This version of the form is not currently in use and is provided for reference only. Download this version of

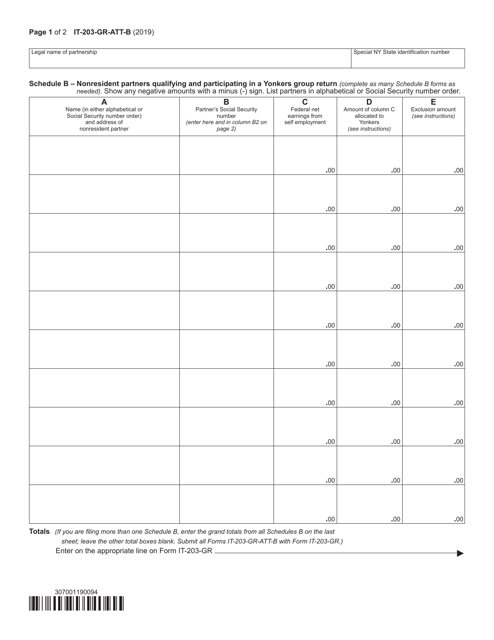

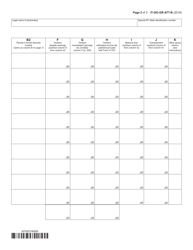

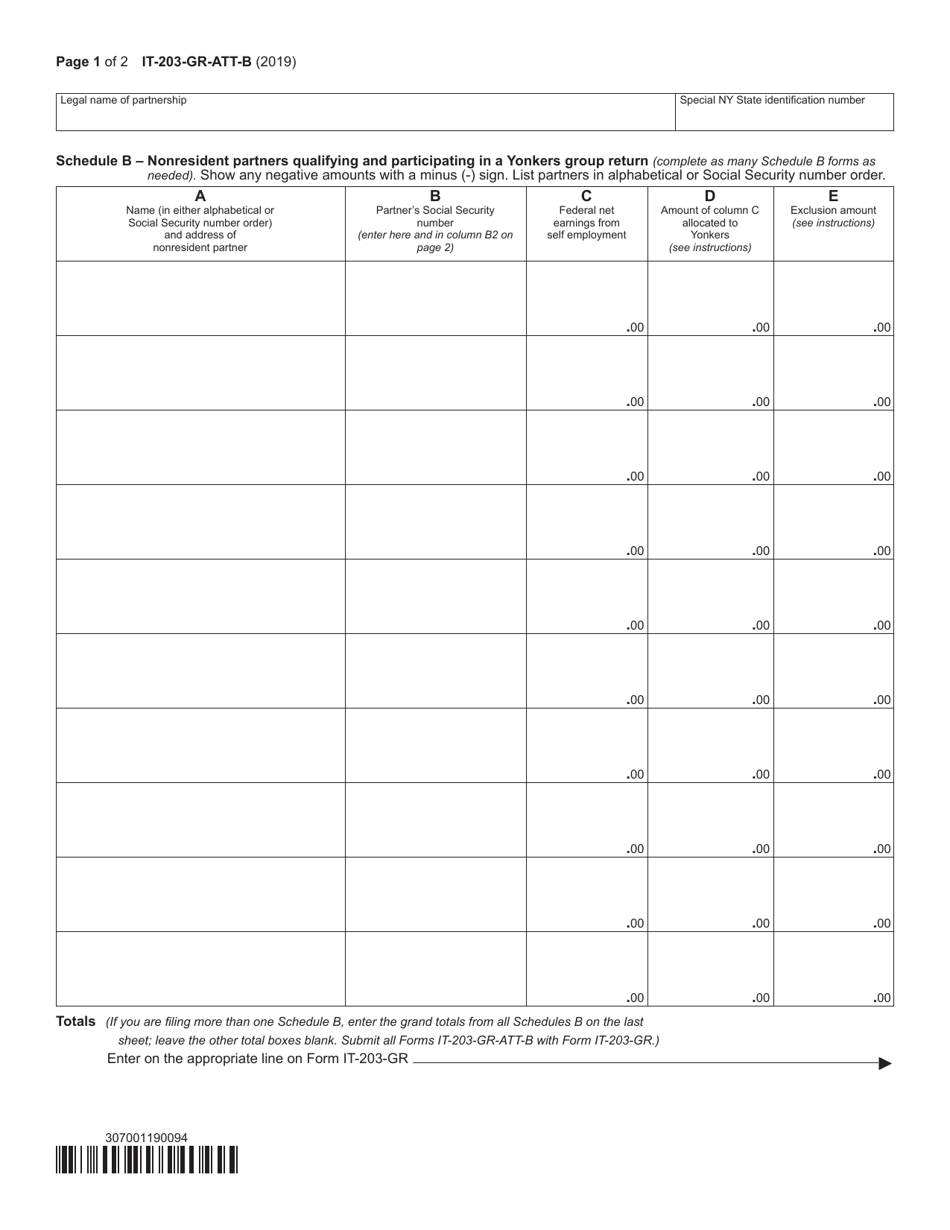

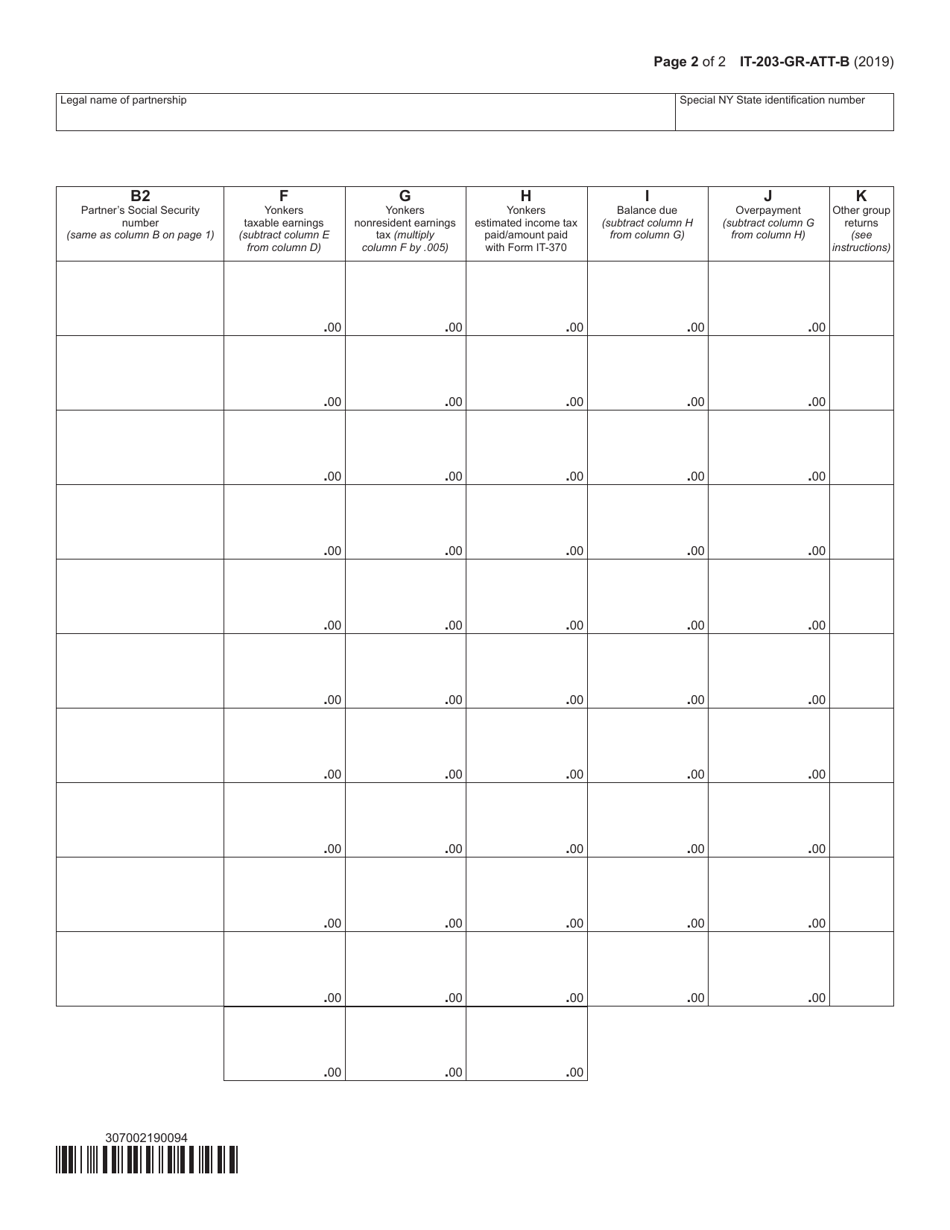

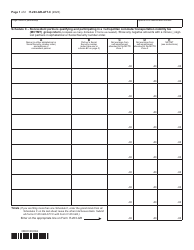

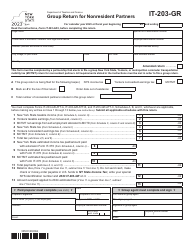

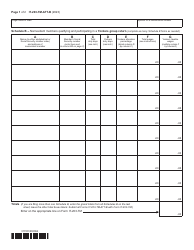

Form IT-203-GR-ATT-B Schedule B

for the current year.

Form IT-203-GR-ATT-B Schedule B Yonkers Group Return for Nonresident Partners - New York

What Is Form IT-203-GR-ATT-B Schedule B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-GR-ATT-B Schedule B?

A: Form IT-203-GR-ATT-B Schedule B is a tax form used for Yonkers group returns for nonresident partners in the state of New York.

Q: Who needs to file Form IT-203-GR-ATT-B Schedule B?

A: Partnerships with nonresident partners who are part of a Yonkers group in New York need to file Form IT-203-GR-ATT-B Schedule B.

Q: What is a Yonkers group?

A: A Yonkers group refers to a group of partnerships that have nonresident partners and are subject to the Yonkers city tax in New York.

Q: What information is required to complete Form IT-203-GR-ATT-B Schedule B?

A: Form IT-203-GR-ATT-B Schedule B requires information about the nonresident partners and their distributive share of income, deductions, and credits.

Q: When is the deadline to file Form IT-203-GR-ATT-B Schedule B?

A: The deadline to file Form IT-203-GR-ATT-B Schedule B is the same as the deadline for filing the partnership tax return, which is generally April 15th.

Q: What are the consequences of not filing Form IT-203-GR-ATT-B Schedule B?

A: Failure to file Form IT-203-GR-ATT-B Schedule B may result in penalties and interest imposed by the New York State Department of Taxation and Finance.

Q: Can Form IT-203-GR-ATT-B Schedule B be e-filed?

A: Yes, Form IT-203-GR-ATT-B Schedule B can be e-filed using approved tax software or through a tax professional.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-GR-ATT-B Schedule B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.