This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-205-J

for the current year.

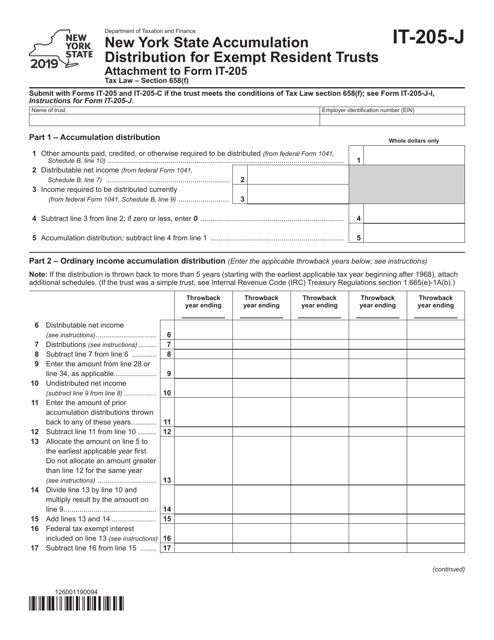

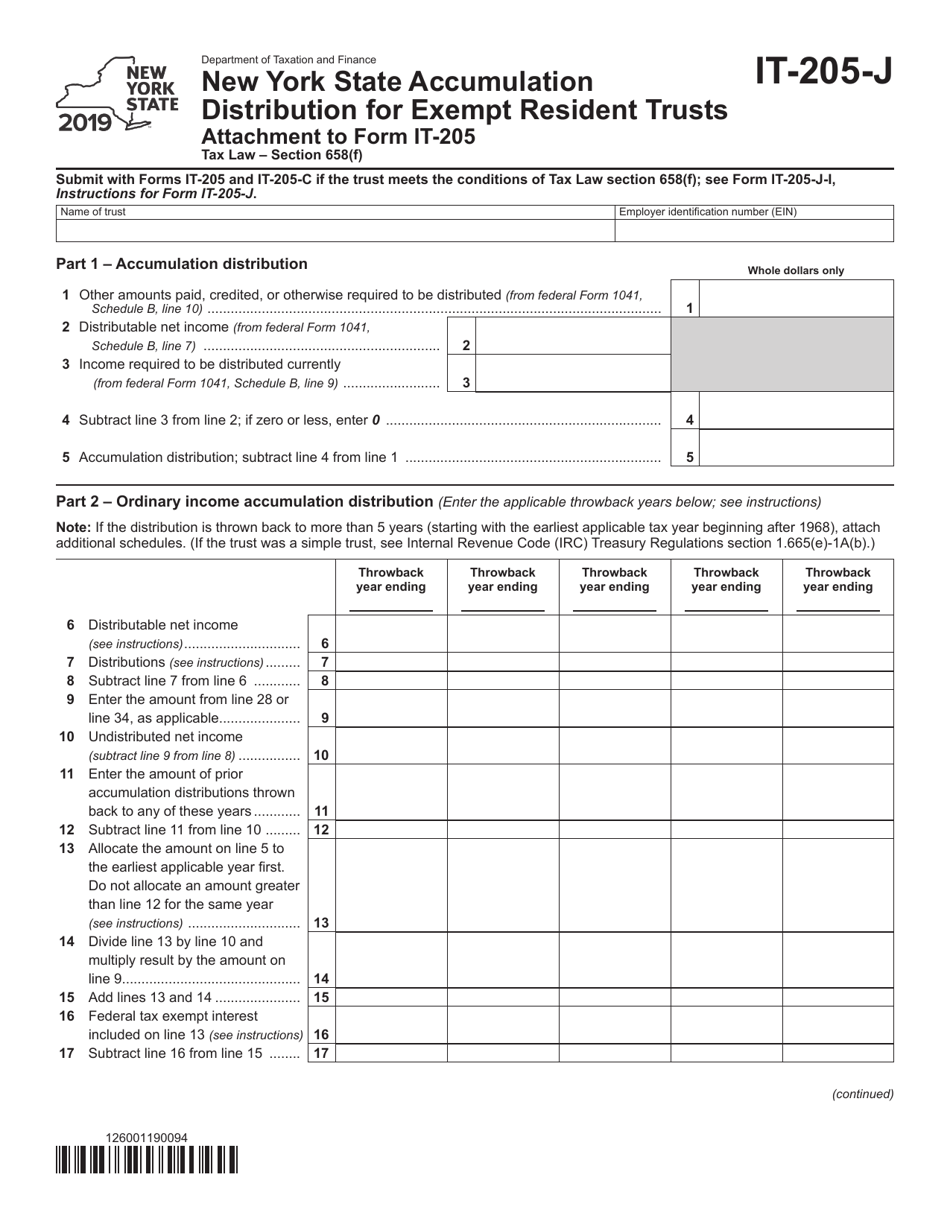

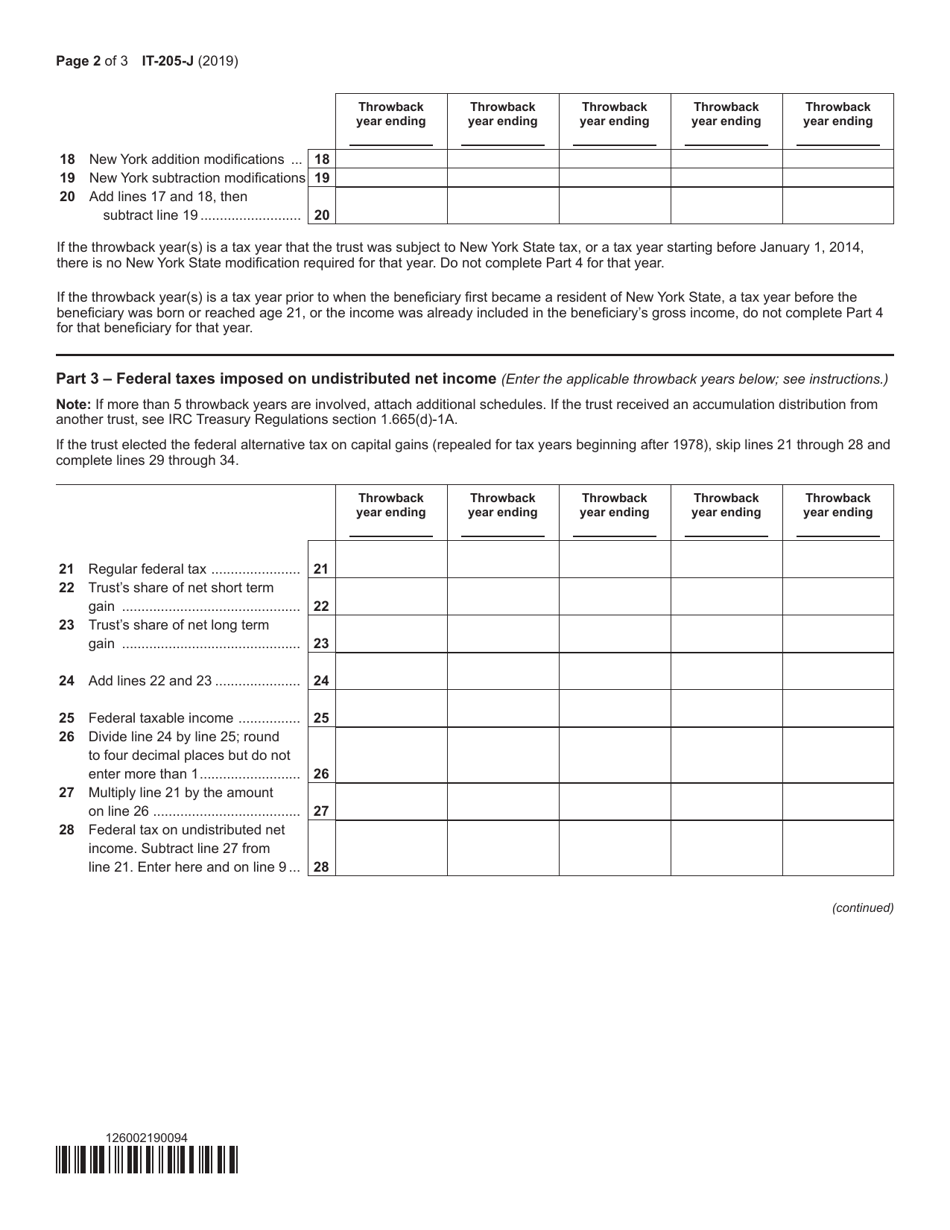

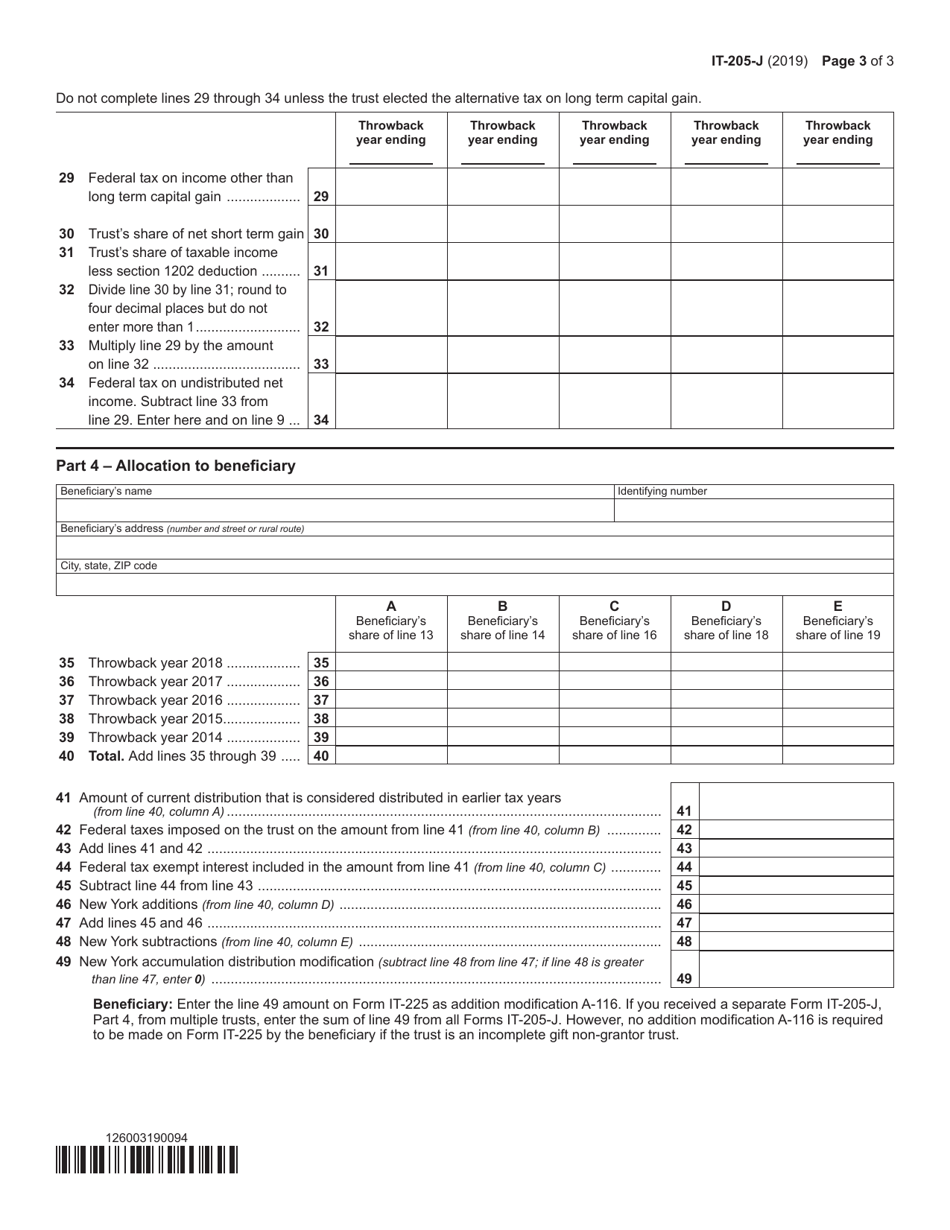

Form IT-205-J New York State Accumulation Distribution for Exempt Resident Trusts - New York

What Is Form IT-205-J?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205-J?

A: Form IT-205-J is a tax form for reporting accumulation distributions for exempt resident trusts in New York State.

Q: Who needs to file Form IT-205-J?

A: Exempt resident trusts in New York State that have made accumulation distributions need to file Form IT-205-J.

Q: What are accumulation distributions?

A: Accumulation distributions are certain types of income distributed by a trust to its beneficiaries.

Q: Is Form IT-205-J for individuals or businesses?

A: Form IT-205-J is specifically for trusts, not individuals or businesses.

Q: When is the deadline to file Form IT-205-J?

A: The deadline to file Form IT-205-J is April 15th, or the next business day if April 15th falls on a weekend or holiday.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-J by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.