This version of the form is not currently in use and is provided for reference only. Download this version of

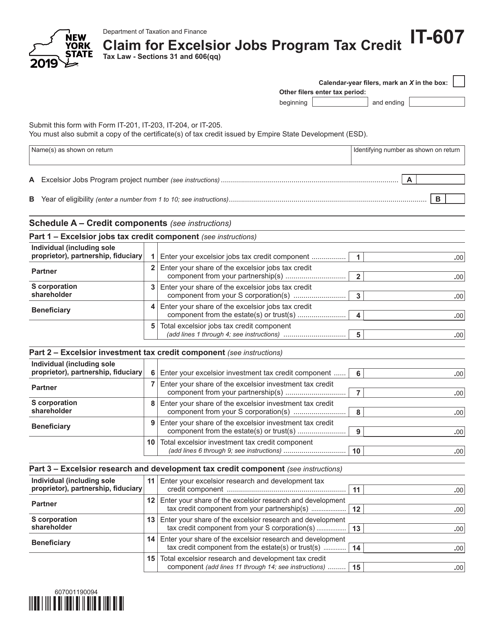

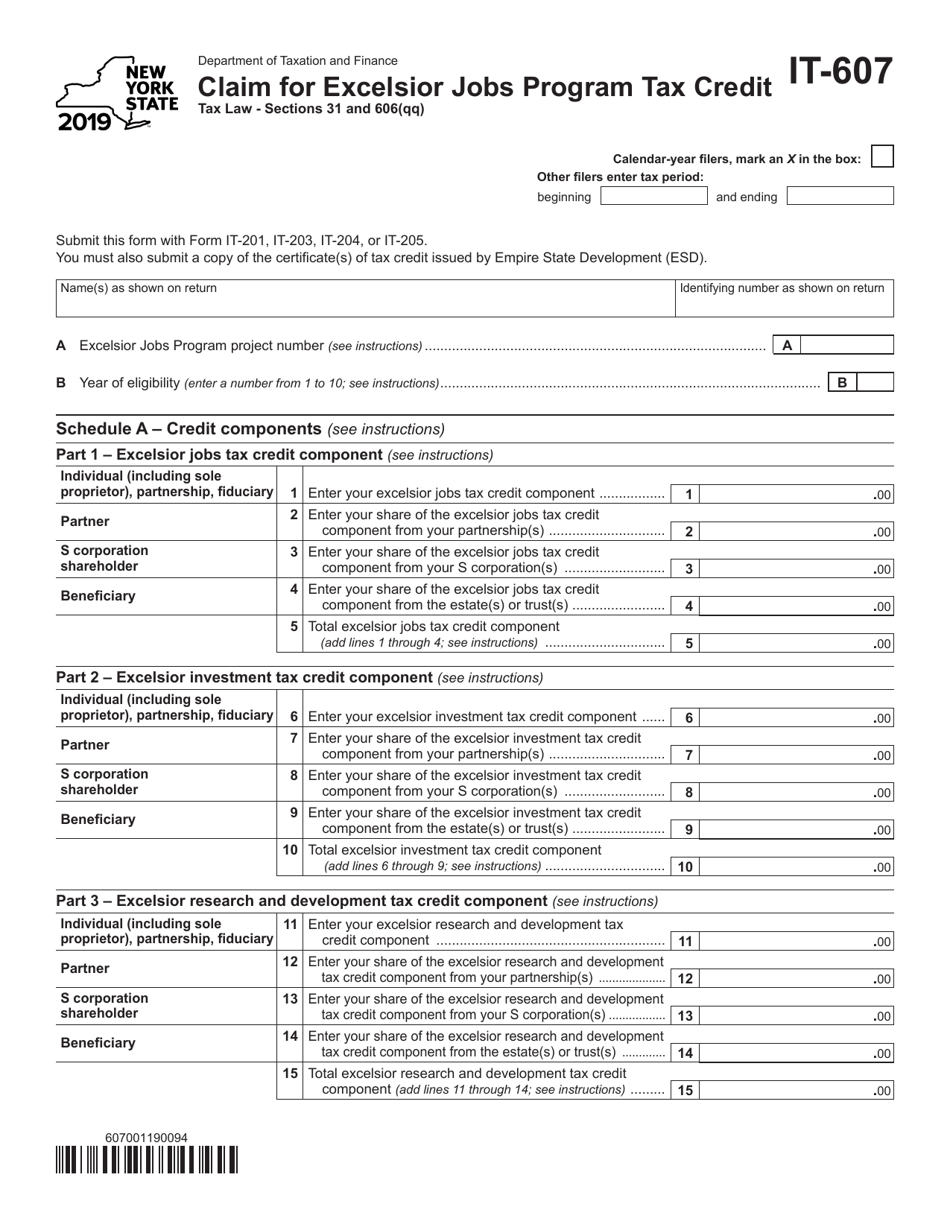

Form IT-607

for the current year.

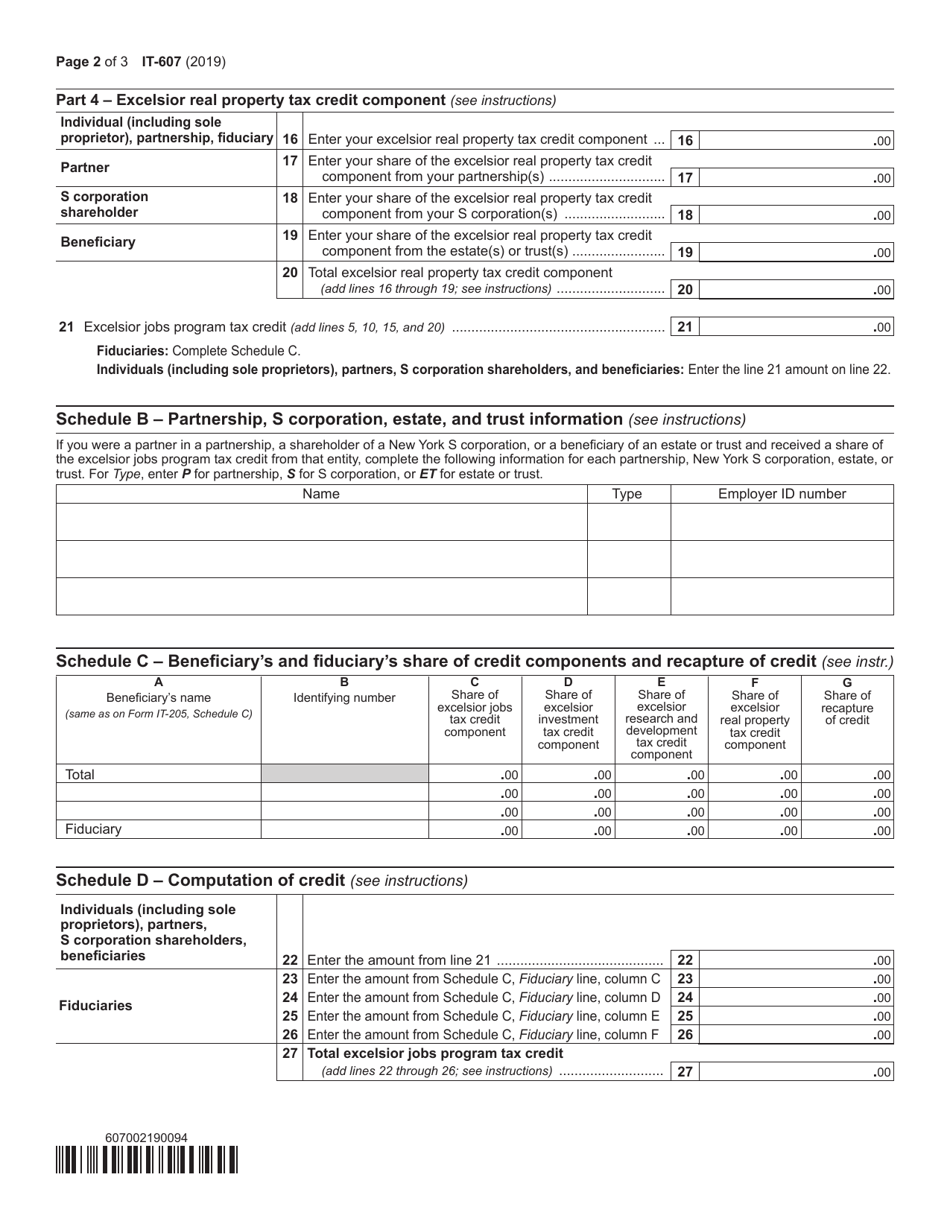

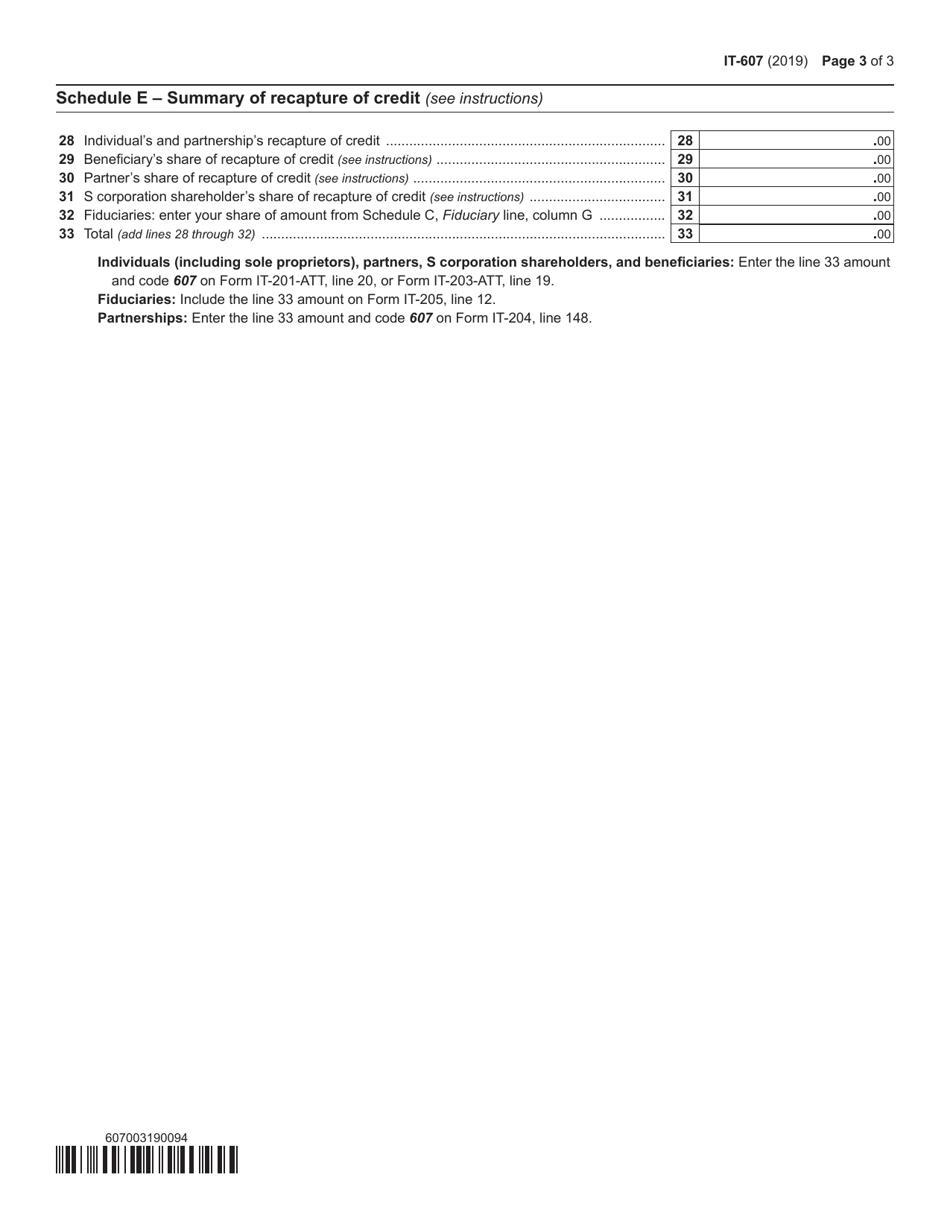

Form IT-607 Claim for Excelsior Jobs Program Tax Credit - New York

What Is Form IT-607?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-607?

A: Form IT-607 is used to claim the Excelsior Jobs ProgramTax Credit in New York.

Q: What is the Excelsior Jobs Program Tax Credit?

A: The Excelsior Jobs Program Tax Credit is a tax credit offered by the state of New York to businesses that create new jobs and make certain investments.

Q: Who is eligible to claim the Excelsior Jobs Program Tax Credit?

A: Businesses that meet certain criteria, such as creating new jobs and making qualified investments, may be eligible to claim the Excelsior Jobs Program Tax Credit.

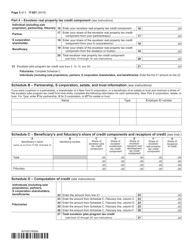

Q: How do I fill out Form IT-607?

A: You will need to provide information about your business, the jobs created, and the qualified investments made. The form includes instructions on how to complete each section.

Q: What documents should I include with Form IT-607?

A: You may need to include additional supporting documents, such as proof of job creation and investment expenses. The specific requirements are outlined in the form's instructions.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-607 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.