This version of the form is not currently in use and is provided for reference only. Download this version of

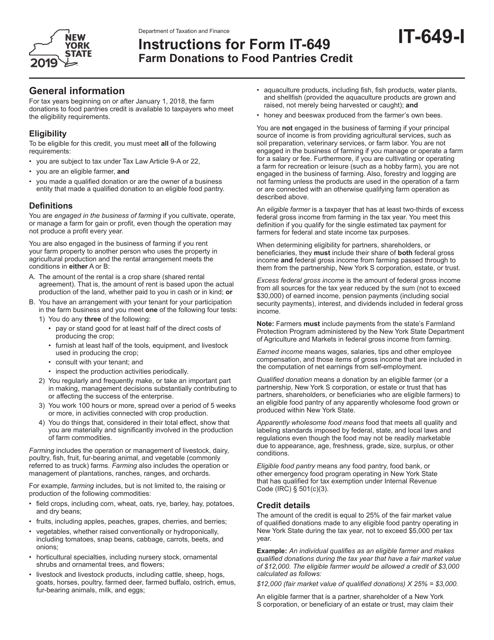

Instructions for Form IT-649

for the current year.

Instructions for Form IT-649 Farm Donations to Food Pantries Credit - New York

This document contains official instructions for Form IT-649 , Farm Donations to Food Pantries Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-649 is available for download through this link.

FAQ

Q: What is Form IT-649?

A: Form IT-649 is a tax form in New York.

Q: What is the purpose of Form IT-649?

A: Form IT-649 is used to claim the Farm Donations to Food Pantries Credit in New York.

Q: Who is eligible to claim the Farm Donations to Food Pantries Credit?

A: Farmers in New York who donate qualified agricultural products to eligible food pantries are eligible to claim this credit.

Q: What is a qualified agricultural product?

A: A qualified agricultural product refers to food and beverages that are grown, produced, or processed in New York State.

Q: How much is the Farm Donations to Food Pantries Credit?

A: The credit is equal to 25% of the fair market value of the qualified agricultural products donated.

Q: Are there any limitations to the credit?

A: Yes, the credit is limited to $5,000 per taxpayer per year.

Q: What documentation is required to claim the credit?

A: Taxpayers must maintain records that substantiate the qualified agricultural products donated, including receipts, invoices, and other supporting documentation.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.