This version of the form is not currently in use and is provided for reference only. Download this version of

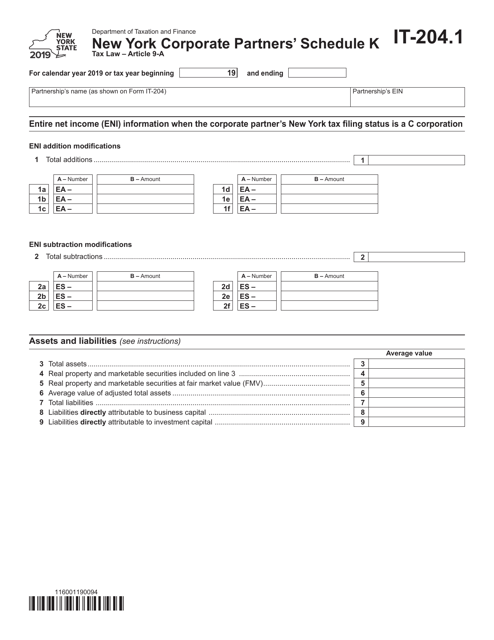

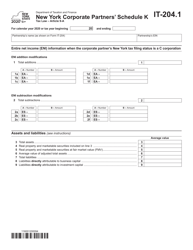

Form IT-204.1 Schedule K

for the current year.

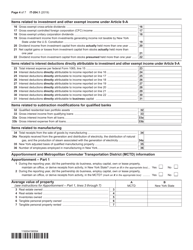

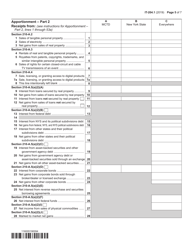

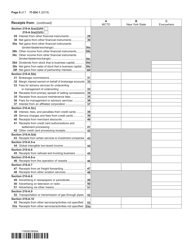

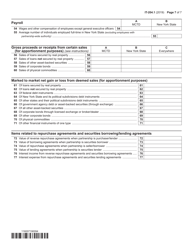

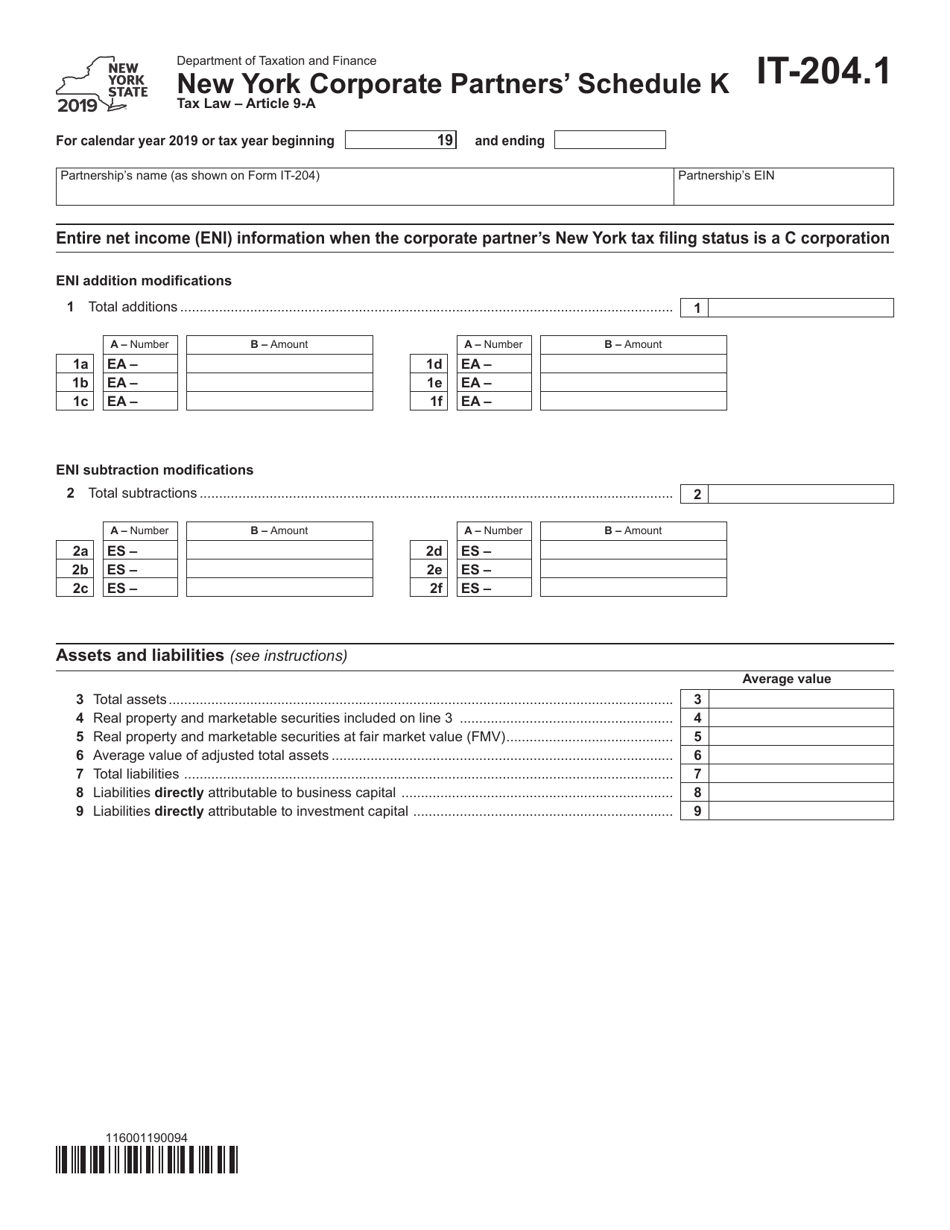

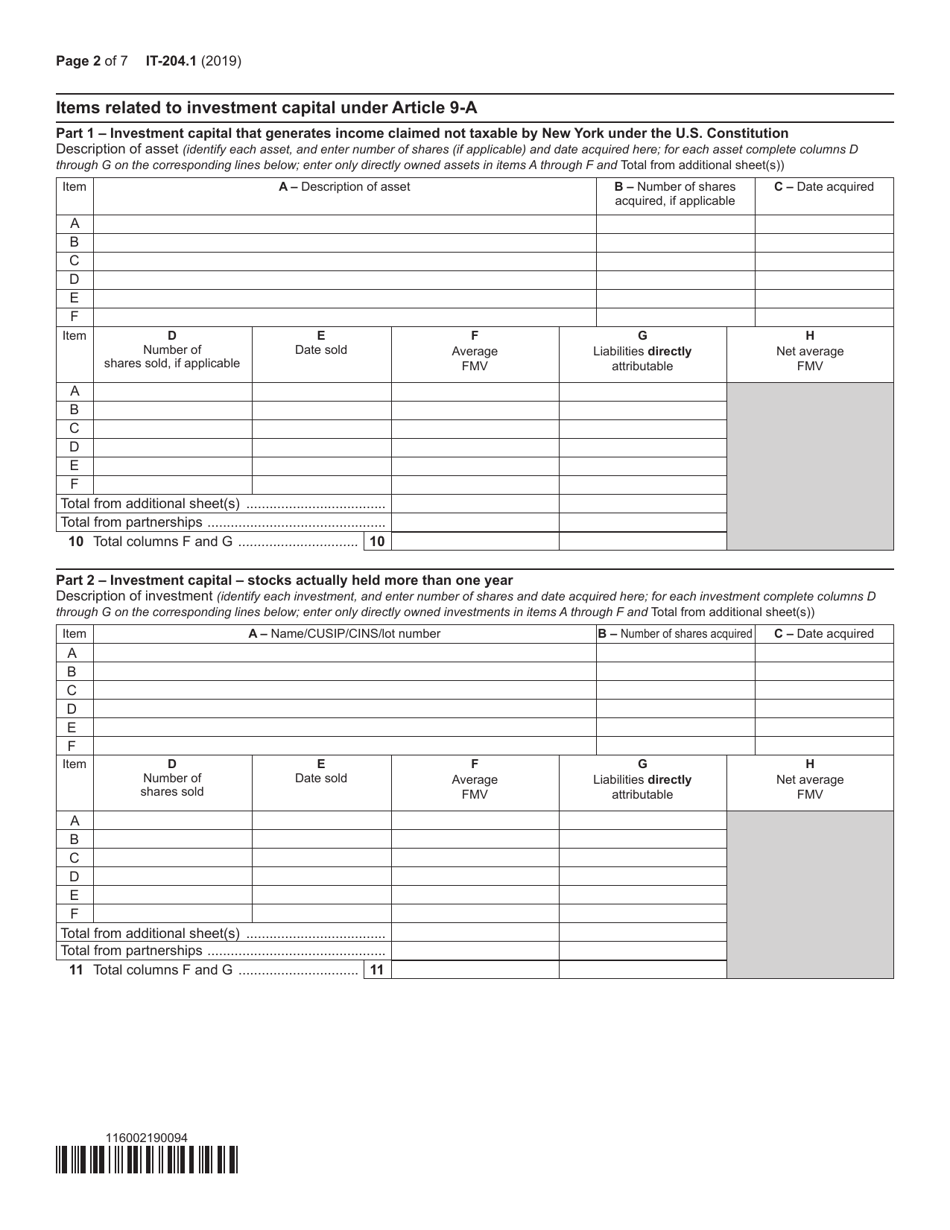

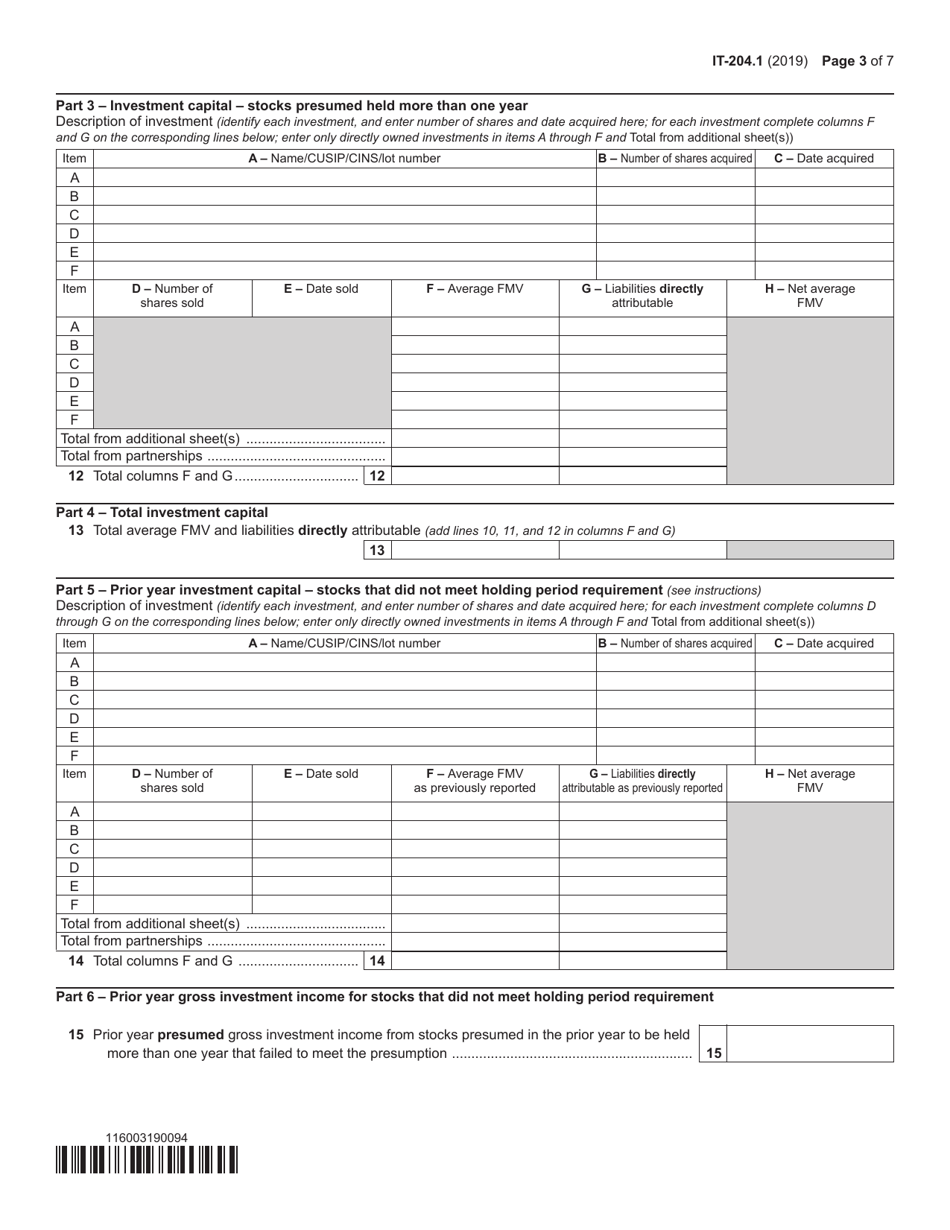

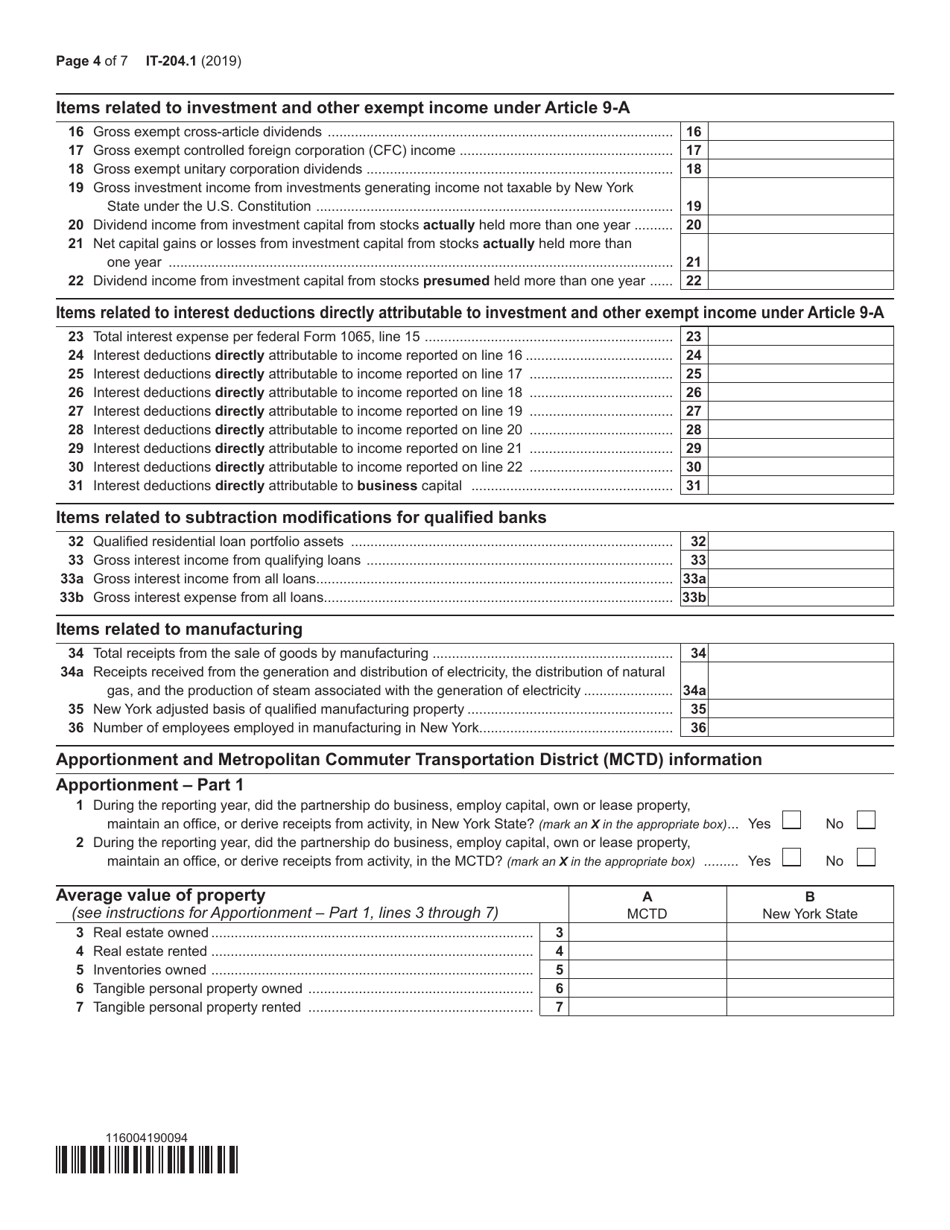

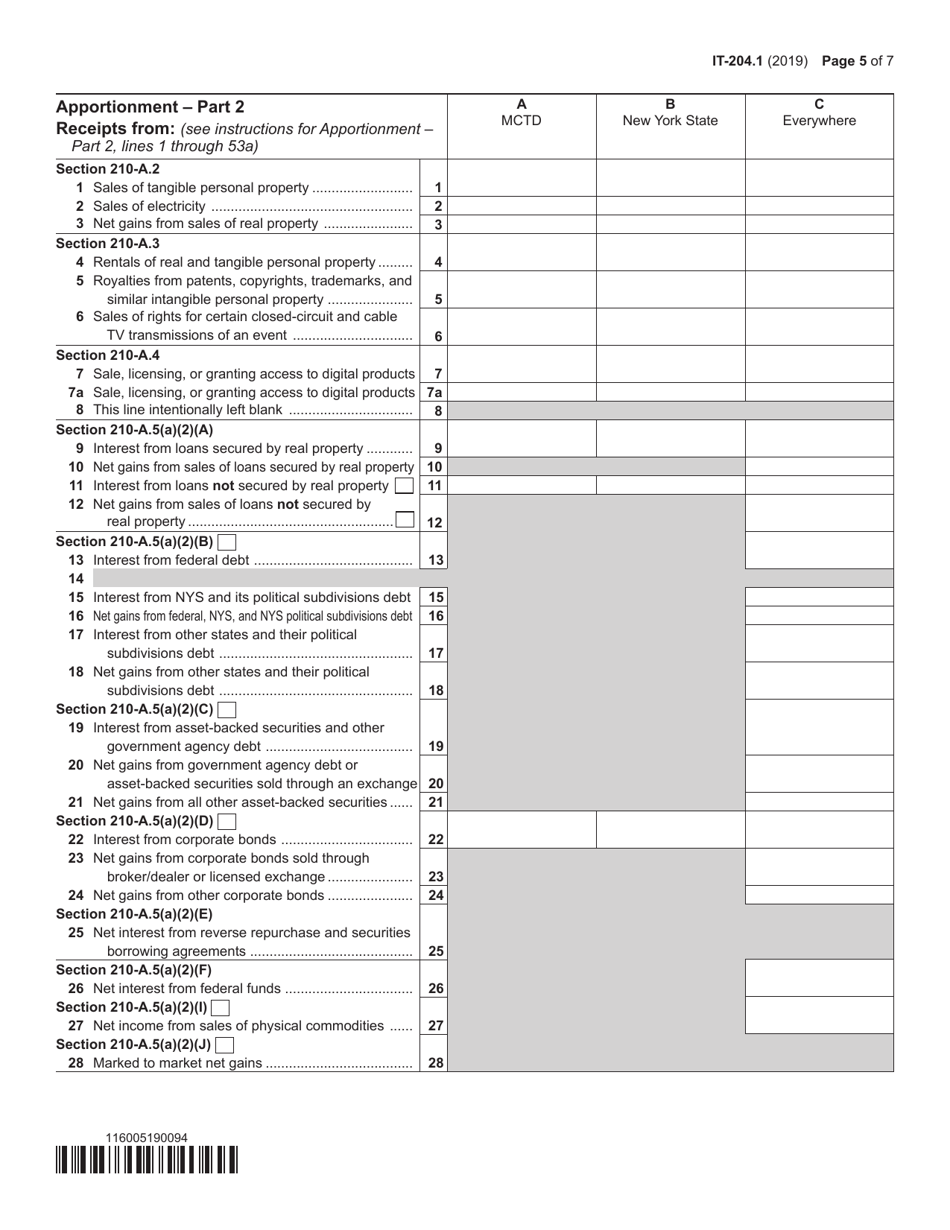

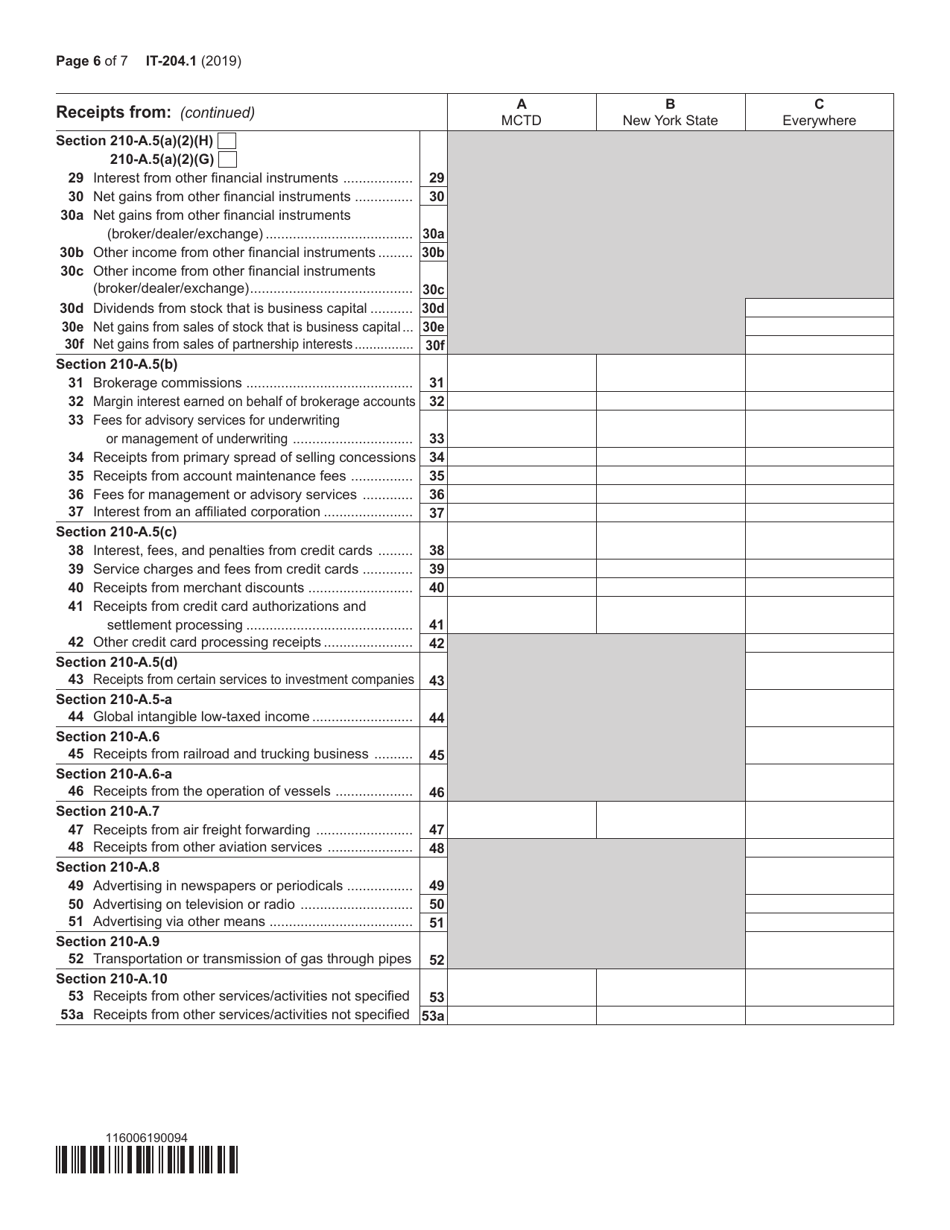

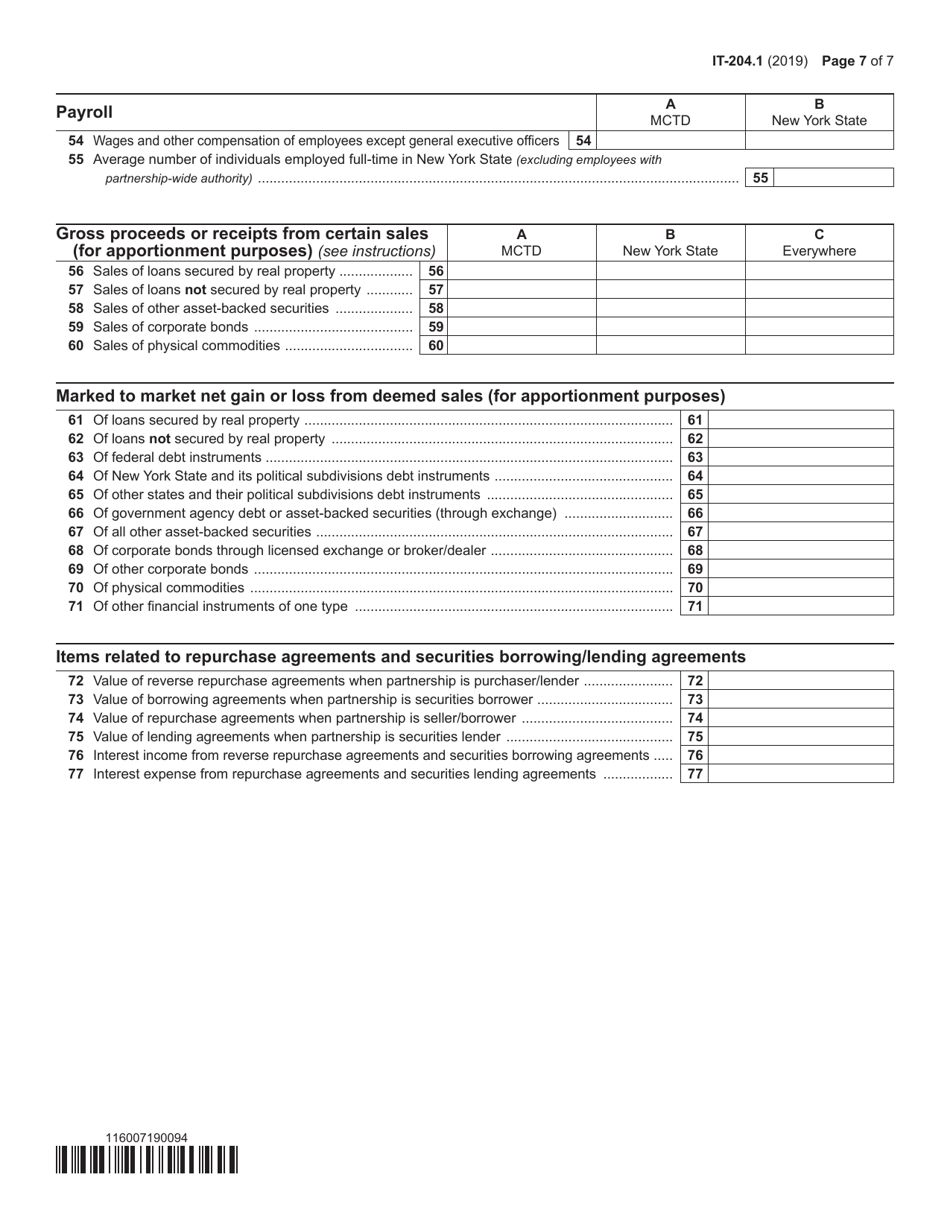

Form IT-204.1 Schedule K New York Corporate Partners' Schedule - New York

What Is Form IT-204.1 Schedule K?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-204.1?

A: Form IT-204.1 is the New York Corporate Partners' Schedule.

Q: What is Schedule K on Form IT-204.1?

A: Schedule K is the section on Form IT-204.1 that is used to report information about New York corporate partners.

Q: Who needs to file Form IT-204.1?

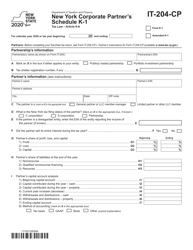

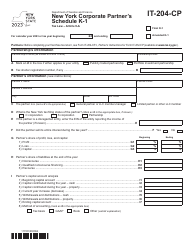

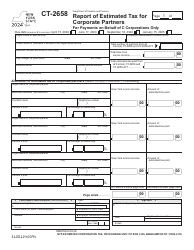

A: Form IT-204.1 must be filed by partnerships with New York corporate partners.

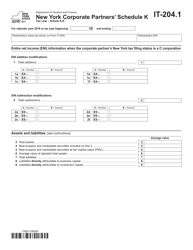

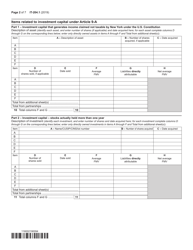

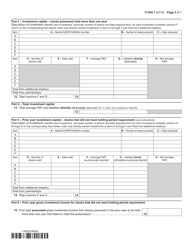

Q: What information needs to be reported on Schedule K?

A: Schedule K requires reporting of various details about New York corporate partners, including their names, addresses, tax identification numbers, and distributive share of income.

Q: Is Form IT-204.1 a separate filing or part of another form?

A: Form IT-204.1 is a separate schedule that must be attached to the partnership's New York state tax return.

Q: Are there any filing deadlines for Form IT-204.1?

A: The deadline for filing Form IT-204.1 is the same as the deadline for filing the partnership's New York state tax return, which is typically April 15th.

Q: Are there any penalties for late filing or failure to file Form IT-204.1?

A: Yes, there can be penalties for late filing or failure to file Form IT-204.1. It is important to file the form on time to avoid these penalties.

Q: Is Form IT-204.1 required for partnerships without New York corporate partners?

A: No, Form IT-204.1 is only required for partnerships with New York corporate partners.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204.1 Schedule K by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.