This version of the form is not currently in use and is provided for reference only. Download this version of

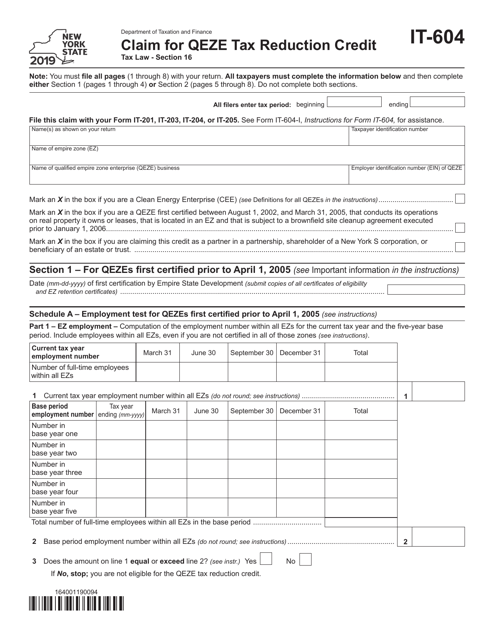

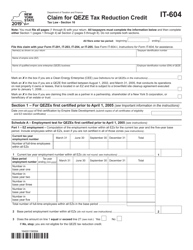

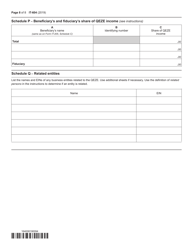

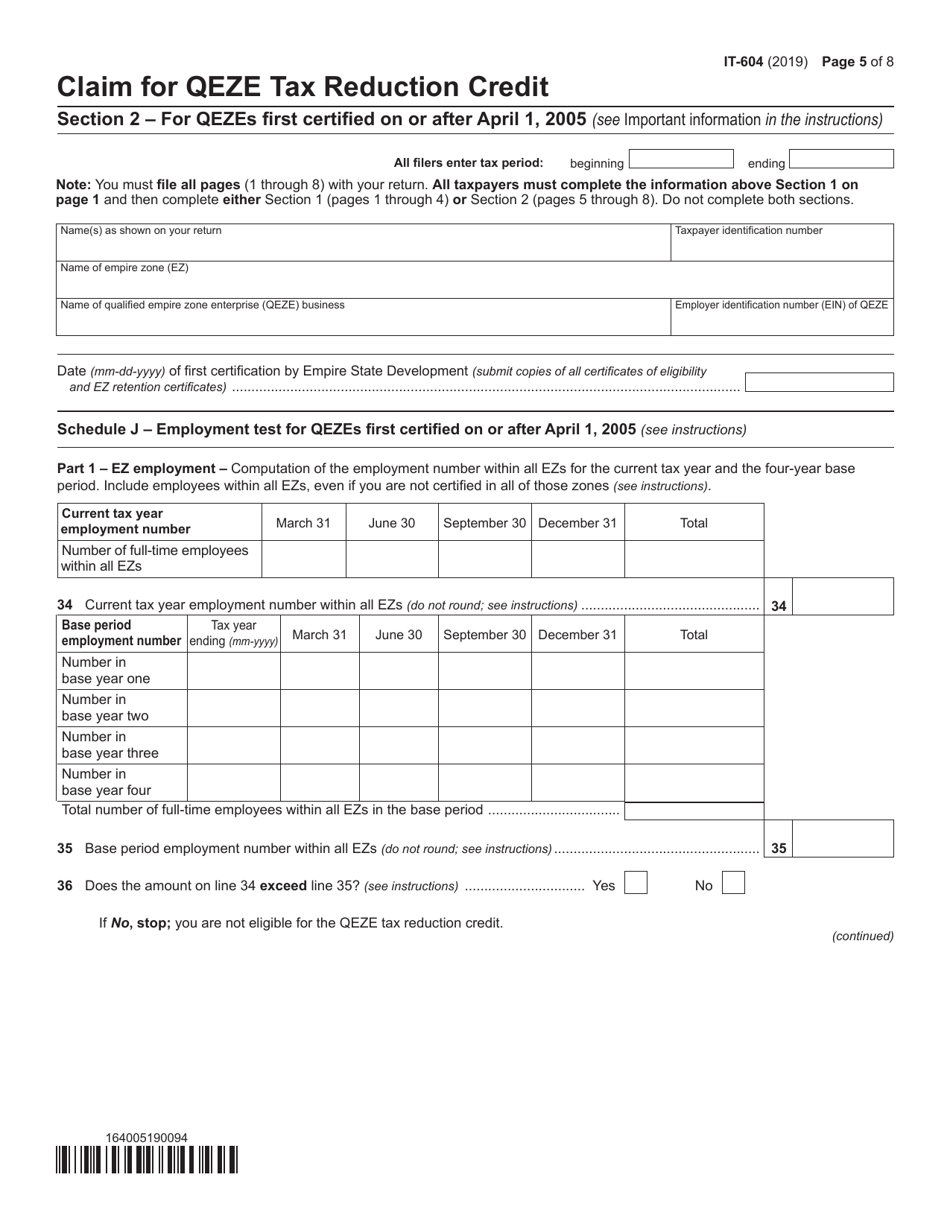

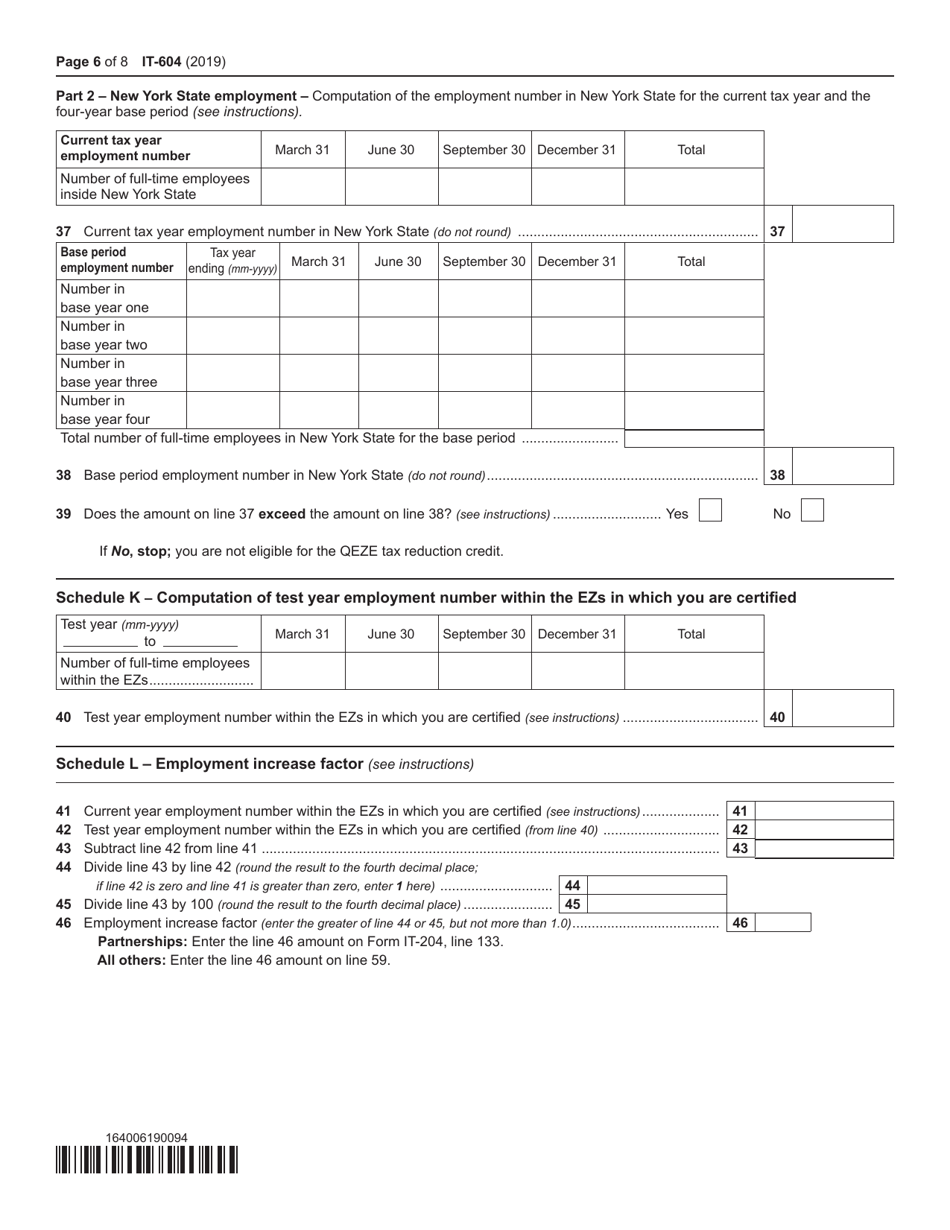

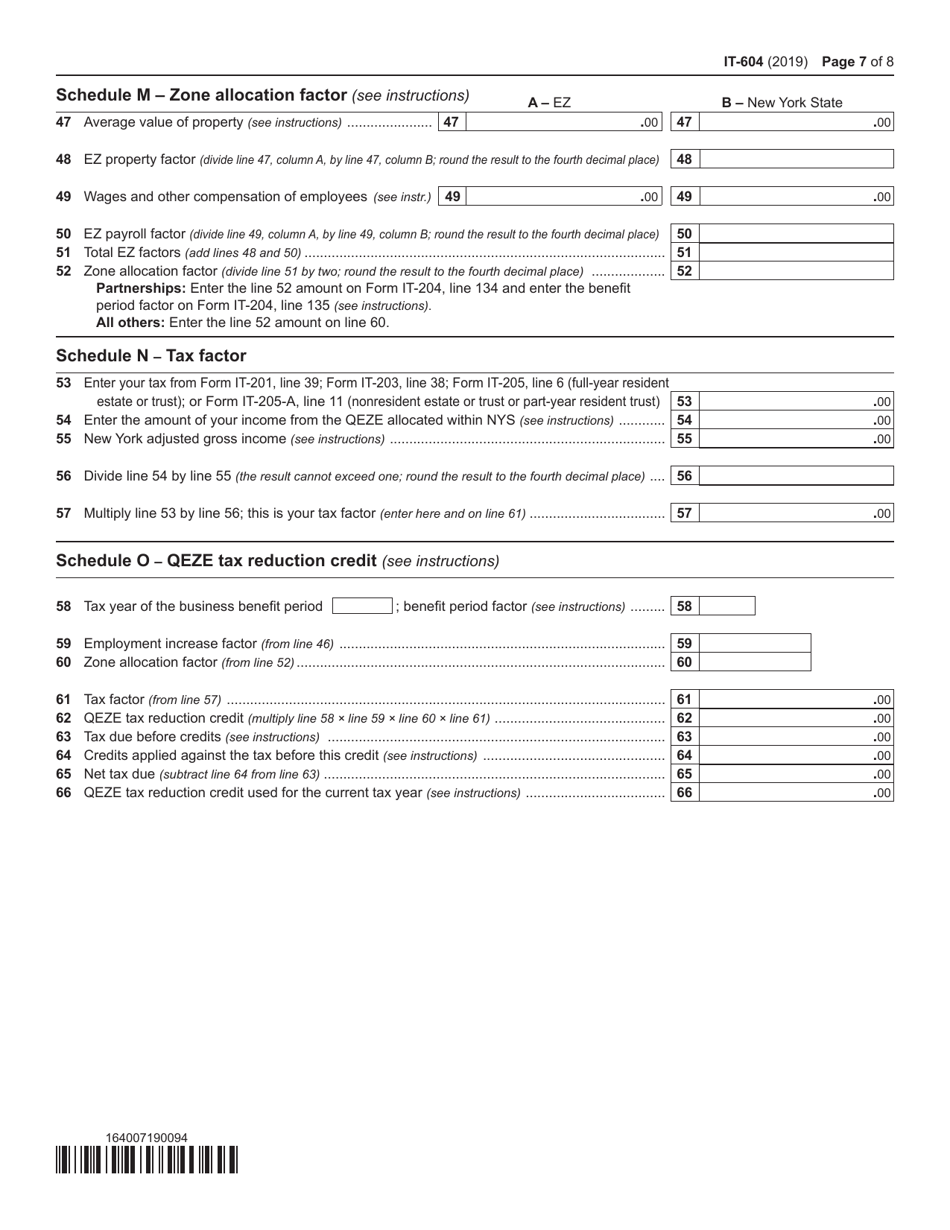

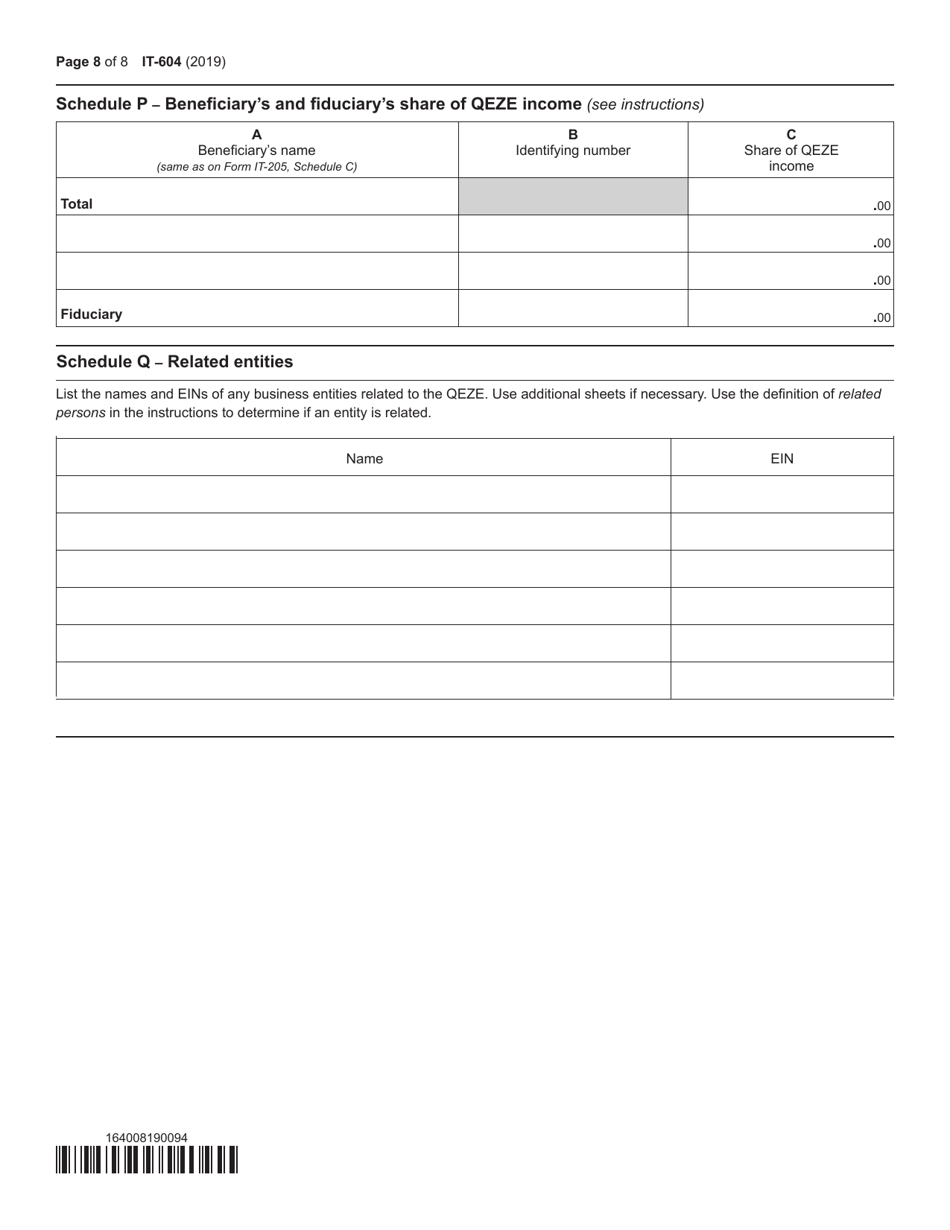

Form IT-604

for the current year.

Form IT-604 Claim for Qeze Tax Reduction Credit - New York

What Is Form IT-604?

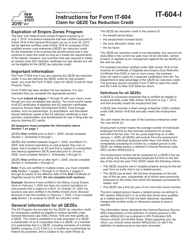

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-604?

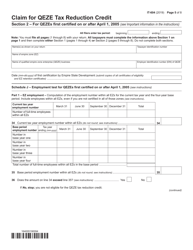

A: Form IT-604 is a claim form for the QEZ Tax Reduction Credit in New York.

Q: What is the QEZ Tax Reduction Credit?

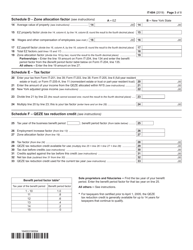

A: The QEZ Tax Reduction Credit is a tax credit offered to businesses operating in certain Qualified Empire Zones (QEZ) in New York.

Q: Who can file Form IT-604?

A: Businesses that meet the requirements for the QEZ Tax Reduction Credit can file Form IT-604.

Q: What are the requirements for the QEZ Tax Reduction Credit?

A: To qualify for the credit, businesses must be located in a designated Qualified Empire Zone and meet certain eligibility criteria determined by the New York State Department of Economic Development.

Q: Is Form IT-604 available for residents?

A: No, Form IT-604 is specifically for businesses and not for individual residents.

Q: Can I claim the QEZ Tax Reduction Credit if I am not located in a Qualified Empire Zone?

A: No, businesses must be located in a designated Qualified Empire Zone to be eligible for the QEZ Tax Reduction Credit.

Q: What is the deadline to file Form IT-604?

A: The deadline to file Form IT-604 is typically the same as the deadline for filing New York State business tax returns, which is generally March 15th.

Q: What supporting documents do I need to include with Form IT-604?

A: Businesses filing Form IT-604 may be required to provide supporting documentation such as proof of location in a Qualified Empire Zone and other relevant financial records.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-604 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.