This version of the form is not currently in use and is provided for reference only. Download this version of

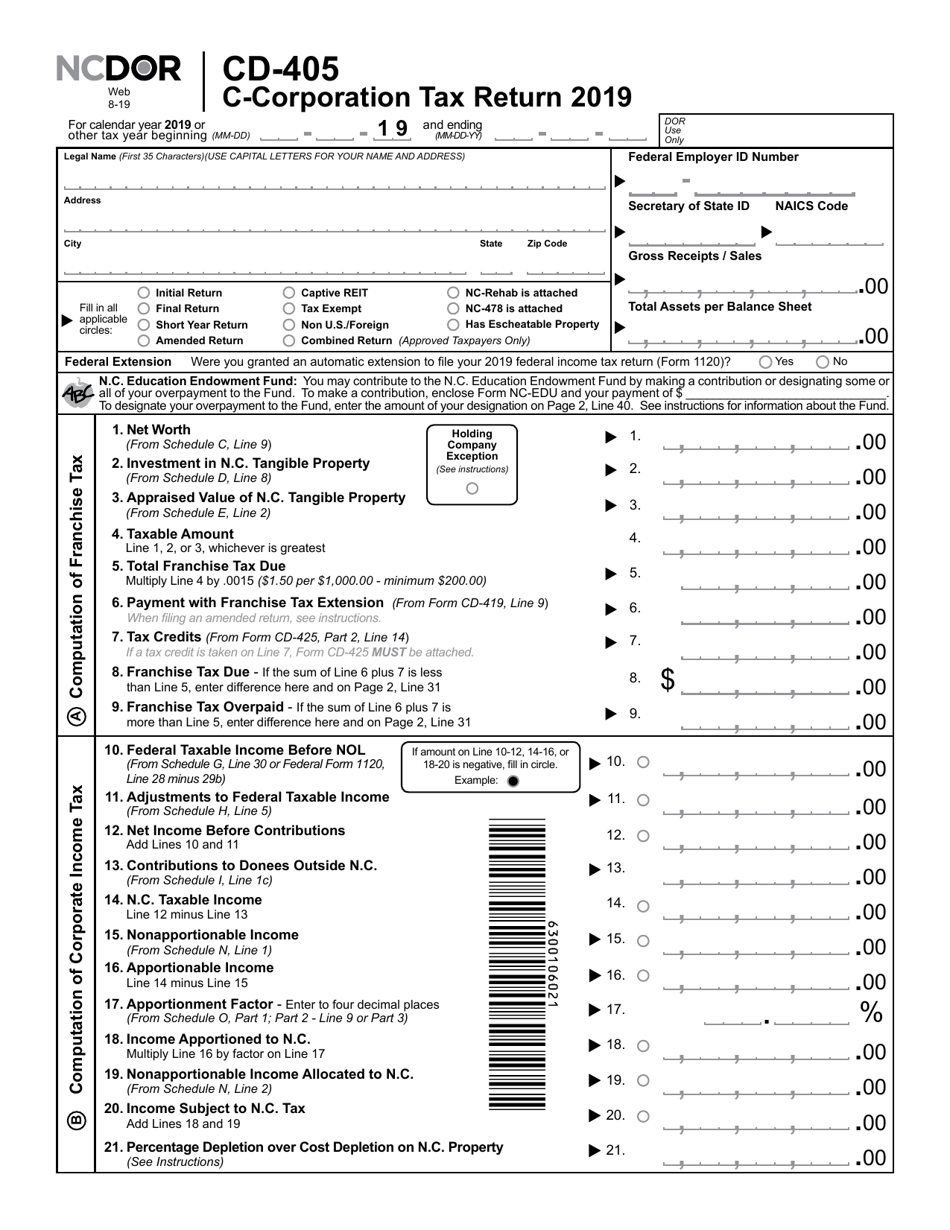

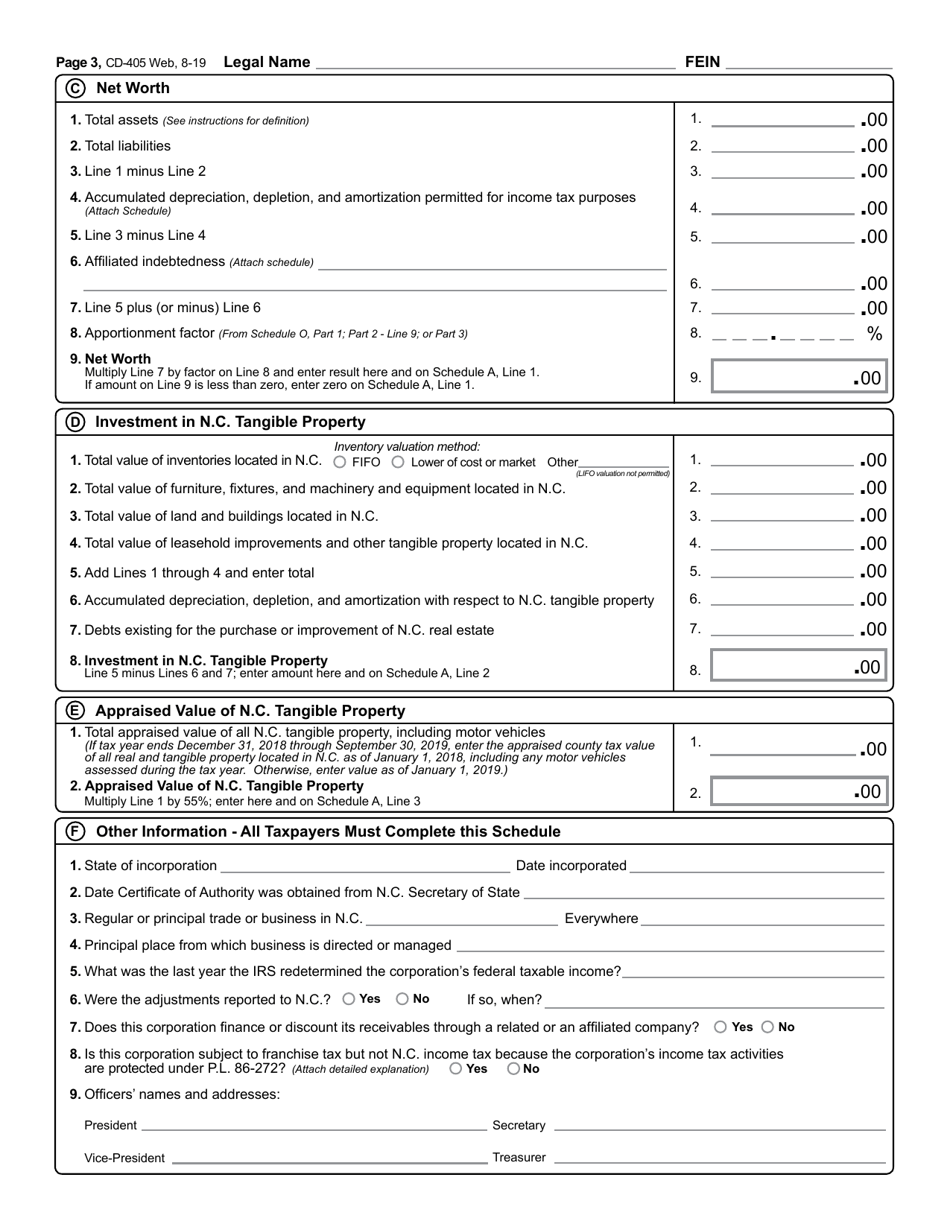

Form CD-405

for the current year.

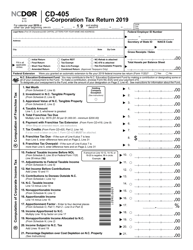

Form CD-405 C-Corporation Tax Return - North Carolina

What Is Form CD-405?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CD-405?

A: Form CD-405 is the C-Corporation Tax Return for the state of North Carolina.

Q: Who needs to file Form CD-405?

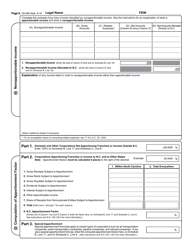

A: C-Corporations that do business or have income in North Carolina need to file Form CD-405.

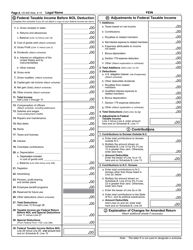

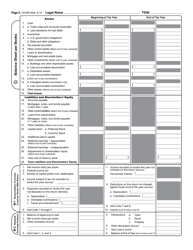

Q: What information do I need to complete Form CD-405?

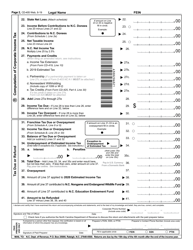

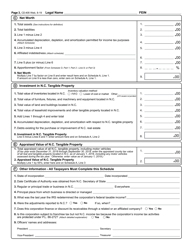

A: You will need information about your corporation's income, deductions, credits, and tax liability.

Q: When is Form CD-405 due?

A: Form CD-405 is due on the 15th day of the fourth month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form CD-405?

A: Yes, there are penalties for late filing, including interest and possible additional penalties.

Q: Can I get an extension to file Form CD-405?

A: Yes, you can request an extension by filing Form CD-419. However, an extension of time to file does not extend the time to pay any tax due.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

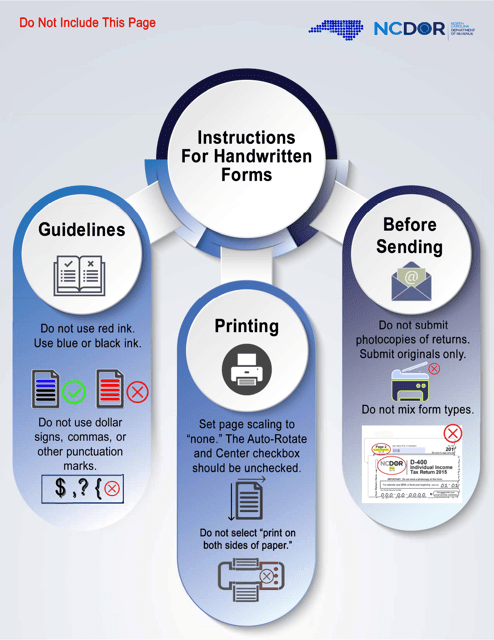

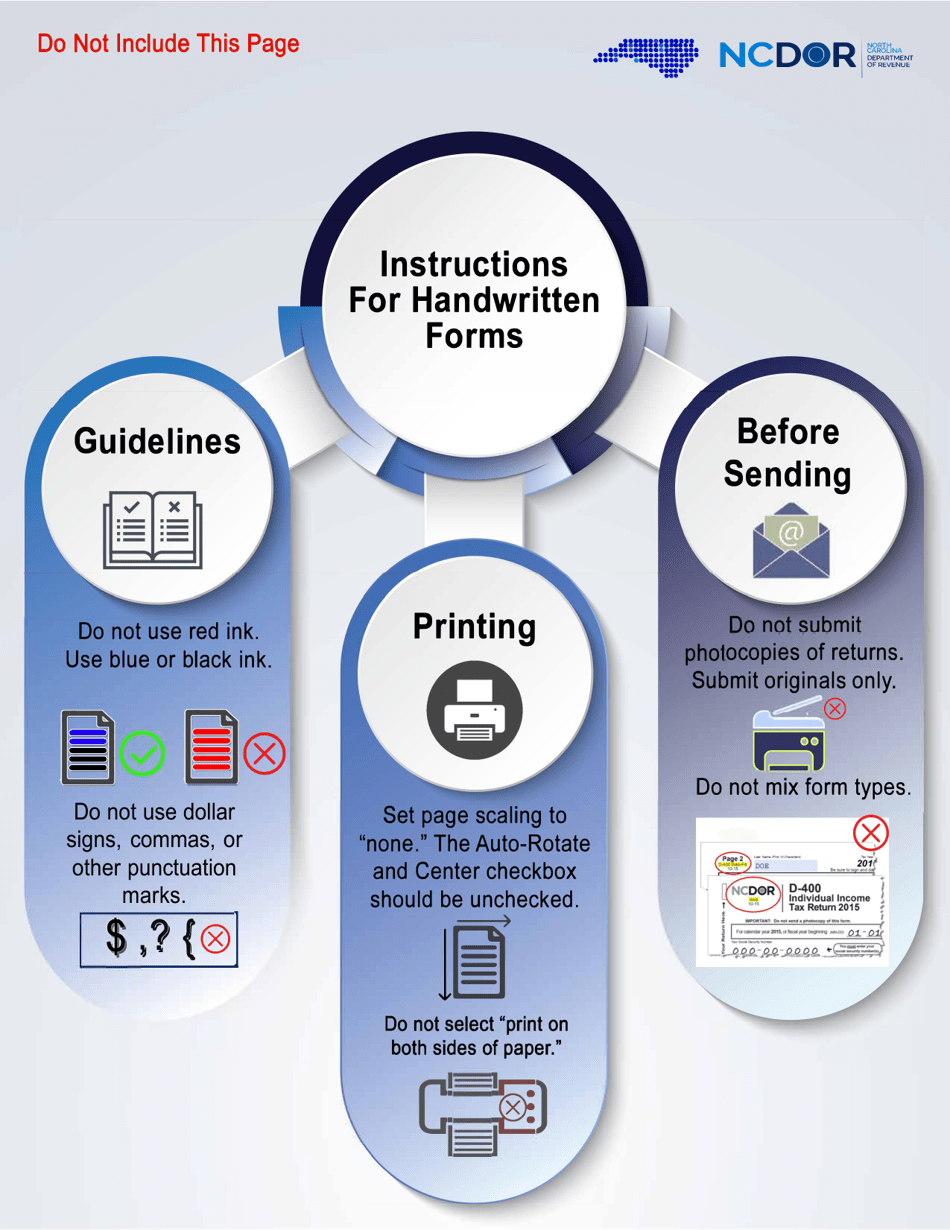

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-405 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.