This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-280

for the current year.

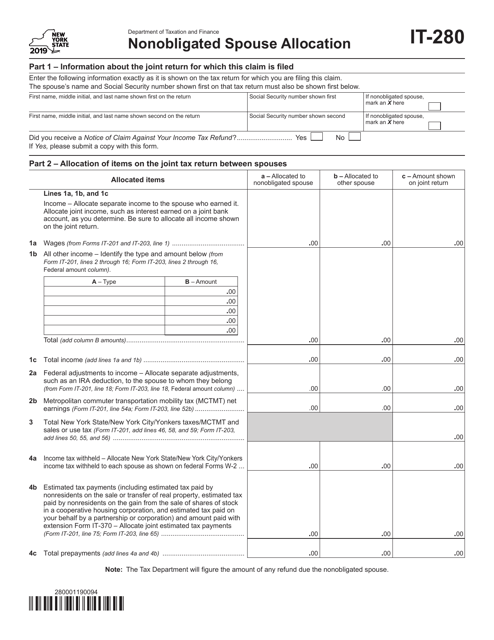

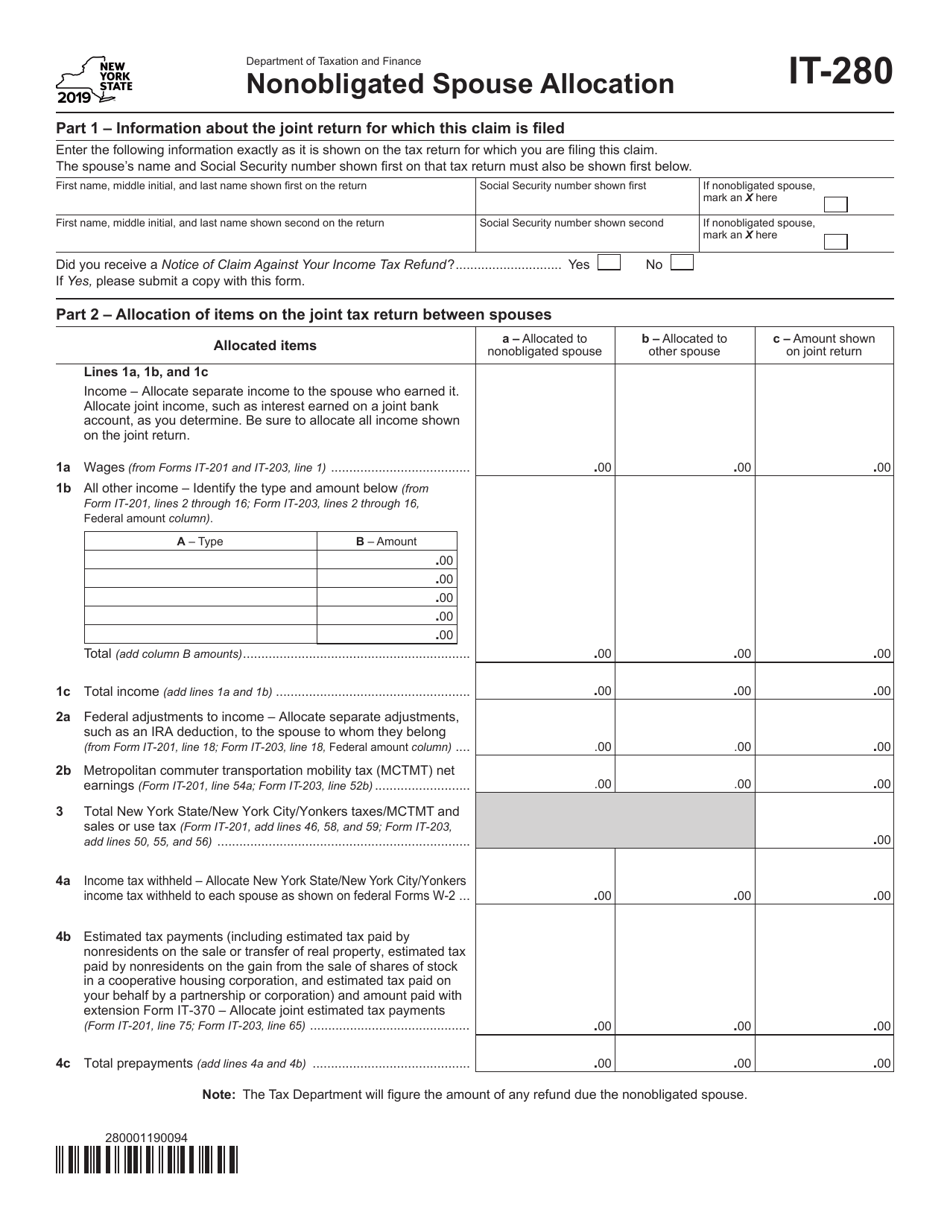

Form IT-280 Nonobligated Spouse Allocation - New York

What Is Form IT-280?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-280?

A: Form IT-280 is a tax form used by residents of New York to allocate nonobligated spouse income.

Q: Who needs to file Form IT-280?

A: Residents of New York who are married or in a civil union and wish to allocate their nonobligated spouse income.

Q: What is nonobligated spouse income?

A: Nonobligated spouse income refers to the income of a spouse that is not legally obligated to pay a joint tax liability.

Q: Why is Form IT-280 necessary?

A: Form IT-280 is necessary to ensure that each spouse is only responsible for their own individual tax liability.

Q: When is the deadline to file Form IT-280?

A: The deadline to file Form IT-280 coincides with the deadline for filing your New York State income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-280 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.