This version of the form is not currently in use and is provided for reference only. Download this version of

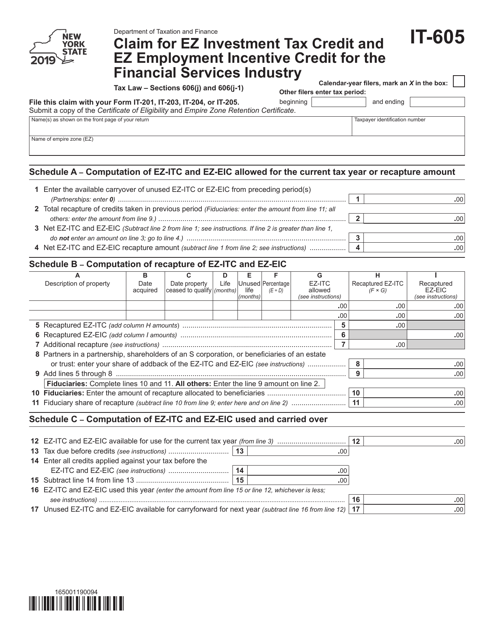

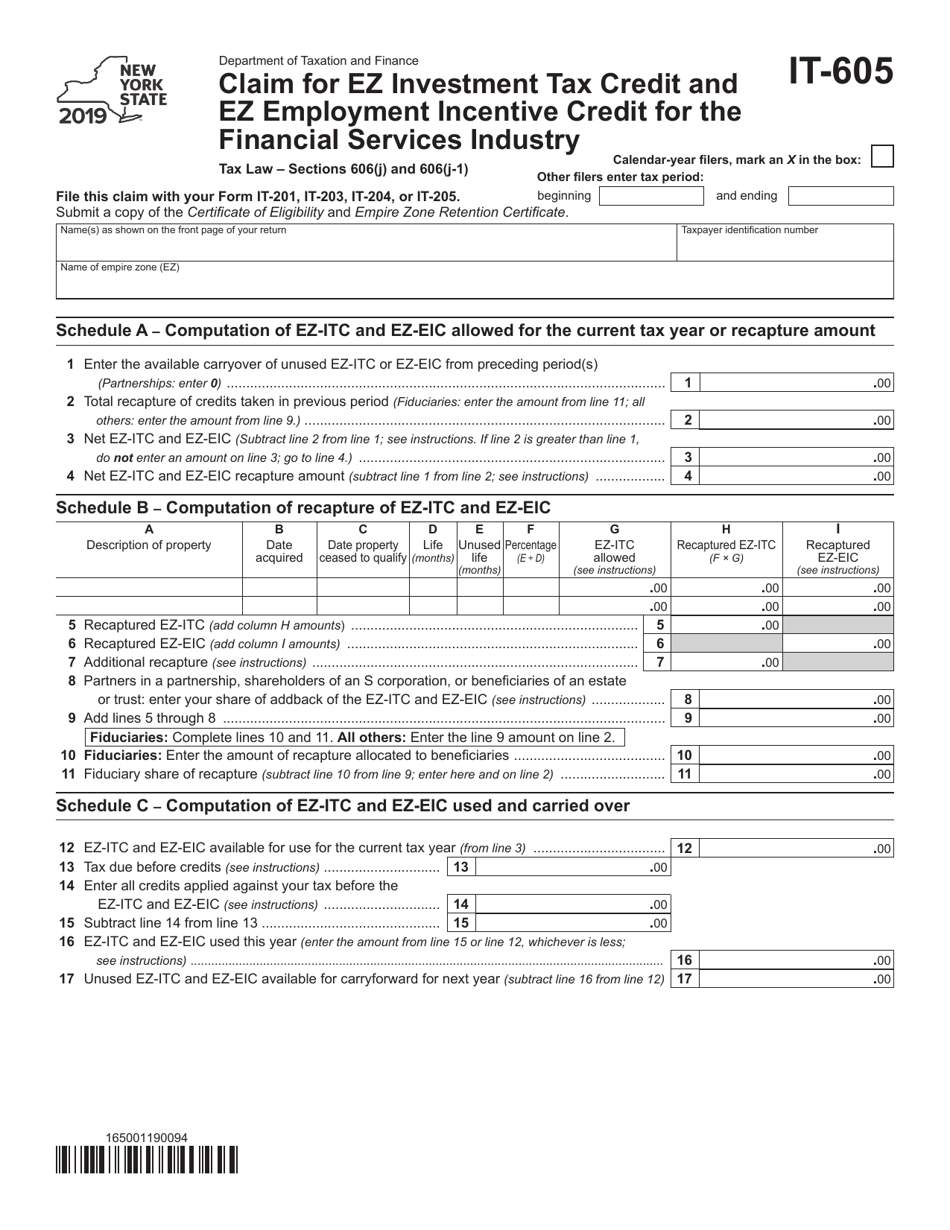

Form IT-605

for the current year.

Form IT-605 Claim for Ez Investment Tax Credit and Ez Employment Incentive Credit for the Financial Services Industry - New York

What Is Form IT-605?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-605?

A: Form IT-605 is a claim form for the Investment Tax Credit and Employment Incentive Credit for the Financial Services Industry in New York.

Q: Who can file Form IT-605?

A: Companies in the financial services industry in New York can file Form IT-605 to claim the Investment Tax Credit and Employment Incentive Credit.

Q: What is the purpose of Form IT-605?

A: The purpose of Form IT-605 is to allow companies in the financial services industry to claim tax credits for investments and employment incentives.

Q: What are the requirements for filing Form IT-605?

A: Companies must meet certain eligibility criteria and provide supporting documentation to file Form IT-605.

Q: When is the deadline for filing Form IT-605?

A: The deadline for filing Form IT-605 is usually March 15th of the year following the tax year.

Q: Are there any penalties for late filing of Form IT-605?

A: Yes, there are penalties for late filing of Form IT-605, so it is important to file it on time.

Q: What types of tax credits can be claimed with Form IT-605?

A: Form IT-605 allows companies to claim the Investment Tax Credit and Employment Incentive Credit specifically for the financial services industry.

Q: Can I file Form IT-605 electronically?

A: Yes, Form IT-605 can be filed electronically using the New York State Department of Taxation and Finance's e-File system.

Q: Can I claim both the Investment Tax Credit and Employment Incentive Credit with Form IT-605?

A: Yes, companies in the financial services industry can claim both credits using Form IT-605.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-605 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.