This version of the form is not currently in use and is provided for reference only. Download this version of

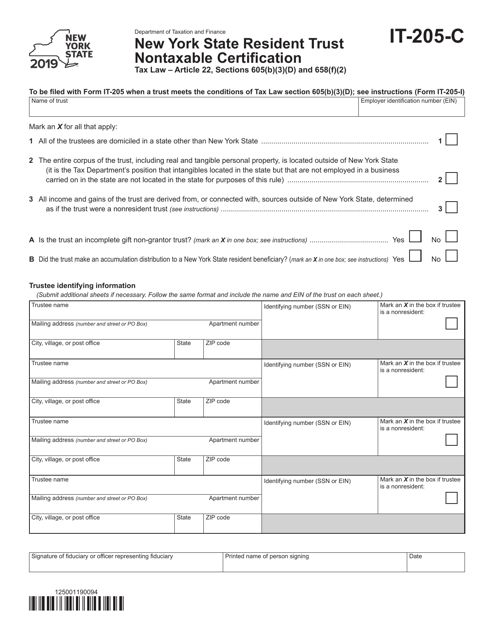

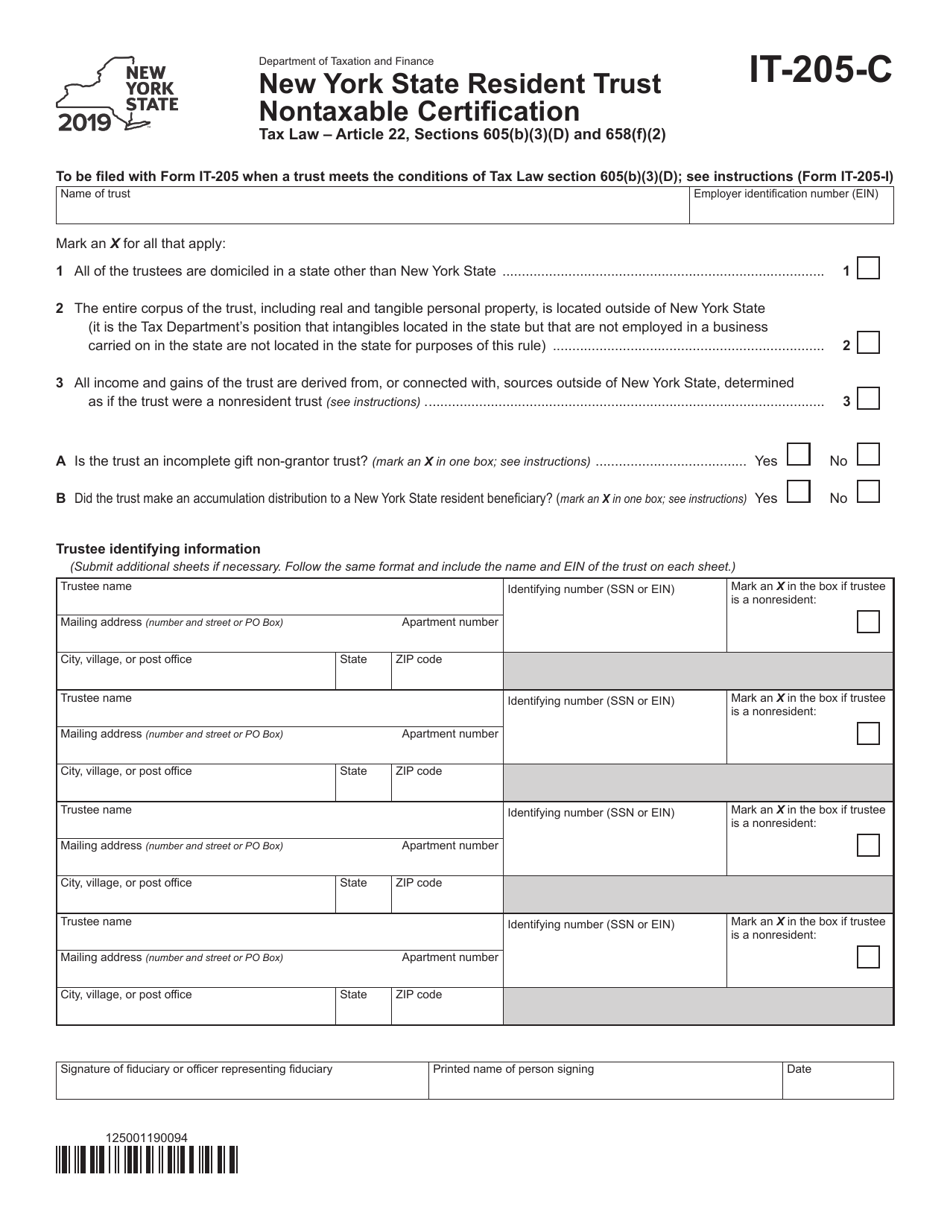

Form IT-205-C

for the current year.

Form IT-205-C New York State Resident Trust Nontaxable Certification - New York

What Is Form IT-205-C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-205-C?

A: Form IT-205-C is the New York State Resident Trust Nontaxable Certification.

Q: Who needs to file Form IT-205-C?

A: Resident trusts in New York State that meet certain requirements need to file Form IT-205-C.

Q: What is the purpose of Form IT-205-C?

A: The purpose of Form IT-205-C is to certify that a resident trust's income is nontaxable.

Q: What are the requirements to file Form IT-205-C?

A: To file Form IT-205-C, the resident trust must meet the qualifying conditions outlined by the New York State Department of Taxation and Finance.

Q: When is Form IT-205-C due?

A: Form IT-205-C is due on the same date as Form IT-205, the New York State Fiduciary Income Tax Return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.