This version of the form is not currently in use and is provided for reference only. Download this version of

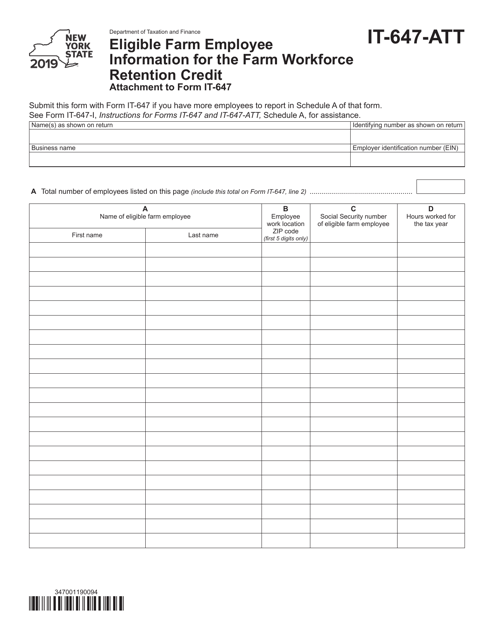

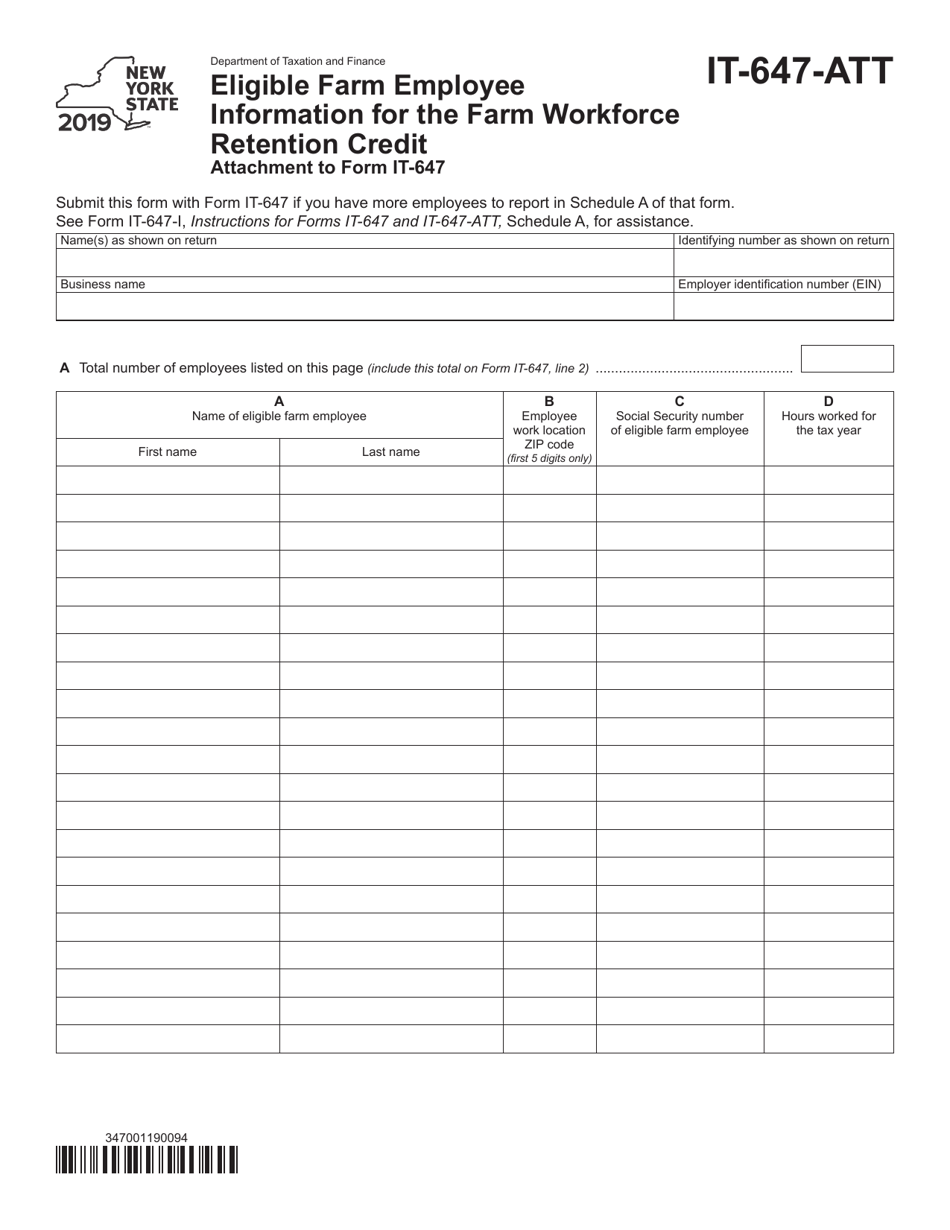

Form IT-647-ATT

for the current year.

Form IT-647-ATT Eligible Farm Employee Information for the Farm Workforce Retention Credit - New York

What Is Form IT-647-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-647-ATT?

A: Form IT-647-ATT is a tax form used in New York to provide eligible farm employee information for the Farm Workforce Retention Credit.

Q: What is the Farm Workforce Retention Credit?

A: The Farm Workforce Retention Credit is a tax credit available to farmers in New York who employ eligible farm employees.

Q: Who is an eligible farm employee?

A: An eligible farm employee is an individual who works on a farm in New York for at least 500 hours during a calendar year.

Q: What information is required on Form IT-647-ATT?

A: Form IT-647-ATT requires information about the eligible farm employee, including their name, social security number, and the number of hours worked on the farm.

Q: How do I file Form IT-647-ATT?

A: Form IT-647-ATT should be filed with the New York State Department of Taxation and Finance.

Q: Is there a deadline for filing Form IT-647-ATT?

A: Yes, Form IT-647-ATT must be filed by the due date of the taxpayer's New York State tax return for the taxable year.

Q: Can I claim the Farm Workforce Retention Credit if I am not a farmer?

A: No, the Farm Workforce Retention Credit is only available to farmers in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-647-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.