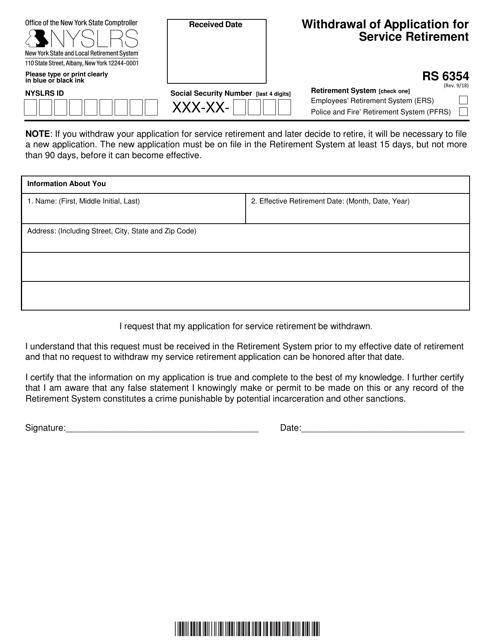

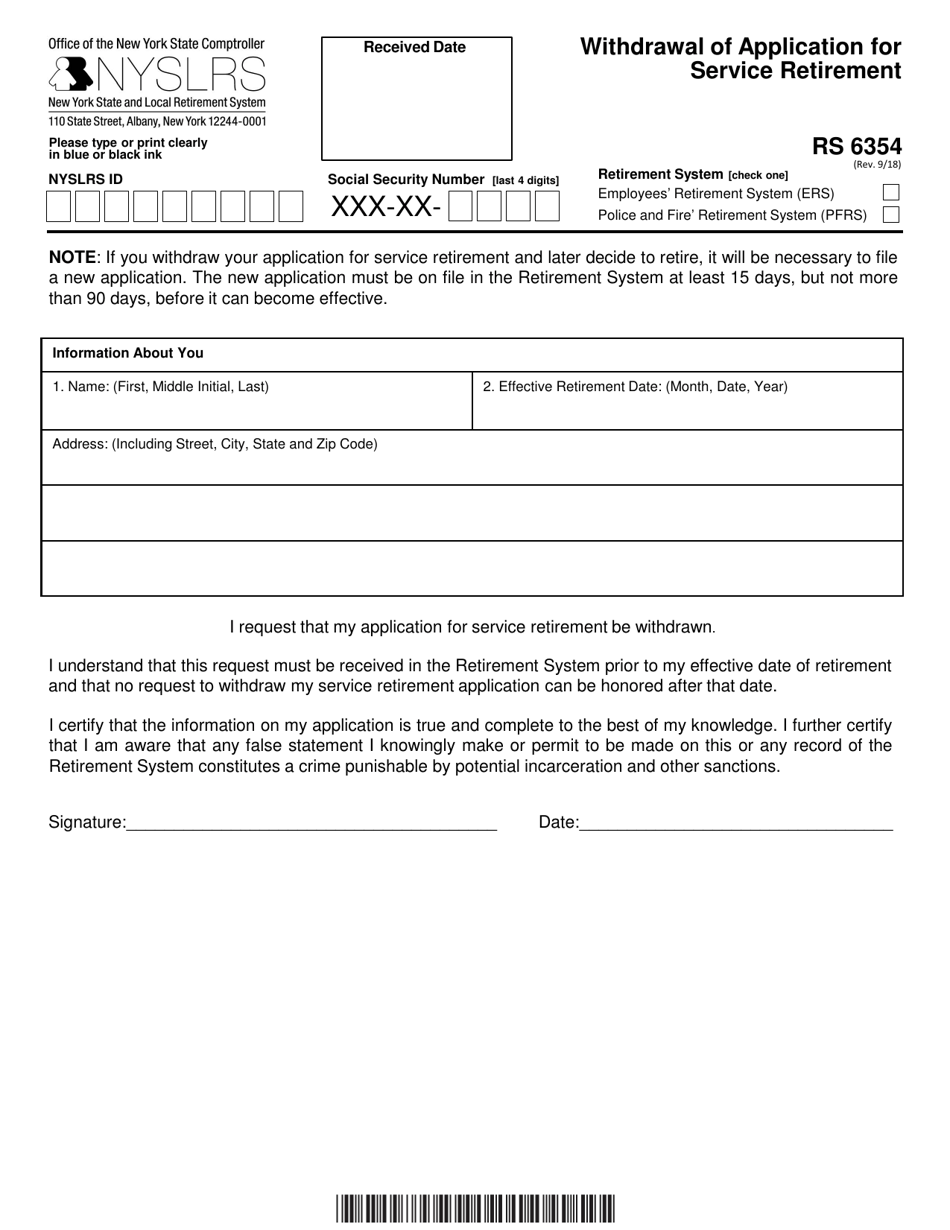

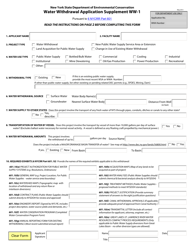

Form RS6354 Withdrawal of Application for Service Retirement - New York

What Is Form RS6354?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

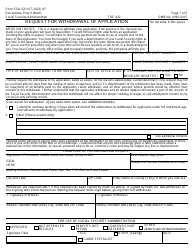

Q: What is Form RS6354?

A: Form RS6354 is a form used to withdraw an application for service retirement in the state of New York.

Q: Who can use Form RS6354?

A: Form RS6354 is used by members of the New York State and Local Retirement System who have submitted an application for service retirement and wish to withdraw that application.

Q: Why would someone want to withdraw their application for service retirement?

A: There can be various reasons why someone may want to withdraw their application for service retirement, such as a change in retirement plans or a decision to continue working.

Q: Is there a deadline for submitting Form RS6354?

A: There is no specific deadline for submitting Form RS6354, but it is recommended to submit it as soon as the decision to withdraw the application is made.

Q: What happens after submitting Form RS6354?

A: Once Form RS6354 is submitted to the NYSLRS, the retirement application will be withdrawn and the member will continue to be an active member of the retirement system.

Q: Are there any fees or penalties for withdrawing an application for service retirement?

A: There are no fees or penalties associated with withdrawing an application for service retirement in New York.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RS6354 by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.