This version of the form is not currently in use and is provided for reference only. Download this version of

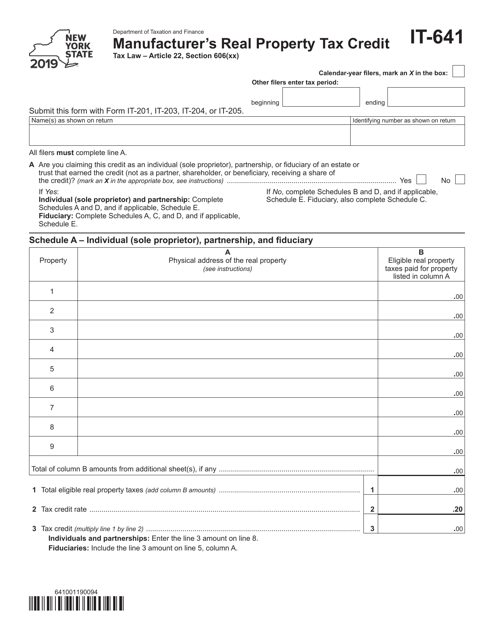

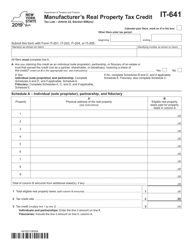

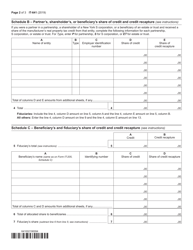

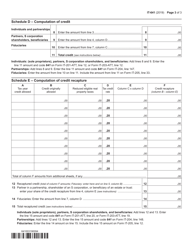

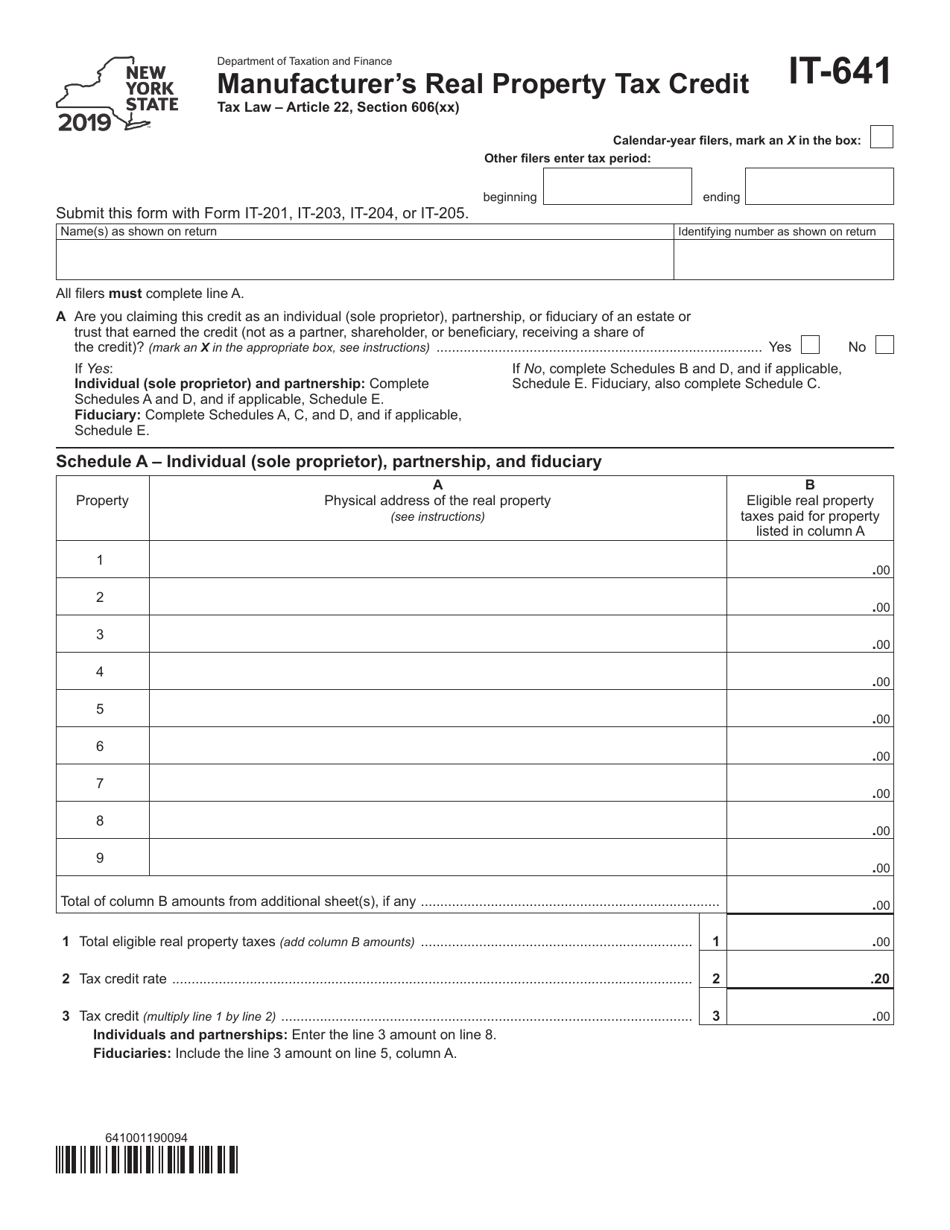

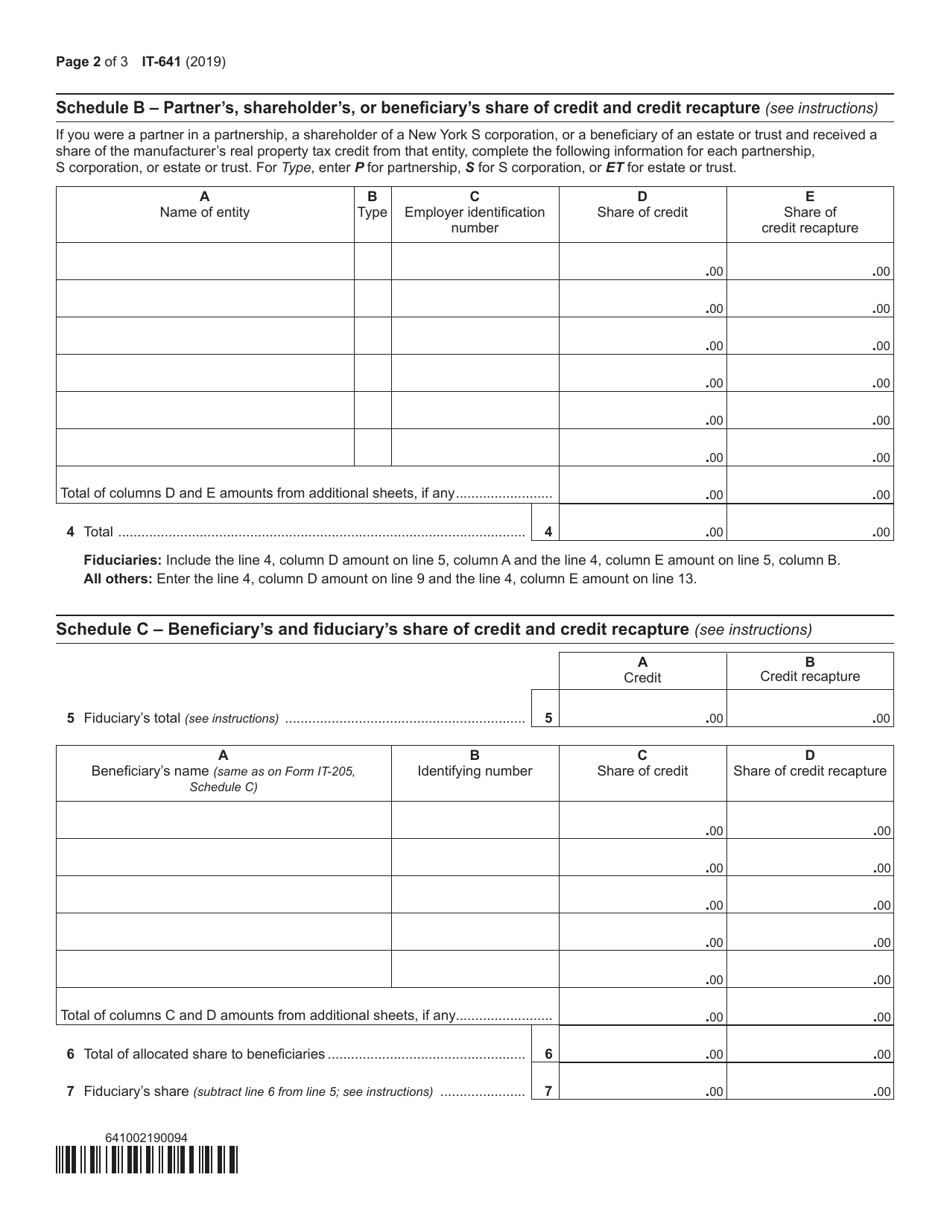

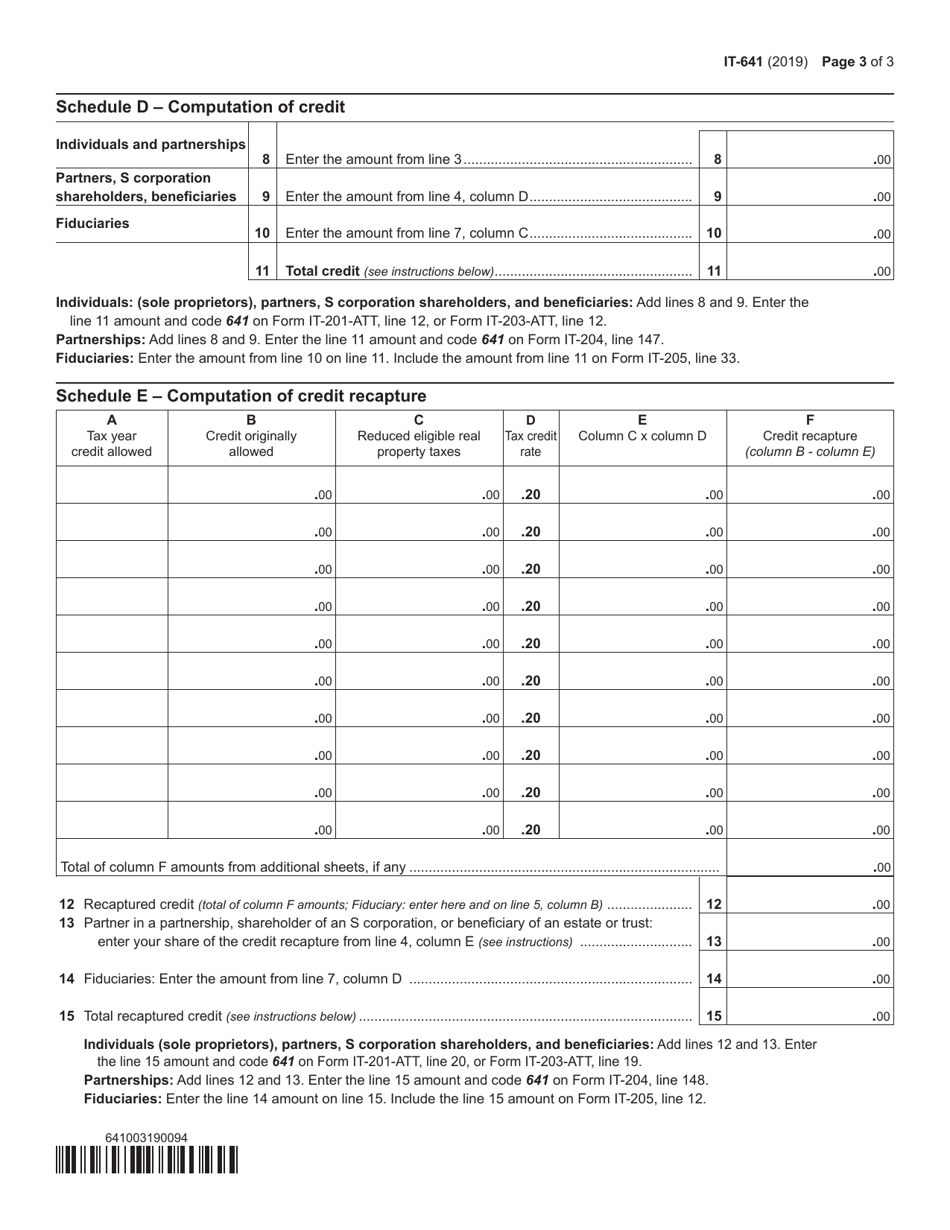

Form IT-641

for the current year.

Form IT-641 Manufacturer's Real Property Tax Credit - New York

What Is Form IT-641?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-641?

A: Form IT-641 is a tax form in New York.

Q: What is the purpose of Form IT-641?

A: The purpose of Form IT-641 is to claim the Manufacturer's Real Property Tax Credit in New York.

Q: Who can use Form IT-641?

A: Only manufacturers in New York can use Form IT-641 to claim the tax credit.

Q: What is the Manufacturer's Real Property Tax Credit?

A: The Manufacturer's Real Property Tax Credit is a tax credit available to manufacturers in New York to reduce their real property tax liability.

Q: How do I qualify for the Manufacturer's Real Property Tax Credit?

A: To qualify for the Manufacturer's Real Property Tax Credit, you must be a manufacturer and meet certain eligibility criteria specified by the New York State Department of Taxation and Finance.

Q: When is the deadline to file Form IT-641?

A: The deadline to file Form IT-641 is usually the same as the deadline for filing your New York state income tax return, which is April 15th.

Q: Can I file Form IT-641 electronically?

A: Yes, you can file Form IT-641 electronically using the New York State Department of Taxation and Finance's e-file system.

Q: Are there any fees associated with filing Form IT-641?

A: No, there are no fees associated with filing Form IT-641.

Q: What supporting documents do I need to include with Form IT-641?

A: You may need to include documentation such as property tax bills and other information to support your claim for the Manufacturer's Real Property Tax Credit.

Q: Can I amend a previously filed Form IT-641?

A: Yes, you can file an amended Form IT-641 if you need to make changes or corrections to a previously filed form.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-641 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.