This version of the form is not currently in use and is provided for reference only. Download this version of

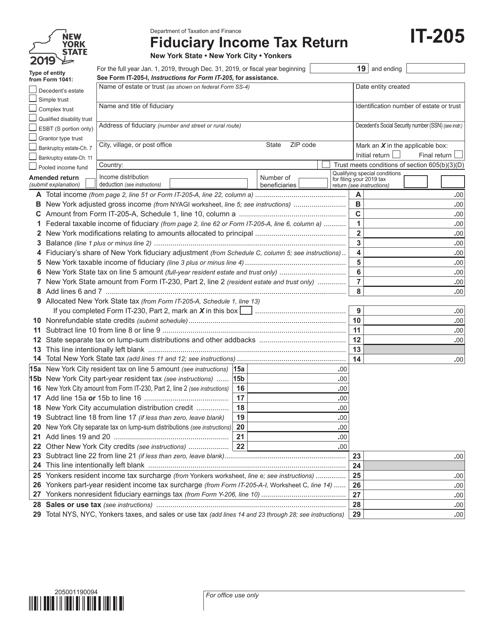

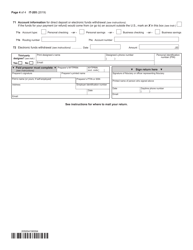

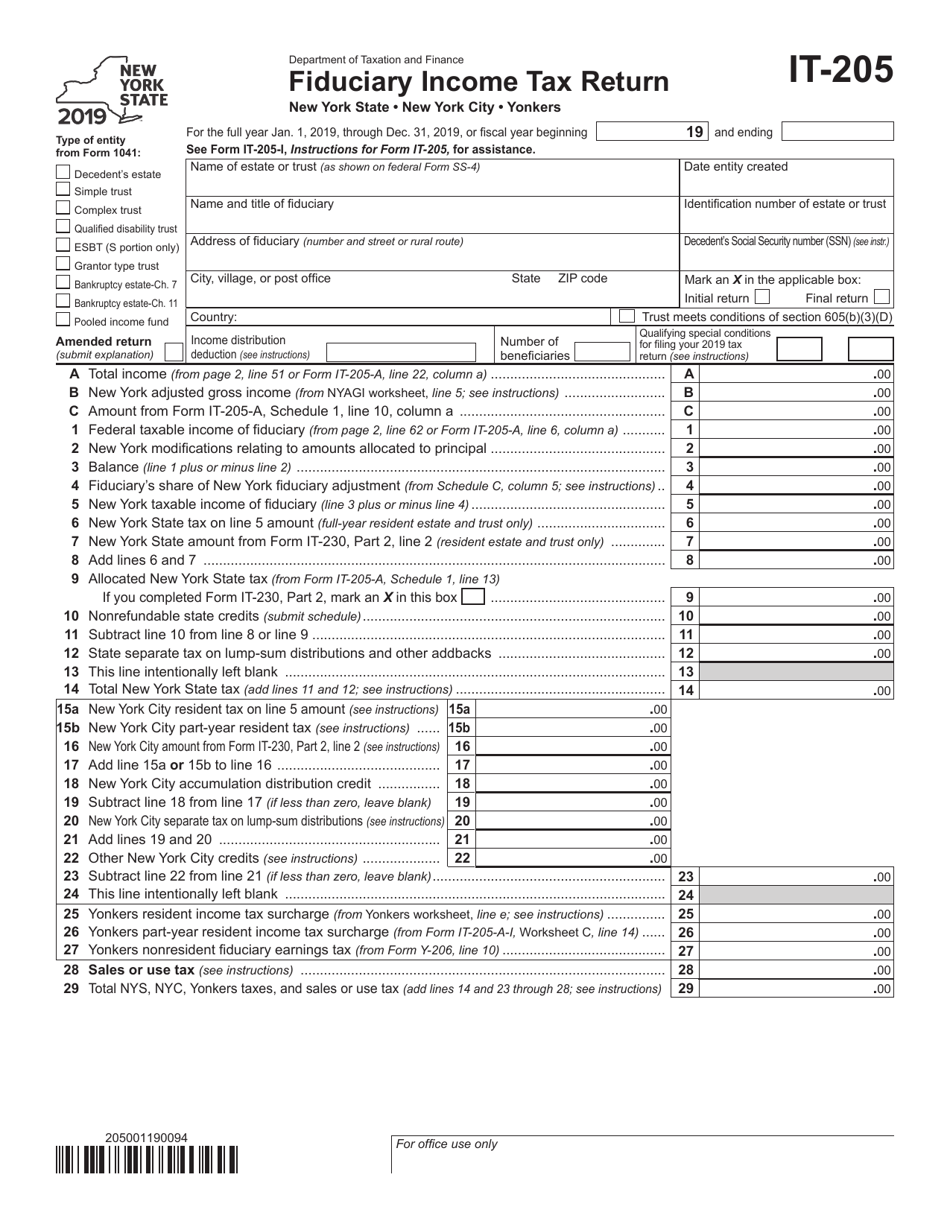

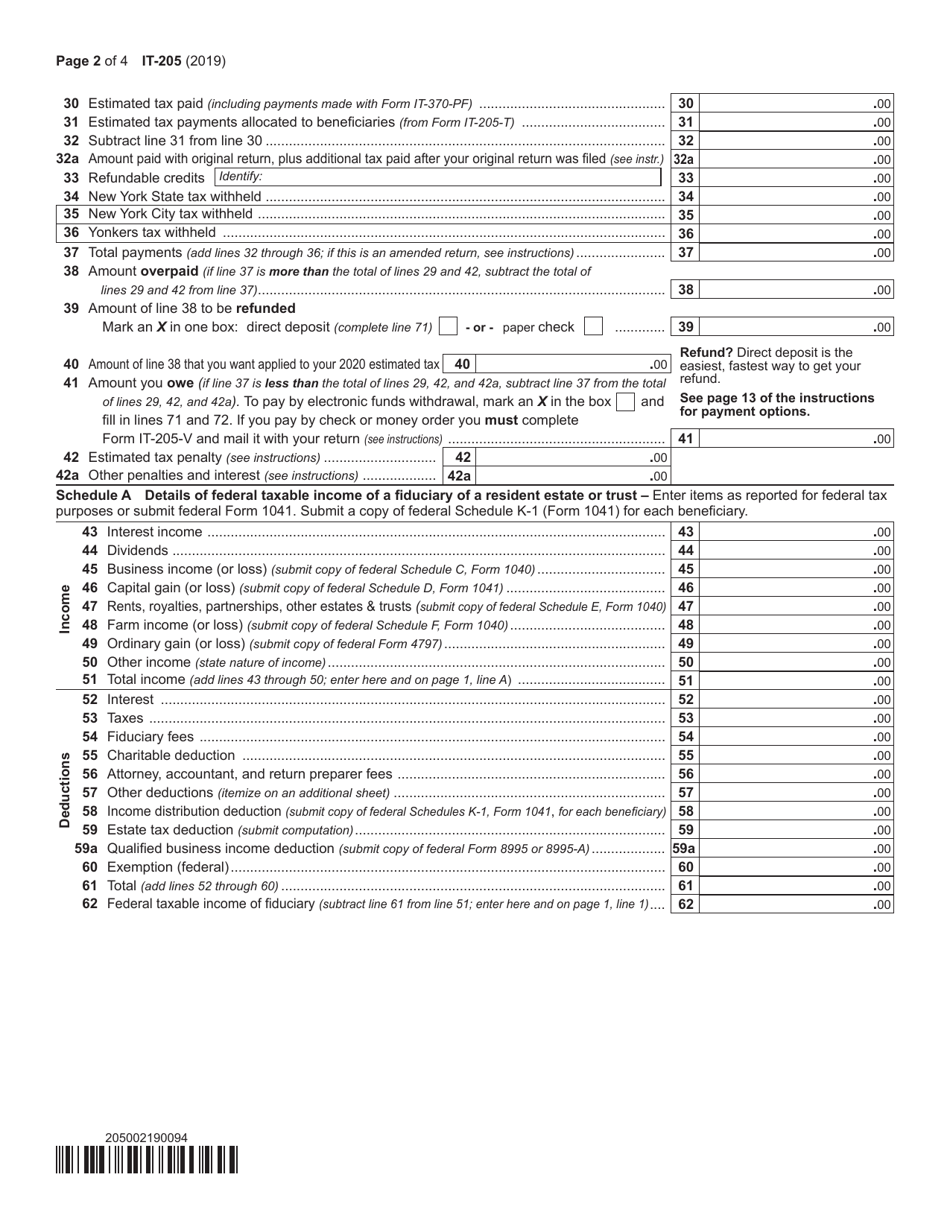

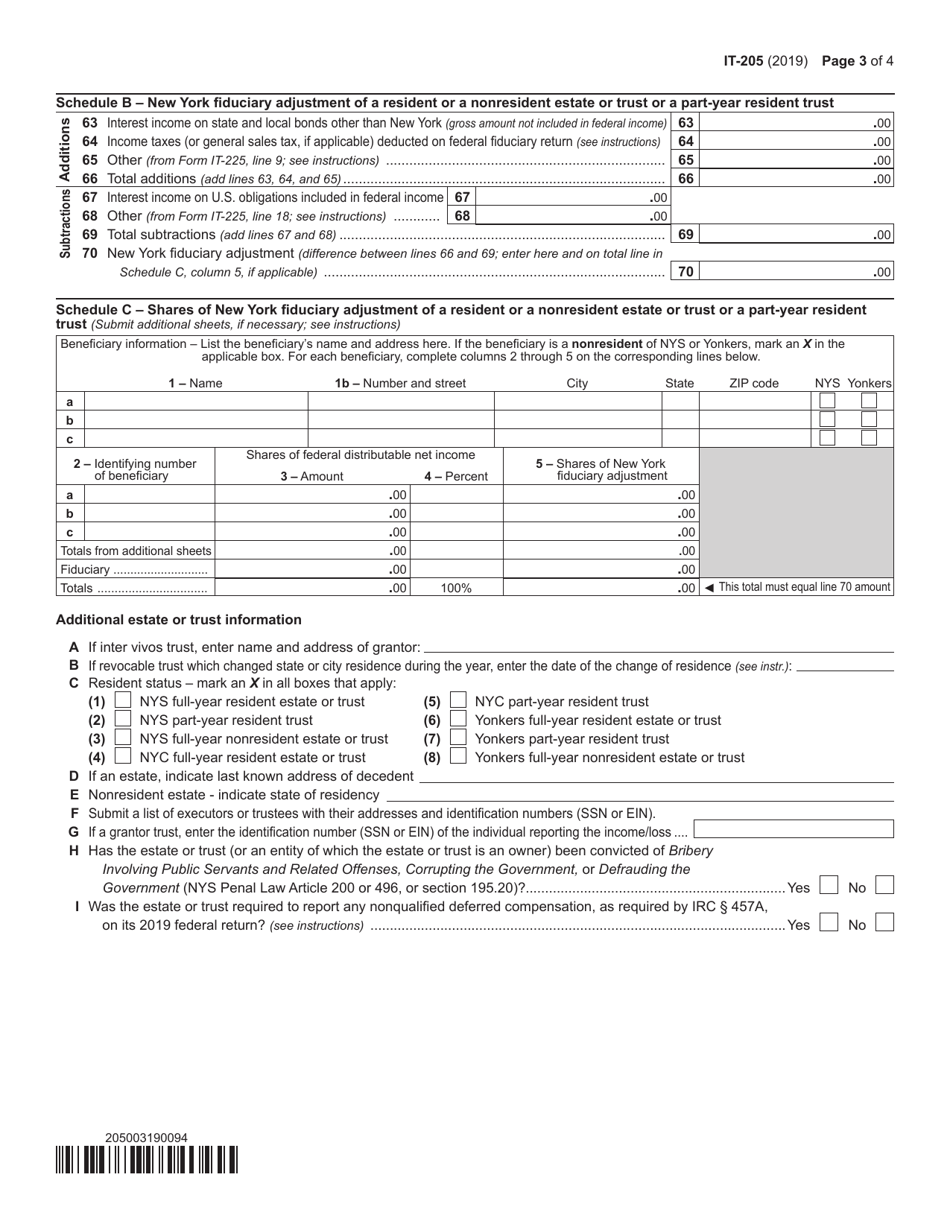

Form IT-205

for the current year.

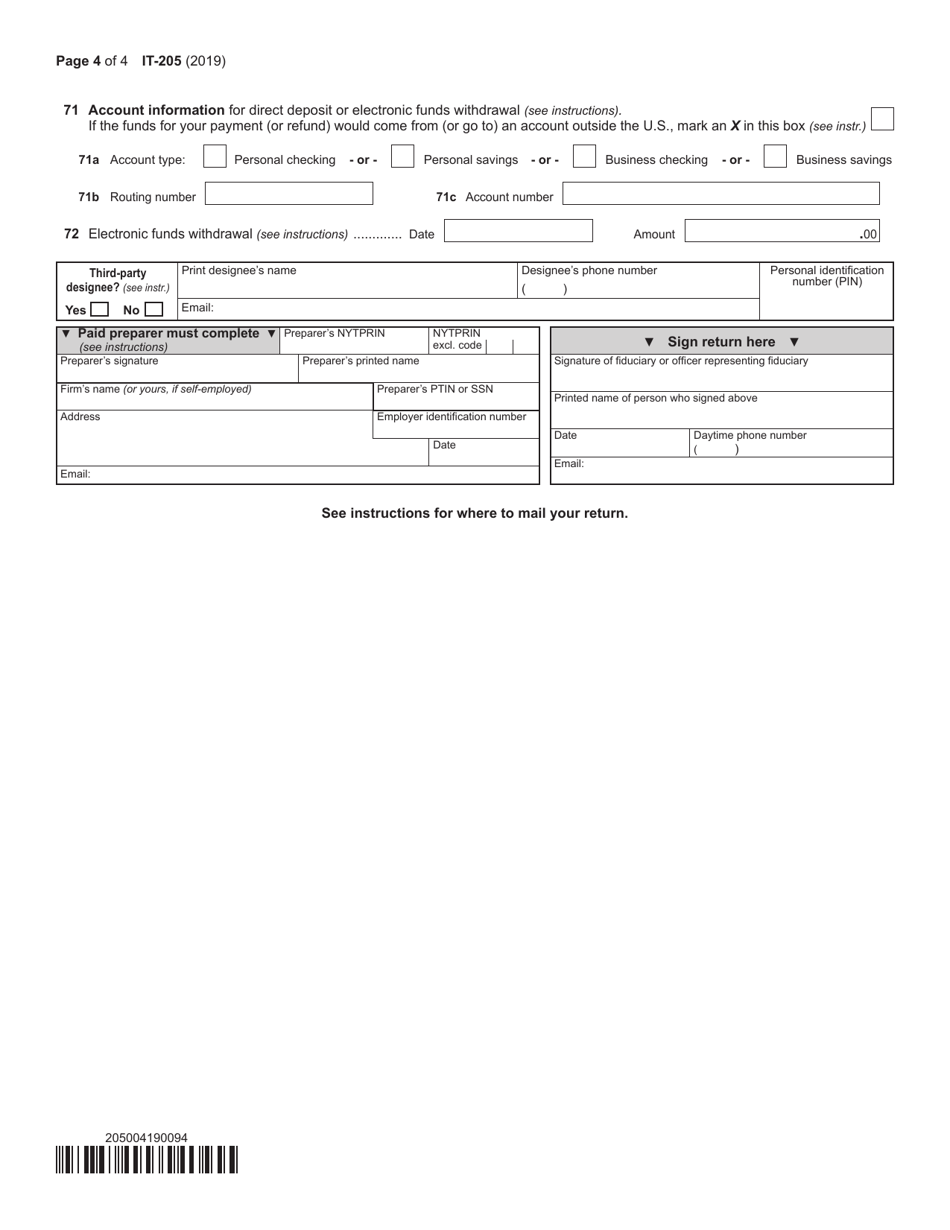

Form IT-205 Fiduciary Income Tax Return - New York

What Is Form IT-205?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205?

A: Form IT-205 is the Fiduciary Income Tax Return for residents of New York.

Q: Who needs to file Form IT-205?

A: Form IT-205 must be filed by fiduciaries, such as executors, trustees, or guardians, who have New York source income.

Q: What is the purpose of Form IT-205?

A: Form IT-205 is used to report and calculate the income, deductions, and credits of a fiduciary.

Q: When is Form IT-205 due?

A: Form IT-205 is generally due on or before the 15th day of the 4th month following the close of the tax year.

Q: Are there any penalties for not filing Form IT-205?

A: Yes, failure to file Form IT-205 or paying the tax due on time may result in penalties and interest.

Q: Can I e-file Form IT-205?

A: Yes, Form IT-205 can be e-filed using approved tax software or through a professional tax preparer.

Q: Is there a minimum income threshold for filing Form IT-205?

A: No, there is no specific minimum income threshold for filing Form IT-205.

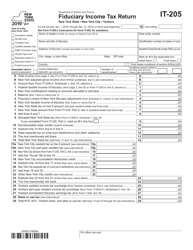

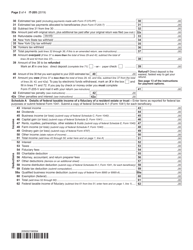

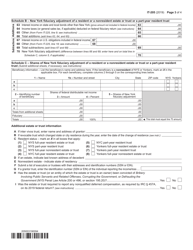

Q: Do I need to attach any supporting documents with Form IT-205?

A: Yes, you should attach all necessary schedules, statements, and documentation to support the information reported on Form IT-205.

Q: Can I amend Form IT-205 if I made an error?

A: Yes, you can amend Form IT-205 by filing an amended return using Form IT-205-A, Amended Fiduciary Income Tax Return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.