This version of the form is not currently in use and is provided for reference only. Download this version of

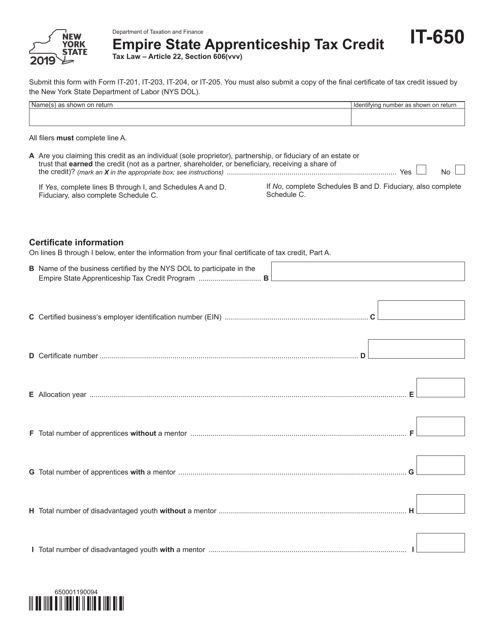

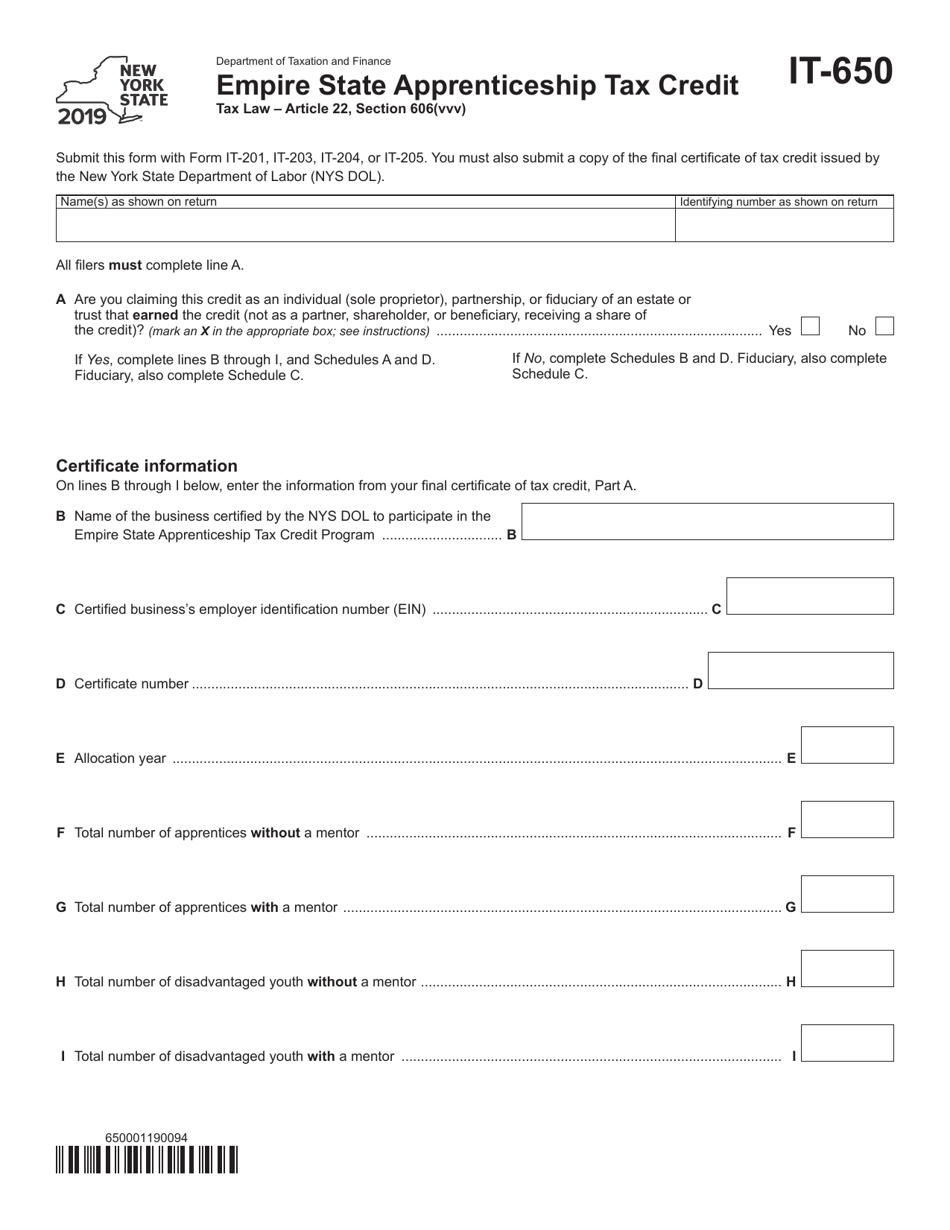

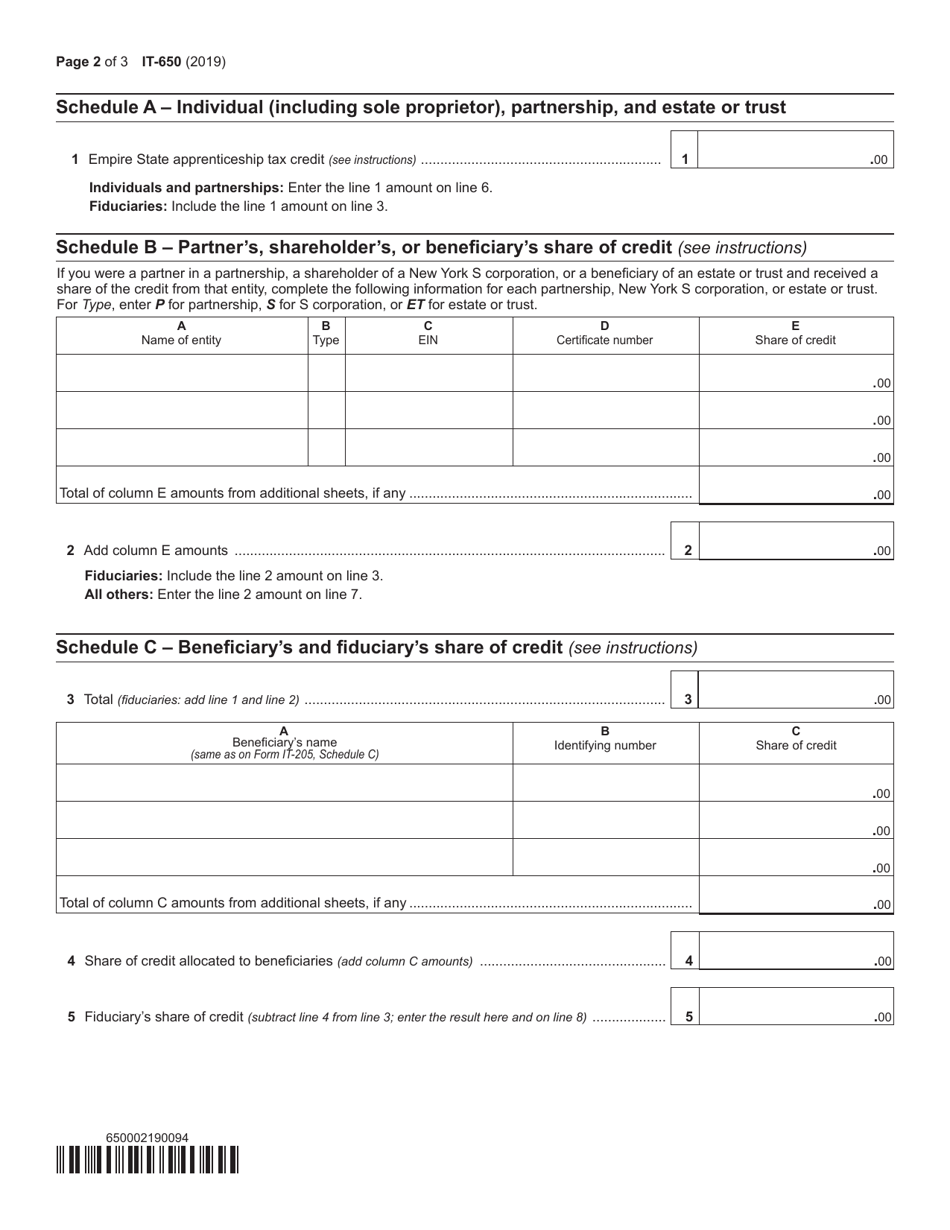

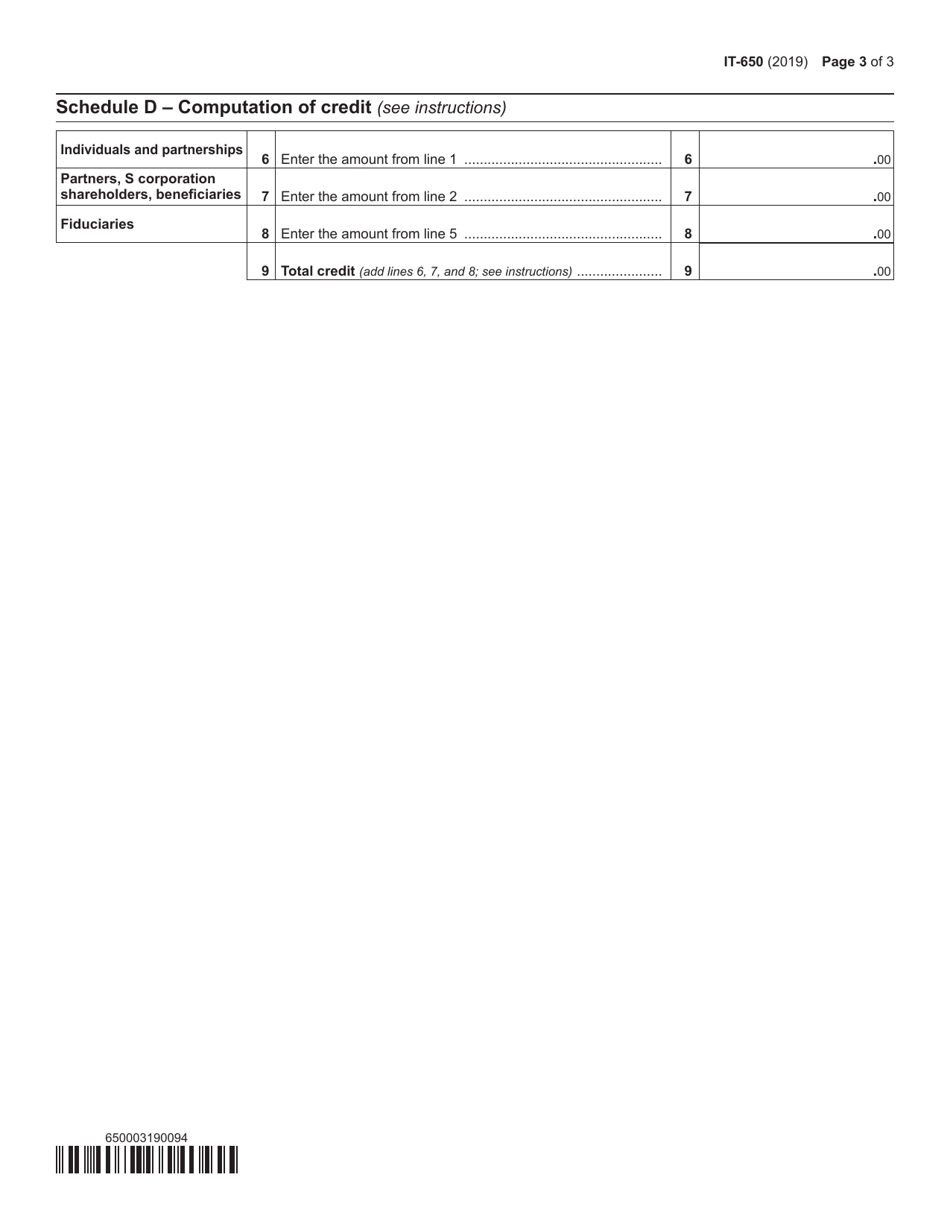

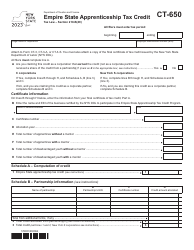

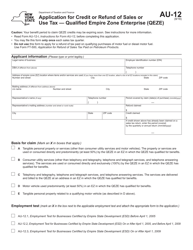

Form IT-650

for the current year.

Form IT-650 Empire State Apprenticeship Tax Credit - New York

What Is Form IT-650?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-650?

A: Form IT-650 is the Empire StateApprenticeship Tax Credit form in New York.

Q: What is the Empire State Apprenticeship Tax Credit?

A: The Empire State Apprenticeship Tax Credit is a tax credit available to businesses in New York that hire qualified apprentices.

Q: Who is eligible for the Empire State Apprenticeship Tax Credit?

A: Businesses in New York that hire eligible apprentices registered with the New York State Department of Labor are eligible for the tax credit.

Q: What is the purpose of Form IT-650?

A: Form IT-650 is used by businesses in New York to claim the Empire State Apprenticeship Tax Credit.

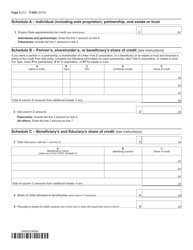

Q: How do I fill out Form IT-650?

A: You should follow the instructions on the form and provide the required information, including details about the apprentices you hired and the amount of credit you are claiming.

Q: When is Form IT-650 due?

A: Form IT-650 is generally due on or before the due date of your business tax return.

Q: What if I have questions or need assistance with Form IT-650?

A: If you have questions or need assistance with Form IT-650, you can contact the New York State Department of Taxation and Finance for guidance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-650 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.