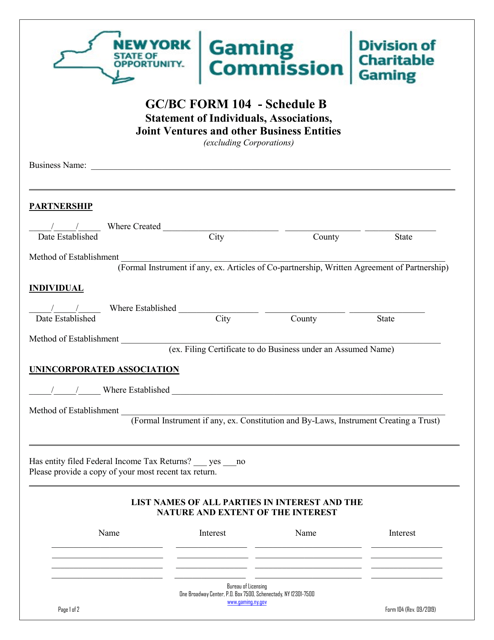

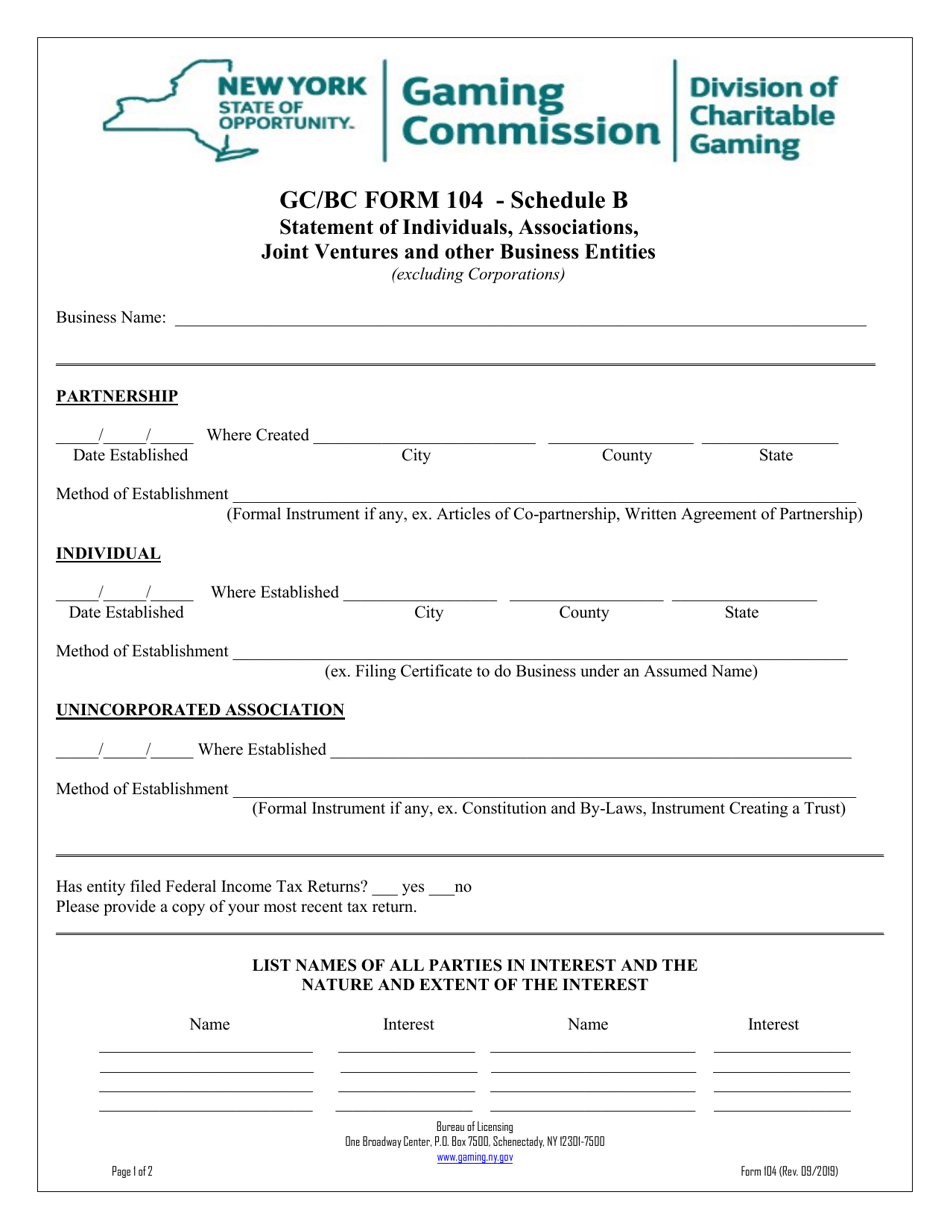

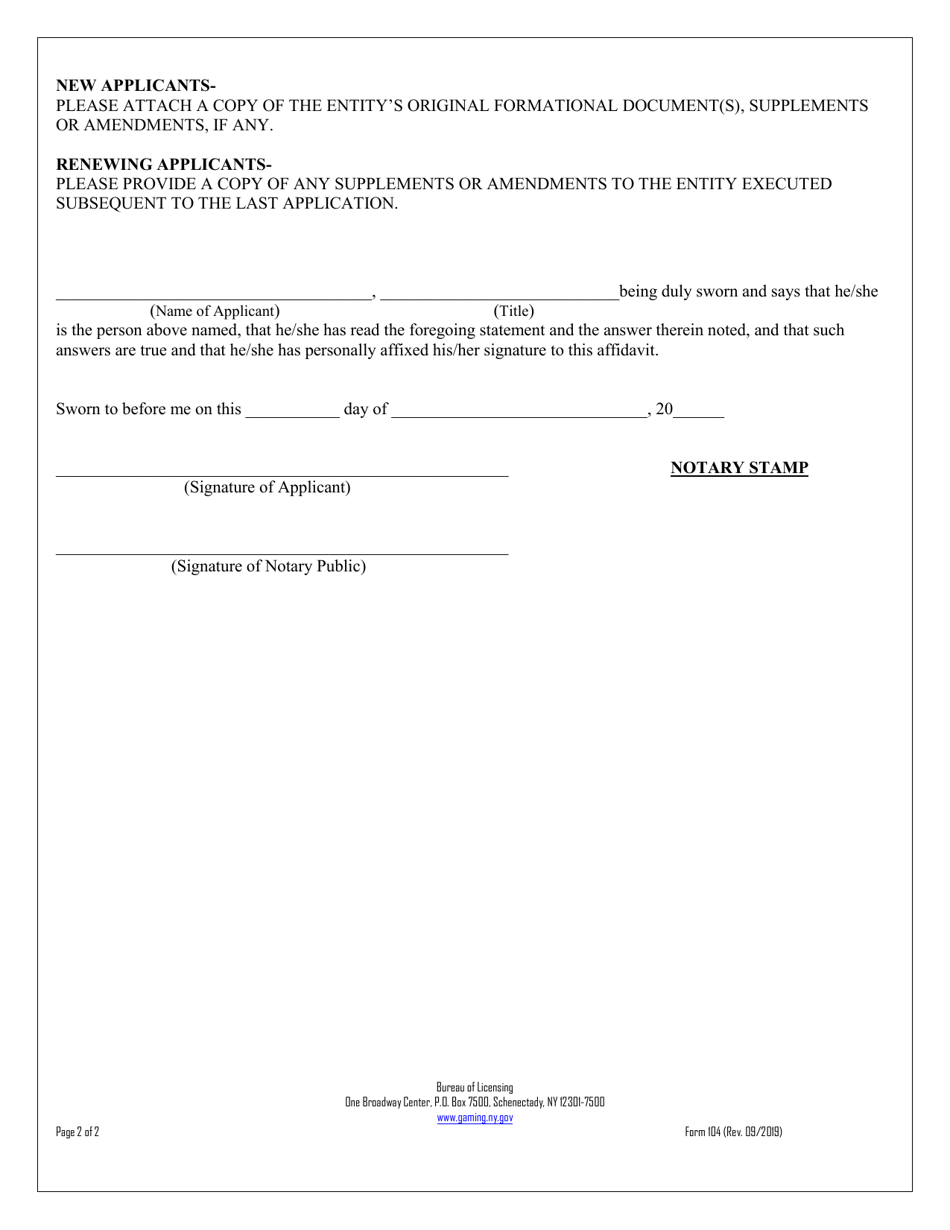

Form 104 Schedule B Statement of Individuals, Associations, Joint Ventures and Other Business Entities - New York

What Is Form 104 Schedule B?

This is a legal form that was released by the New York State Gaming Commission - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 104 Schedule B?

A: Form 104 Schedule B is a statement used to report information about individuals, associations, joint ventures, and other business entities in New York.

Q: Who needs to file Form 104 Schedule B?

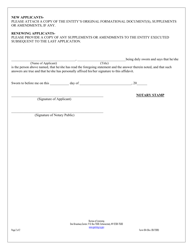

A: Individuals, associations, joint ventures, and other business entities in New York who are required to report certain information need to file Form 104 Schedule B.

Q: What information is reported on Form 104 Schedule B?

A: Form 104 Schedule B requires the reporting of details about individuals, associations, joint ventures, and other business entities, such as names, addresses, ownership percentages, and more.

Q: When is the deadline for filing Form 104 Schedule B?

A: The deadline for filing Form 104 Schedule B depends on the specific requirements and guidelines set by the New York taxing authority. It is important to refer to the instructions provided with the form or consult with a tax professional to determine the deadline.

Q: Are there any penalties for not filing Form 104 Schedule B?

A: Failure to file Form 104 Schedule B or filing it incorrectly may result in penalties imposed by the New York taxing authority. It is important to comply with the filing requirements to avoid penalties.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the New York State Gaming Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 104 Schedule B by clicking the link below or browse more documents and templates provided by the New York State Gaming Commission.