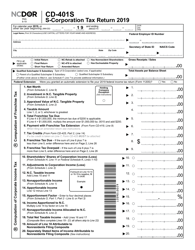

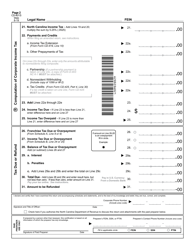

This version of the form is not currently in use and is provided for reference only. Download this version of

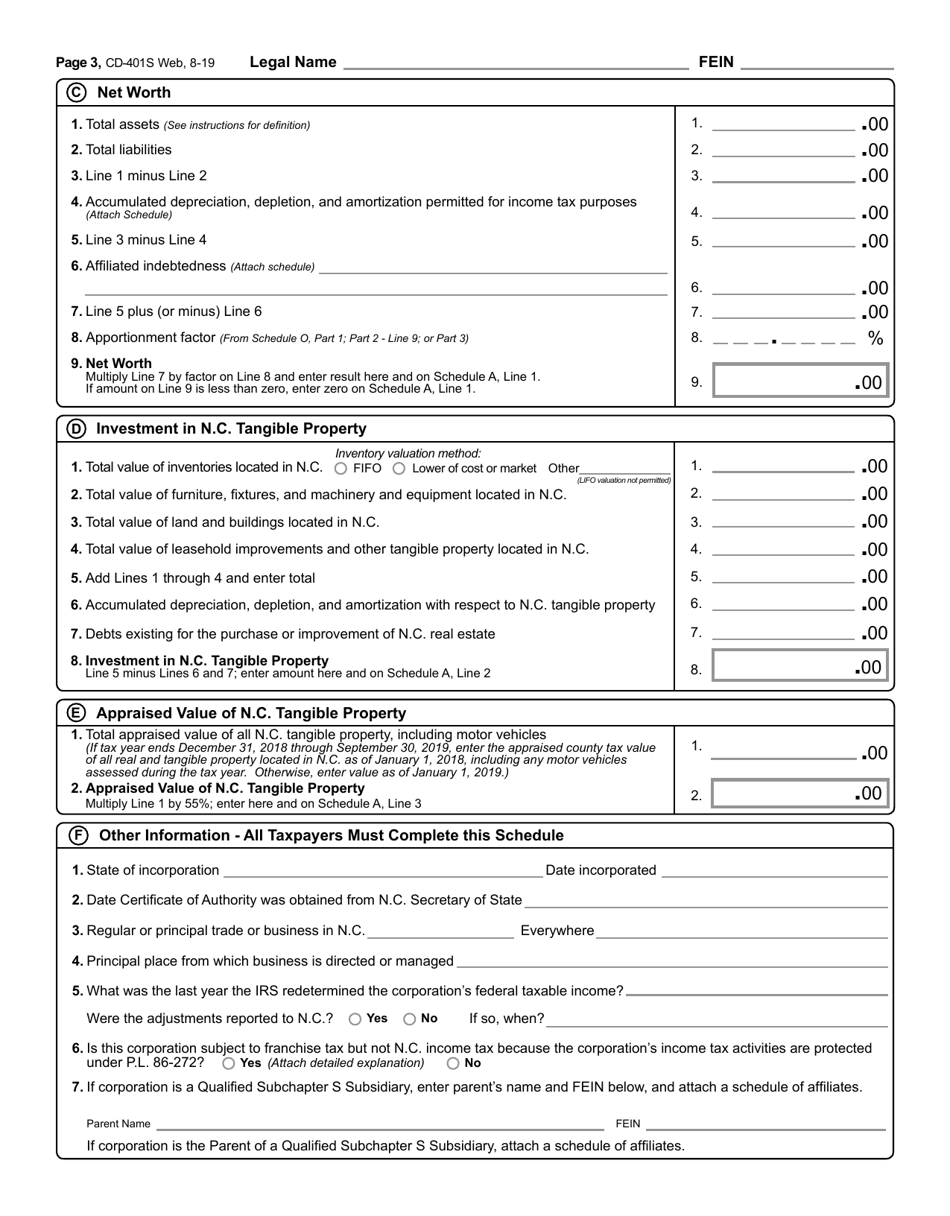

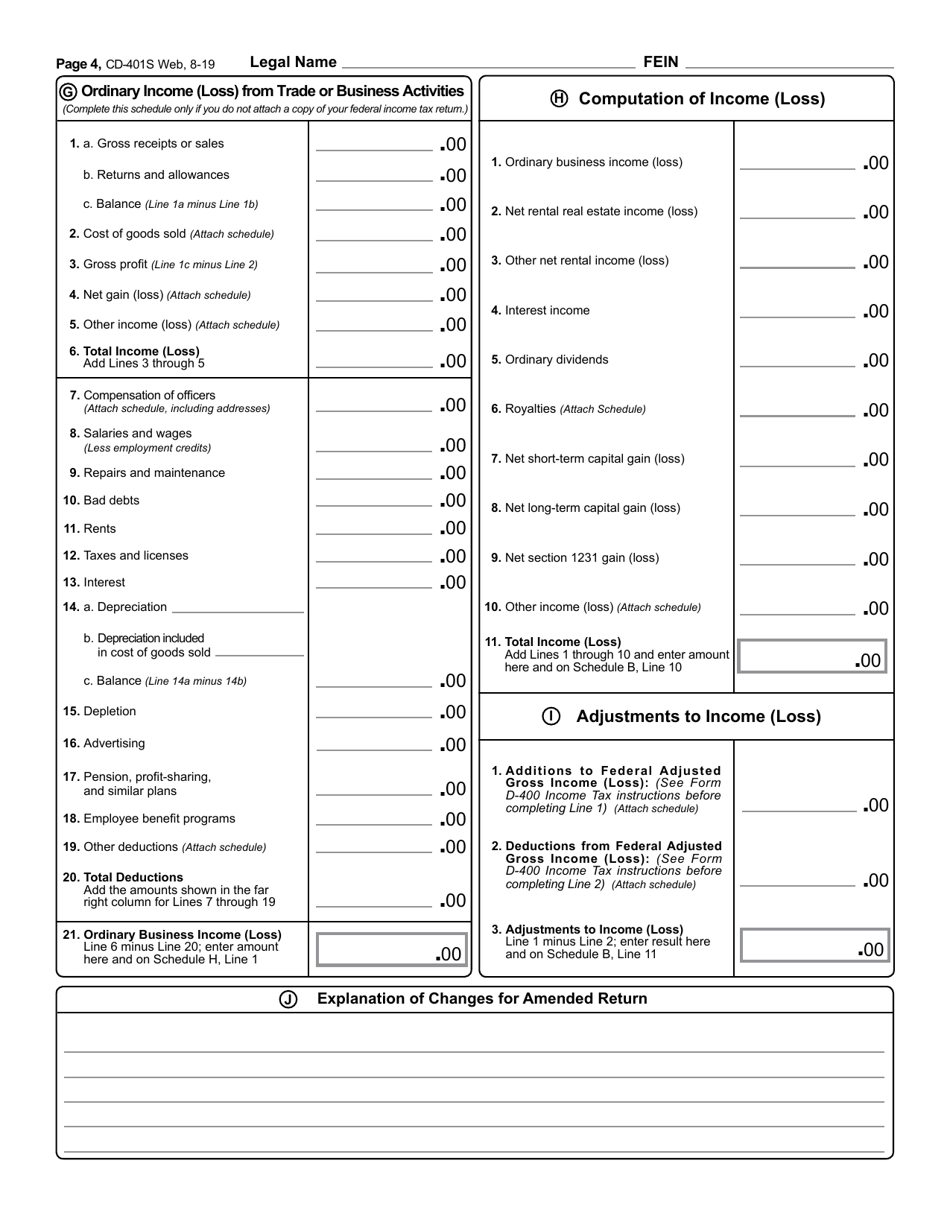

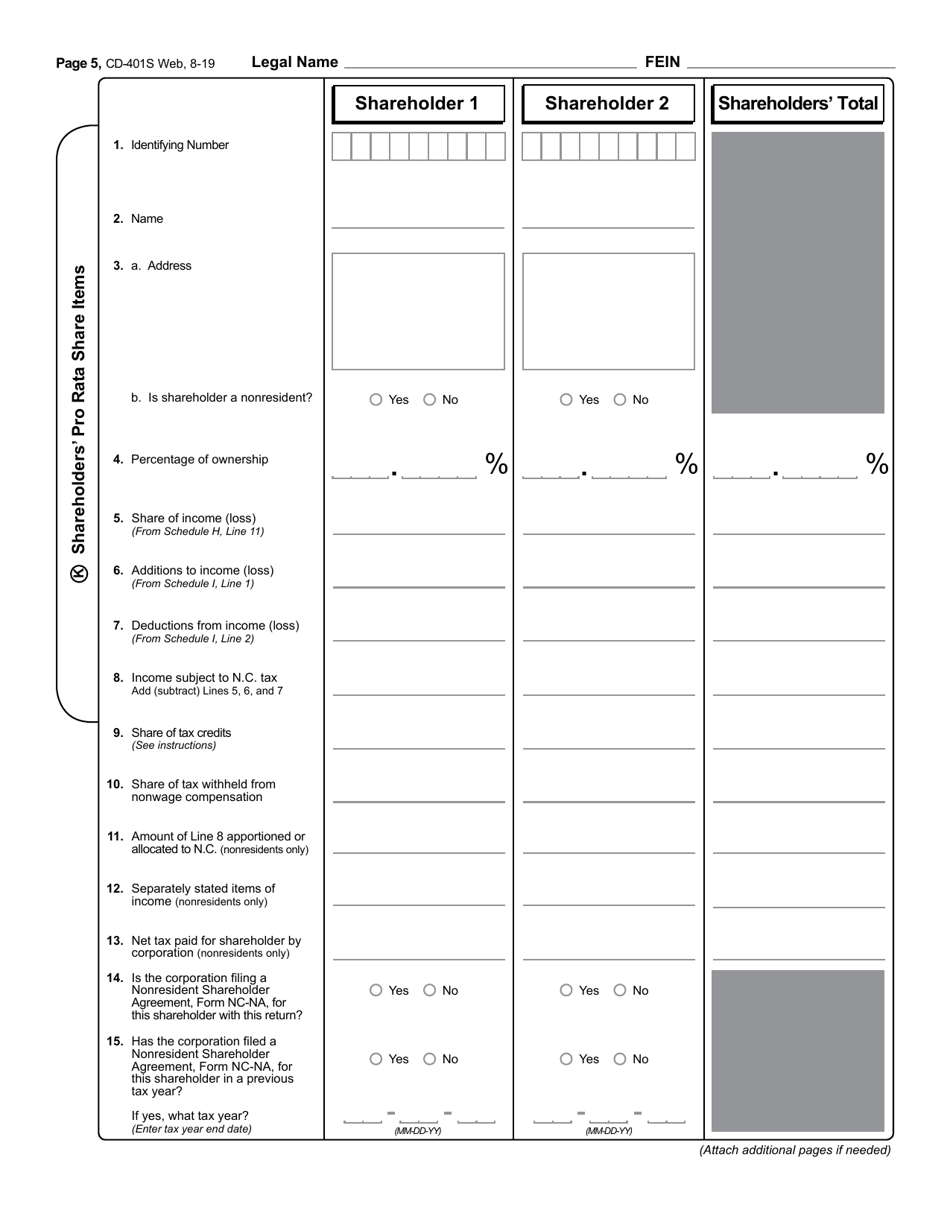

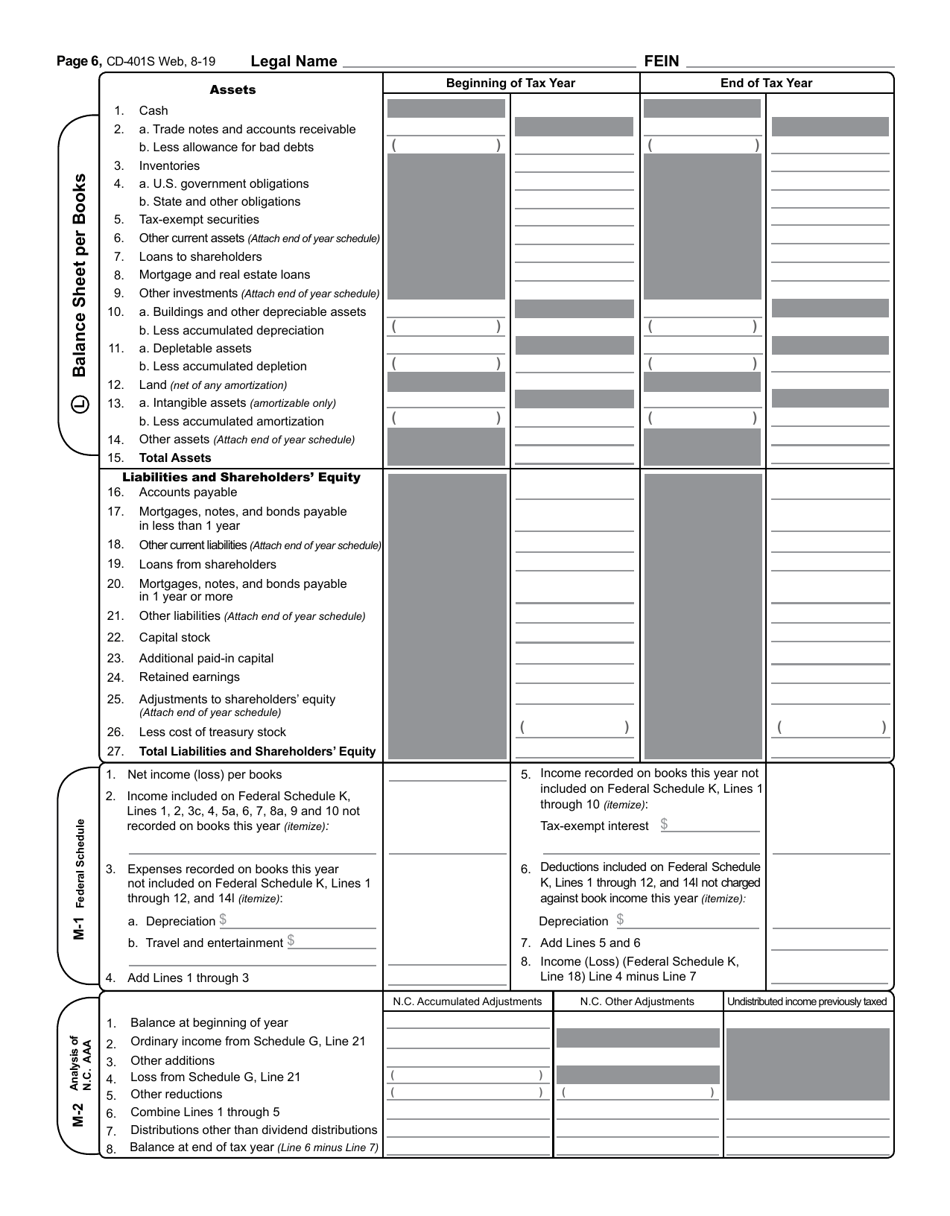

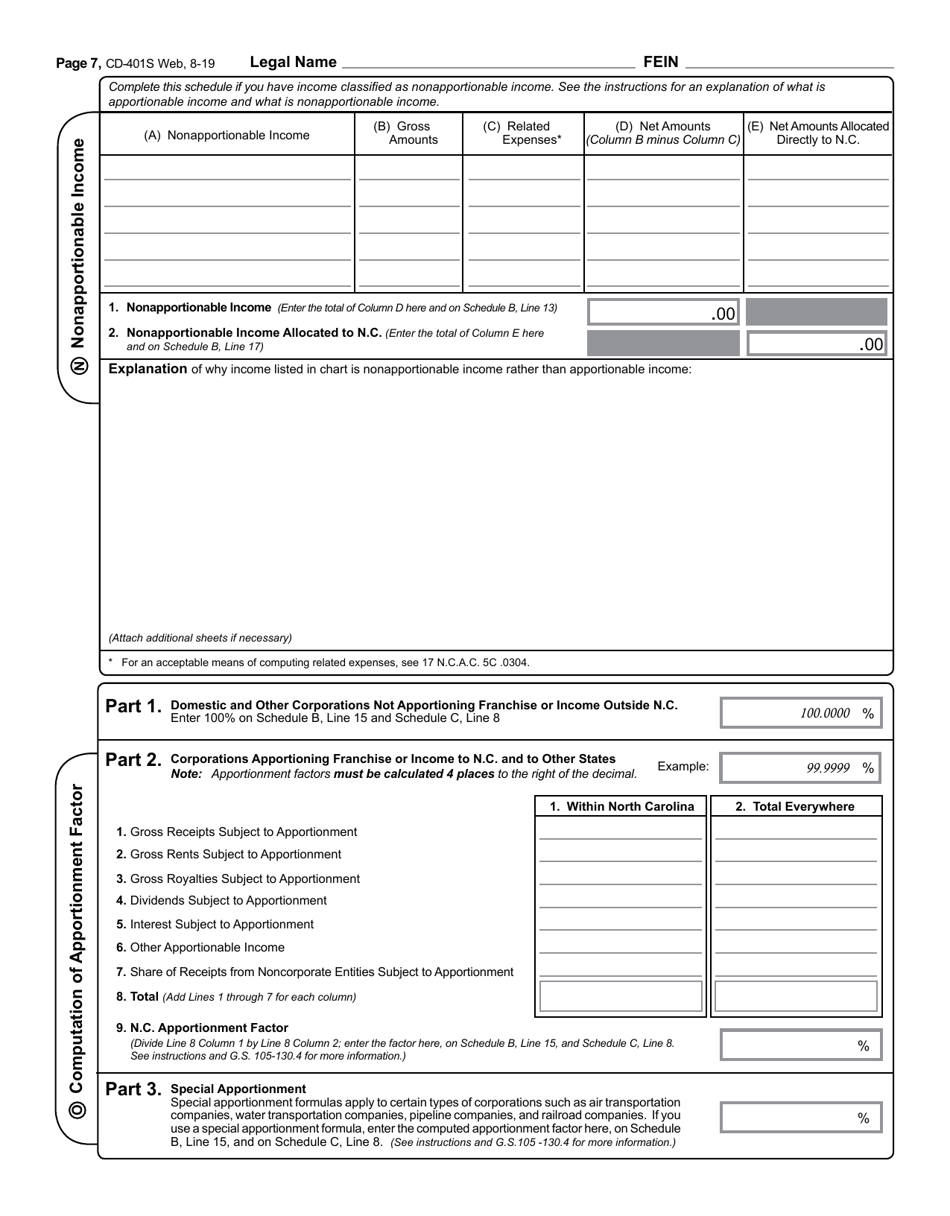

Form CD-401S

for the current year.

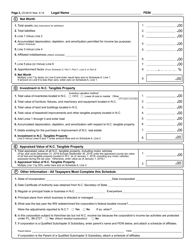

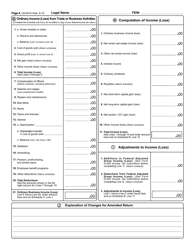

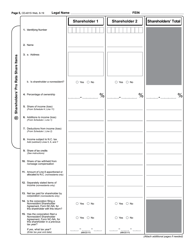

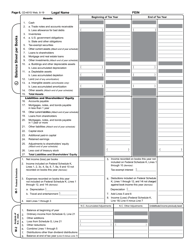

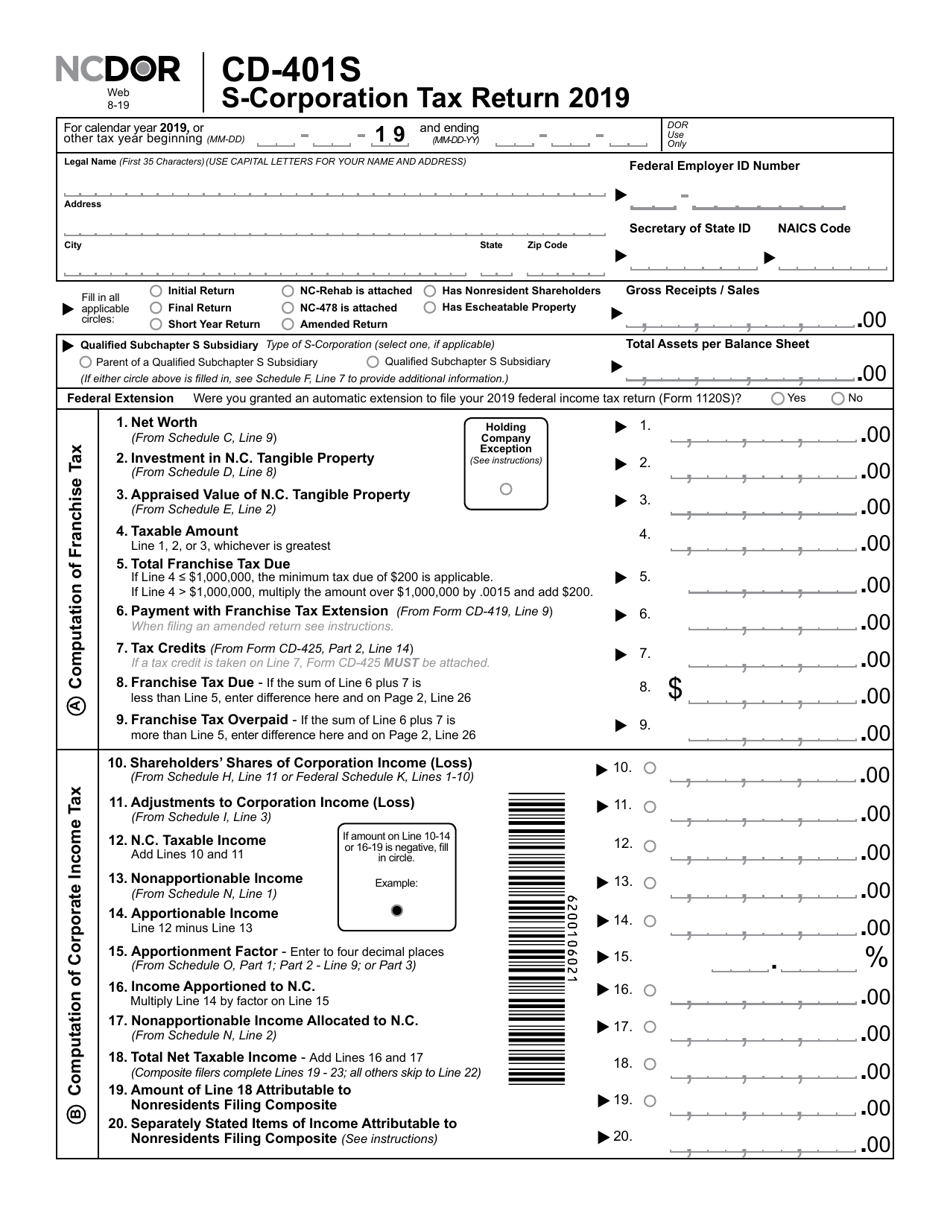

Form CD-401S S-Corporation Tax Return - North Carolina

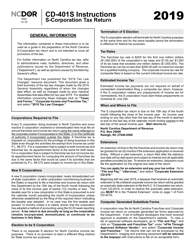

What Is Form CD-401S?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CD-401S?

A: Form CD-401S is the S-Corporation Tax Return for North Carolina.

Q: Who needs to file Form CD-401S?

A: S-Corporations doing business in North Carolina need to file Form CD-401S.

Q: What is the purpose of Form CD-401S?

A: Form CD-401S is used to report the income, deductions, and tax liability of an S-Corporation in North Carolina.

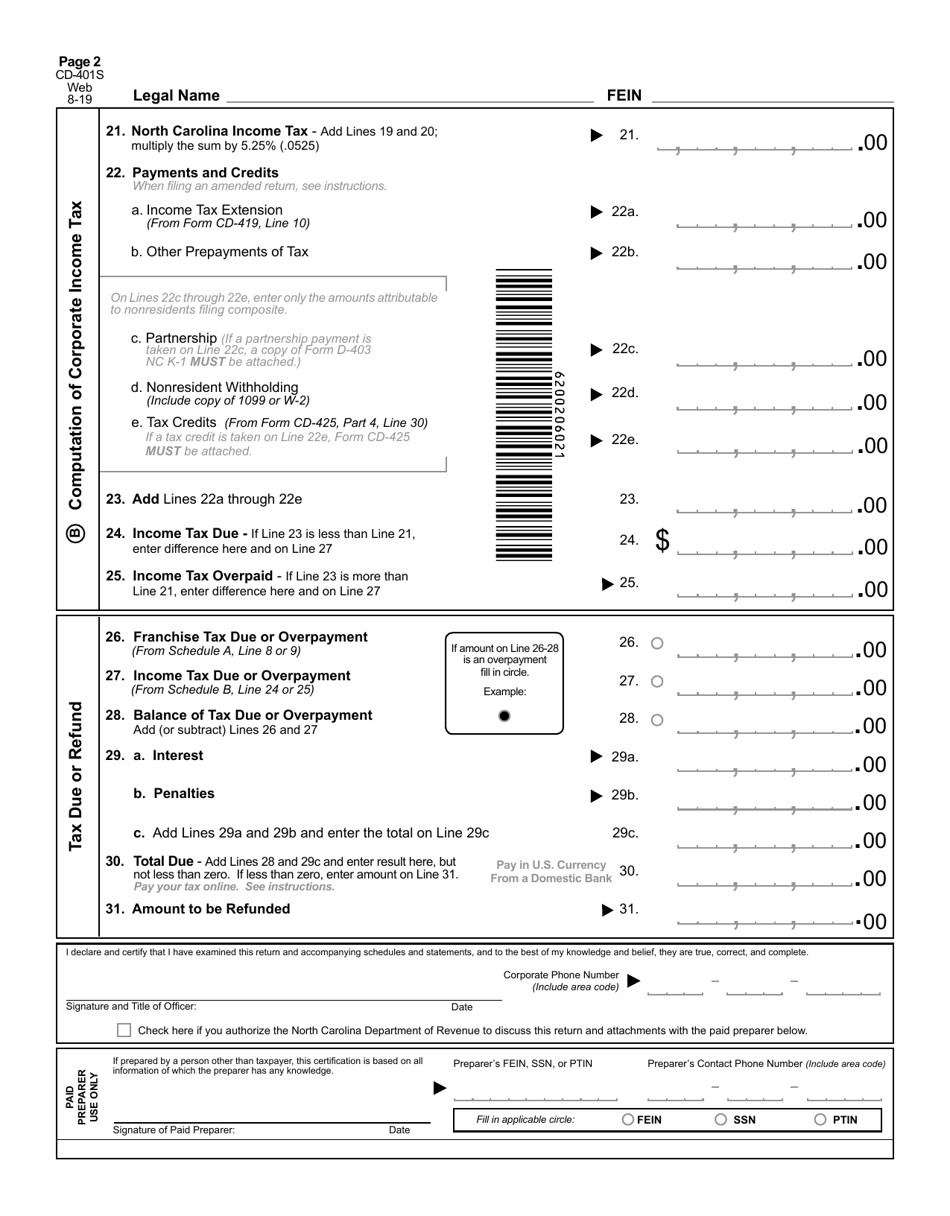

Q: When is the deadline to file Form CD-401S?

A: The deadline to file Form CD-401S is the 15th day of the third month following the close of the tax year.

Q: Are there any penalties for late filing of Form CD-401S?

A: Yes, there may be penalties for late filing or underpayment of taxes. It is important to file Form CD-401S on time.

Q: Can Form CD-401S be filed electronically?

A: Yes, Form CD-401S can be filed electronically through the North Carolina Department of Revenue's eFile system.

Q: Is Form CD-401S only for S-Corporations?

A: Yes, Form CD-401S is specifically for S-Corporations. Other types of corporations have different tax forms.

Q: What other documents do I need to include with Form CD-401S?

A: You may need to include supporting schedules, such as Schedule K-1, and any applicable federal tax forms.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

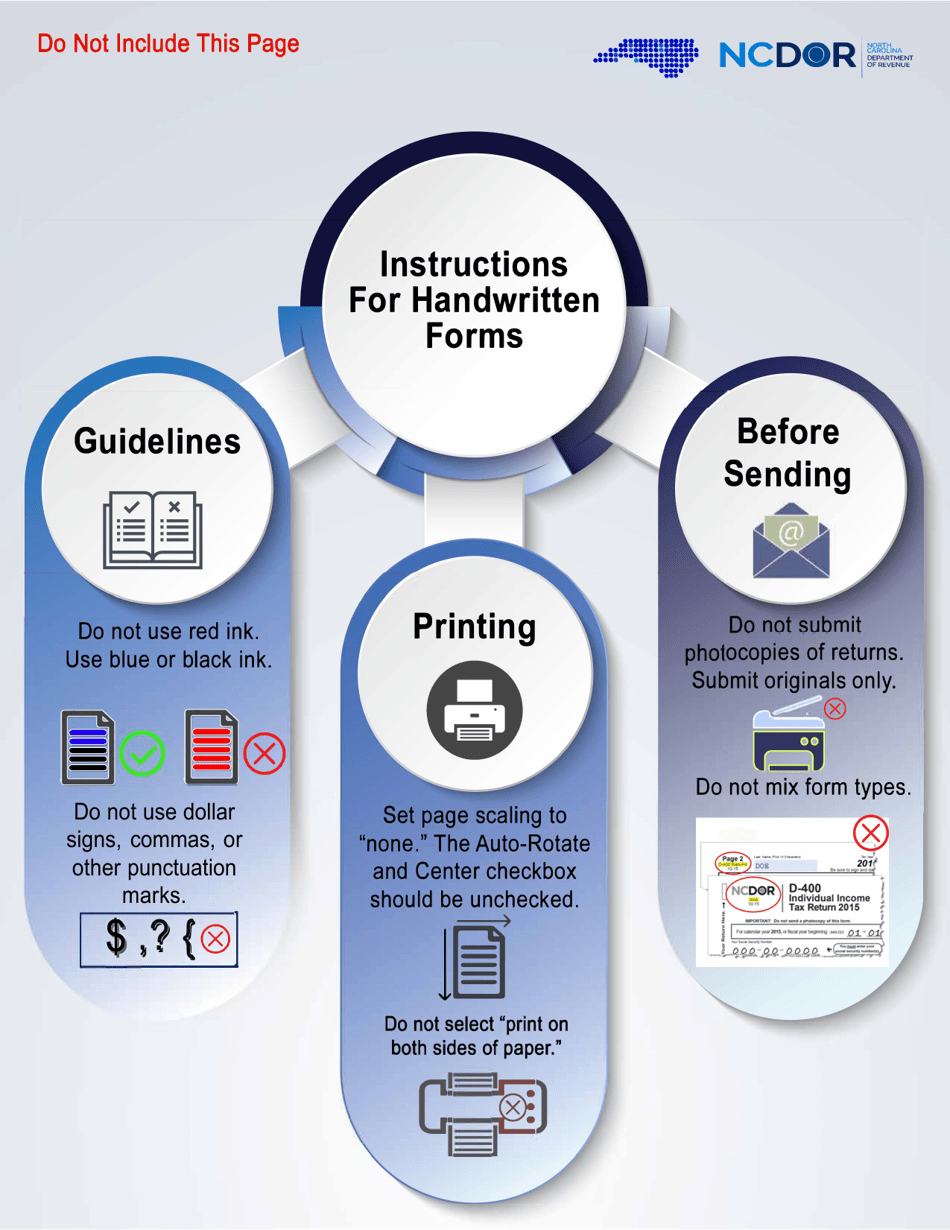

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-401S by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.