This version of the form is not currently in use and is provided for reference only. Download this version of

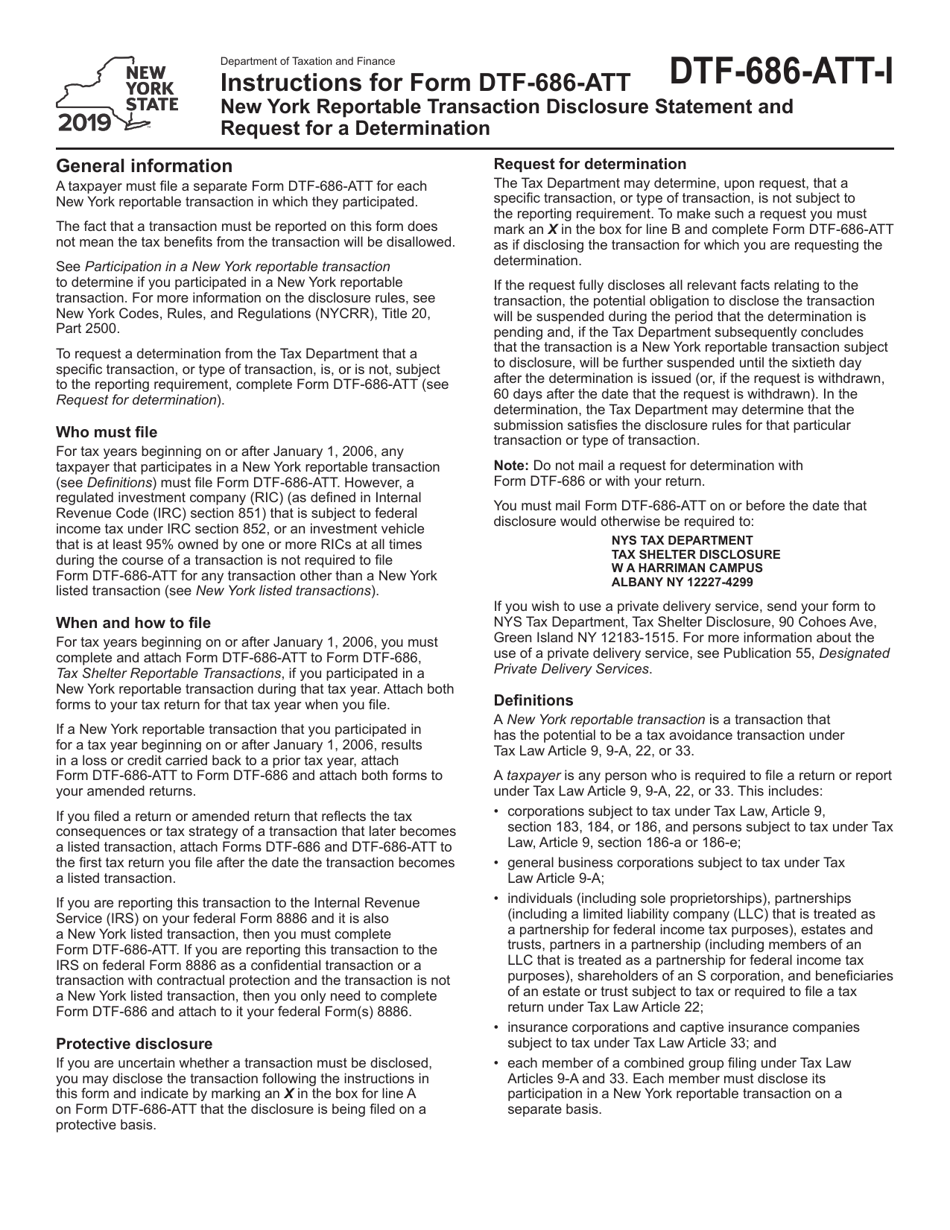

Instructions for Form DTF-686-ATT

for the current year.

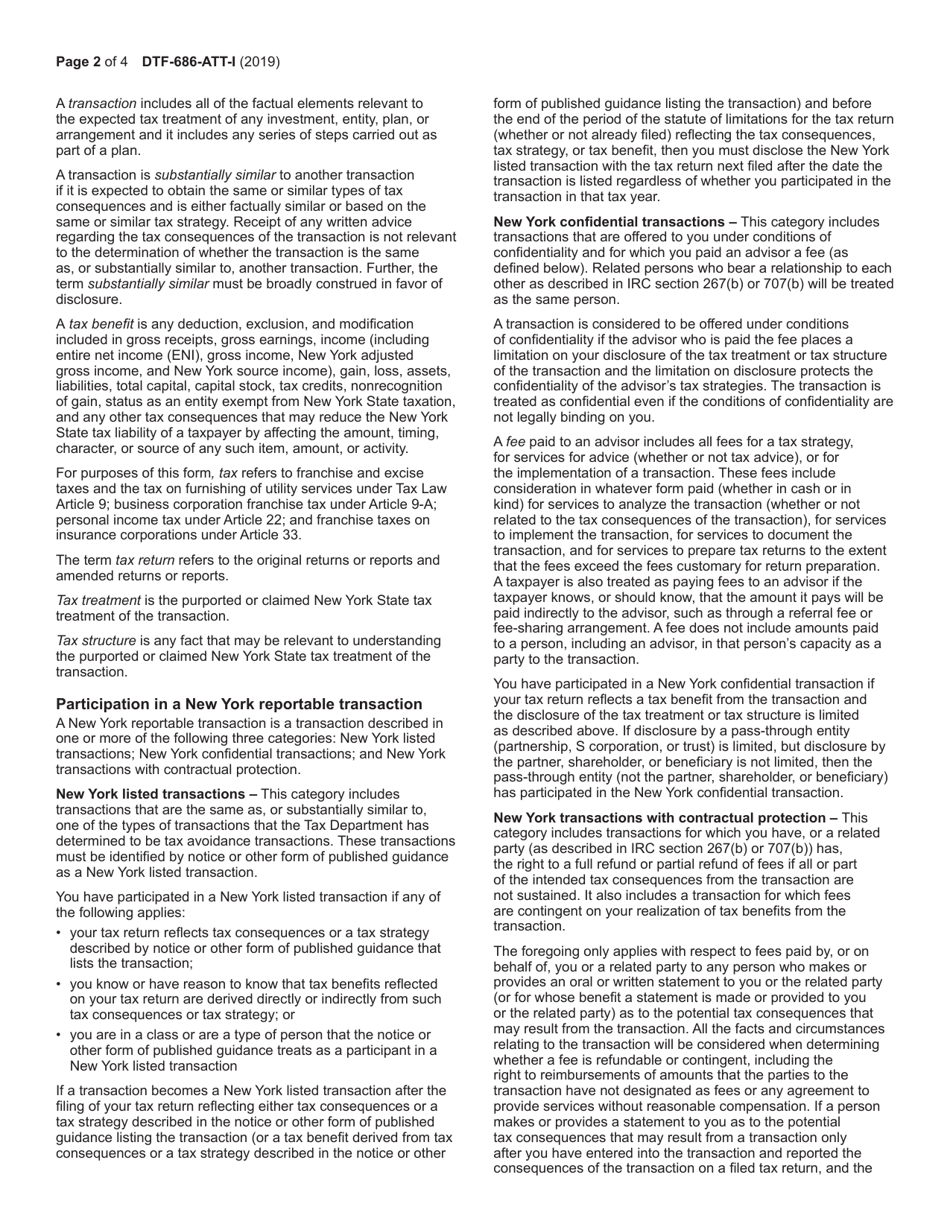

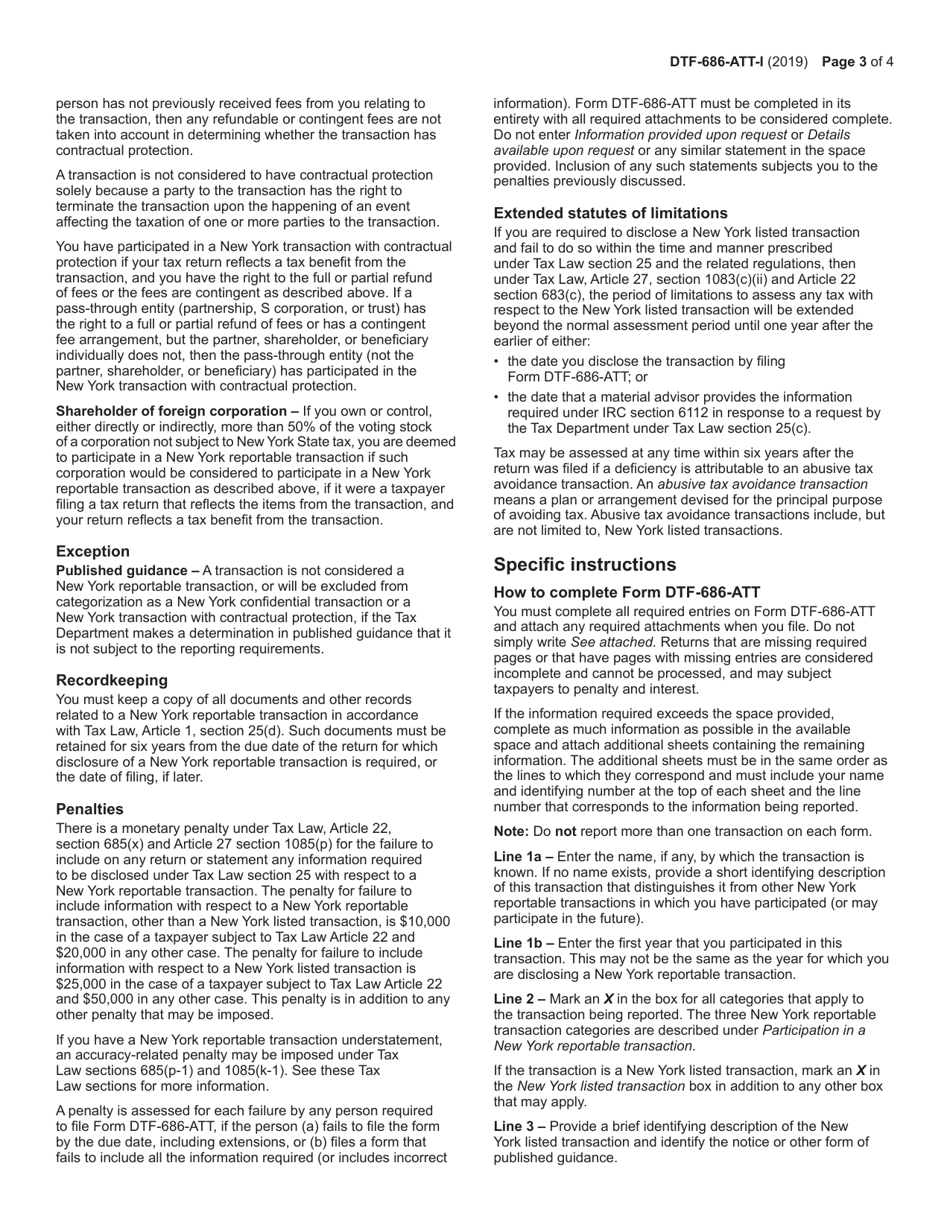

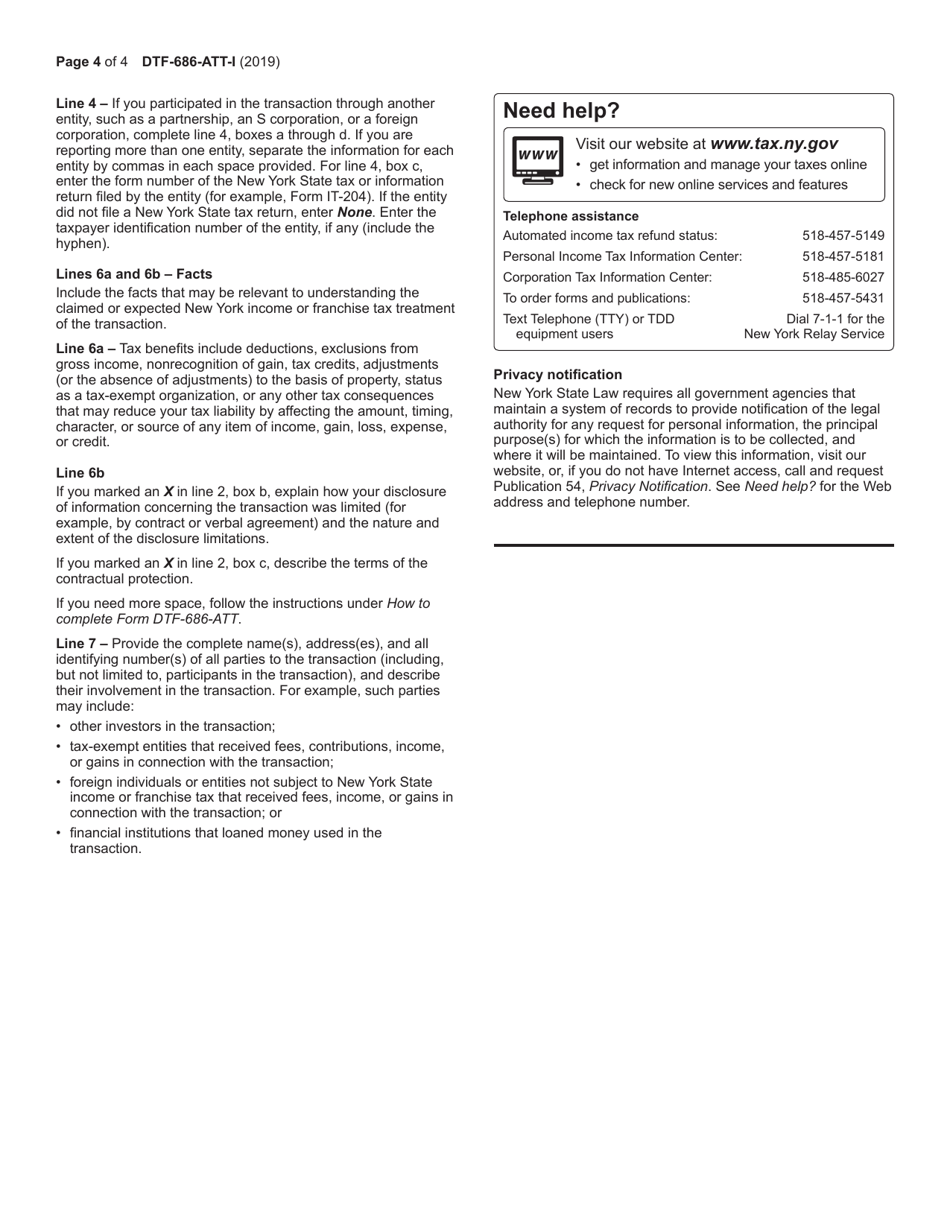

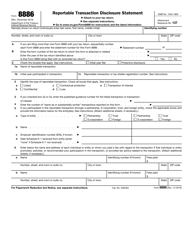

Instructions for Form DTF-686-ATT New York Reportable Transaction Disclosure Statement and Request for a Determination - New York

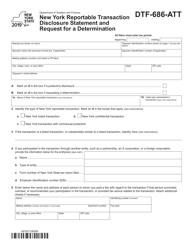

This document contains official instructions for Form DTF-686-ATT , New York Request for a Determination - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form DTF-686-ATT is available for download through this link.

FAQ

Q: What is Form DTF-686-ATT?

A: Form DTF-686-ATT is the New York Reportable Transaction Disclosure Statement and Request for a Determination form.

Q: What is the purpose of Form DTF-686-ATT?

A: The purpose of Form DTF-686-ATT is to report certain transactions to the New York State Department of Taxation and Finance and to request a determination regarding the tax treatment of those transactions.

Q: Who needs to file Form DTF-686-ATT?

A: Any person or entity that enters into a reportable transaction as defined by the New York Tax Law must file Form DTF-686-ATT.

Q: What is a reportable transaction?

A: A reportable transaction is a transaction that meets certain criteria specified by the New York Tax Law, such as significant tax benefits or the use of certain tax avoidance strategies.

Q: When is the deadline to file Form DTF-686-ATT?

A: The deadline to file Form DTF-686-ATT is generally within 90 days after the transaction is entered into or, in certain cases, by the due date of the taxpayer's New York State tax return for the period in which the transaction occurred.

Q: Are there any penalties for failing to file Form DTF-686-ATT?

A: Yes, failure to timely file Form DTF-686-ATT may result in penalties imposed by the New York State Department of Taxation and Finance.

Q: Can I request a determination regarding the tax treatment of a transaction without filing Form DTF-686-ATT?

A: No, you must file Form DTF-686-ATT in order to request a determination regarding the tax treatment of a transaction.

Q: What supporting documentation should be included with Form DTF-686-ATT?

A: You should include any relevant documents, such as transaction documents, financial statements, and tax opinions, that support your request for a determination.

Q: Is the information provided on Form DTF-686-ATT confidential?

A: No, the information provided on Form DTF-686-ATT may be subject to disclosure under the New York State Freedom of Information Law.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.