This version of the form is not currently in use and is provided for reference only. Download this version of

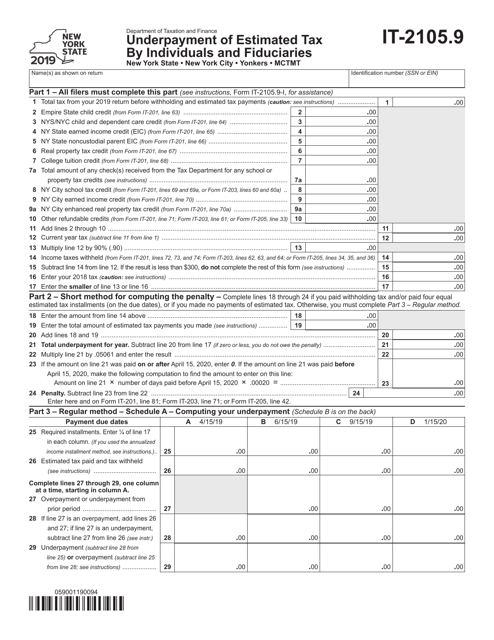

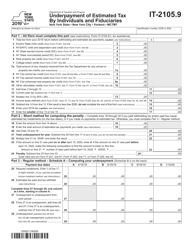

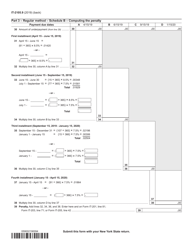

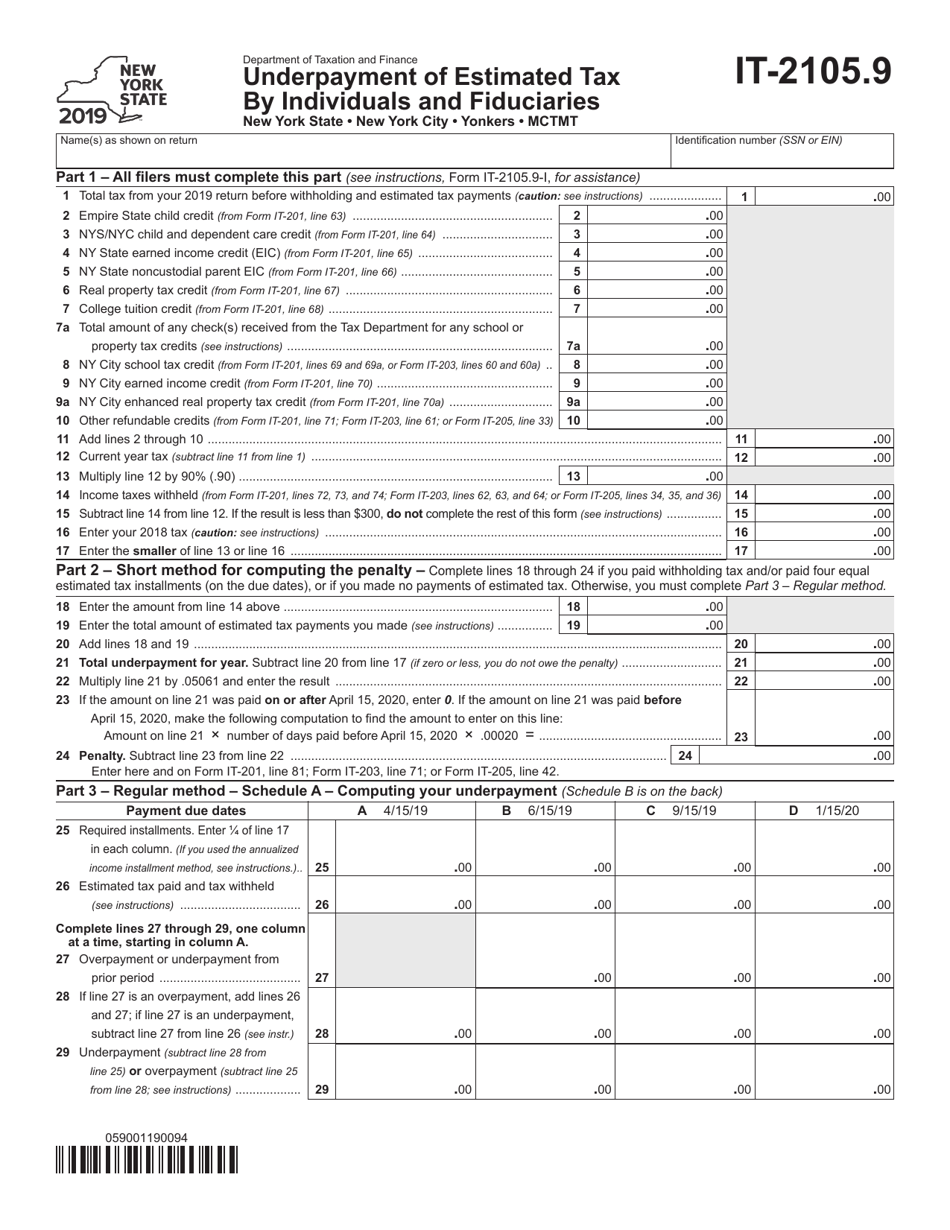

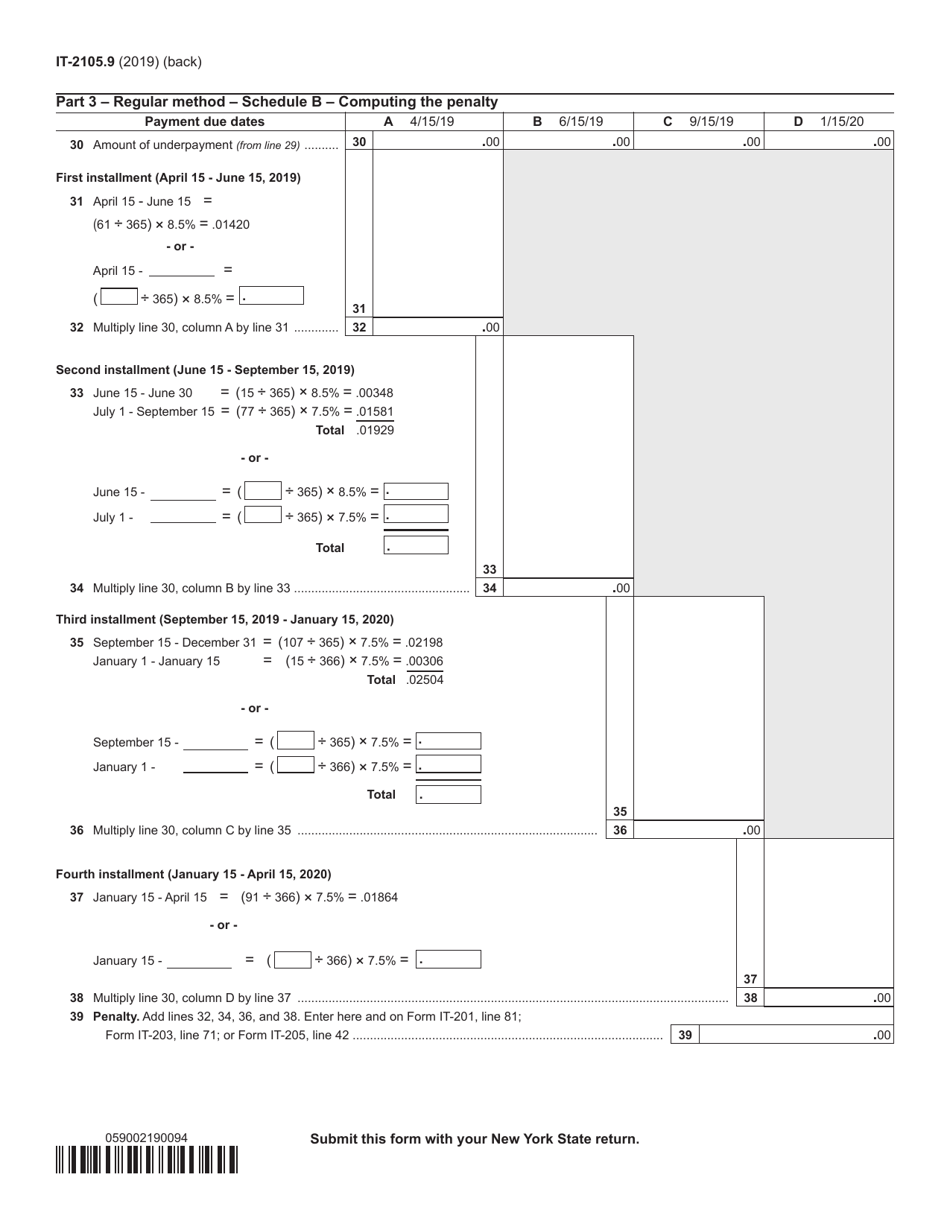

Form IT-2105.9

for the current year.

Form IT-2105.9 Underpayment of Estimated Tax by Individuals and Fiduciaries - New York

What Is Form IT-2105.9?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2105.9?

A: Form IT-2105.9 is a tax form used in New York to report underpayment of estimated tax by individuals and fiduciaries.

Q: Who needs to file Form IT-2105.9?

A: Individuals and fiduciaries who have underpaid their estimated tax in New York need to file Form IT-2105.9.

Q: When do I need to file Form IT-2105.9?

A: Form IT-2105.9 must be filed by April 15th of the following year.

Q: What happens if I don't file Form IT-2105.9?

A: If you don't file Form IT-2105.9 or pay the underpayment penalty, you may be subject to interest charges and penalties.

Q: Can I e-file Form IT-2105.9?

A: No, Form IT-2105.9 cannot be e-filed. It must be filed by mail.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2105.9 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.