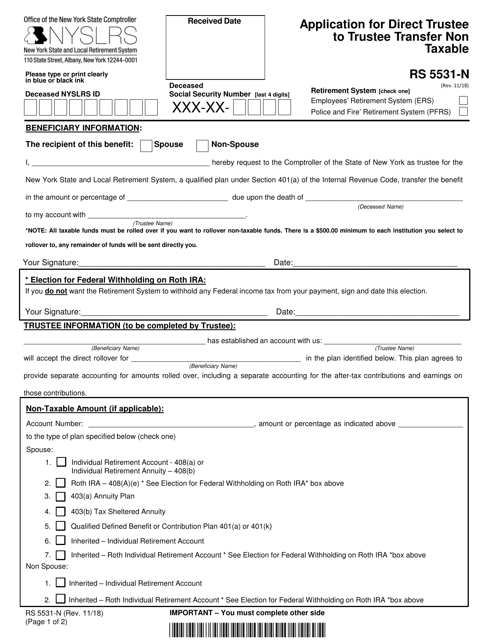

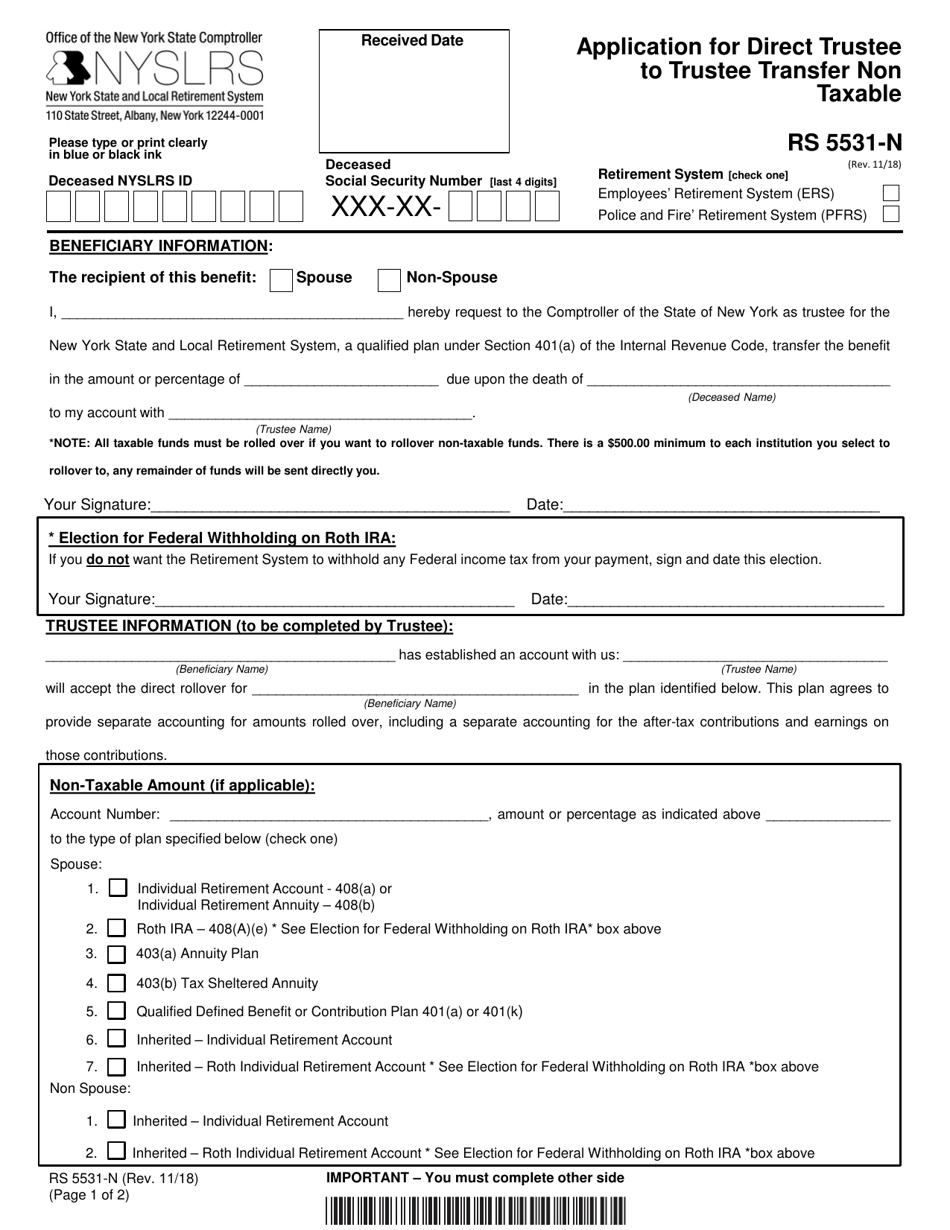

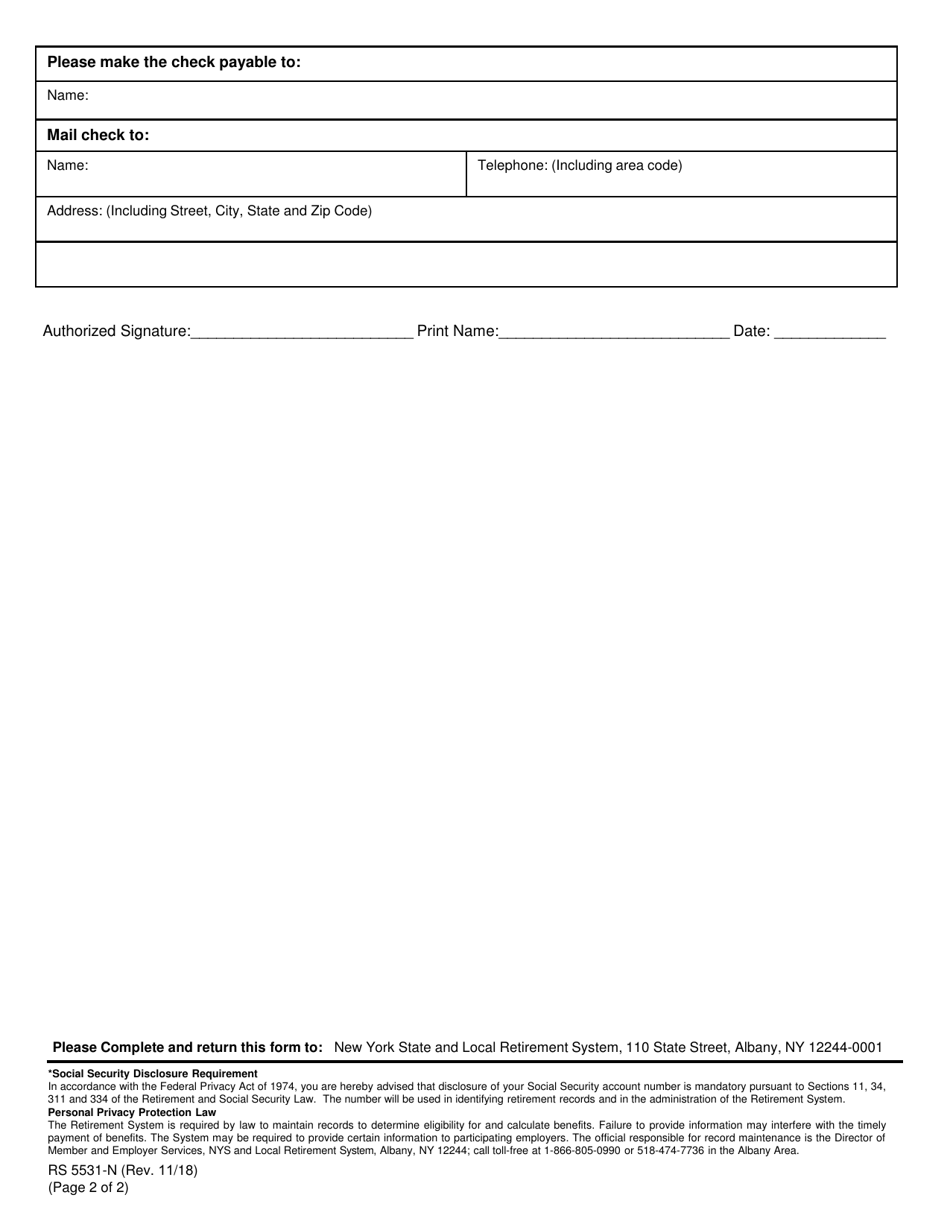

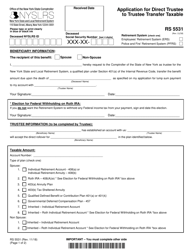

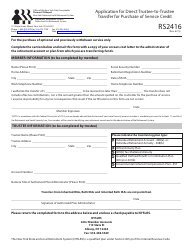

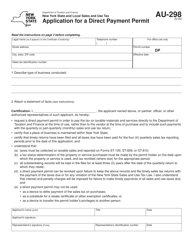

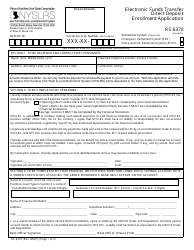

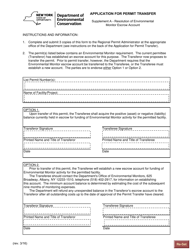

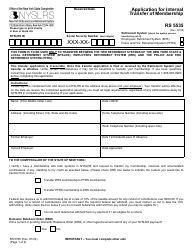

Form RS5531-N Application for Direct Trustee to Trustee Transfer Non Taxable - New York

What Is Form RS5531-N?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RS5531-N form?

A: The RS5531-N form is an application for a direct trustee to trustee transfer that is non-taxable in the state of New York.

Q: What is a direct trustee to trustee transfer?

A: A direct trustee to trustee transfer is the movement of assets between two different trustees without any tax consequences.

Q: Who is eligible to use the RS5531-N form?

A: The RS5531-N form is typically used by individuals or entities in New York who want to transfer assets between different trust accounts without incurring any tax liabilities.

Q: Is the transfer taxable?

A: No, the transfer facilitated by the RS5531-N form is non-taxable, meaning there are no tax consequences associated with the transfer.

Q: Are there any fees associated with filing the RS5531-N form?

A: It is always advisable to check with the New York State Department of Taxation and Finance or consult a tax professional to determine if any fees are applicable.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

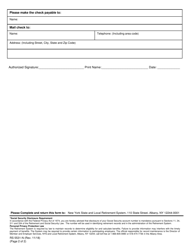

Download a fillable version of Form RS5531-N by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.