This version of the form is not currently in use and is provided for reference only. Download this version of

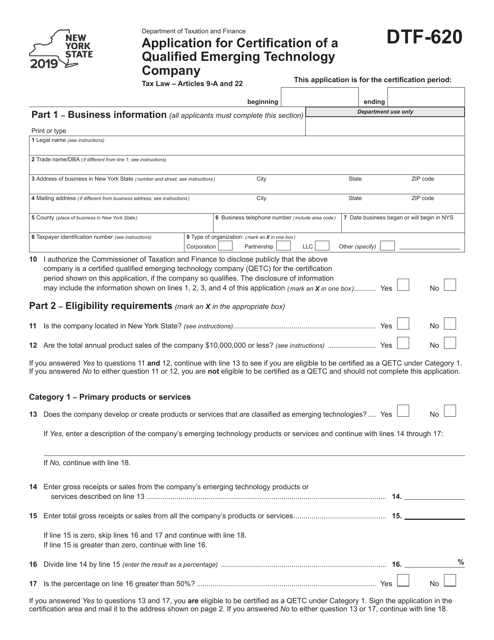

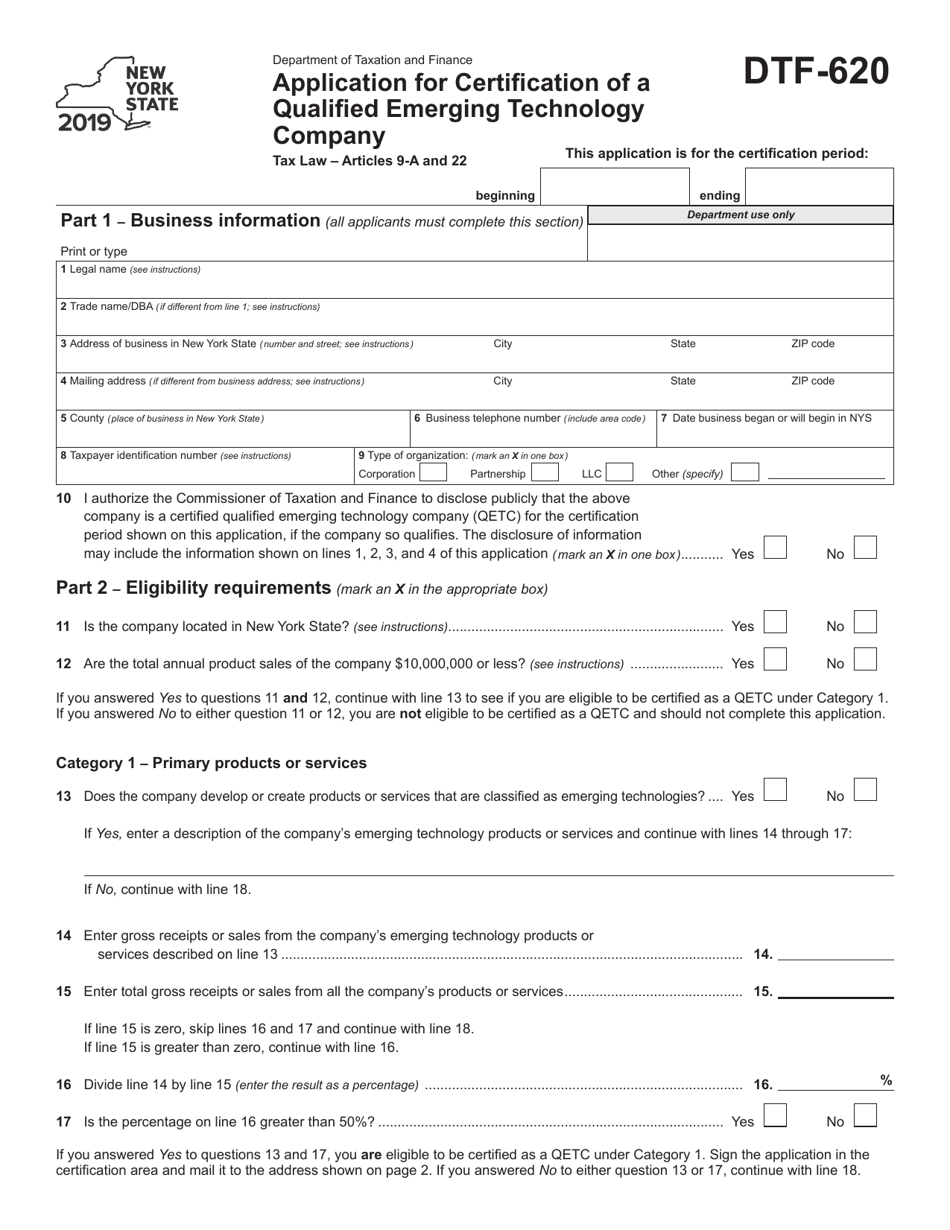

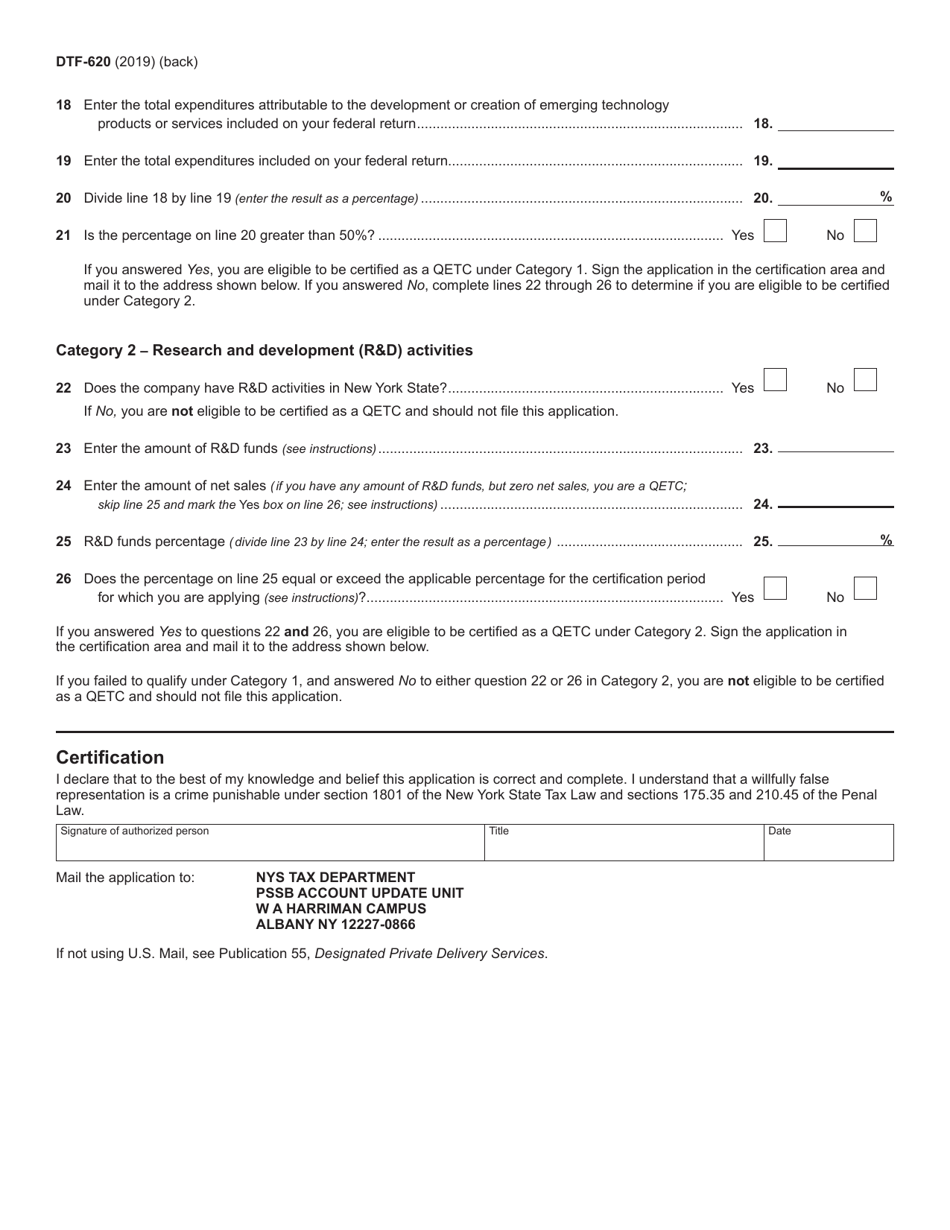

Form DTF-620

for the current year.

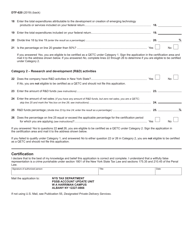

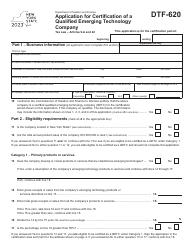

Form DTF-620 Application for Certification of a Qualified Emerging Technology Company - New York

What Is Form DTF-620?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-620?

A: Form DTF-620 is an application for certification of a Qualified Emerging Technology Company in New York.

Q: What is a Qualified Emerging Technology Company?

A: A Qualified Emerging Technology Company is a company that meets certain criteria and is eligible for tax benefits.

Q: Who can apply for certification as a Qualified Emerging Technology Company?

A: Any company that meets the eligibility requirements can apply for certification.

Q: What are the tax benefits of being a Qualified Emerging Technology Company?

A: Qualified Emerging Technology Companies may be eligible for tax credits and exemptions.

Q: What information is required on Form DTF-620?

A: Form DTF-620 requires information about the company's business activities, ownership, and financials.

Q: Are there any fees associated with submitting Form DTF-620?

A: There are no fees for submitting Form DTF-620.

Q: What is the processing time for Form DTF-620?

A: The processing time for Form DTF-620 may vary, but it typically takes a few weeks to receive a decision.

Q: What happens after my company is certified as a Qualified Emerging Technology Company?

A: After certification, your company may be eligible for tax benefits as outlined by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-620 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.