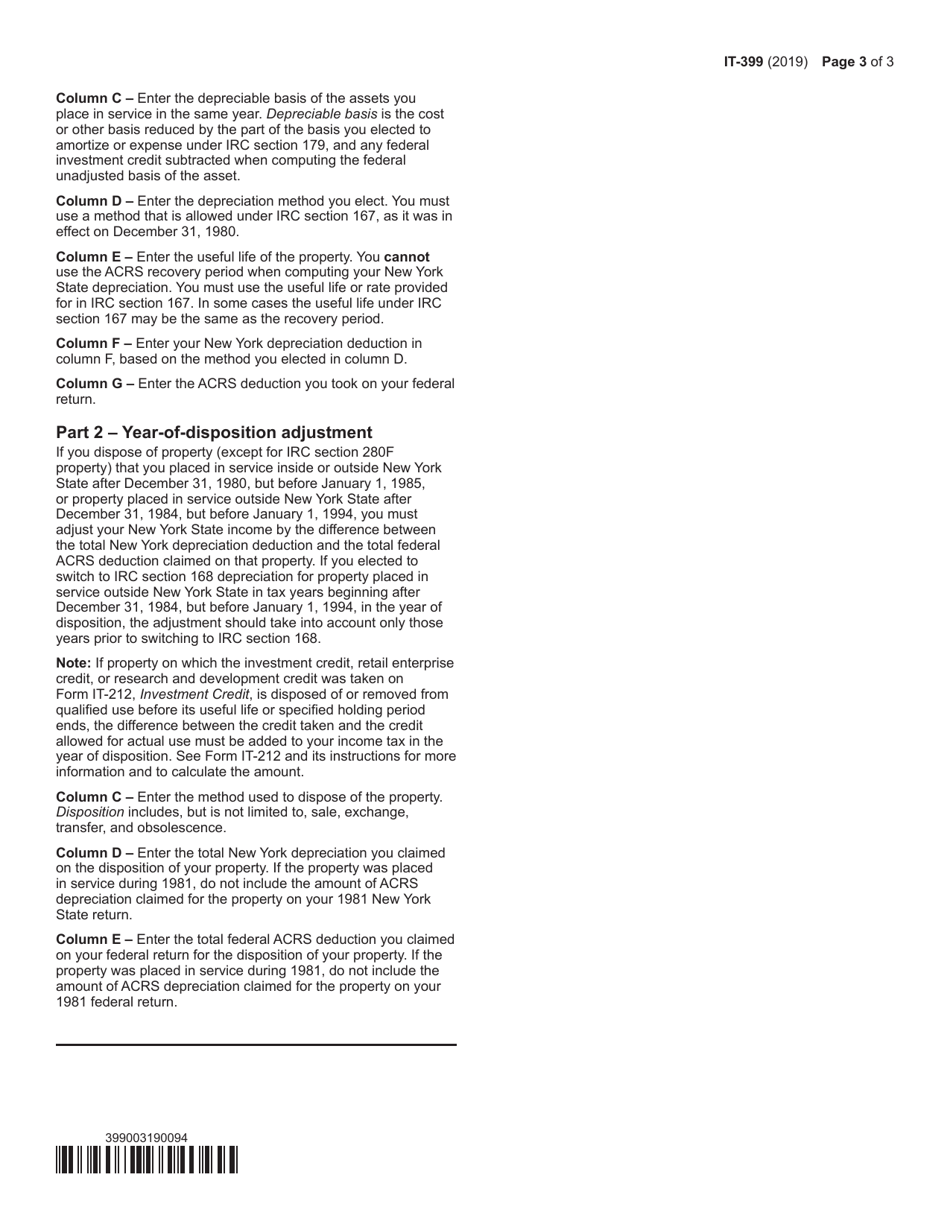

This version of the form is not currently in use and is provided for reference only. Download this version of

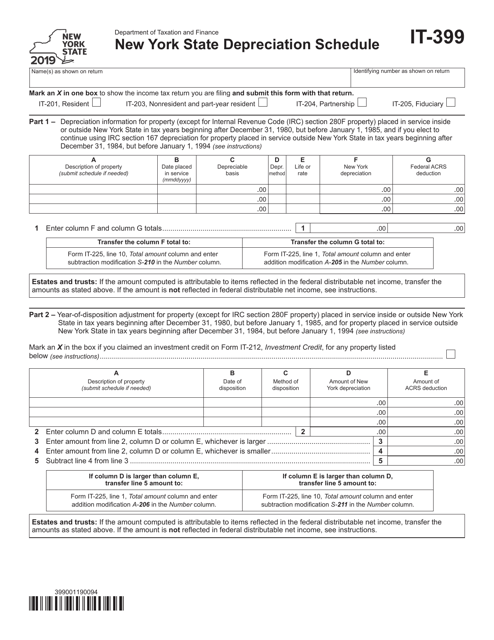

Form IT-399

for the current year.

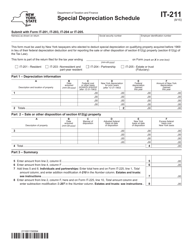

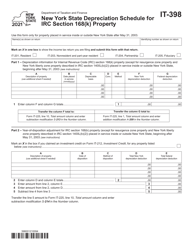

Form IT-399 New York State Depreciation Schedule - New York

What Is Form IT-399?

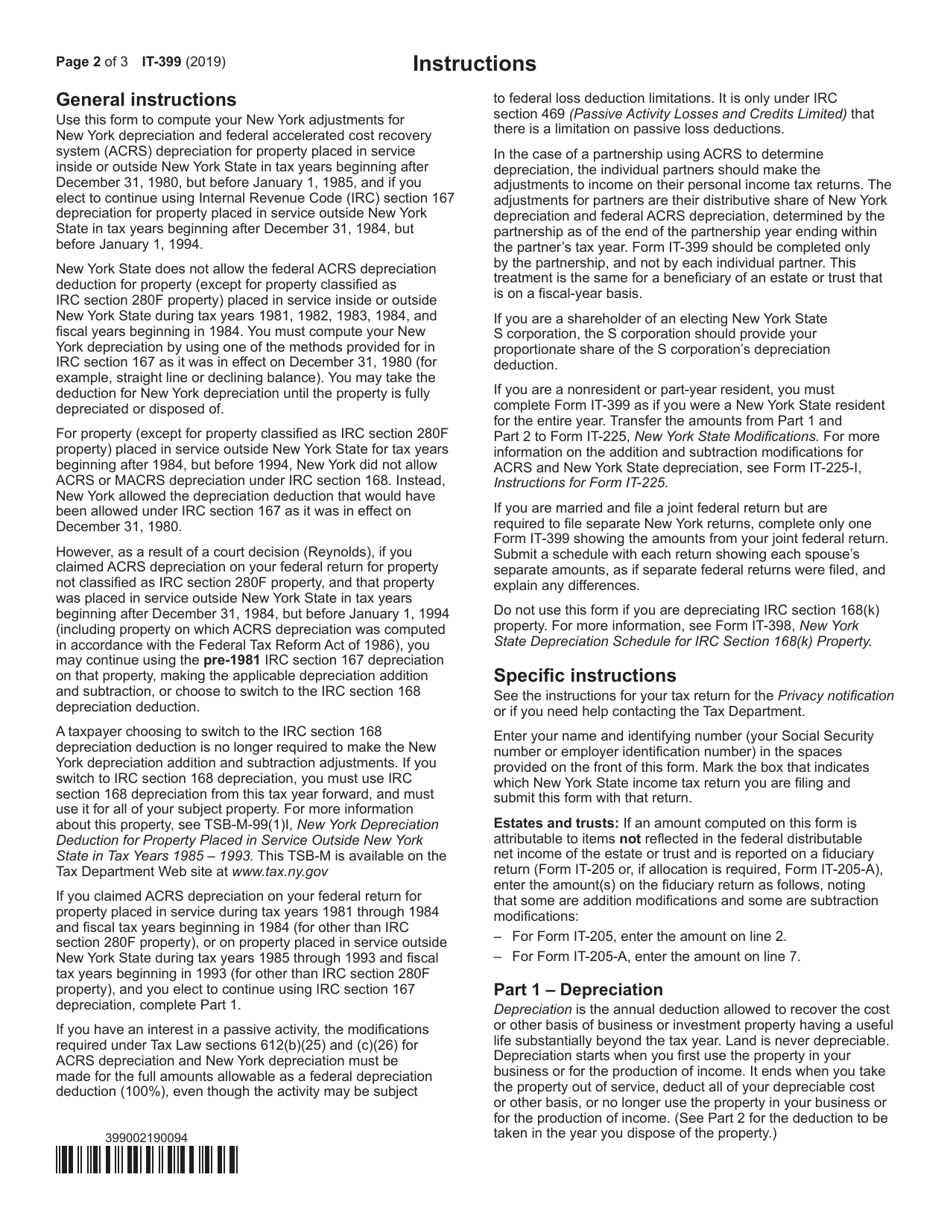

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-399?

A: Form IT-399 is the New York State Depreciation Schedule.

Q: What is the purpose of Form IT-399?

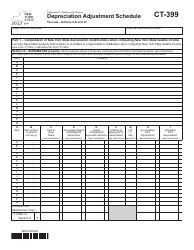

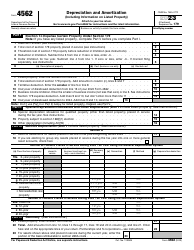

A: The purpose of Form IT-399 is to report depreciation expenses for New York State tax purposes.

Q: Who needs to file Form IT-399?

A: Taxpayers in New York State who have depreciable assets must file Form IT-399.

Q: When is Form IT-399 due?

A: Form IT-399 is due on the same date as your New York State income tax return.

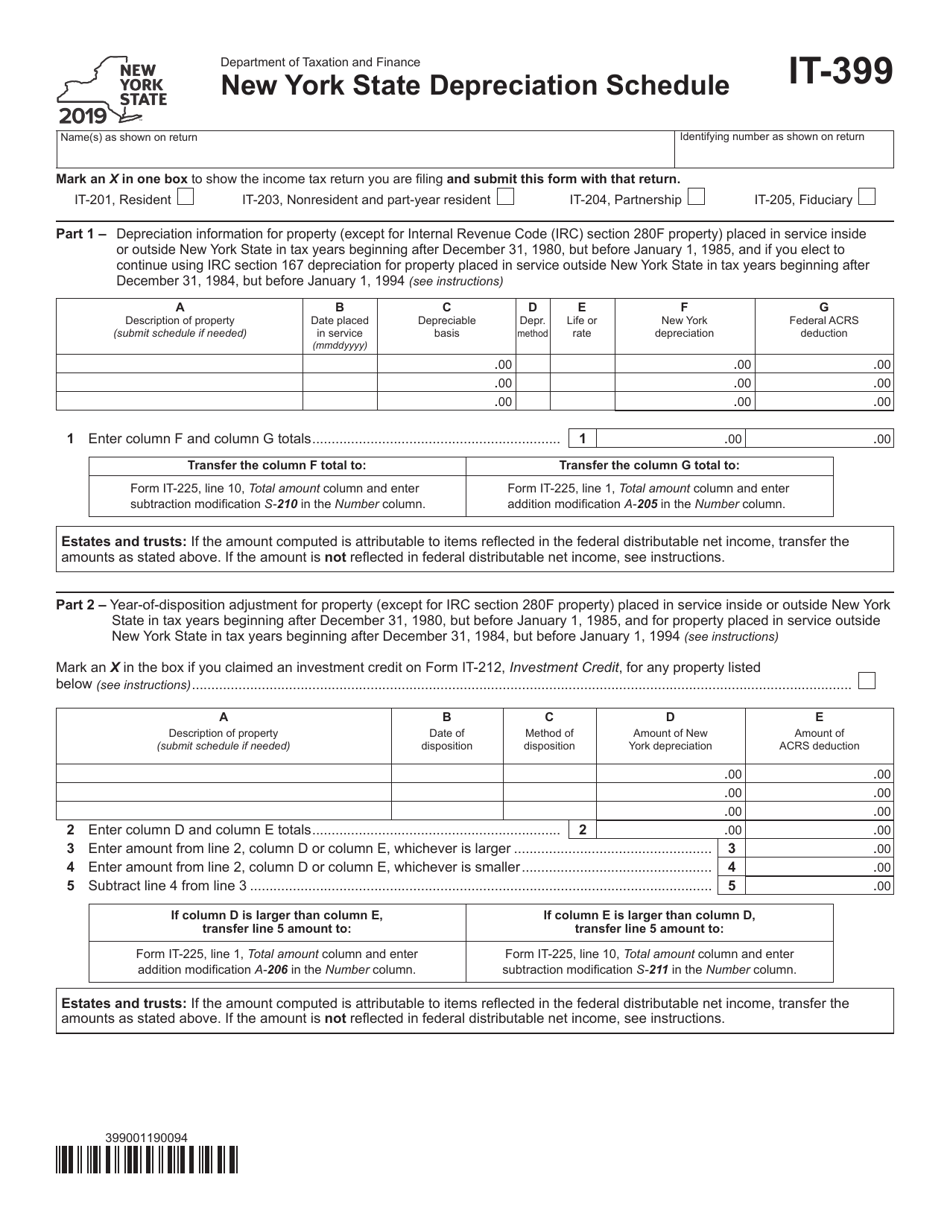

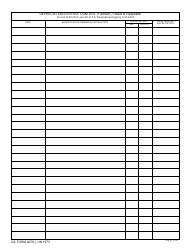

Q: What information is required on Form IT-399?

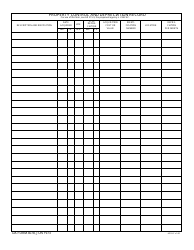

A: Form IT-399 requires you to provide details about your depreciable assets, including their cost, date placed in service, and method of depreciation.

Q: What should I do if I have questions about Form IT-399?

A: If you have questions about Form IT-399, you can contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-399 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.