This version of the form is not currently in use and is provided for reference only. Download this version of

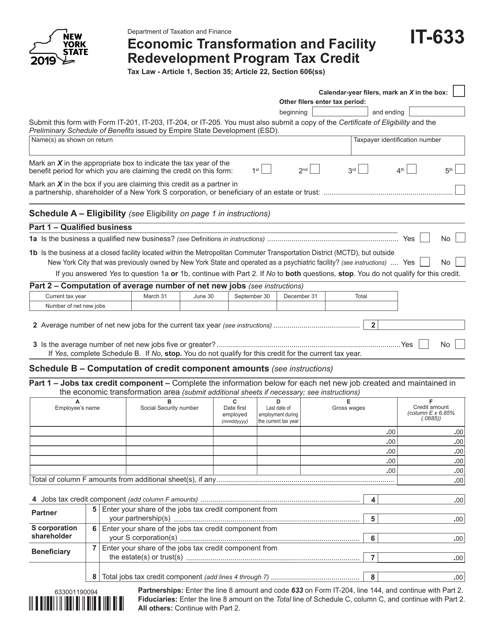

Form IT-633

for the current year.

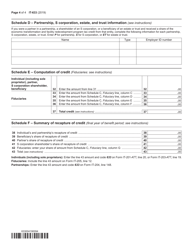

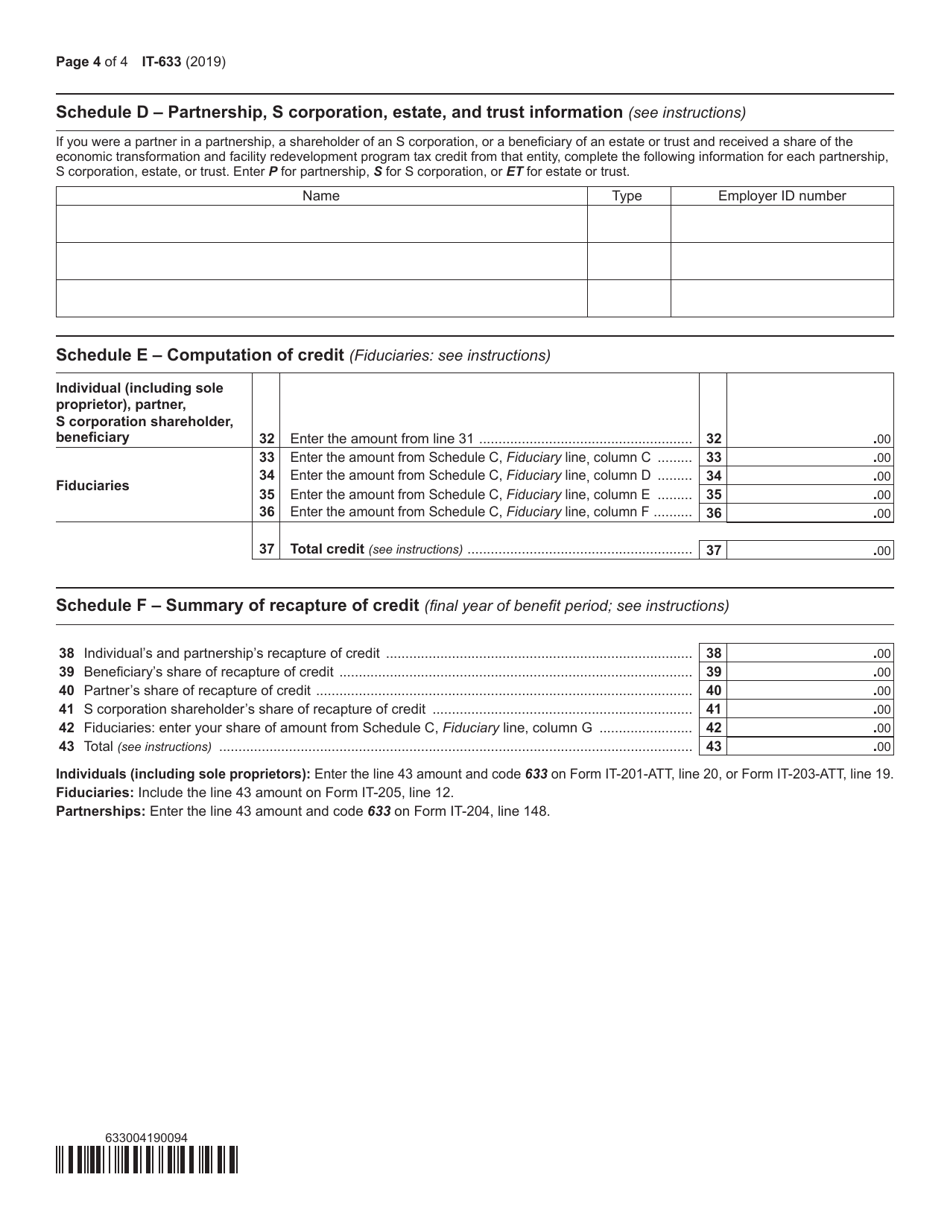

Form IT-633 Economic Transformation and Facility Redevelopment Program Tax Credit - New York

What Is Form IT-633?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-633?

A: Form IT-633 is a tax form used in New York for claiming the Economic Transformation and Facility Redevelopment Program Tax Credit.

Q: What is the Economic Transformation and Facility Redevelopment Program Tax Credit?

A: The Economic Transformation and Facility Redevelopment Program Tax Credit is a tax credit offered in New York to incentivize economic development and the redevelopment of certain facilities.

Q: Who is eligible for the tax credit?

A: Eligibility for the tax credit depends on meeting certain criteria, such as being a qualified taxpayer and participating in an approved economic transformation or facility redevelopment project in New York.

Q: How can I claim the tax credit?

A: To claim the tax credit, you need to complete and file Form IT-633 with the New York State Department of Taxation and Finance.

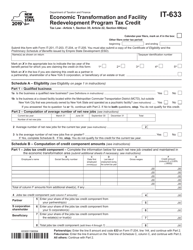

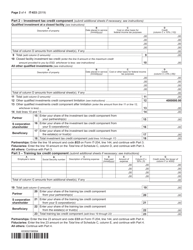

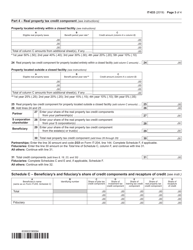

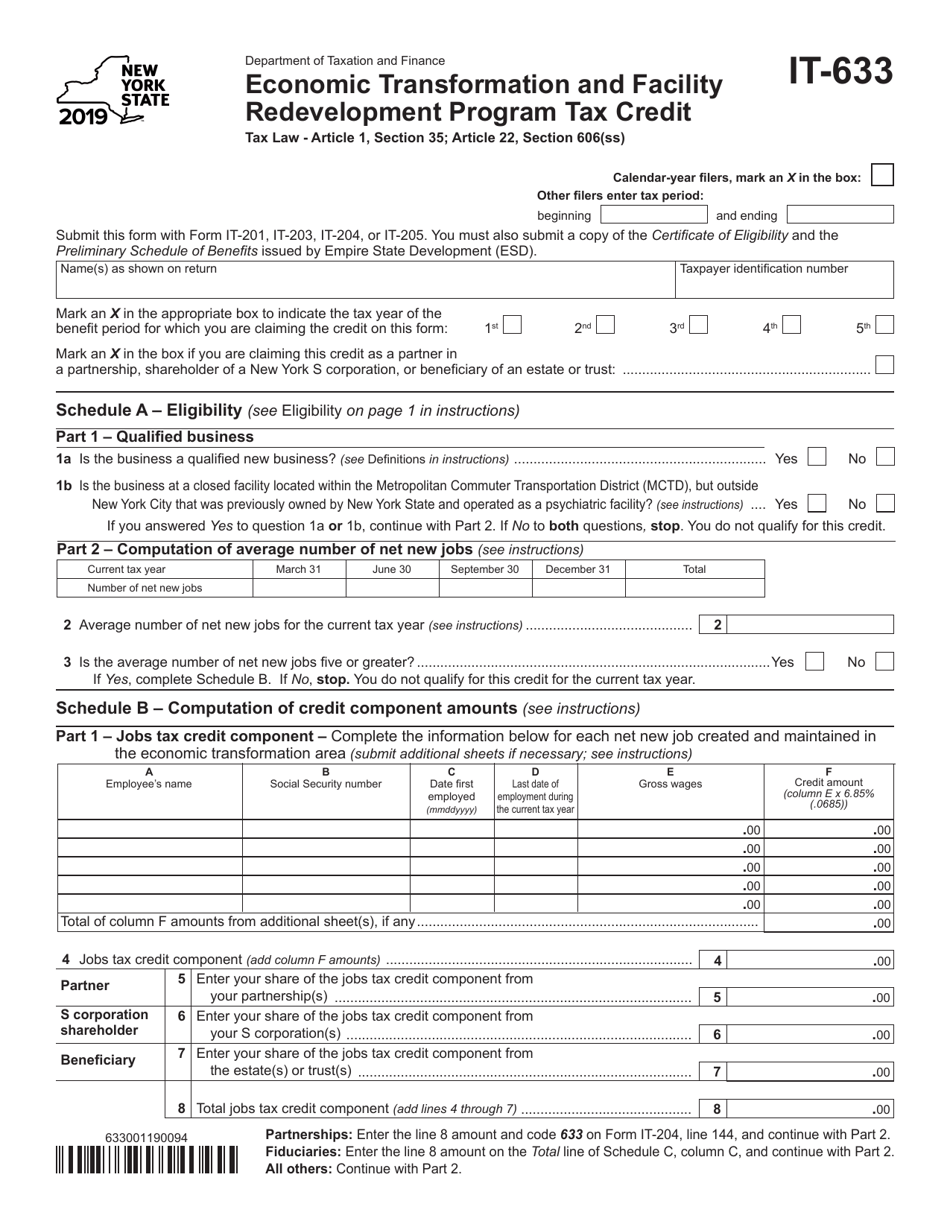

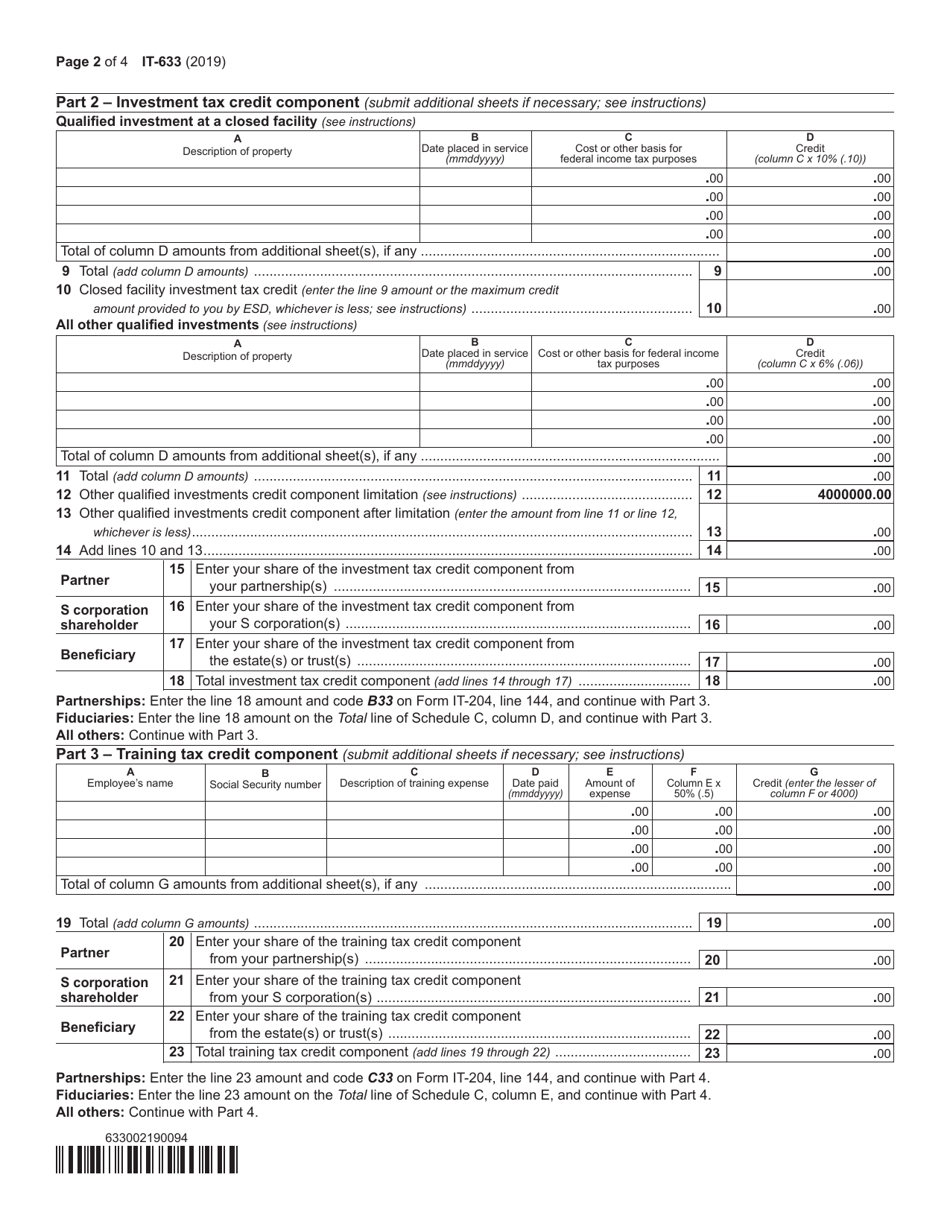

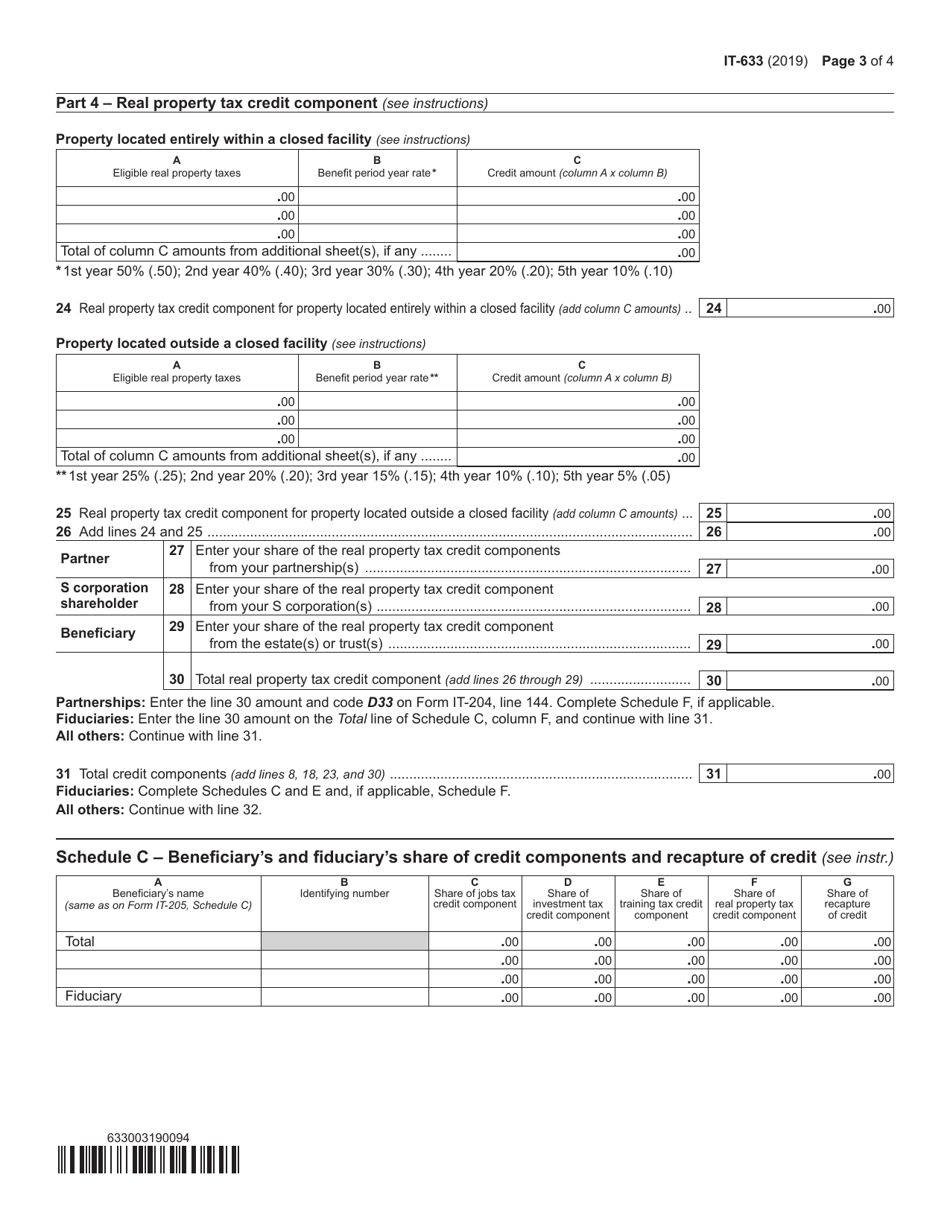

Q: What information do I need to provide on Form IT-633?

A: On Form IT-633, you will need to provide details about the project, including the project identification number, project location, and the amount of eligible tax credit requested.

Q: Is there a deadline for filing Form IT-633?

A: Yes, the deadline for filing Form IT-633 is generally on or before the due date for the related tax return, which is typically April 15th for individuals and March 15th for corporations.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-633 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.