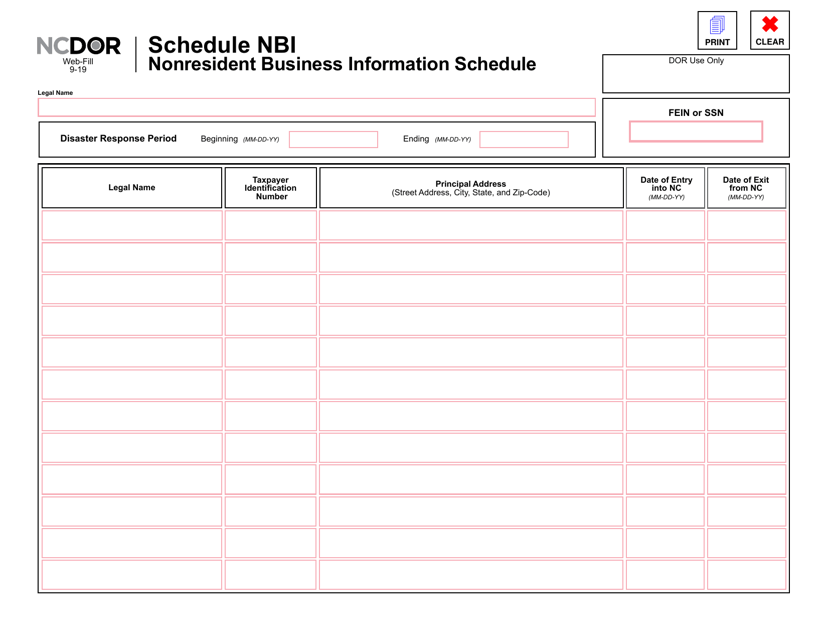

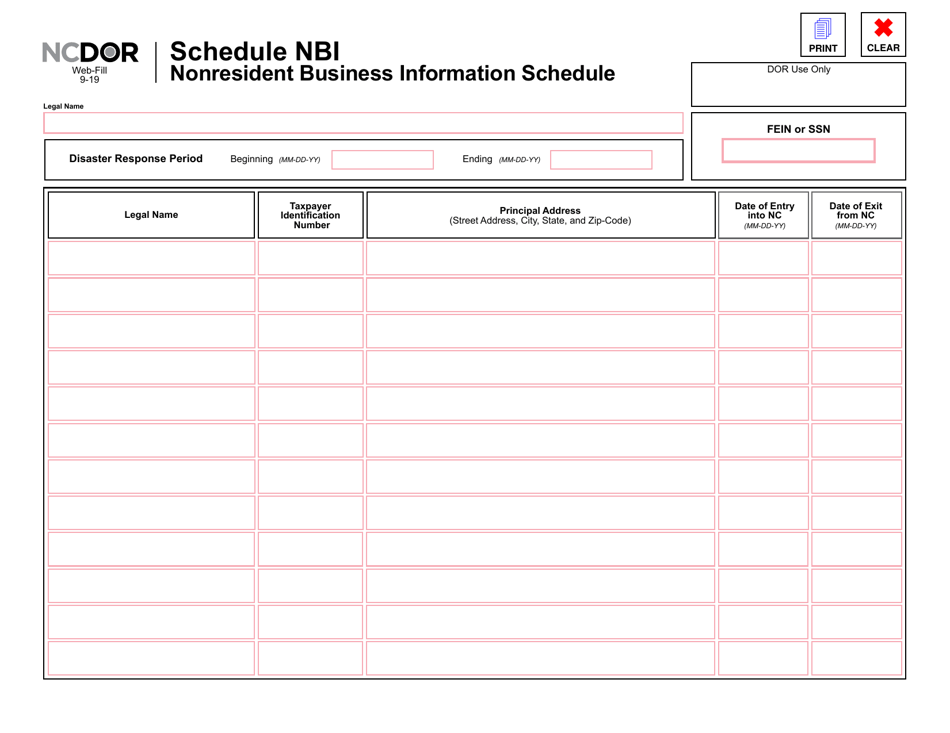

Schedule NBI Nonresident Business Information Schedule - North Carolina

What Is Schedule NBI?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NBI?

A: Schedule NBI is the Nonresident Business Information Schedule.

Q: What is the purpose of Schedule NBI?

A: The purpose of Schedule NBI is to report nonresident business income in North Carolina.

Q: Who needs to file Schedule NBI?

A: Nonresidents who have business income from North Carolina sources need to file Schedule NBI.

Q: When should Schedule NBI be filed?

A: Schedule NBI should be filed with your North Carolina individual income tax return.

Q: How do I complete Schedule NBI?

A: You need to provide information about your nonresident business income, including the amount and the sources.

Q: Is there a filing fee for Schedule NBI?

A: No, there is no filing fee for Schedule NBI.

Q: What happens if I don't file Schedule NBI?

A: Failure to file Schedule NBI can result in penalties and interest.

Q: Can I e-file Schedule NBI?

A: Yes, you can e-file Schedule NBI if you are filing your North Carolina individual income tax return electronically.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NBI by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.