This version of the form is not currently in use and is provided for reference only. Download this version of

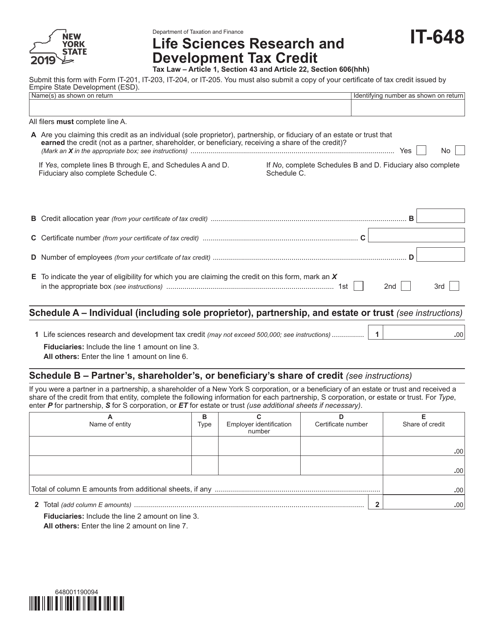

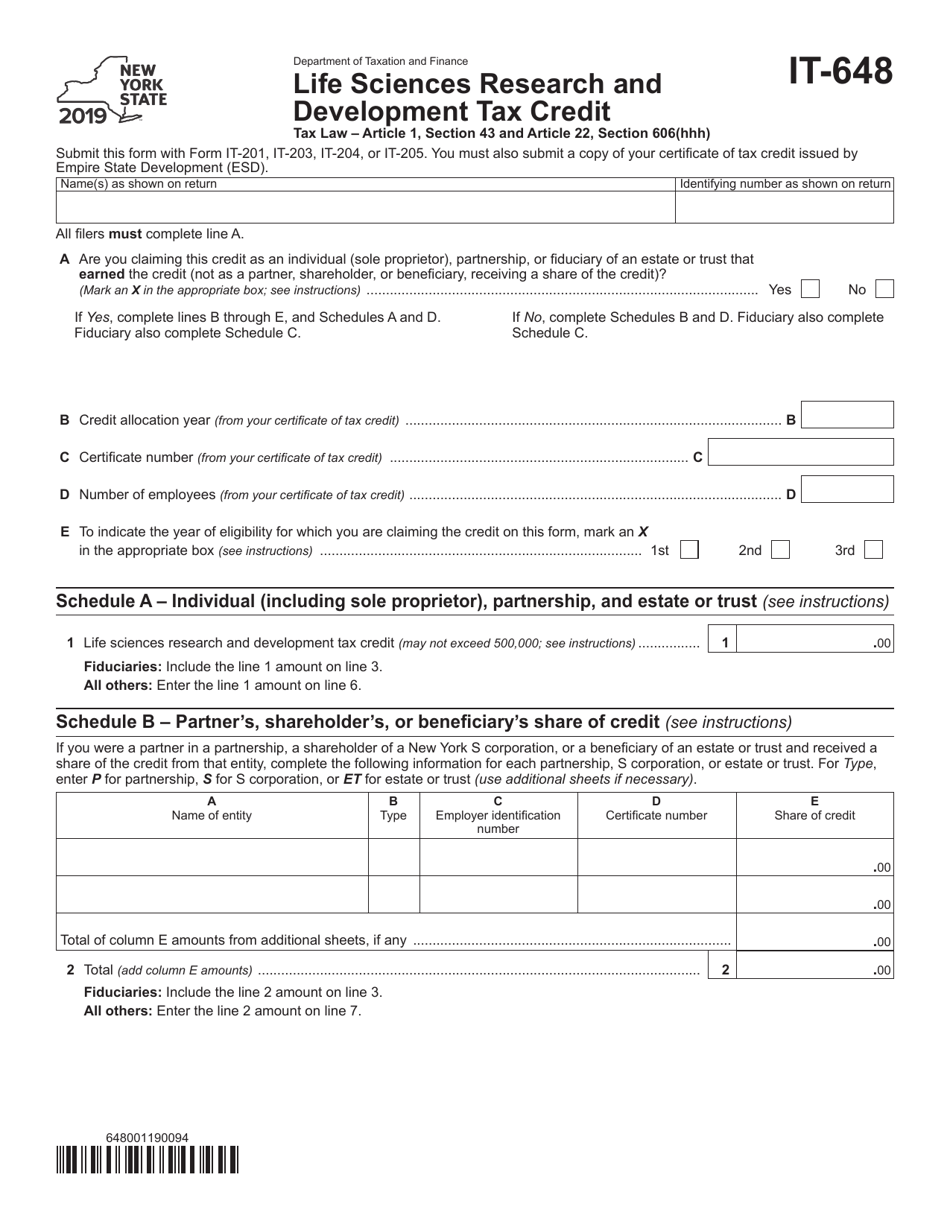

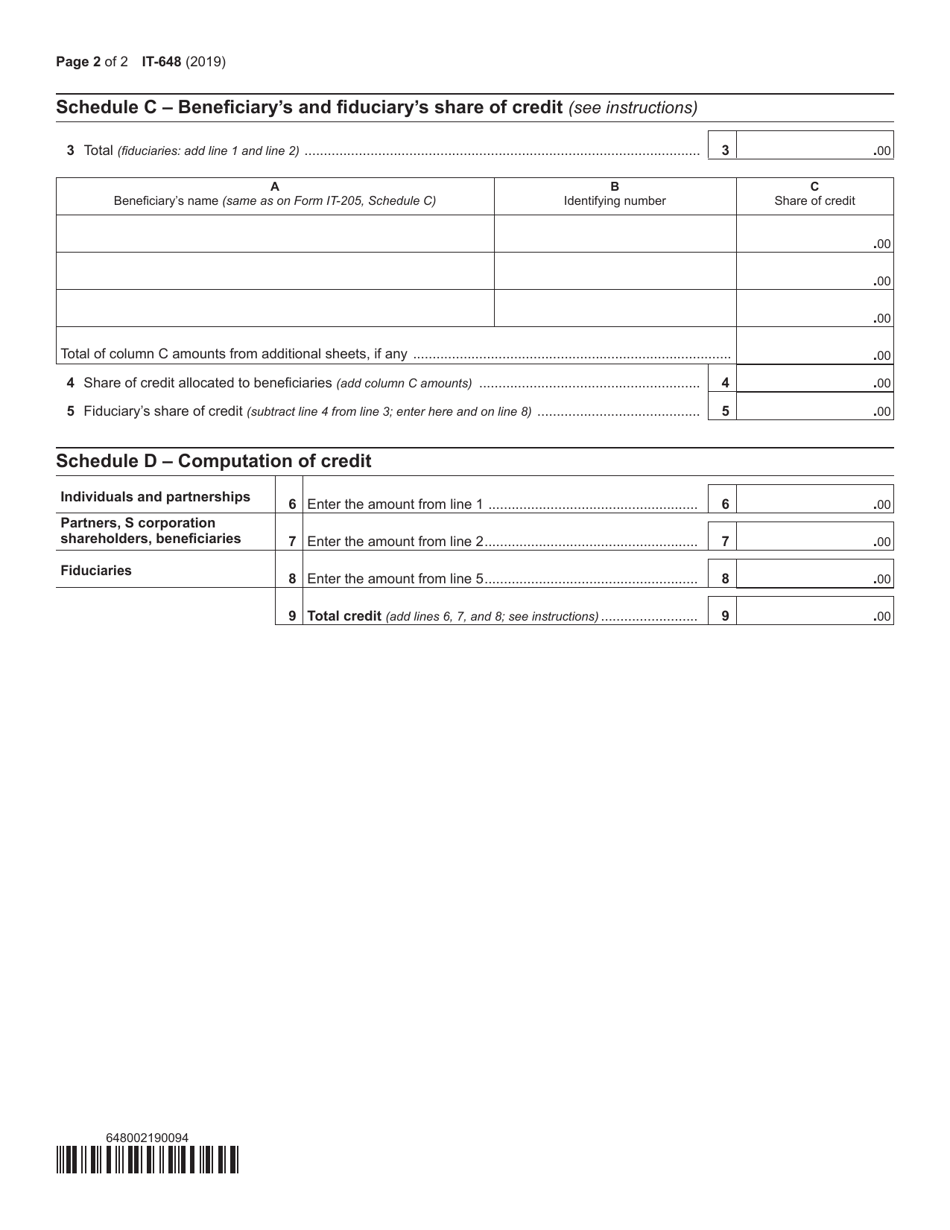

Form IT-648

for the current year.

Form IT-648 Life Sciences Research and Development Tax Credit - New York

What Is Form IT-648?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-648?

A: Form IT-648 is a tax form used to claim the Life Sciences Research and Development Tax Credit in New York.

Q: What is the Life Sciences Research and Development Tax Credit?

A: The Life Sciences Research and Development Tax Credit is a tax credit offered by the state of New York to incentivize companies engaged in qualified life sciences research and development activities.

Q: Who is eligible to claim this tax credit?

A: Companies engaged in qualified life sciences research and development activities in New York may be eligible to claim this tax credit.

Q: What are qualified life sciences research and development activities?

A: Qualified life sciences research and development activities refer to activities that involve the discovery, development, and commercialization of innovative products or processes related to human health and disease prevention.

Q: How much is the tax credit?

A: The amount of the tax credit is based on a percentage of the qualified research expenses incurred by the taxpayer.

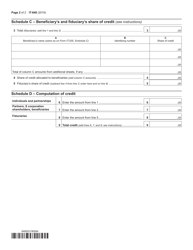

Q: How do I complete Form IT-648?

A: To complete Form IT-648, you will need to provide information about your company, qualified research expenses, and any other required documentation as outlined in the instructions.

Q: When is the deadline to file Form IT-648?

A: The deadline to file Form IT-648 is typically the same as the deadline for filing your New York state tax return, which is generally April 15th or the following business day.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-648 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.