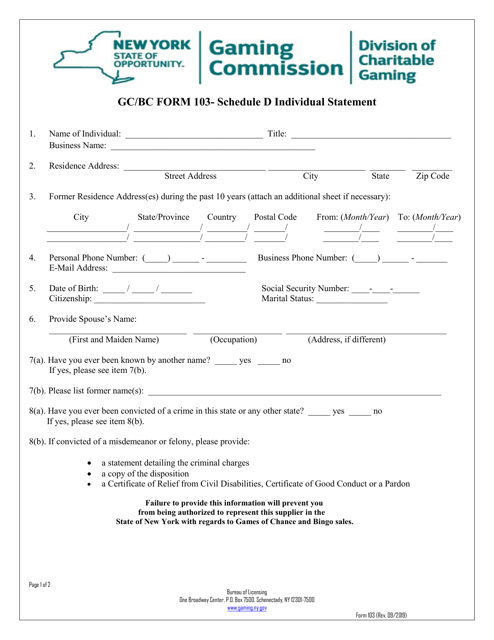

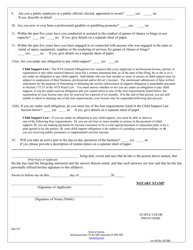

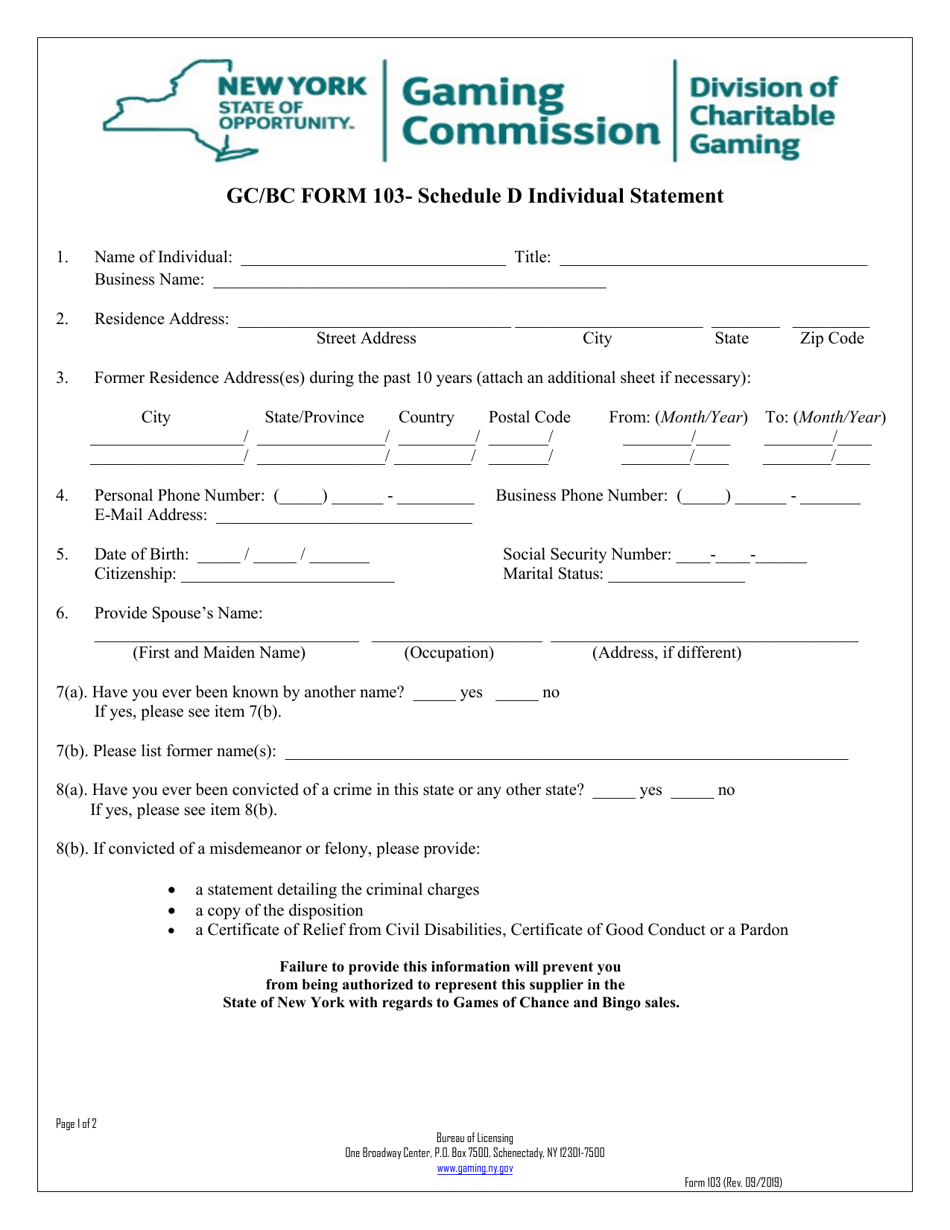

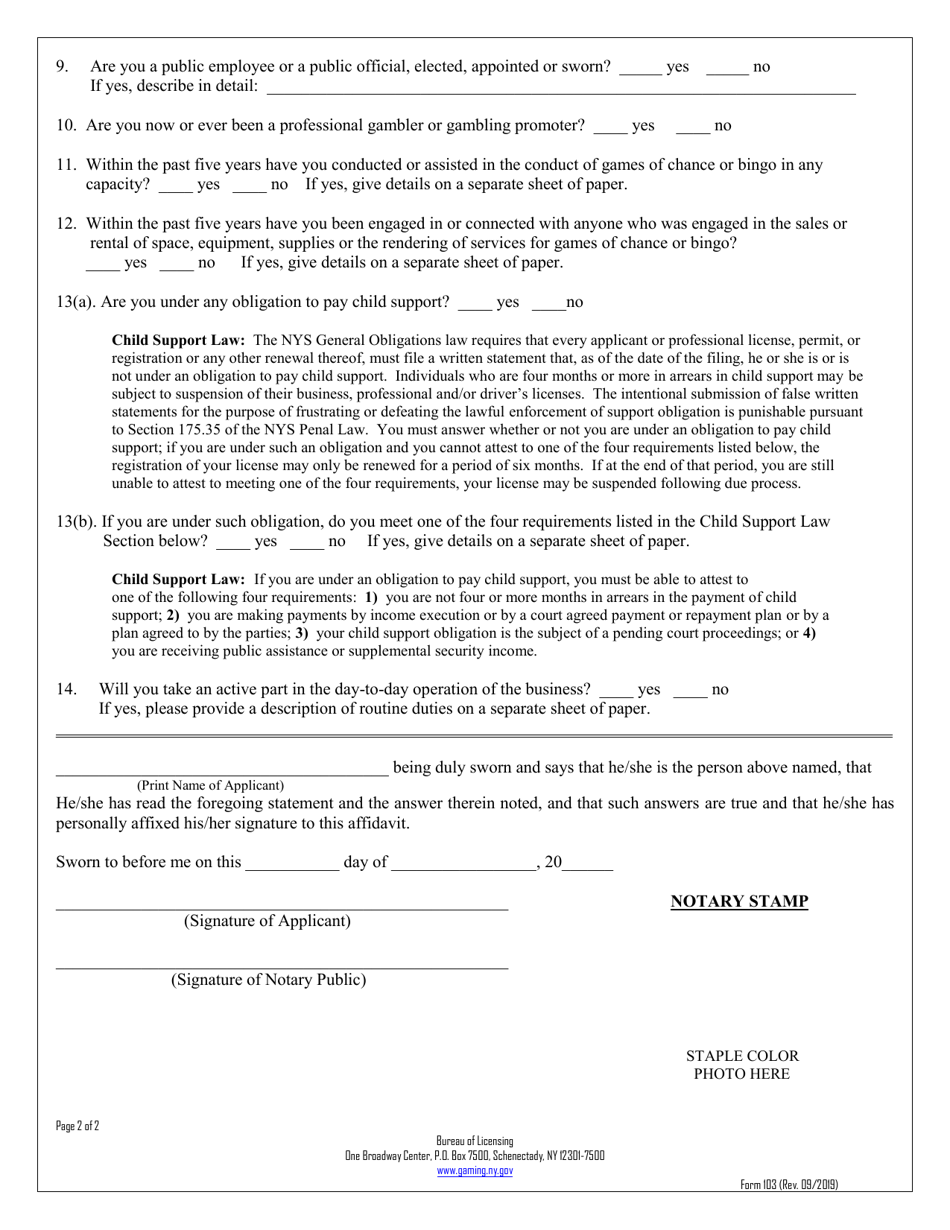

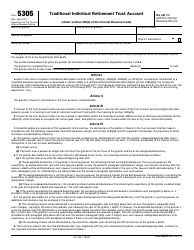

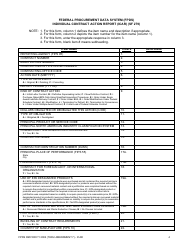

Form 103 Schedule D Individual Statement - New York

What Is Form 103 Schedule D?

This is a legal form that was released by the New York State Gaming Commission - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

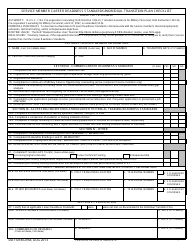

Q: What is Form 103 Schedule D?

A: Form 103 Schedule D is an individual statement used in New York to report income from capital gains and losses.

Q: When do I need to file Form 103 Schedule D?

A: You need to file Form 103 Schedule D if you had capital gains or losses in New York.

Q: What information do I need to complete Form 103 Schedule D?

A: You will need to gather information about your capital gains and losses, including the cost basis and sale proceeds of your assets.

Q: Is there a deadline for filing Form 103 Schedule D?

A: Yes, the deadline for filing Form 103 Schedule D is the same as the deadline for filing your New York state income tax return, usually April 15th.

Q: Do I need to include Form 103 Schedule D with my federal tax return?

A: No, Form 103 Schedule D is specific to New York and should be filed separately with your New York state income tax return.

Q: Can I e-file Form 103 Schedule D?

A: Yes, you can e-file Form 103 Schedule D if you are filing your New York state income tax return electronically.

Q: Are there any special instructions or considerations when filling out Form 103 Schedule D for New York?

A: It is important to carefully review the instructions provided by the New York State Department of Taxation and Finance to ensure accurate completion of the form.

Q: What are the consequences of not filing Form 103 Schedule D?

A: Failing to file Form 103 Schedule D when required may result in penalties or interest charges imposed by the New York State Department of Taxation and Finance.

Q: Can I amend my Form 103 Schedule D if I made a mistake?

A: Yes, you can file an amended Form 103 Schedule D to correct any errors or omissions that you made on your original filing.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the New York State Gaming Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 103 Schedule D by clicking the link below or browse more documents and templates provided by the New York State Gaming Commission.