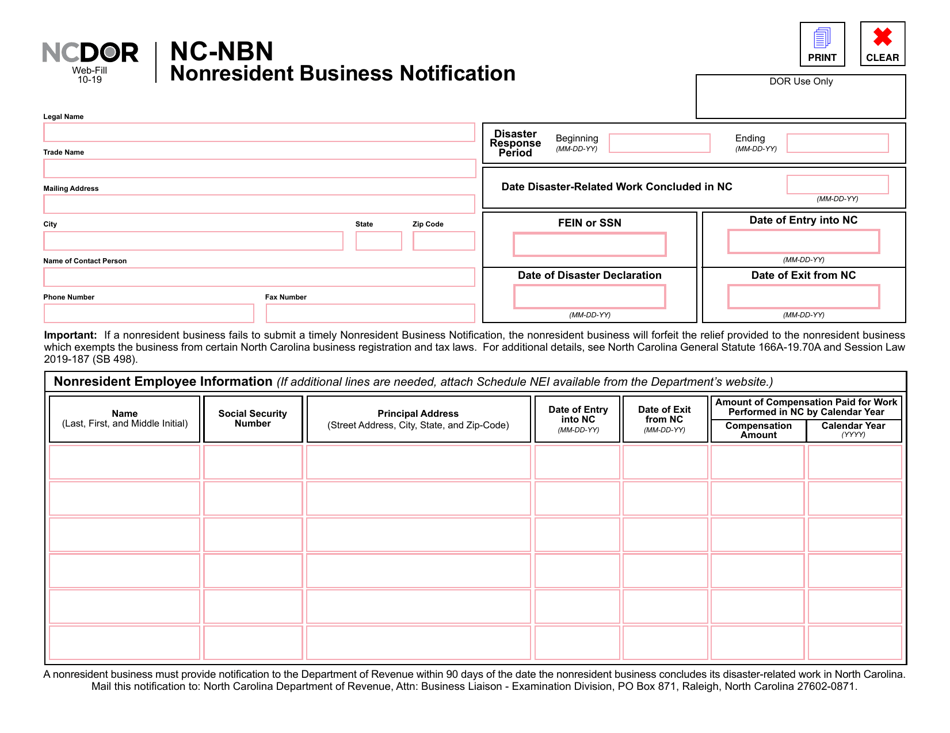

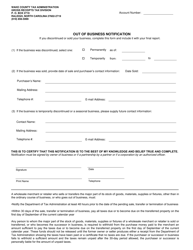

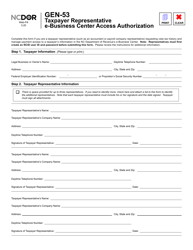

Form NC-NBN Nonresident Business Notification - North Carolina

What Is Form NC-NBN?

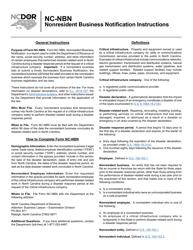

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the NC-NBN form?

A: The NC-NBN form is the Nonresident Business Notification form in North Carolina.

Q: Who needs to fill out the NC-NBN form?

A: Nonresident businesses operating in North Carolina need to fill out the NC-NBN form.

Q: What is the purpose of the NC-NBN form?

A: The purpose of the NC-NBN form is to notify the North Carolina Department of Revenue about nonresident businesses operating in the state.

Q: Is the NC-NBN form mandatory?

A: Yes, the NC-NBN form is mandatory for nonresident businesses operating in North Carolina.

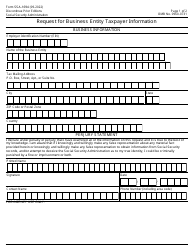

Q: What information do I need to provide on the NC-NBN form?

A: You will need to provide information such as your business name, contact information, federal employer identification number, and a description of your business activities in North Carolina.

Q: Are there any fees associated with the NC-NBN form?

A: No, there are no fees associated with filing the NC-NBN form.

Q: When do I need to submit the NC-NBN form?

A: You need to submit the NC-NBN form within 60 days of commencing business activities in North Carolina.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NC-NBN by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.