This version of the form is not currently in use and is provided for reference only. Download this version of

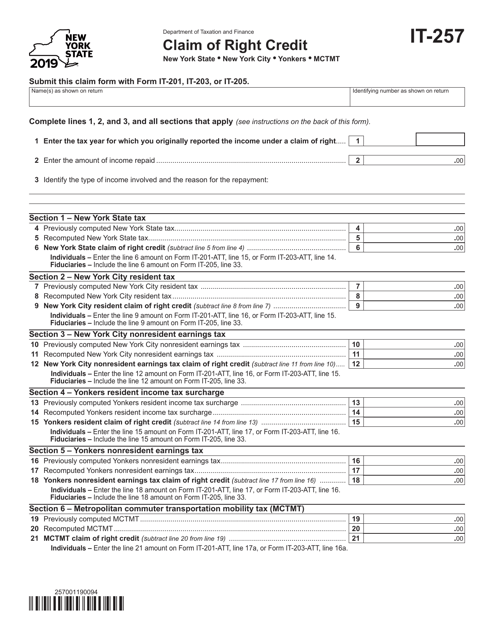

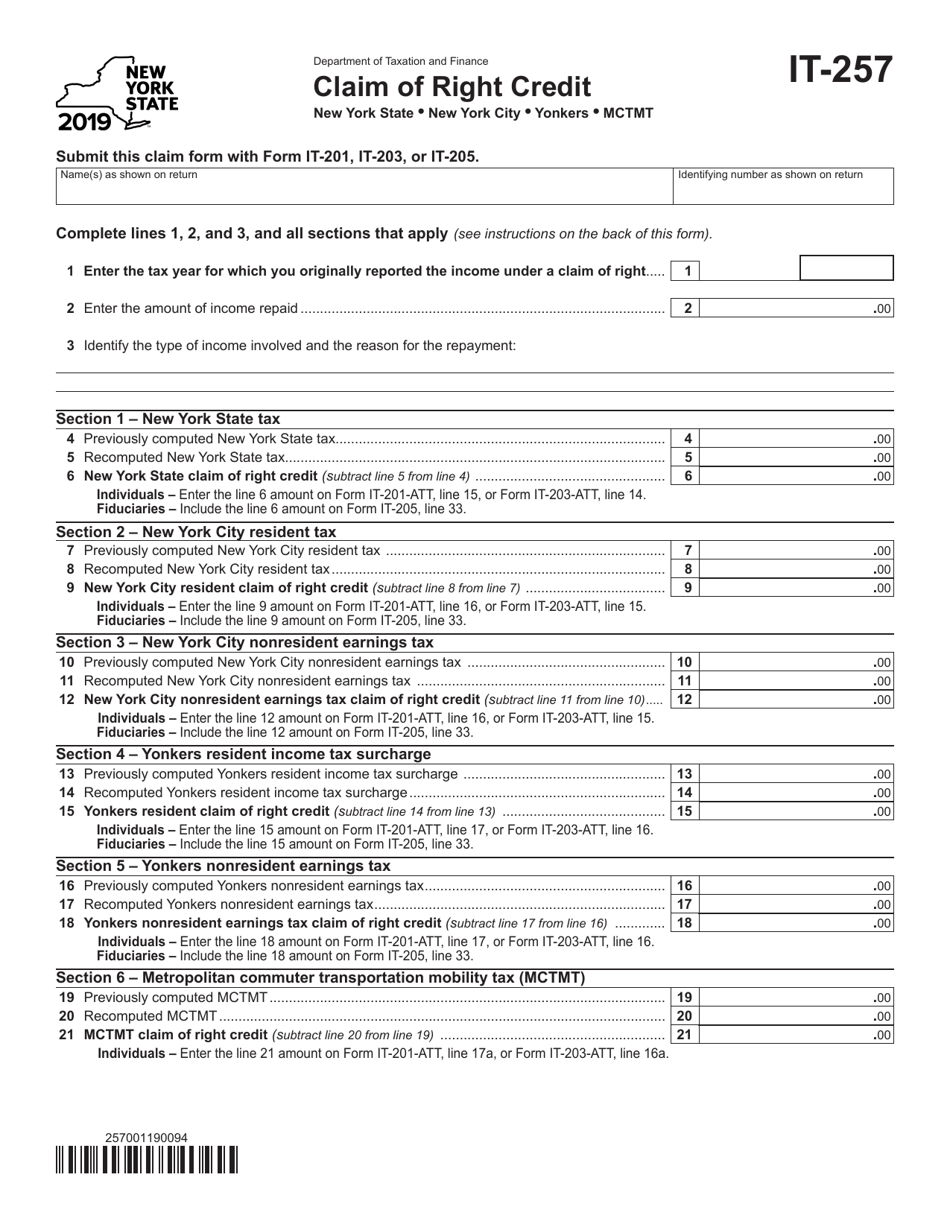

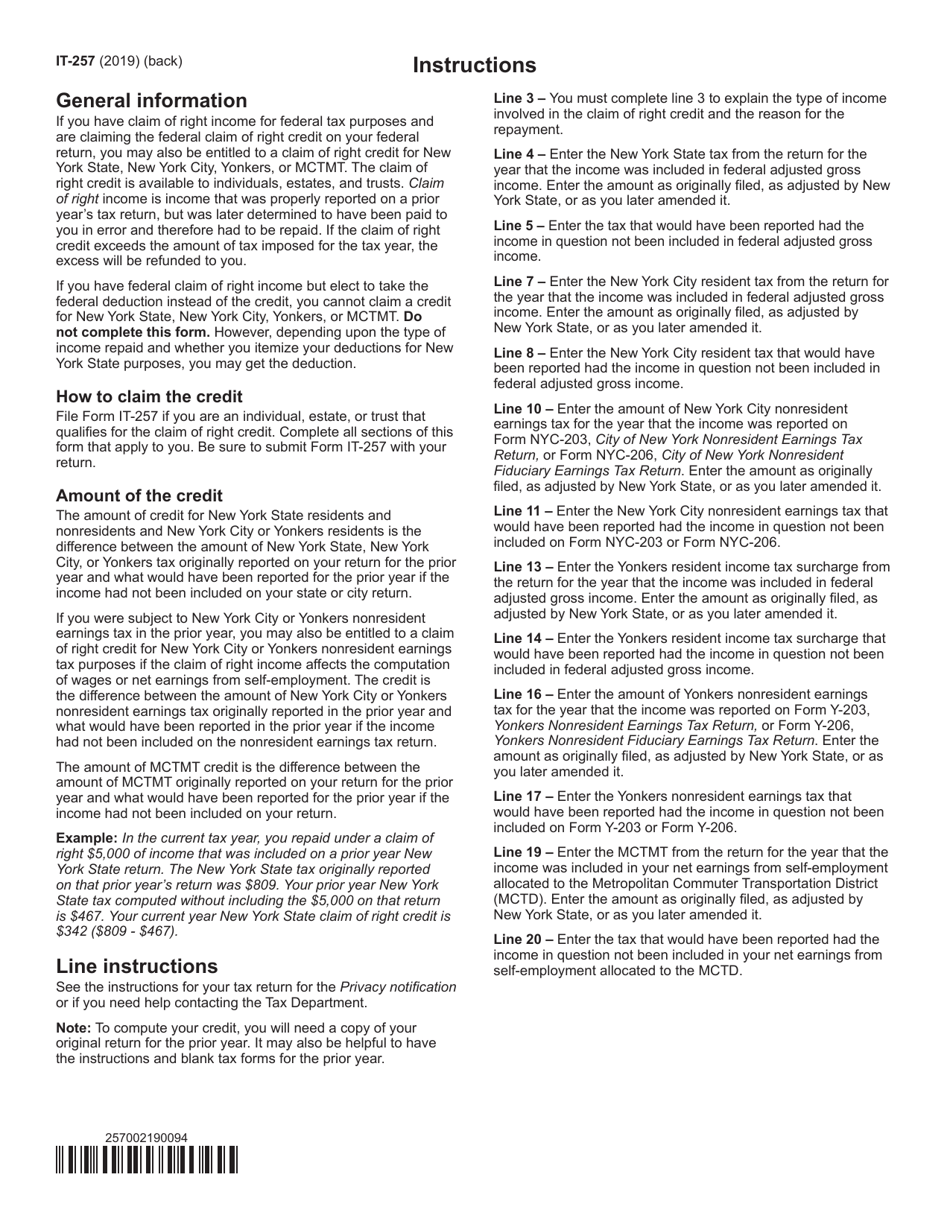

Form IT-257

for the current year.

Form IT-257 Claim of Right Credit - New York

What Is Form IT-257?

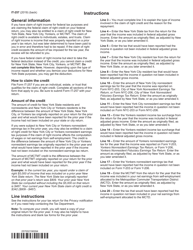

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-257?

A: Form IT-257 is the Claim of Right Credit form for New York State.

Q: What is the Claim of Right Credit?

A: The Claim of Right Credit is a tax credit that allows taxpayers to recoup previously reported income that was later returned or deemed uncollectible.

Q: Who can claim the Claim of Right Credit?

A: Individuals, estates, and trusts that are New York State residents or have income sourced in New York State may be eligible to claim the credit.

Q: What is the purpose of Form IT-257?

A: Form IT-257 is used to calculate and claim the Claim of Right Credit.

Q: Is there a deadline for filing Form IT-257?

A: Yes, the deadline to file Form IT-257 is usually the same as the due date for filing your New York State income tax return.

Q: Are there any additional requirements for claiming the credit?

A: Yes, you must attach supporting documentation, such as a federal income tax return, a Statement of Claim section, or other relevant documents.

Q: Can I claim the Claim of Right Credit if I already received a refund for the original tax year?

A: No, you cannot claim the credit if you have already received a refund for the original tax year.

Q: What happens if I am eligible for the Claim of Right Credit?

A: If you are eligible for the credit, it will reduce your New York State tax liability or increase your refund.

Q: Do I need to pay taxes on the amount of credit I receive?

A: No, the Claim of Right Credit is not taxable income.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-257 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.