This version of the form is not currently in use and is provided for reference only. Download this version of

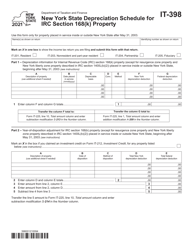

Form IT-398

for the current year.

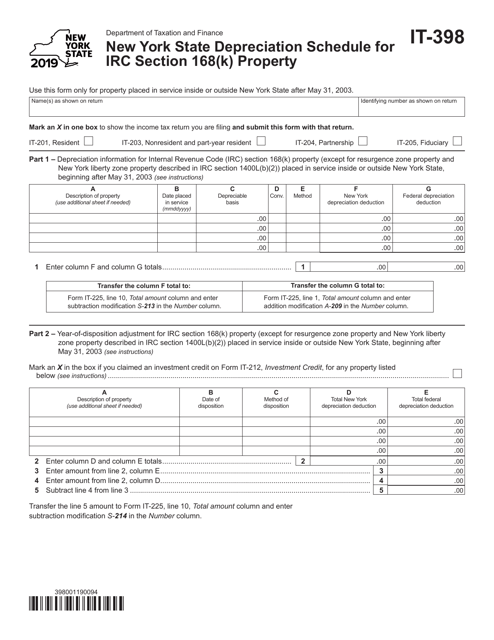

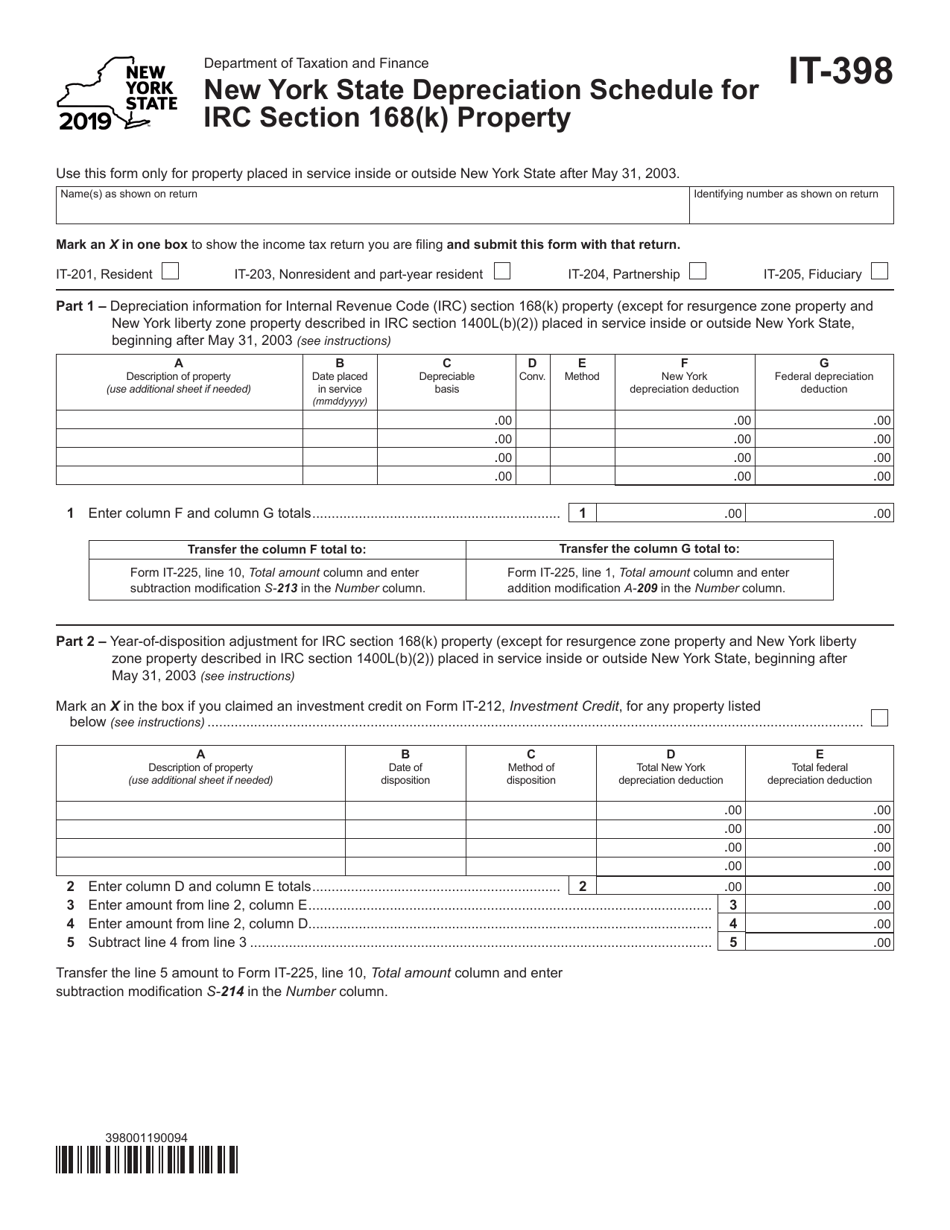

Form IT-398 New York State Depreciation Schedule for IRC Section 168(K) Property - New York

What Is Form IT-398?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-398?

A: Form IT-398 is the New York State Depreciation Schedule for IRC Section 168(K) Property.

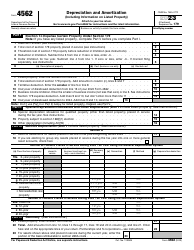

Q: What is IRC Section 168(K) Property?

A: IRC Section 168(K) Property refers to property that qualifies for bonus depreciation under the Internal Revenue Code.

Q: Who needs to file Form IT-398?

A: Taxpayers in New York State who have qualifying property and want to claim bonus depreciation need to file Form IT-398.

Q: What is the purpose of Form IT-398?

A: The purpose of Form IT-398 is to calculate and report the depreciation deduction for qualifying property in New York State.

Q: When is the deadline to file Form IT-398?

A: The deadline to file Form IT-398 is the same as the taxpayer's federal income tax return due date, including extensions.

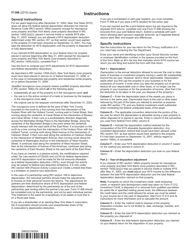

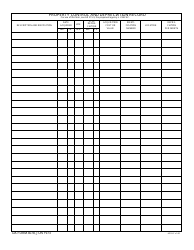

Q: Are there any special instructions for completing Form IT-398?

A: Yes, taxpayers should refer to the instructions provided with the form to ensure accurate completion and reporting of the depreciation deduction.

Q: What happens if I don't file Form IT-398?

A: Failing to file Form IT-398 may result in the taxpayer not being able to claim bonus depreciation for qualifying property in New York State.

Q: Can I file Form IT-398 electronically?

A: Yes, Form IT-398 can be filed electronically using the New York State tax department's e-file system.

Q: Is there a fee for filing Form IT-398?

A: No, there is no fee for filing Form IT-398.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-398 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.