This version of the form is not currently in use and is provided for reference only. Download this version of

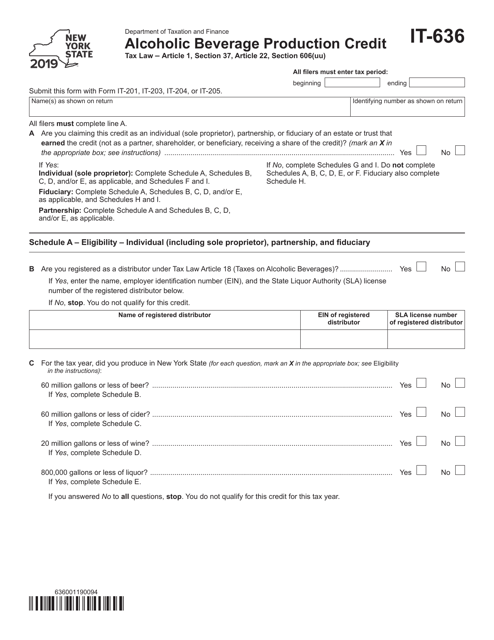

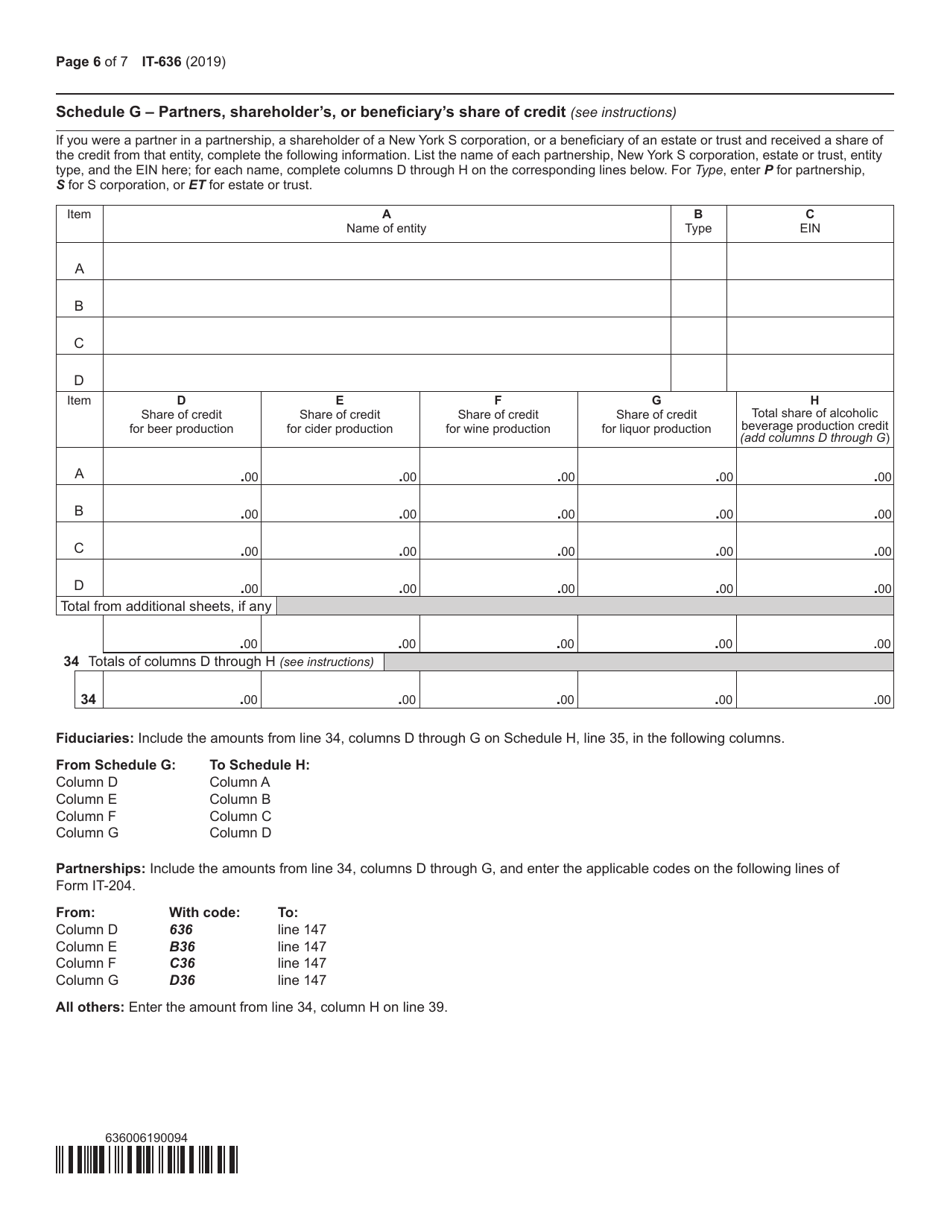

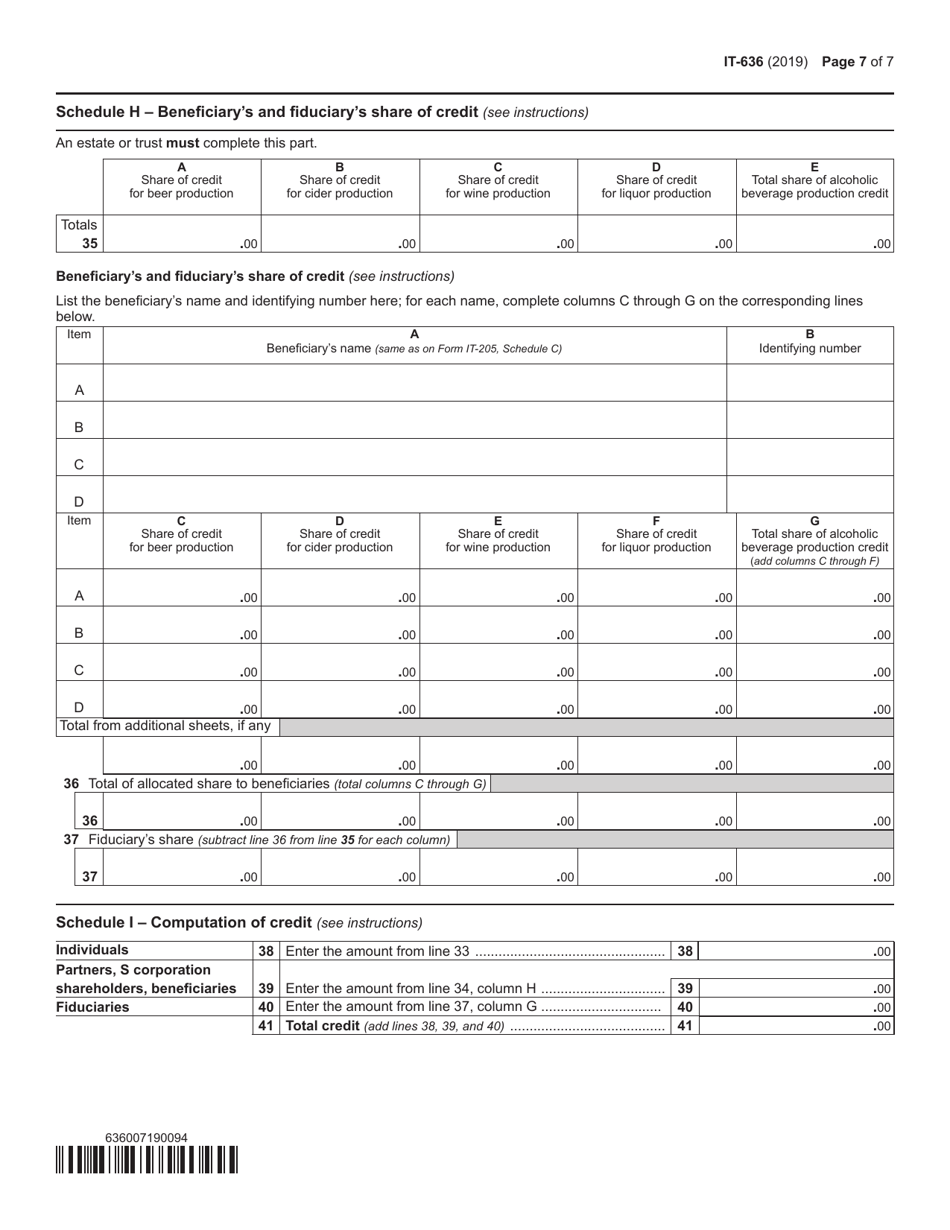

Form IT-636

for the current year.

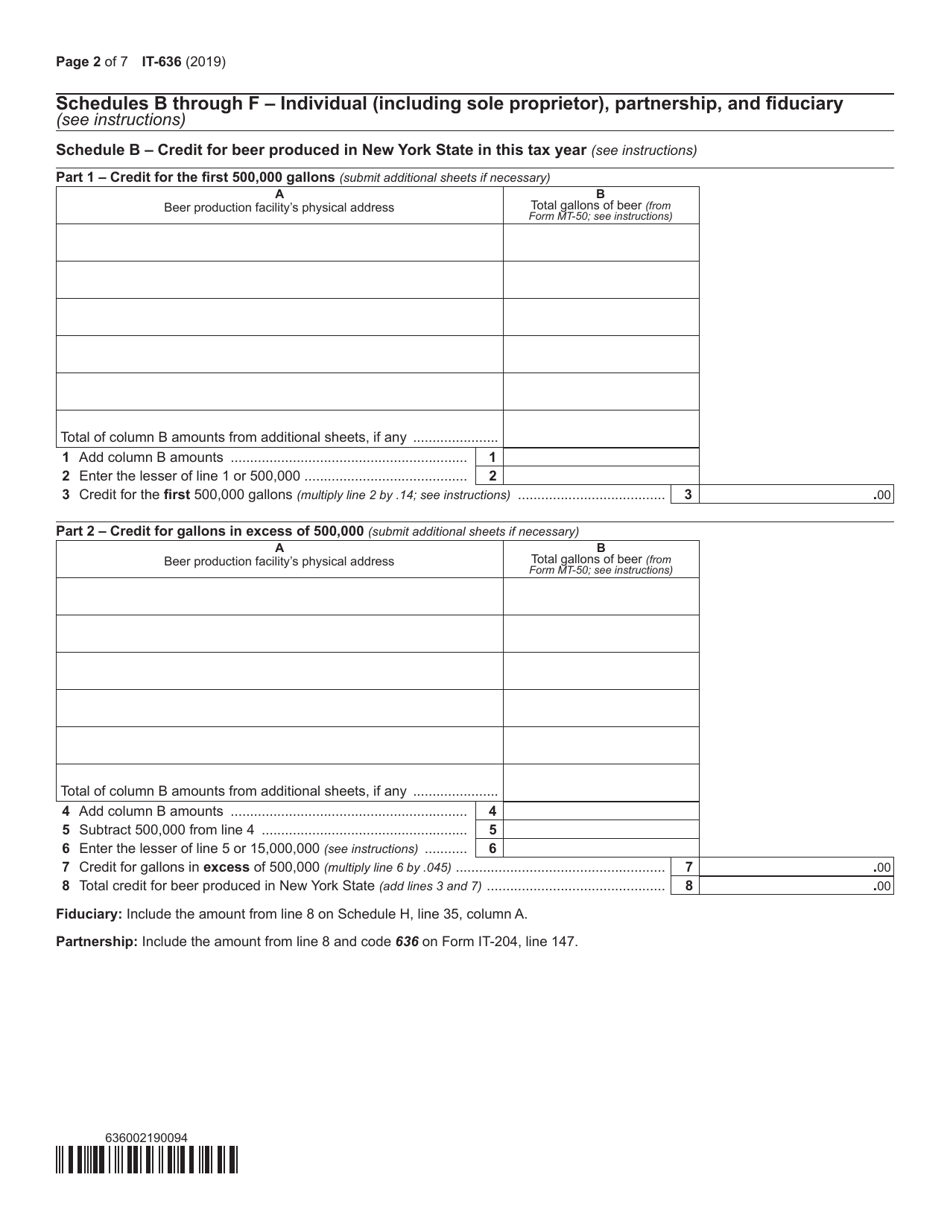

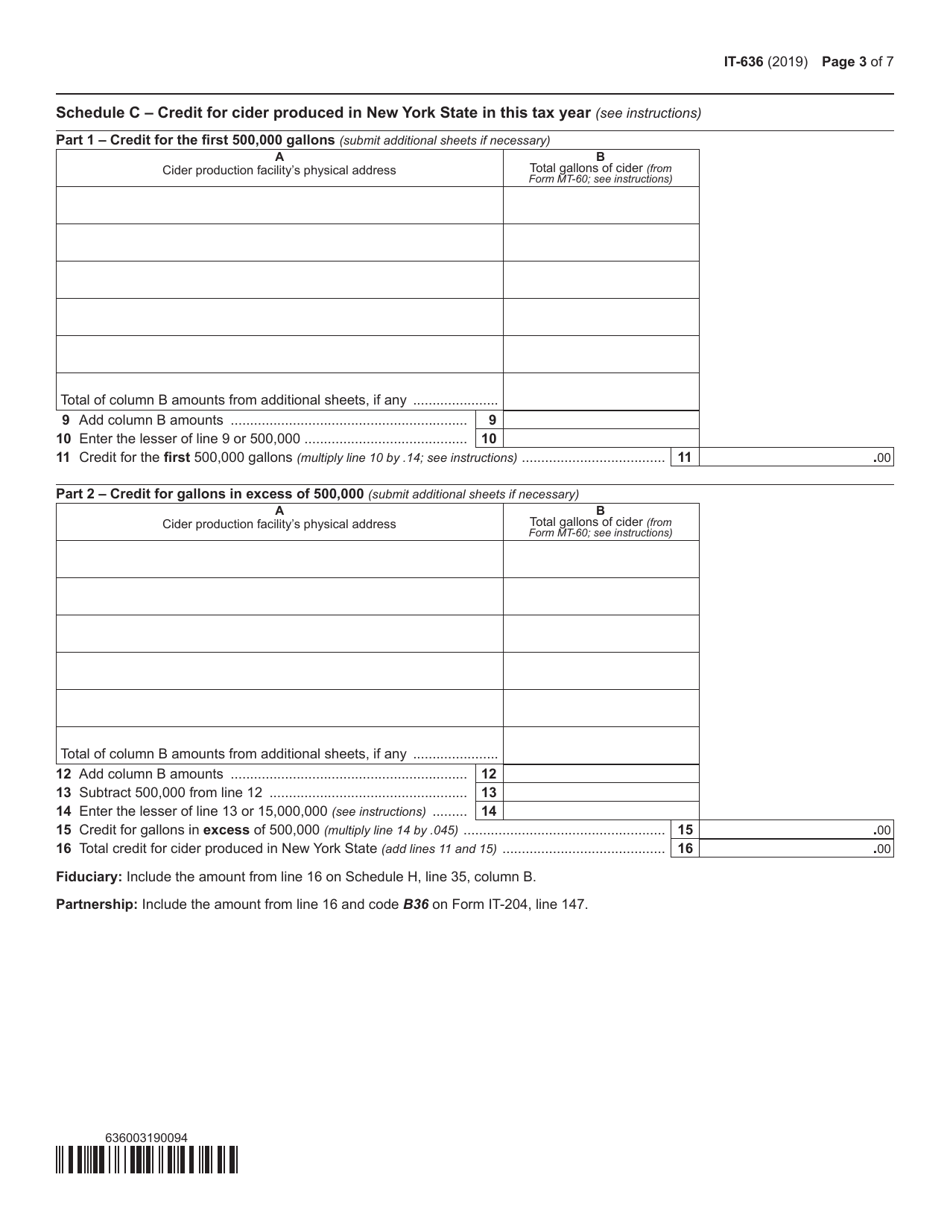

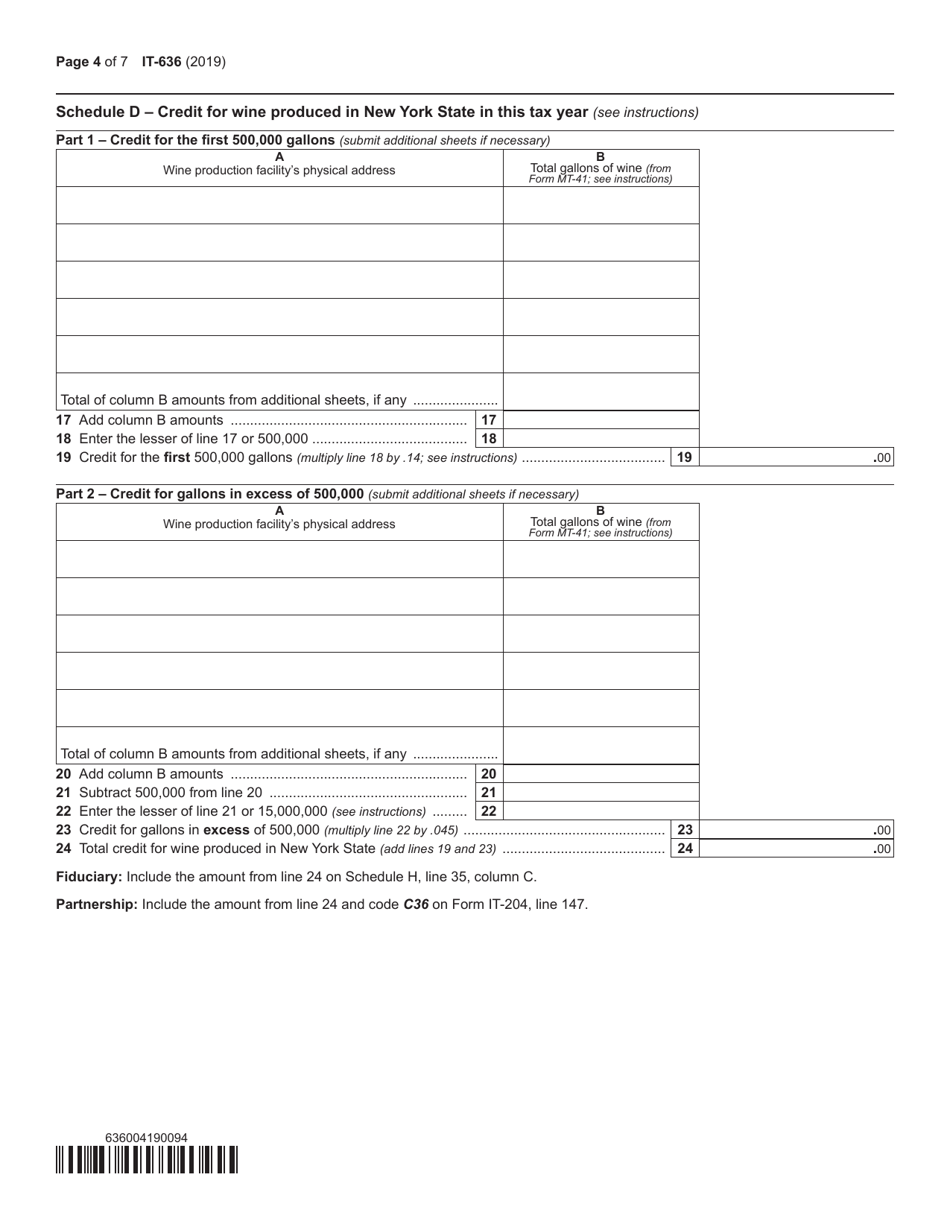

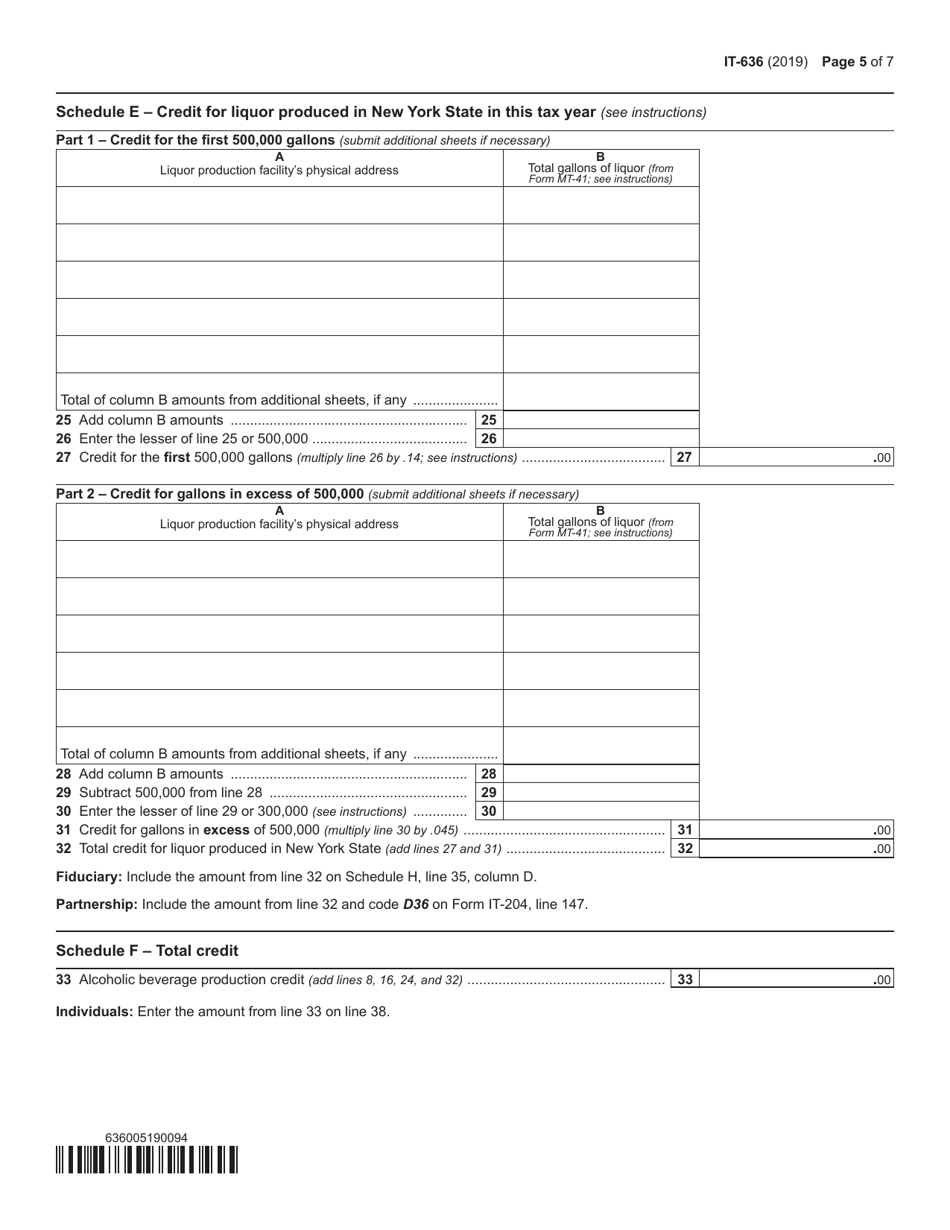

Form IT-636 Alcoholic Beverage Production Credit - New York

What Is Form IT-636?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-636?

A: Form IT-636 is a tax form used in New York to claim the Alcoholic Beverage Production Credit.

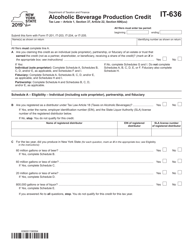

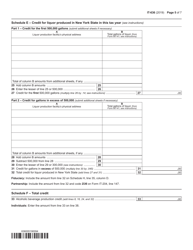

Q: What is the Alcoholic Beverage Production Credit?

A: The Alcoholic Beverage Production Credit is a tax credit available to eligible businesses in New York that produce alcoholic beverages.

Q: Who is eligible for the Alcoholic Beverage Production Credit?

A: Eligible businesses in New York that produce alcoholic beverages are eligible for the credit.

Q: What can the Alcoholic Beverage Production Credit be used for?

A: The credit can be used to offset the business tax liability of eligible businesses that produce alcoholic beverages.

Q: How do I claim the Alcoholic Beverage Production Credit?

A: You can claim the credit by filling out Form IT-636 and attaching it to your New York state tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-636 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.