This version of the form is not currently in use and is provided for reference only. Download this version of

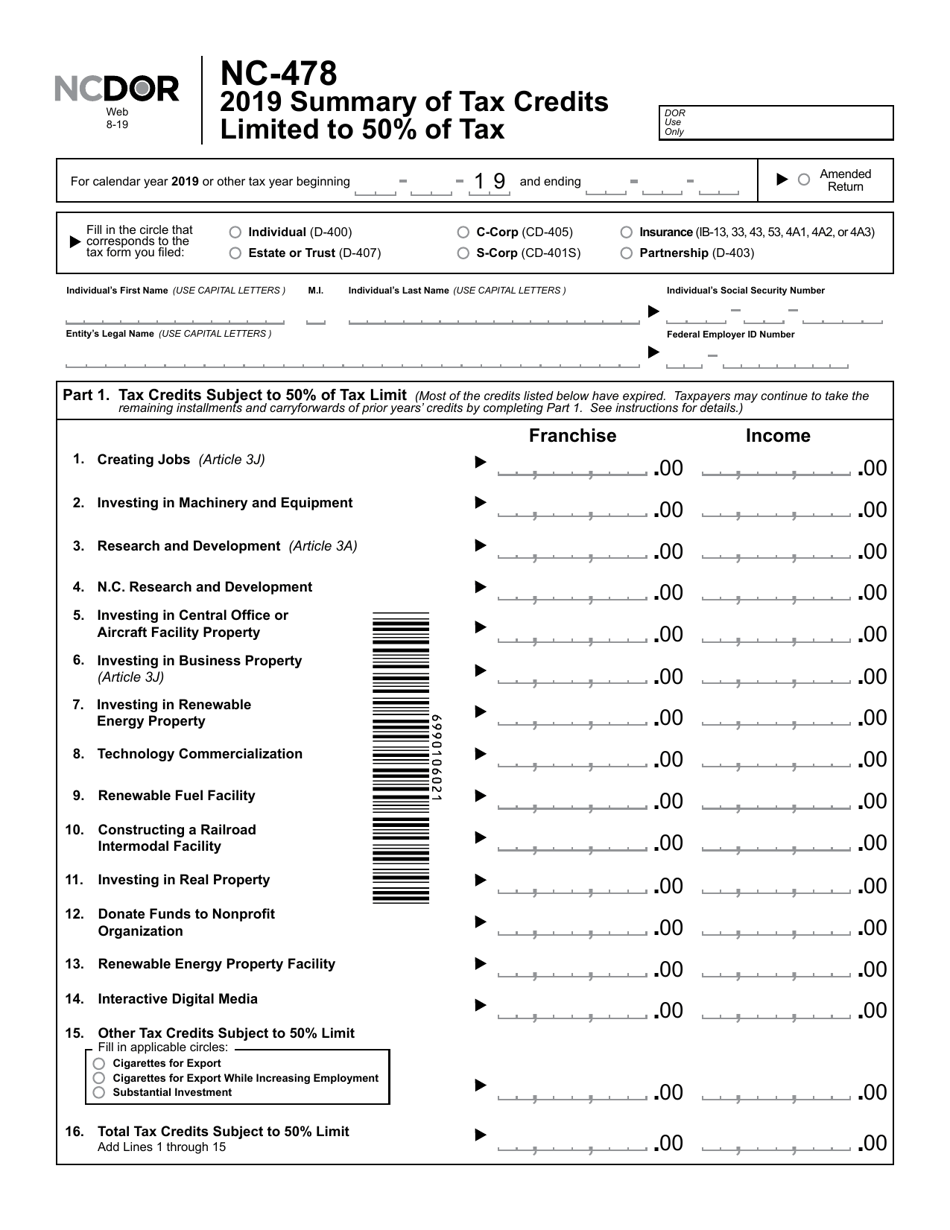

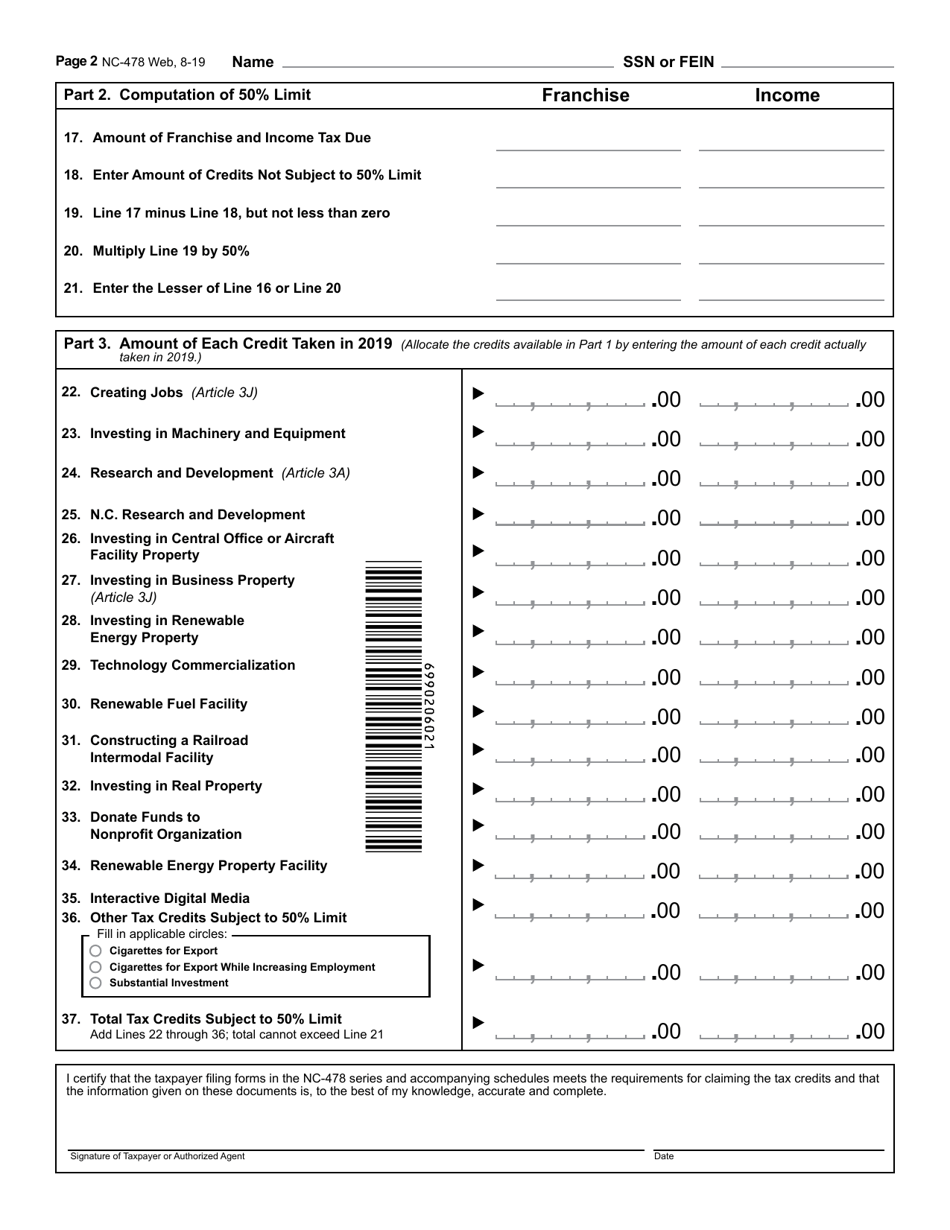

Form NC-478

for the current year.

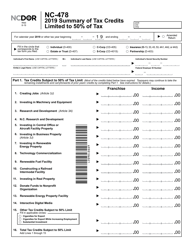

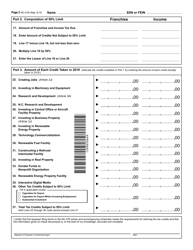

Form NC-478 Summary of Tax Credits Limited to 50% of Tax - North Carolina

What Is Form NC-478?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NC-478?

A: Form NC-478 is a document used in North Carolina to summarize tax credits that are limited to 50% of tax.

Q: What is the purpose of Form NC-478?

A: The purpose of Form NC-478 is to provide a summary of tax credits that are limited to 50% of the tax owed in North Carolina.

Q: Which tax credits are limited to 50% of tax in North Carolina?

A: Certain tax credits in North Carolina are limited to 50% of the tax owed. Form NC-478 is used to summarize these credits.

Q: Do all tax credits in North Carolina have a limit of 50% of tax?

A: No, only certain tax credits in North Carolina are limited to 50% of the tax owed.

Q: When should Form NC-478 be filled out?

A: Form NC-478 should be filled out when you want to claim tax credits in North Carolina that are subject to the 50% limitation.

Q: Can I claim tax credits that exceed 50% of my tax liability in North Carolina?

A: No, you can only claim tax credits in North Carolina up to the limit of 50% of your tax liability.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

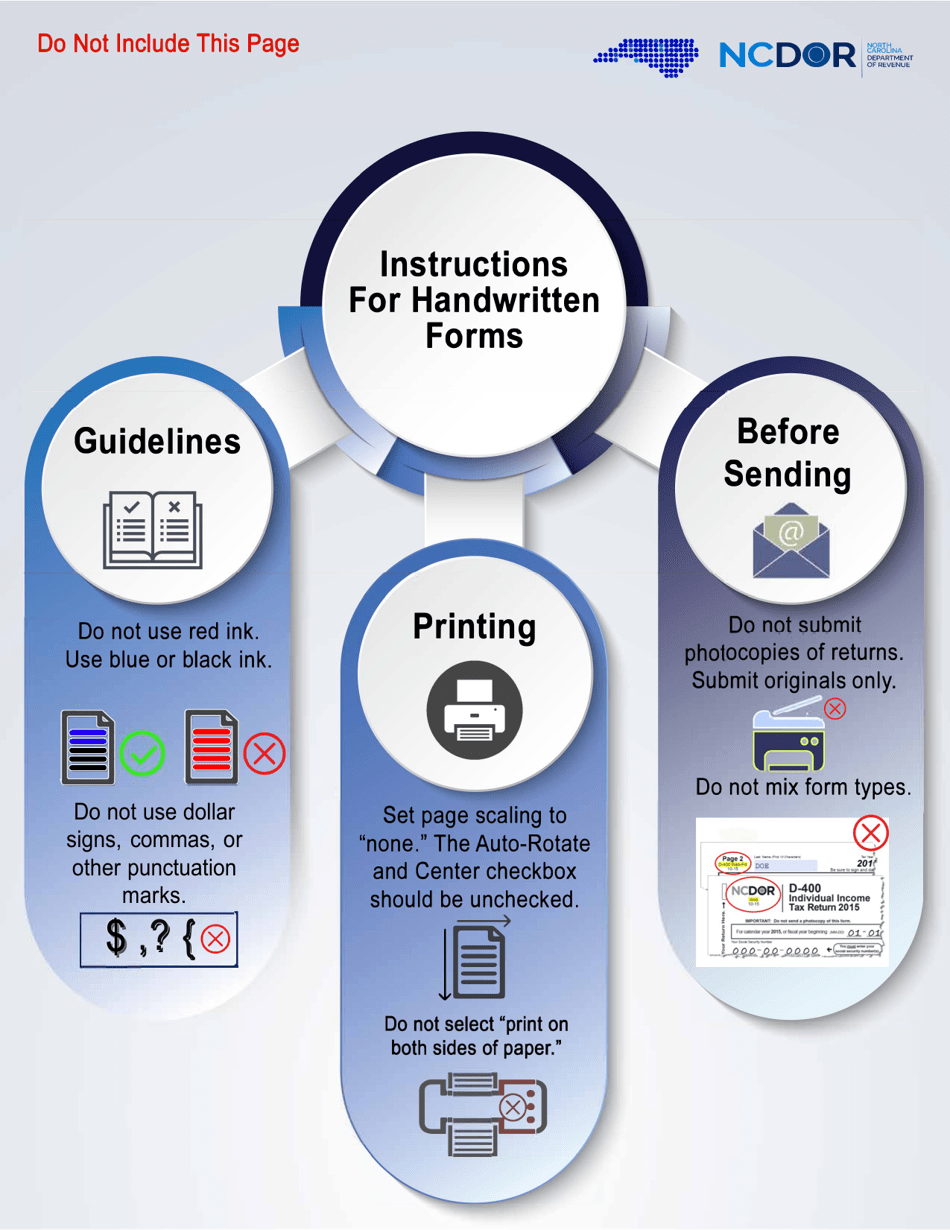

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-478 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.