This version of the form is not currently in use and is provided for reference only. Download this version of

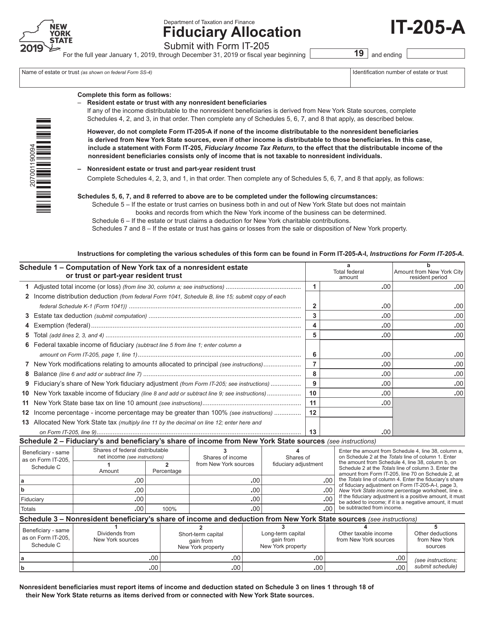

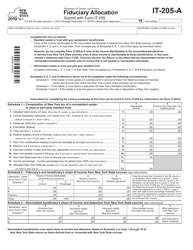

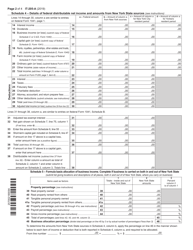

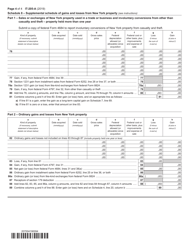

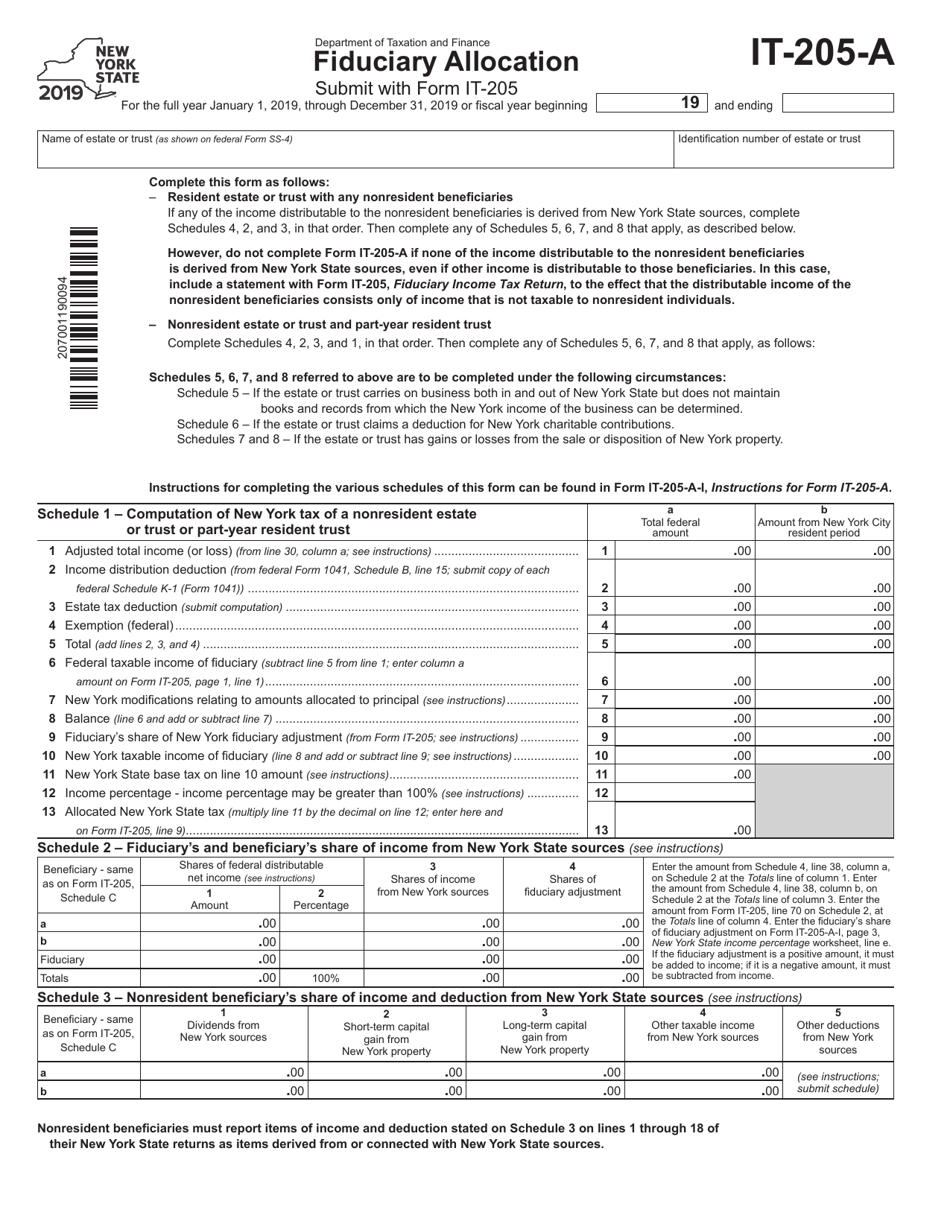

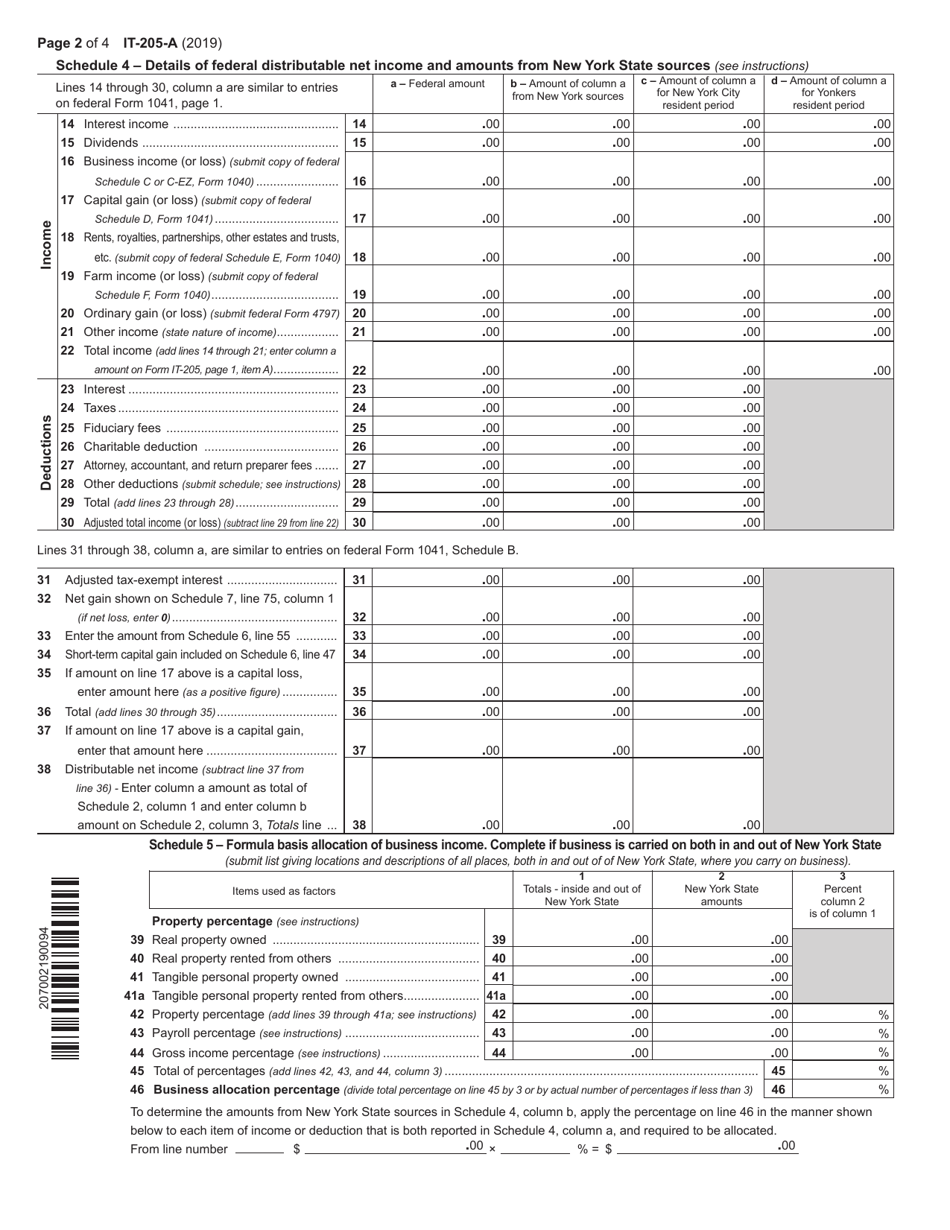

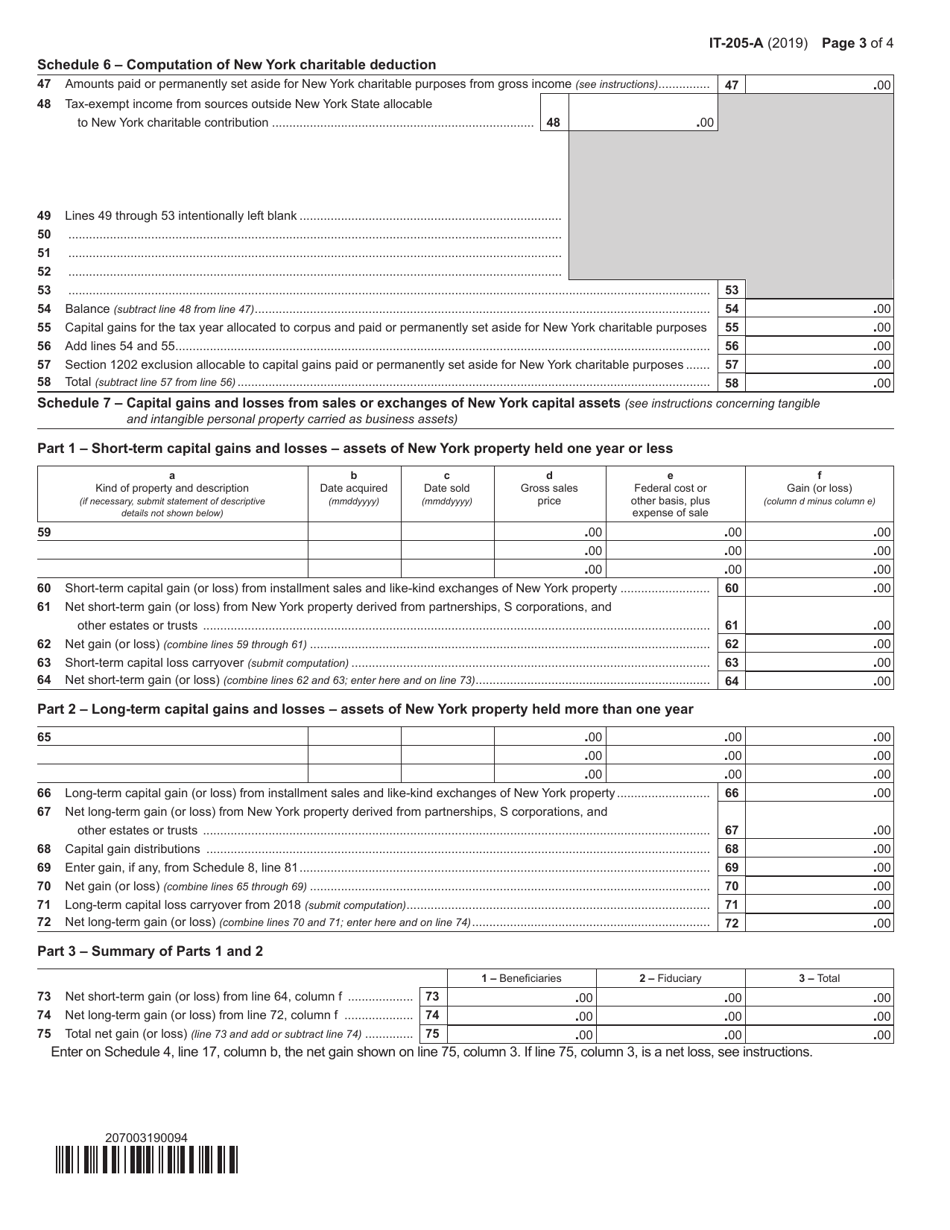

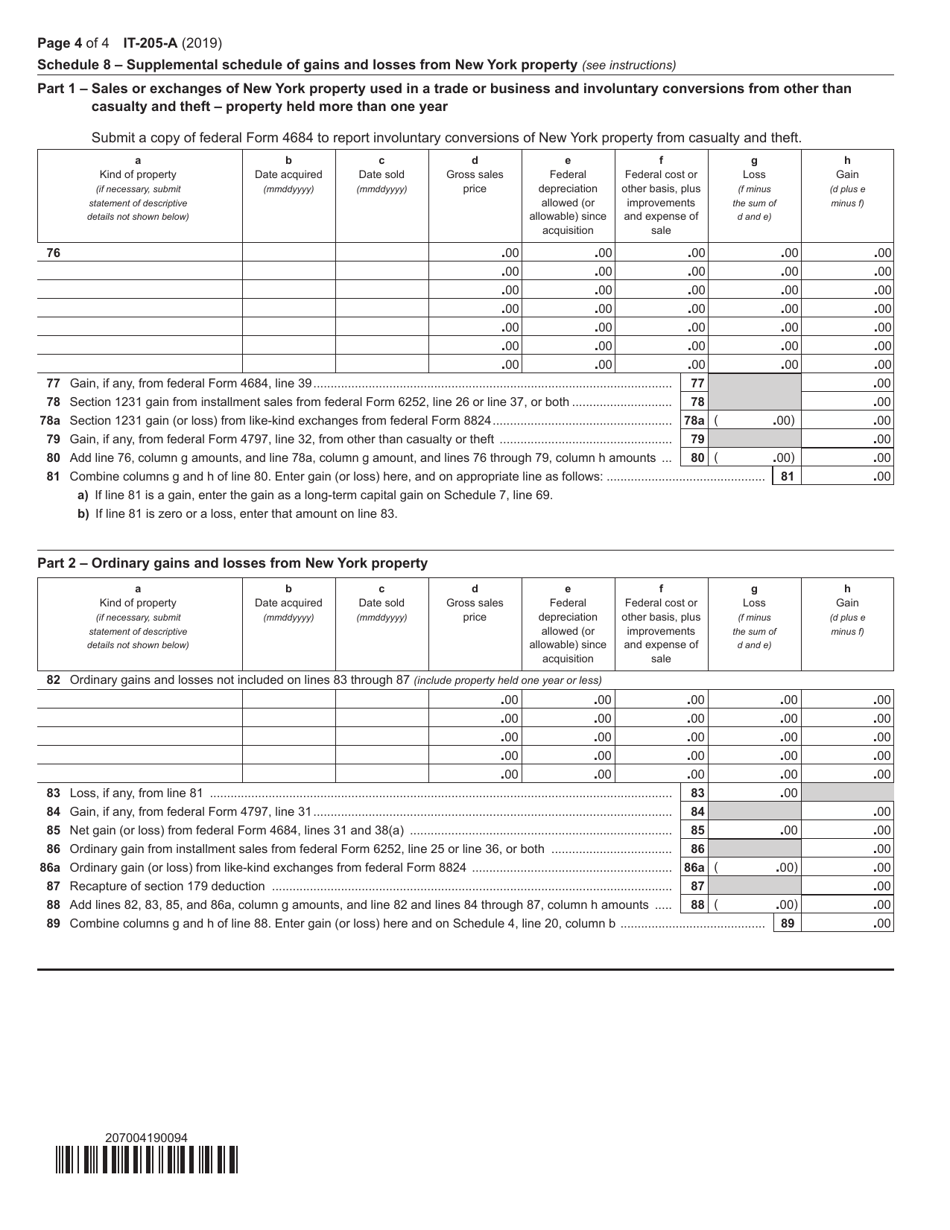

Form IT-205-A

for the current year.

Form IT-205-A Fiduciary Allocation - New York

What Is Form IT-205-A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205-A?

A: Form IT-205-A is the Fiduciary Allocation form used in the state of New York.

Q: Who uses Form IT-205-A?

A: Form IT-205-A is used by fiduciaries in New York to allocate income between the estate or trust and the beneficiaries.

Q: What is the purpose of Form IT-205-A?

A: The purpose of Form IT-205-A is to report and allocate income, deductions, and credits for estates and trusts in New York.

Q: When is Form IT-205-A due?

A: Form IT-205-A is due on or before the fifteenth day of the fourth month following the close of the tax year.

Q: Are there any filing fees for Form IT-205-A?

A: No, there are no filing fees for Form IT-205-A.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.