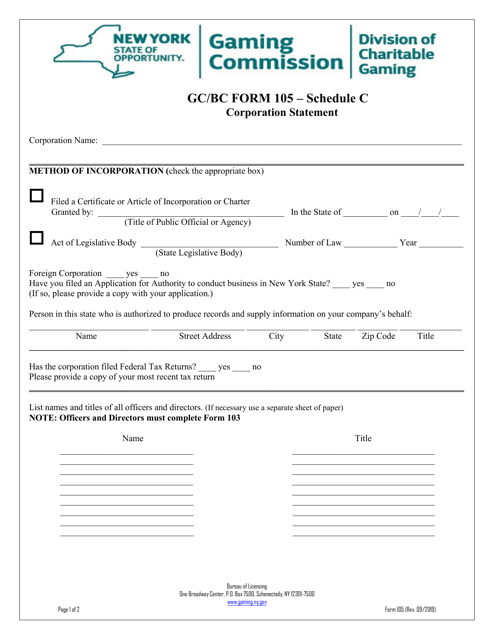

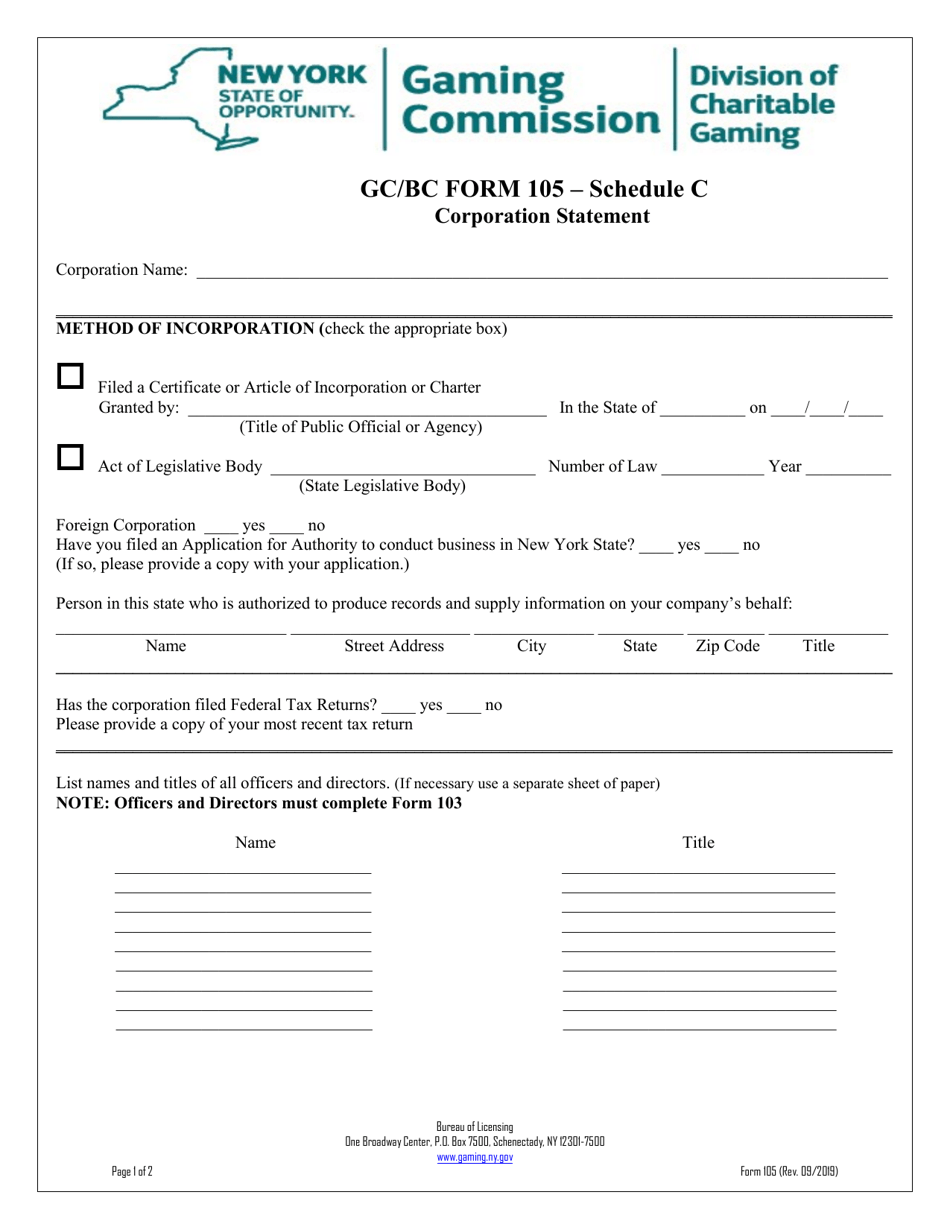

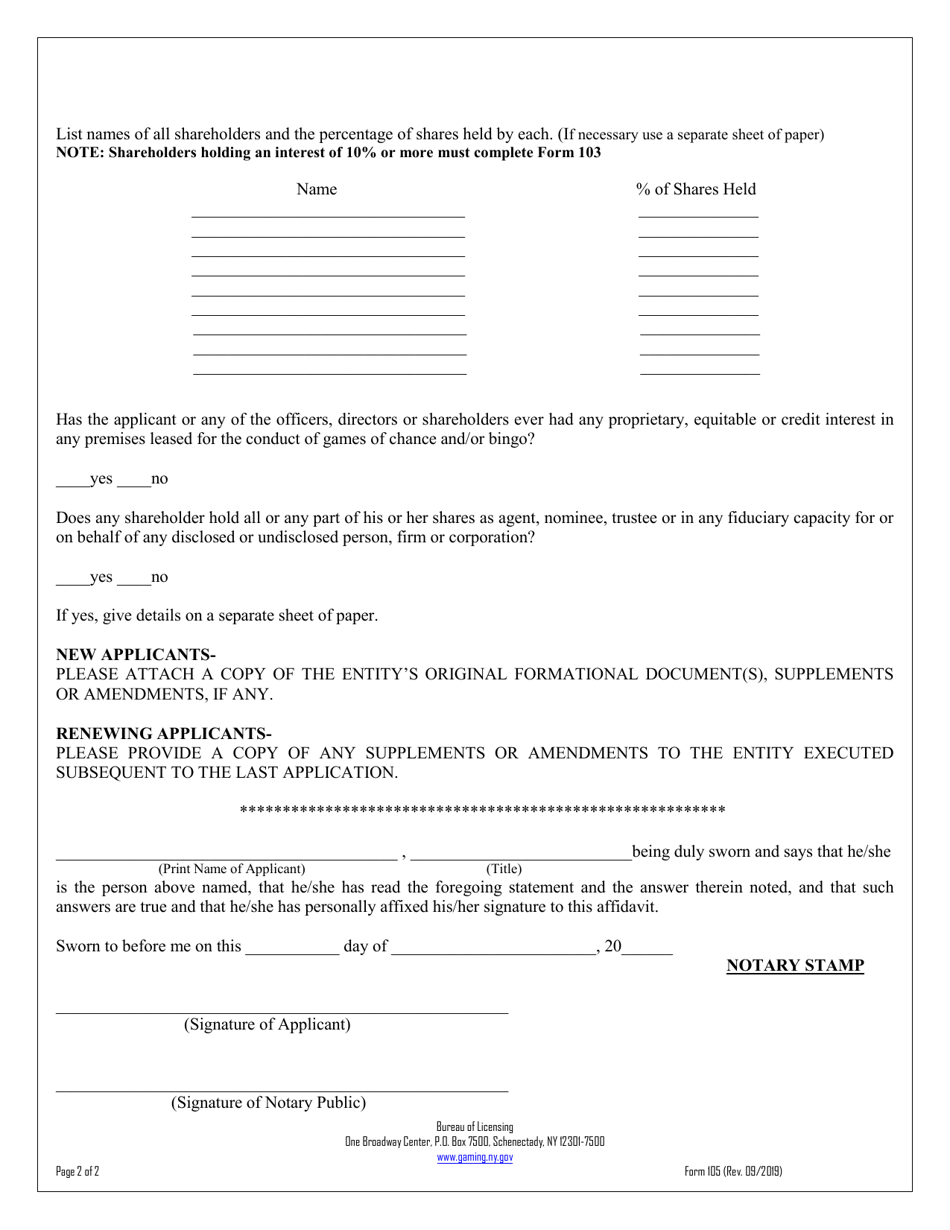

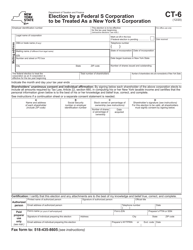

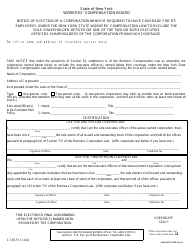

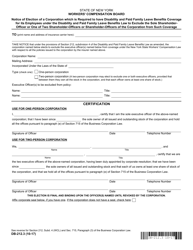

Form 105 Schedule Corporation Statement - New York

What Is Form 105 Schedule С?

This is a legal form that was released by the New York State Gaming Commission - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

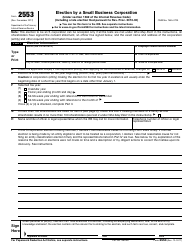

Q: What is Form 105 Schedule Corporation Statement?

A: Form 105 Schedule Corporation Statement is a tax form used by corporations in New York to report their income and calculate their tax liability.

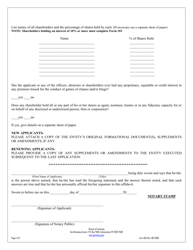

Q: Who should fill out Form 105 Schedule Corporation Statement?

A: Corporations operating in New York are required to fill out Form 105 Schedule Corporation Statement.

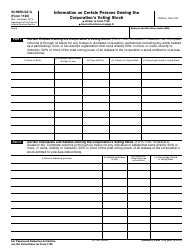

Q: What information needs to be provided on Form 105 Schedule Corporation Statement?

A: Form 105 Schedule Corporation Statement requires corporations to provide information about their income, deductions, and tax credits.

Q: When is the deadline to file Form 105 Schedule Corporation Statement?

A: The deadline to file Form 105 Schedule Corporation Statement is generally on or before the 15th day of the 4th month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form 105 Schedule Corporation Statement?

A: Yes, there are penalties for late filing of Form 105 Schedule Corporation Statement. It is important to file the form by the deadline to avoid penalties and interest.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the New York State Gaming Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 105 Schedule С by clicking the link below or browse more documents and templates provided by the New York State Gaming Commission.