This version of the form is not currently in use and is provided for reference only. Download this version of

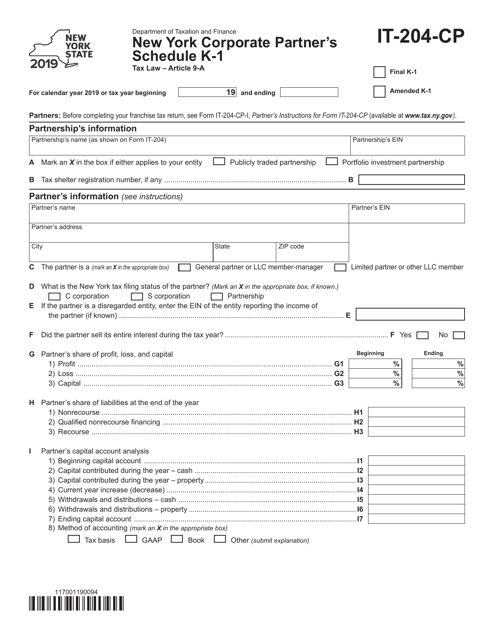

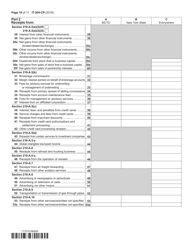

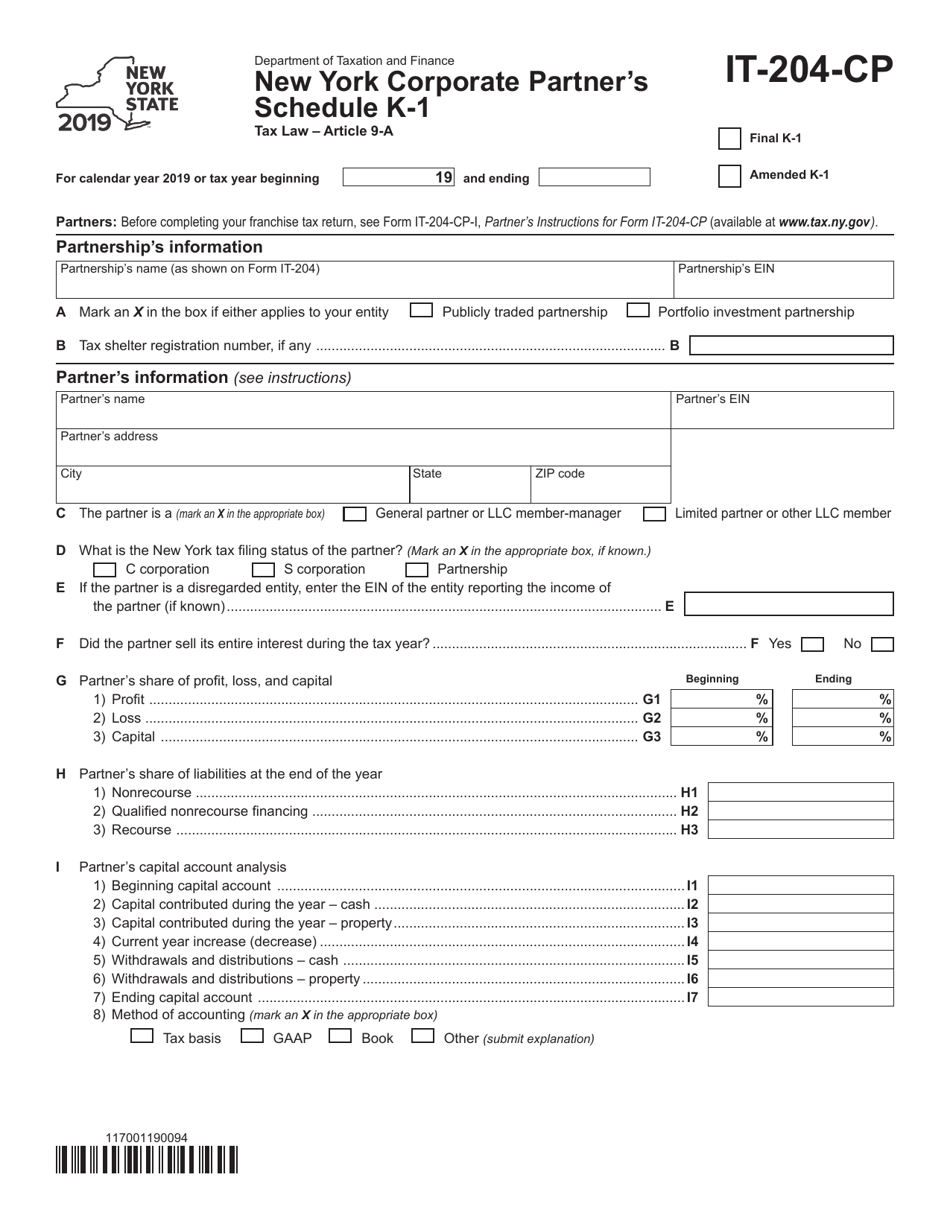

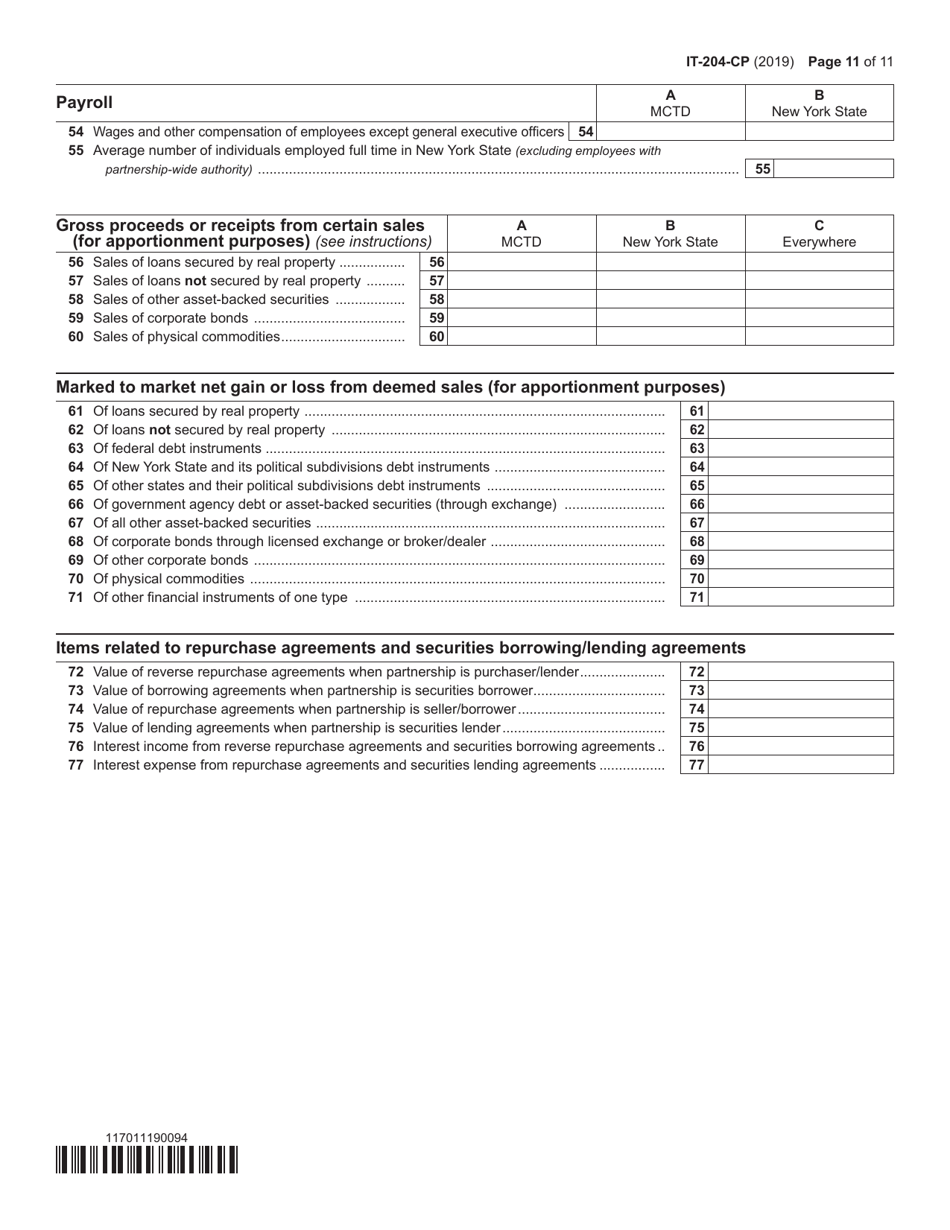

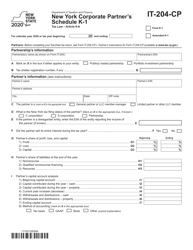

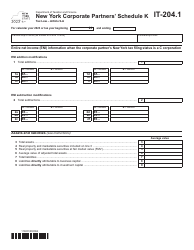

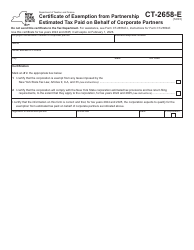

Form IT-204-CP Schedule K-1

for the current year.

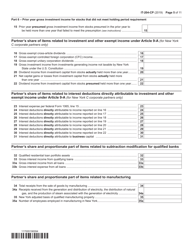

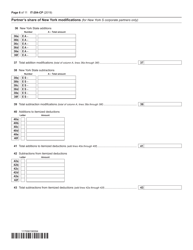

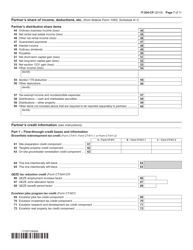

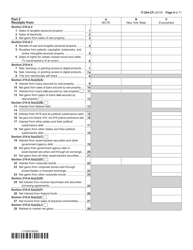

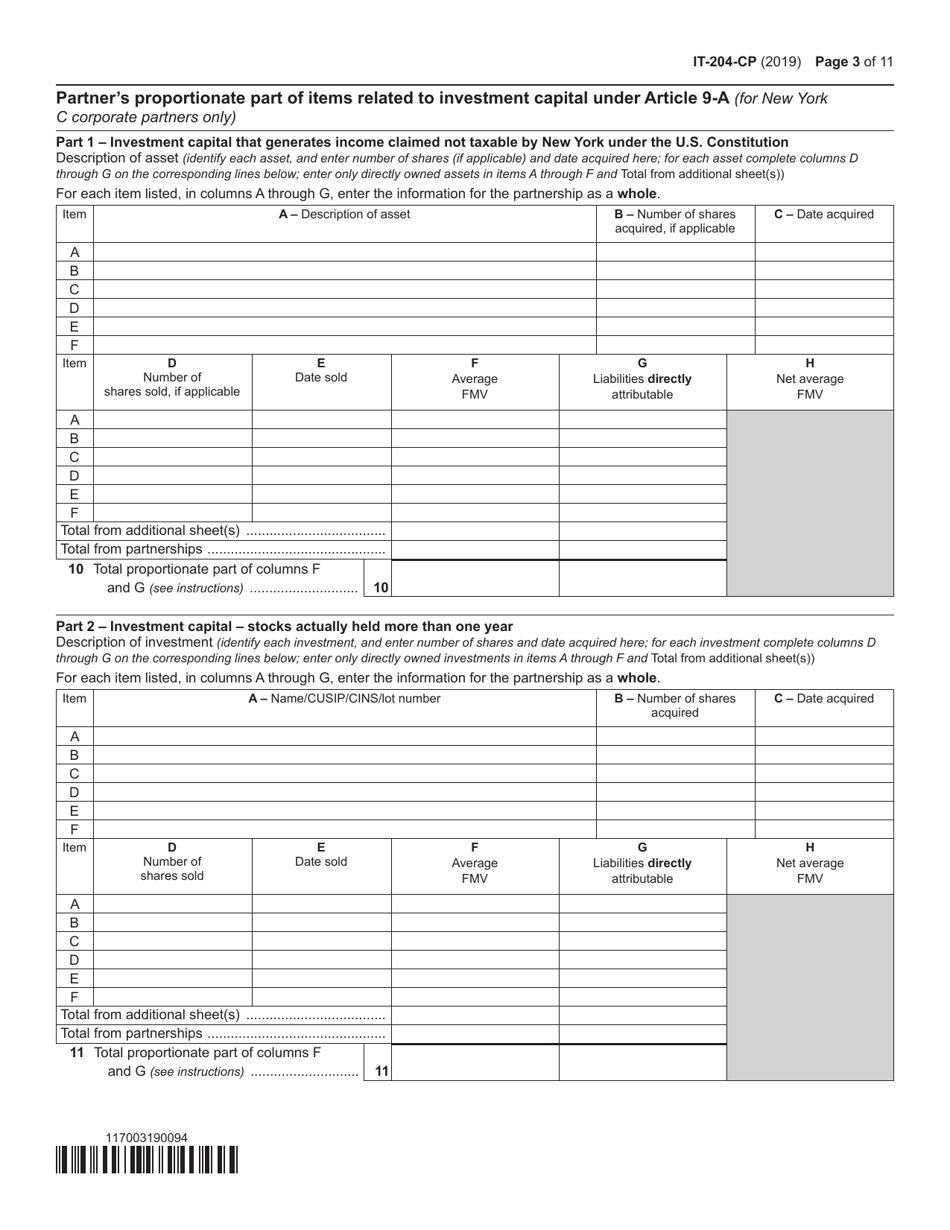

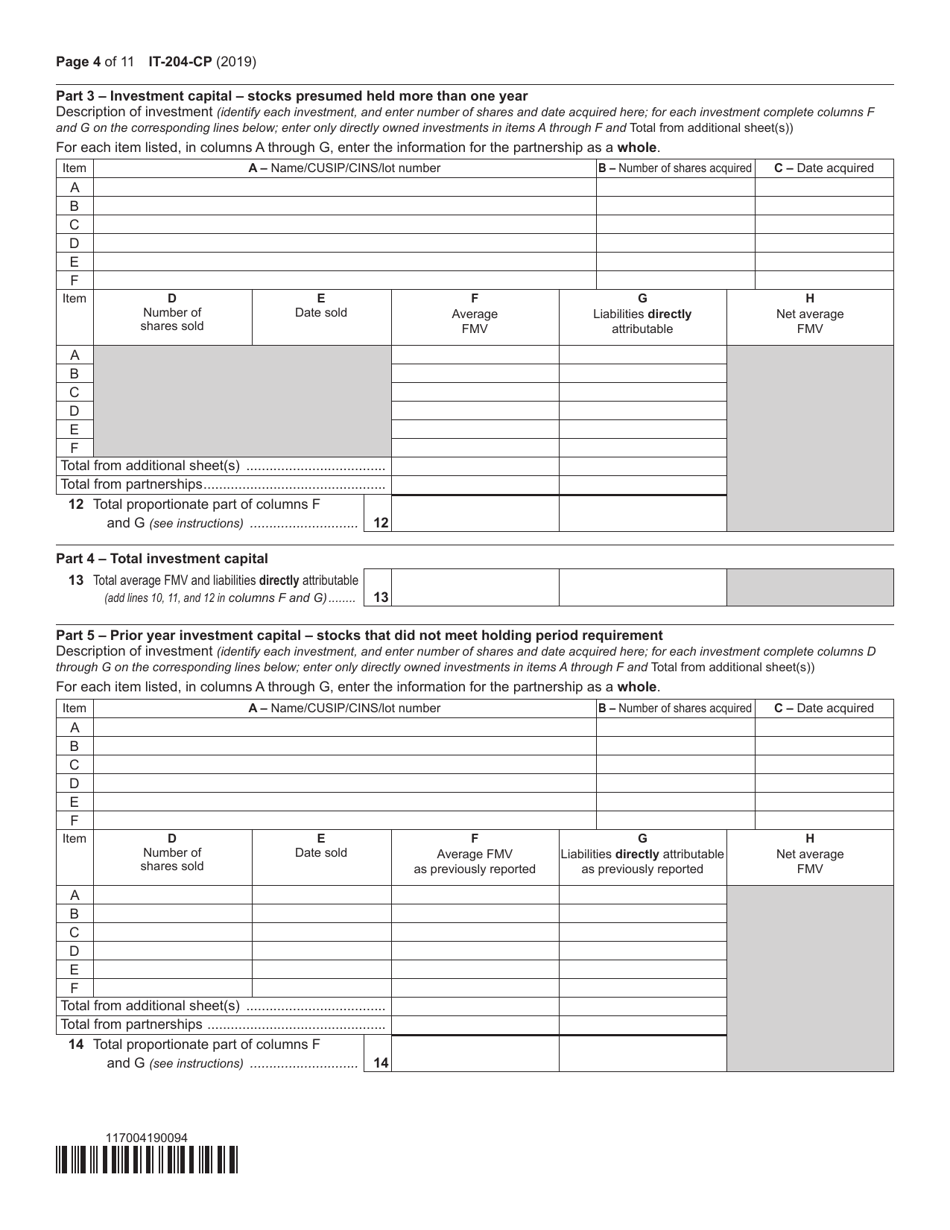

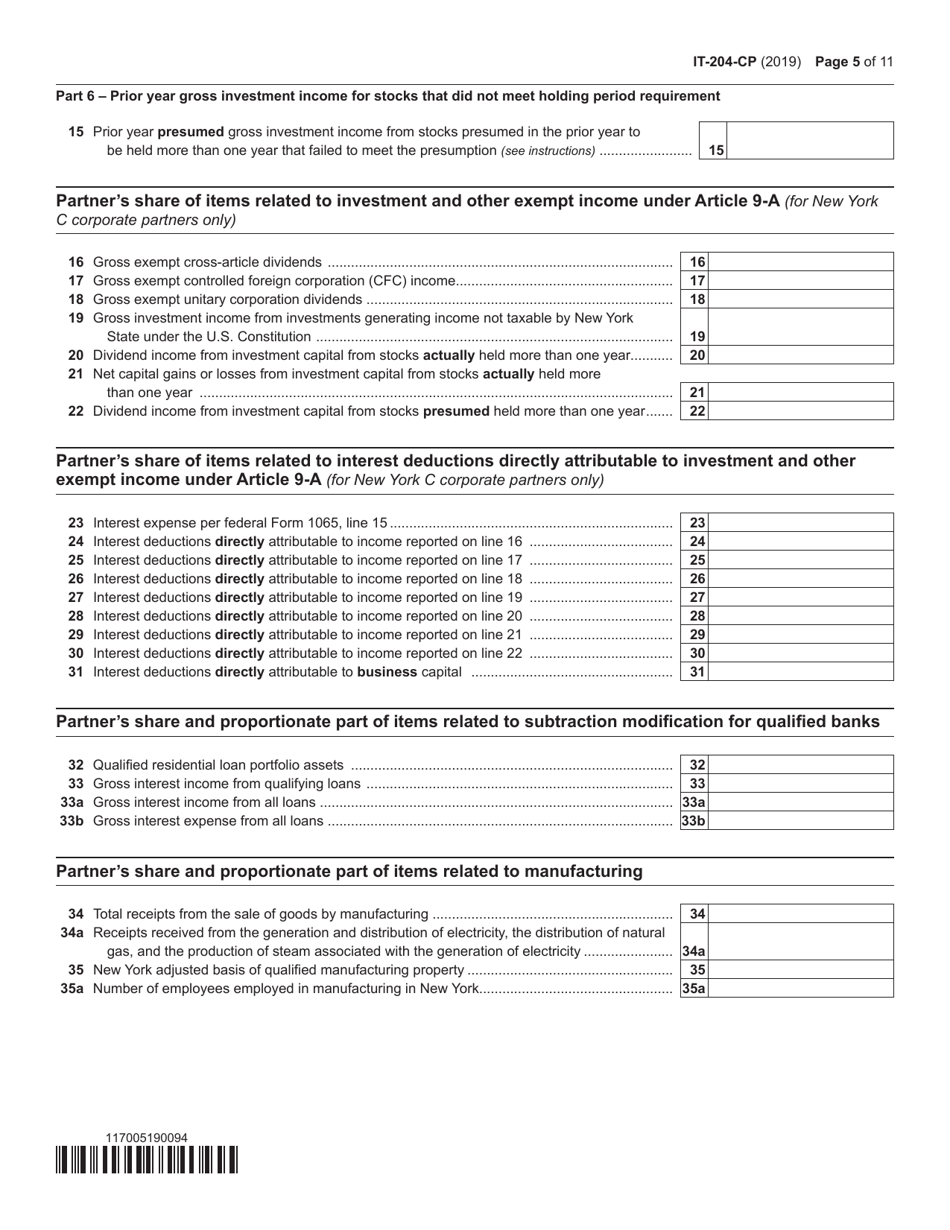

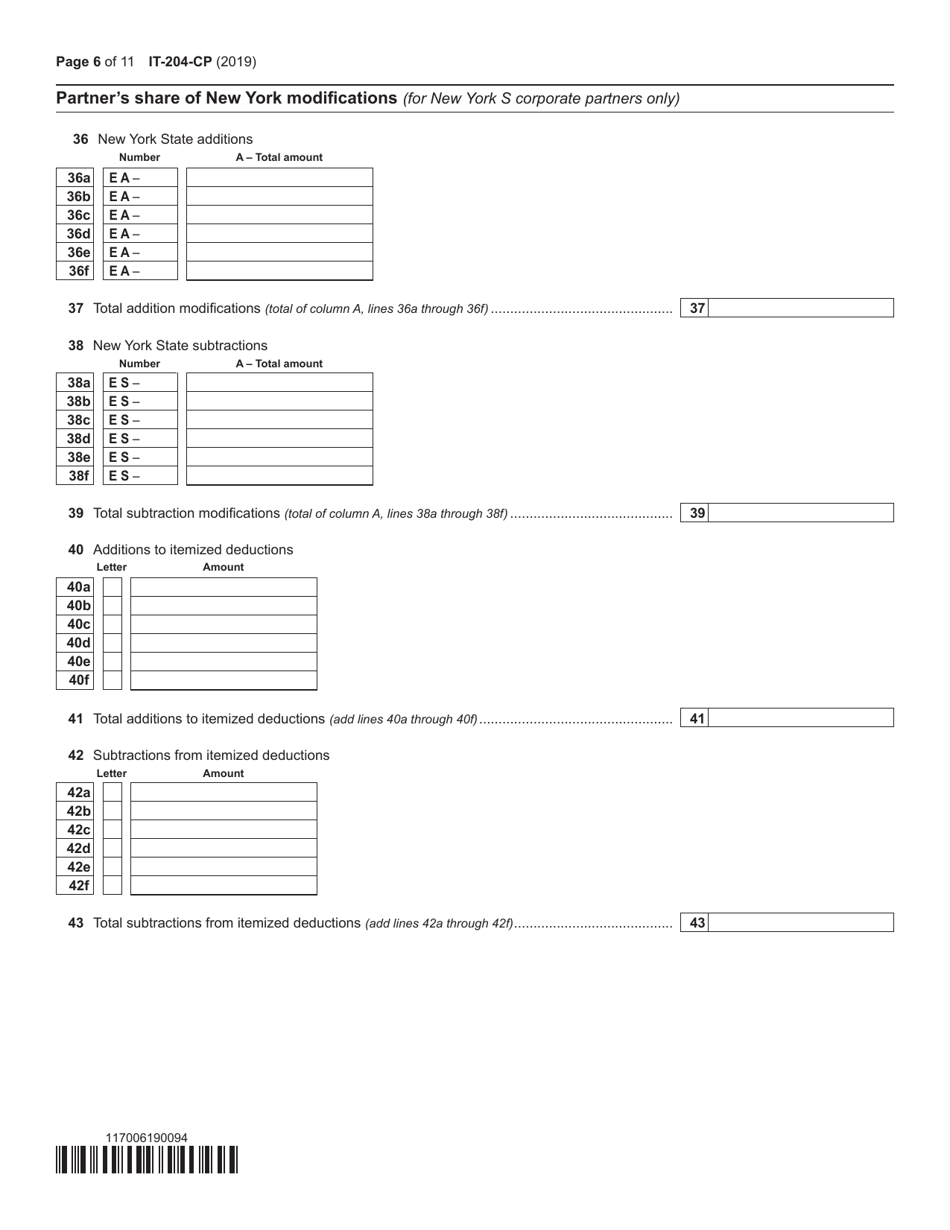

Form IT-204-CP Schedule K-1 New York Corporate Partner's Schedule - New York

What Is Form IT-204-CP Schedule K-1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204-CP?

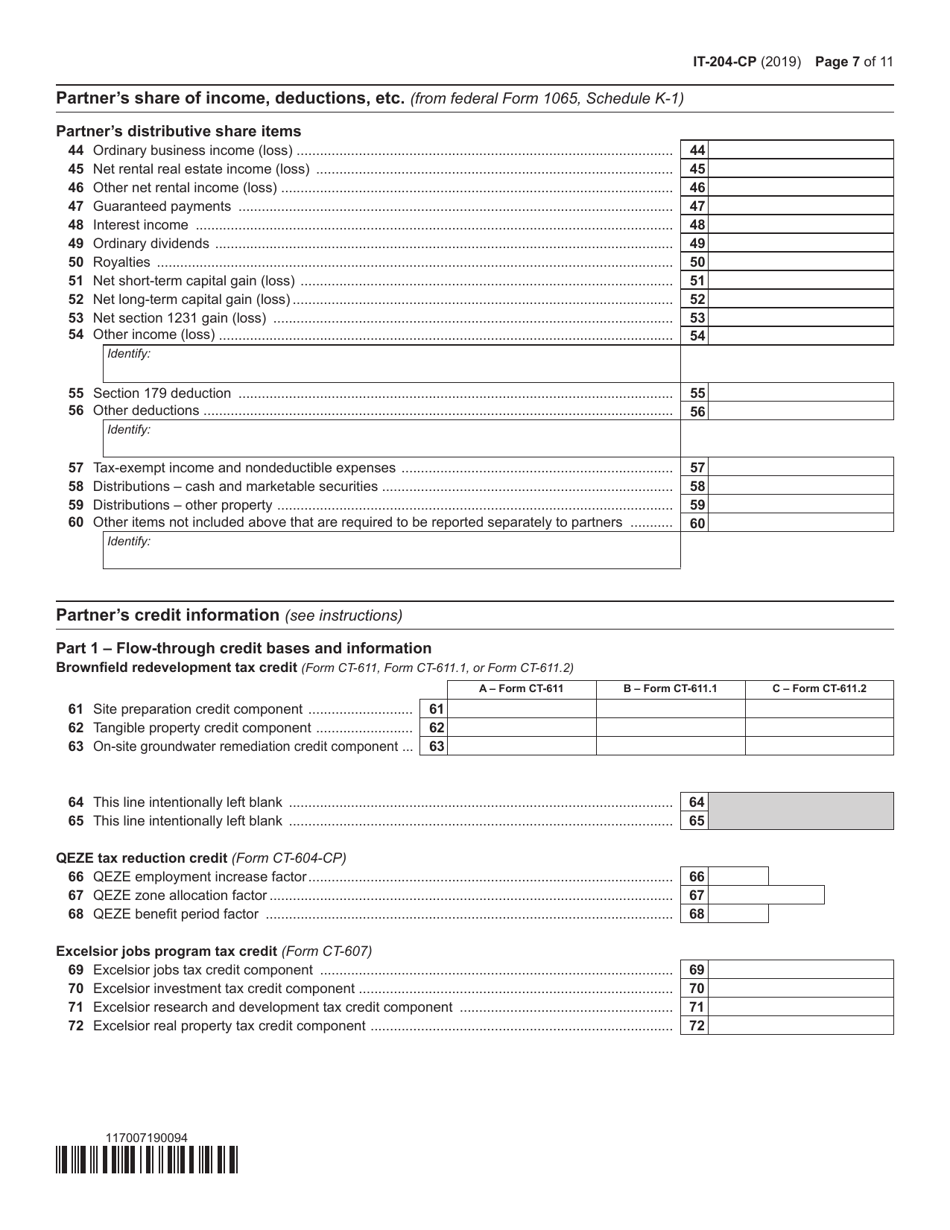

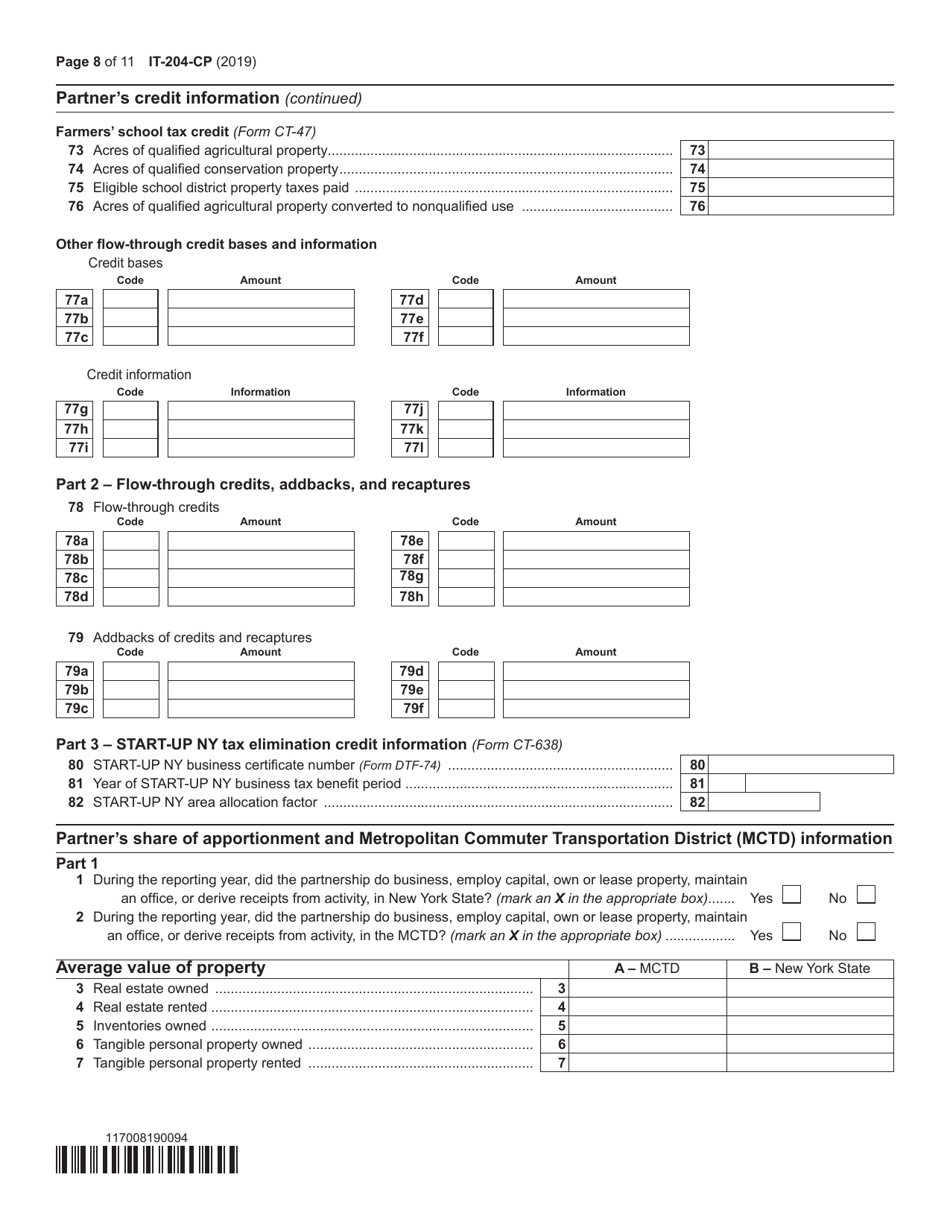

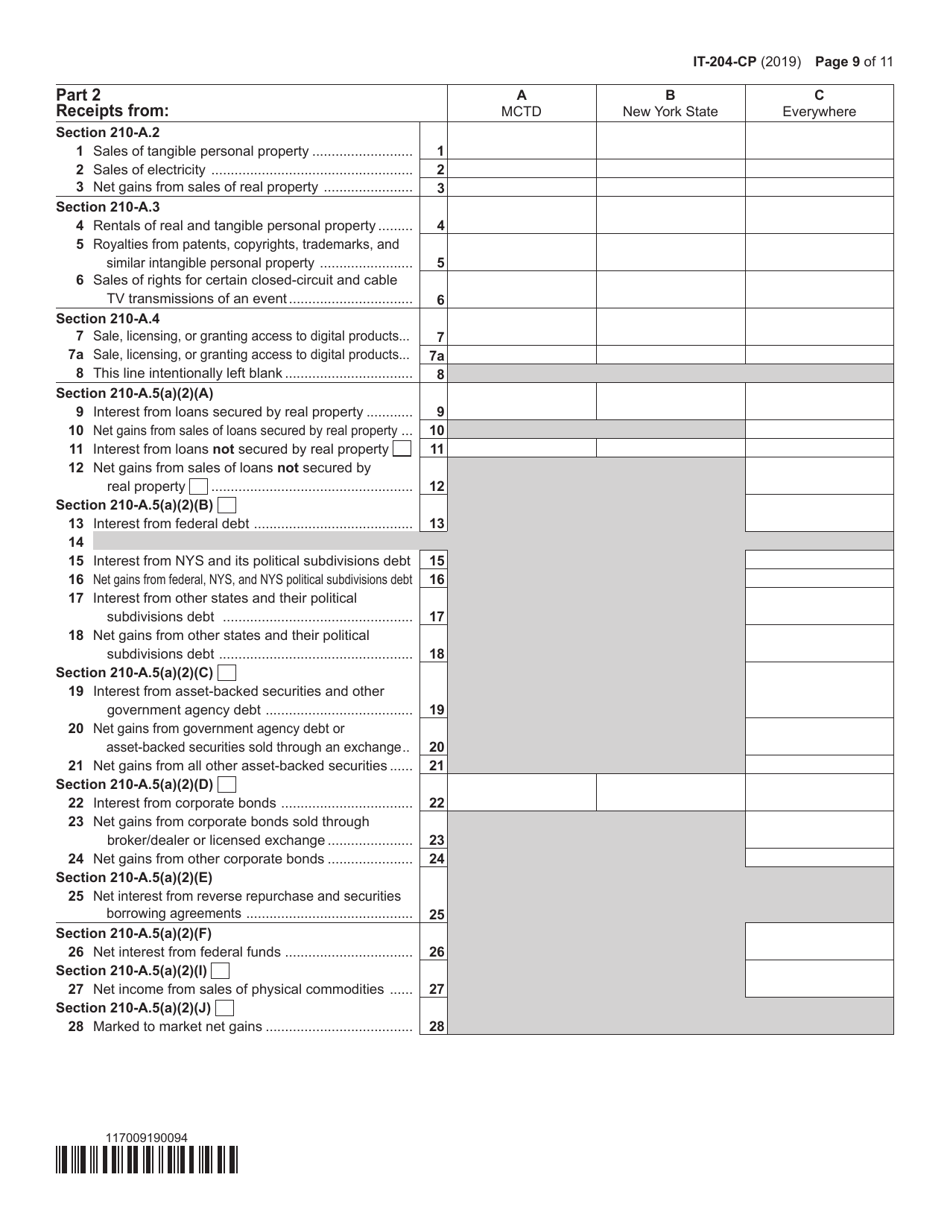

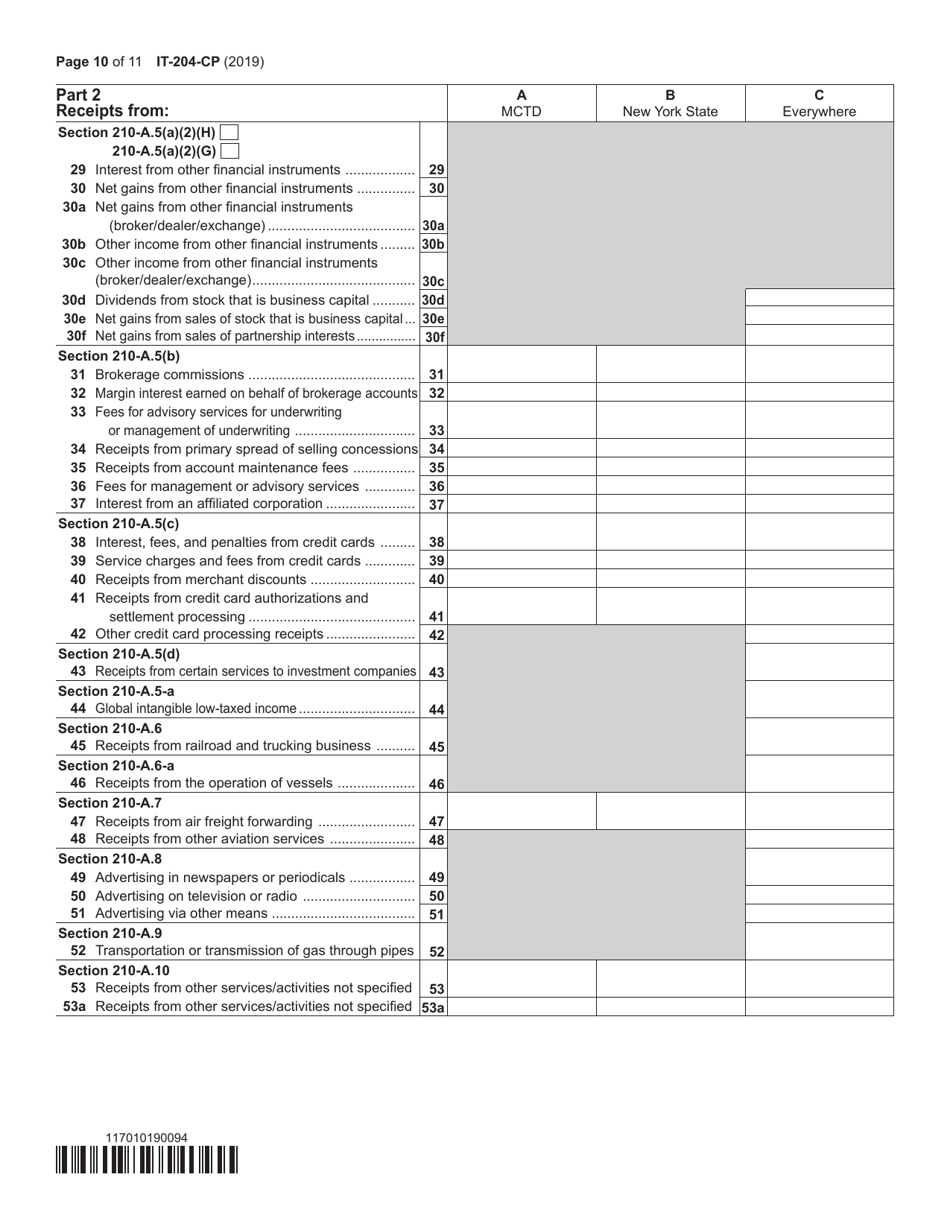

A: Form IT-204-CP is the New York Corporate Partner's Schedule.

Q: What is Schedule K-1?

A: Schedule K-1 is a tax form used to report income, deductions, and credits for partnerships.

Q: Who needs to file Form IT-204-CP?

A: New York partnerships with corporate partners need to file Form IT-204-CP.

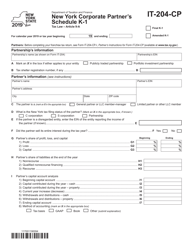

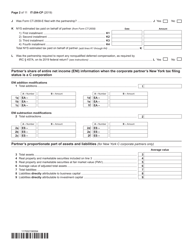

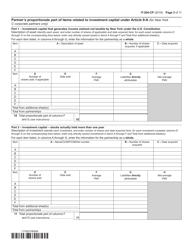

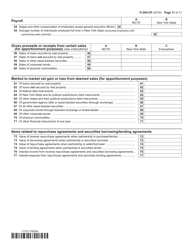

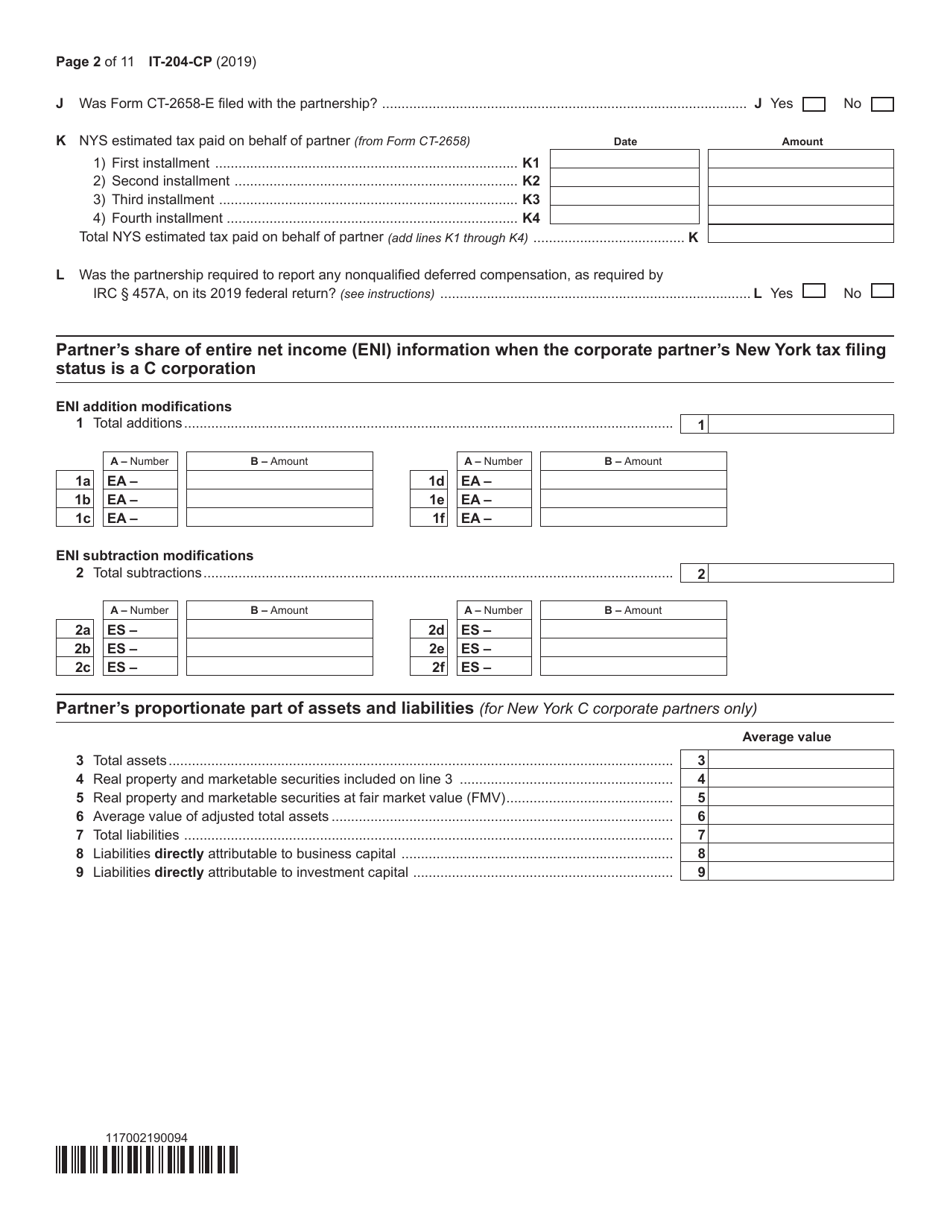

Q: What information is reported on Form IT-204-CP?

A: Form IT-204-CP reports information about the partners' distributive shares of income, deductions, and credits.

Q: Is Form IT-204-CP specific to New York?

A: Yes, Form IT-204-CP is specific to the state of New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204-CP Schedule K-1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.