This version of the form is not currently in use and is provided for reference only. Download this version of

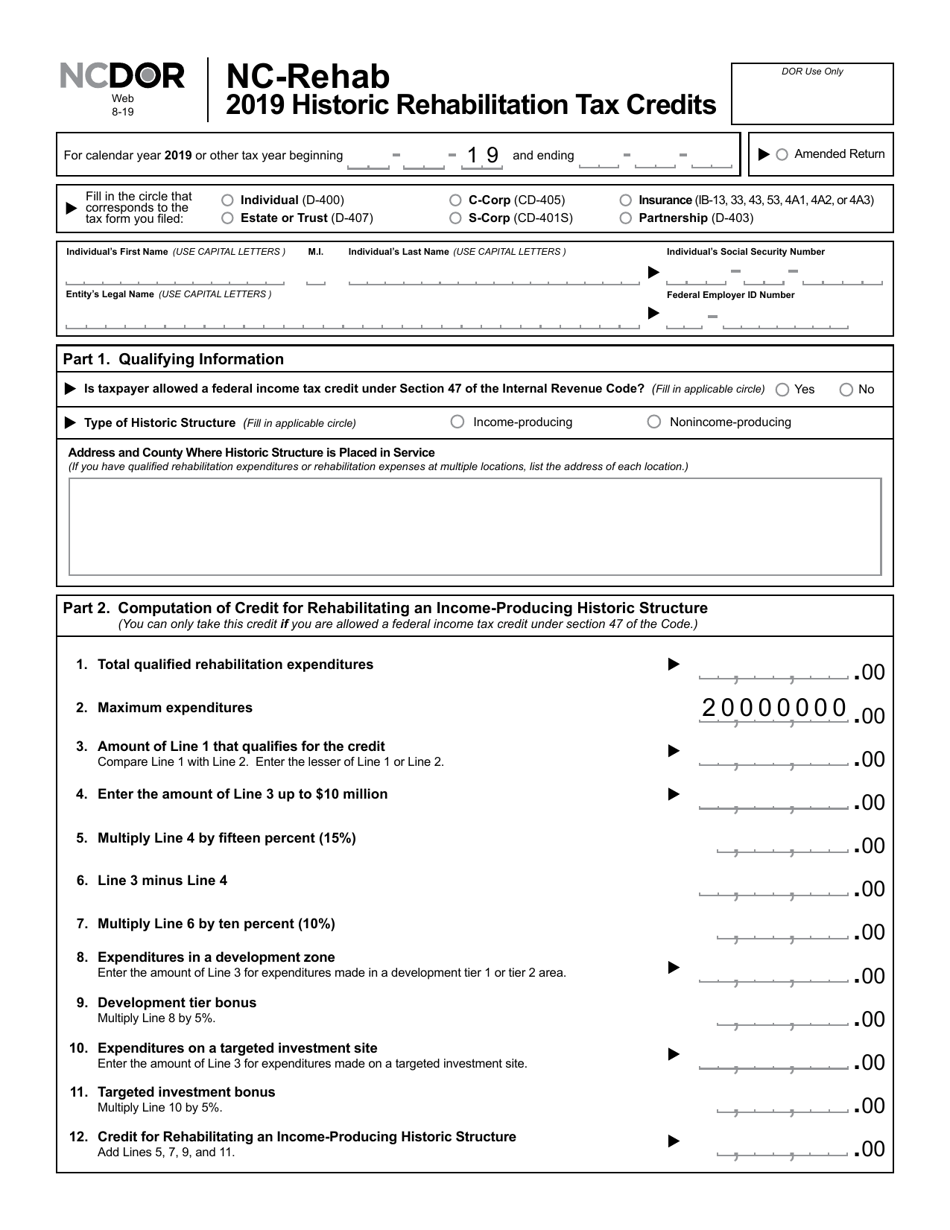

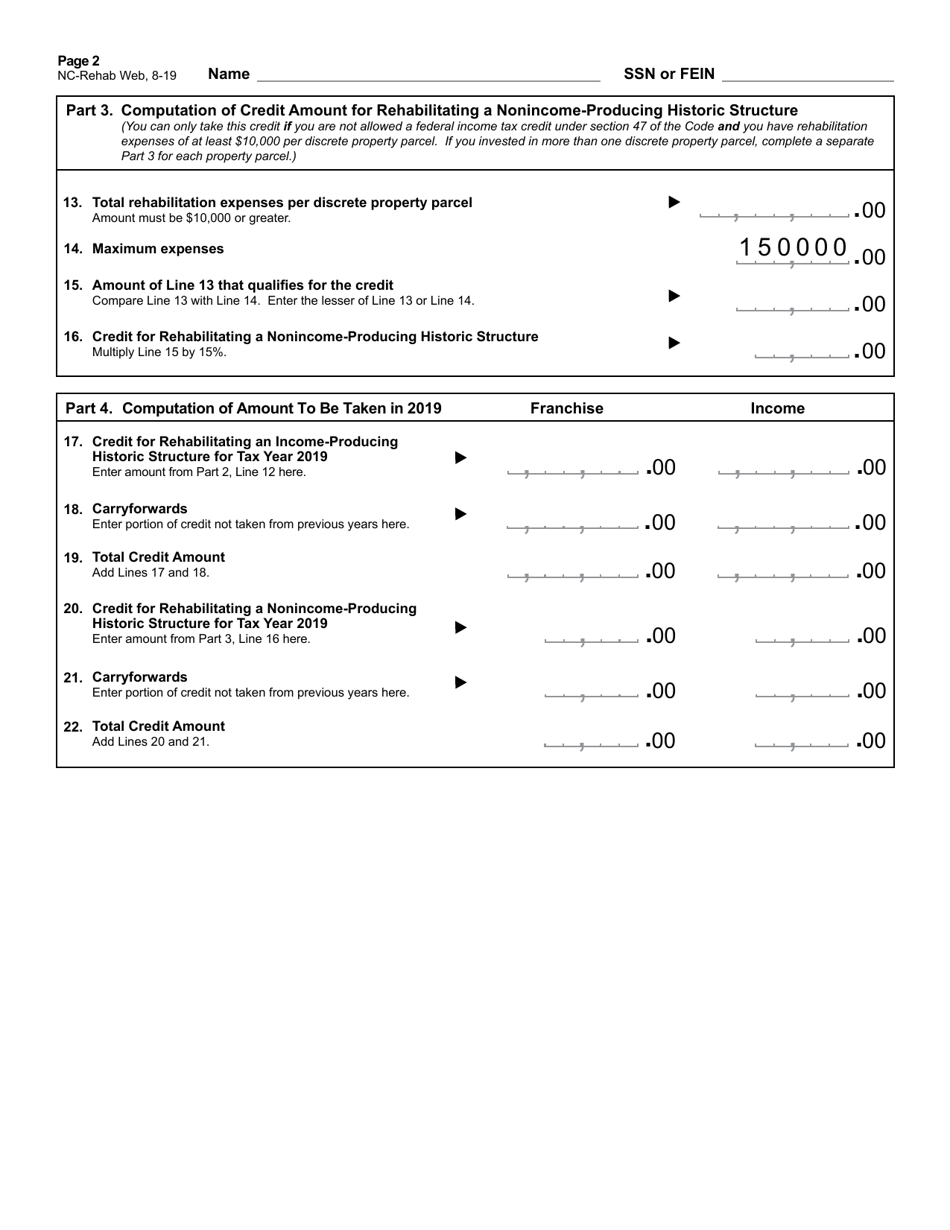

Form NC-REHAB

for the current year.

Form NC-REHAB Historic Rehabilitation Tax Credits - North Carolina

What Is Form NC-REHAB?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-REHAB?

A: Form NC-REHAB is a tax form used to apply for Historic Rehabilitation Tax Credits in North Carolina.

Q: What are Historic Rehabilitation Tax Credits?

A: Historic Rehabilitation Tax Credits are financial incentives provided to individuals or businesses who invest in the rehabilitation of qualified historic properties.

Q: Who is eligible to claim Historic Rehabilitation Tax Credits in North Carolina?

A: Property owners who undertake substantial rehabilitation work on a qualified historic property may be eligible to claim the tax credits.

Q: What is the purpose of the Form NC-REHAB?

A: The Form NC-REHAB is used to document the qualifying rehabilitation work and expenses incurred on a historic property.

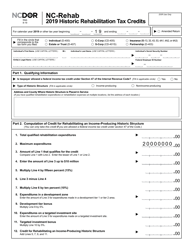

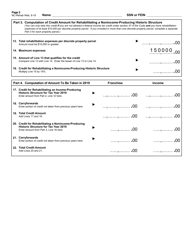

Q: What information is required to complete Form NC-REHAB?

A: The form requires information about the property, the rehabilitation work undertaken, and details of the expenses incurred.

Q: Are there any deadlines for submitting Form NC-REHAB?

A: Yes, the form must be submitted within 30 days of completing the rehabilitation work on the historic property.

Q: How long does it take to process Form NC-REHAB?

A: The processing time for Form NC-REHAB varies, but it generally takes several weeks to a few months.

Q: What are the benefits of claiming Historic Rehabilitation Tax Credits?

A: Claiming Historic Rehabilitation Tax Credits can provide financial incentives and help preserve and restore historic properties.

Q: Are the Historic Rehabilitation Tax Credits refundable?

A: Yes, the Historic Rehabilitation Tax Credits in North Carolina are refundable, meaning they can be used to offset state income tax liability or refunded as cash if there is no tax liability.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

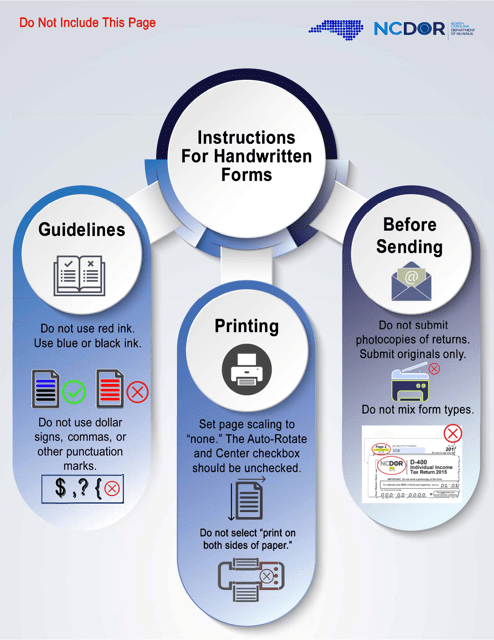

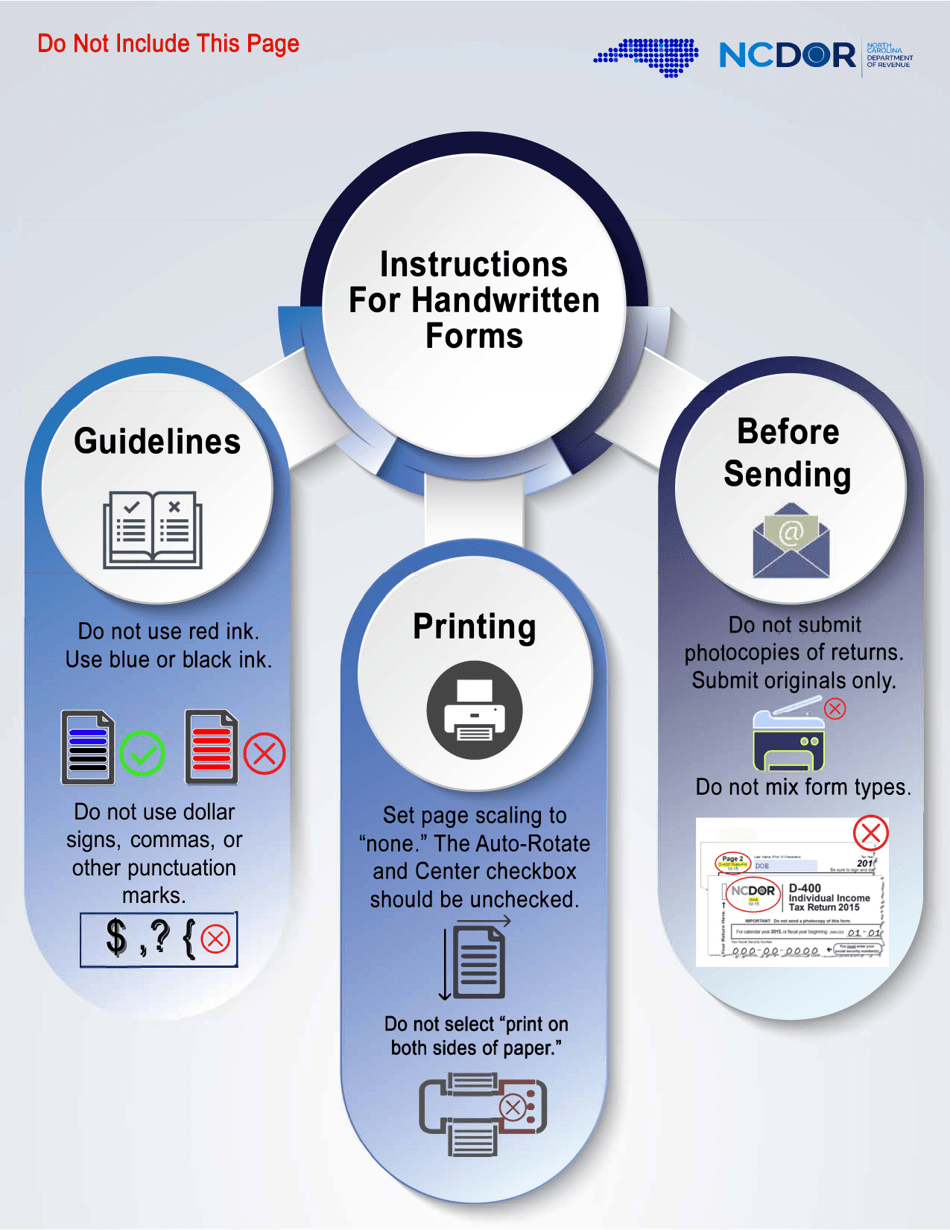

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-REHAB by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.