This version of the form is not currently in use and is provided for reference only. Download this version of

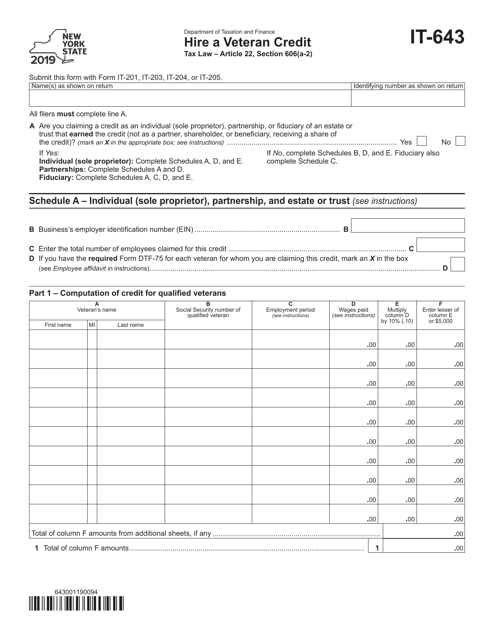

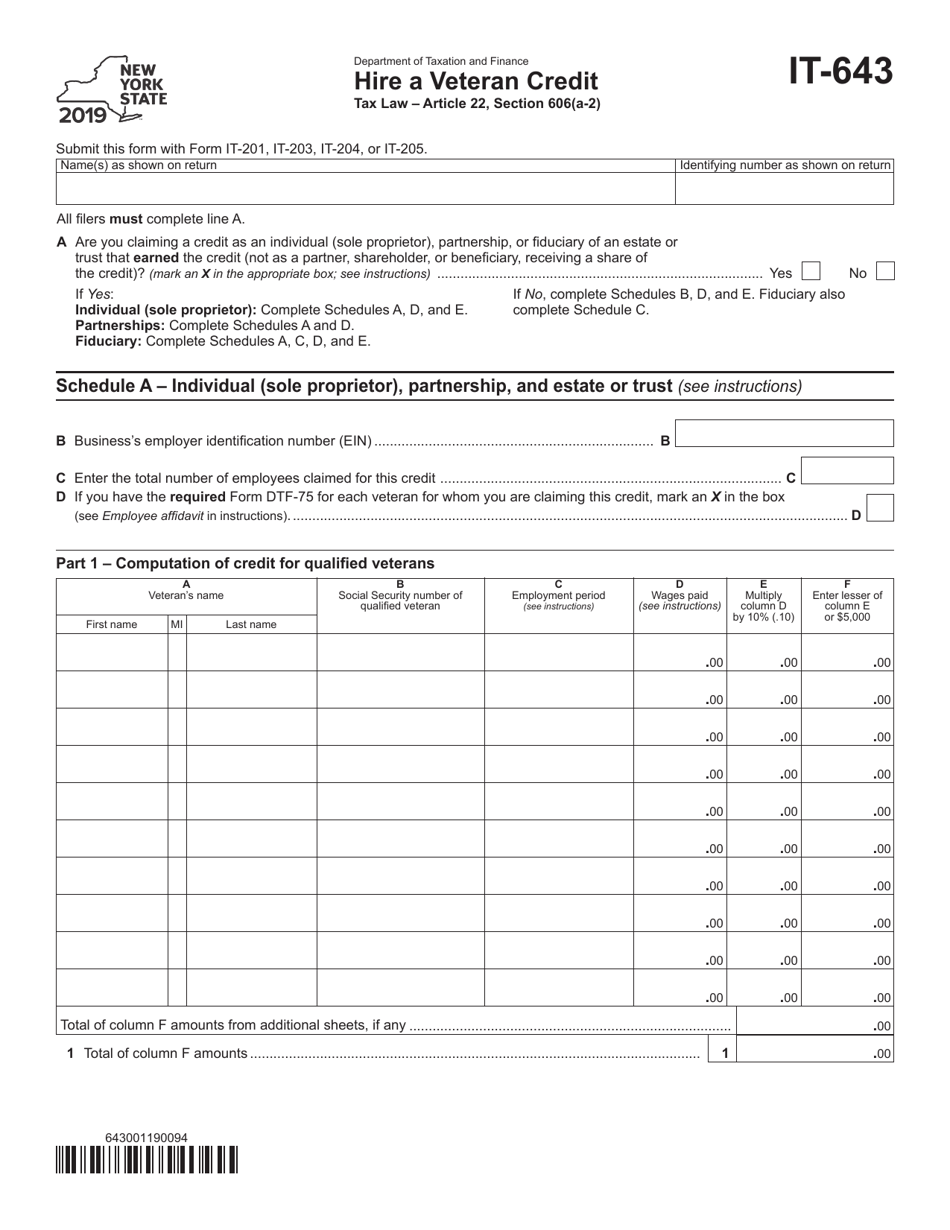

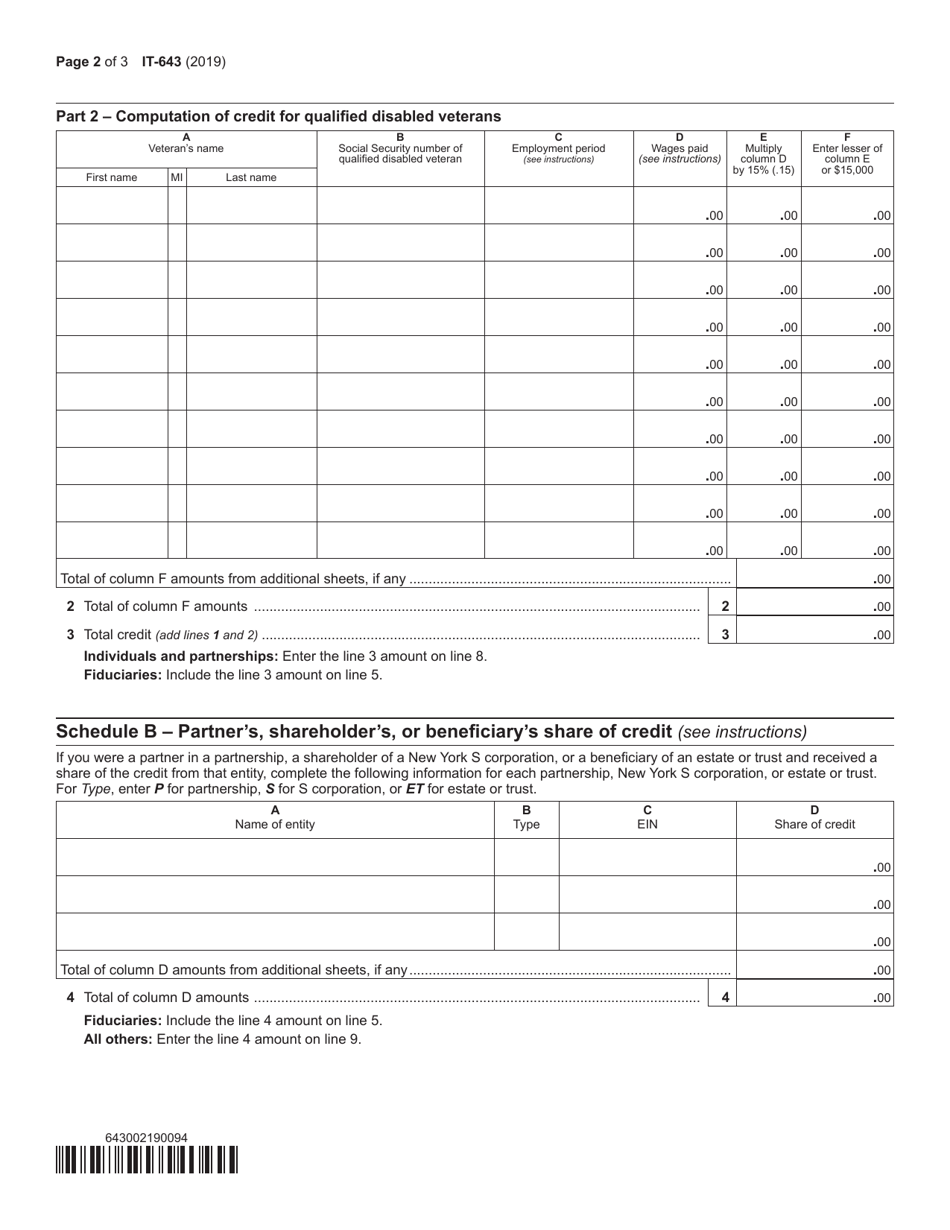

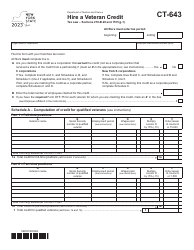

Form IT-643

for the current year.

Form IT-643 Hire a Veteran Credit - New York

What Is Form IT-643?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-643?

A: Form IT-643 is a tax form used in New York to claim the Hire a Veteran Credit.

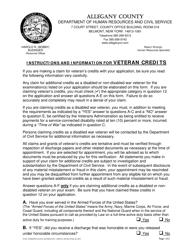

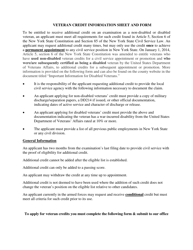

Q: What is the Hire a Veteran Credit?

A: The Hire a Veteran Credit is a tax credit available to employers in New York who hire qualified veterans.

Q: Who is eligible to claim the Hire a Veteran Credit?

A: Employers in New York who hire qualified veterans are eligible to claim the Hire a Veteran Credit.

Q: What is the purpose of the Hire a Veteran Credit?

A: The purpose of the Hire a Veteran Credit is to encourage employers to hire and retain qualified veterans.

Q: How much is the Hire a Veteran Credit?

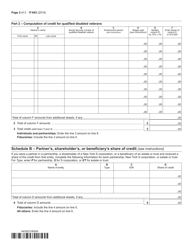

A: The amount of the Hire a Veteran Credit can vary and is based on a percentage of the wages paid to the qualified veteran.

Q: How can an employer claim the Hire a Veteran Credit?

A: To claim the Hire a Veteran Credit, employers must complete and file Form IT-643 with their New York state tax return.

Q: Are there any specific requirements to qualify for the Hire a Veteran Credit?

A: Yes, there are specific requirements that employers and veterans must meet to qualify for the Hire a Veteran Credit. These requirements can be found on Form IT-643 and the accompanying instructions.

Q: Is the Hire a Veteran Credit available in Canada?

A: No, the Hire a Veteran Credit is specific to employers in New York and is not available in Canada.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-643 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.