This version of the form is not currently in use and is provided for reference only. Download this version of

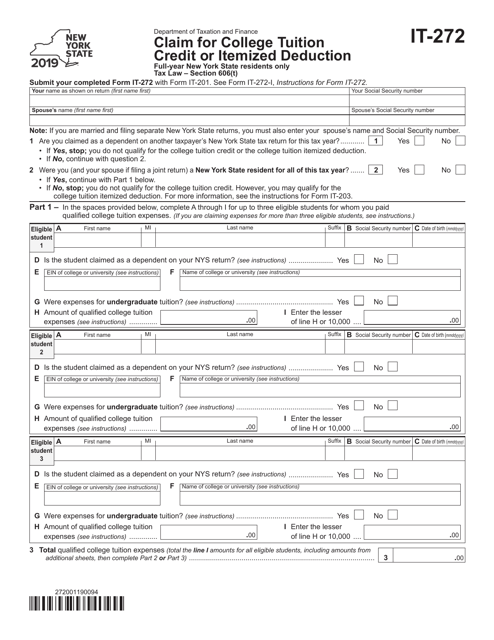

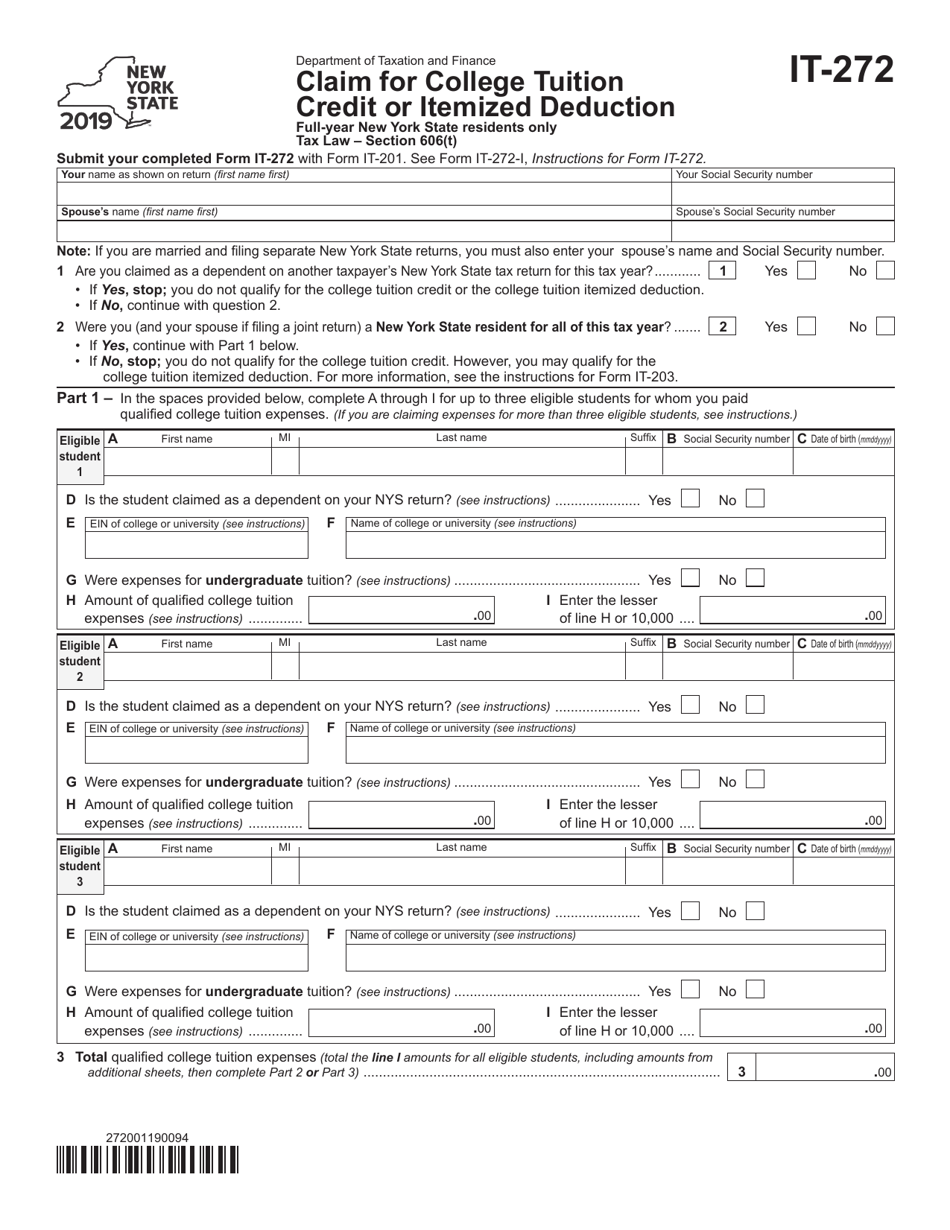

Form IT-272

for the current year.

Form IT-272 Claim for College Tuition Credit or Itemized Deduction - New York

What Is Form IT-272?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

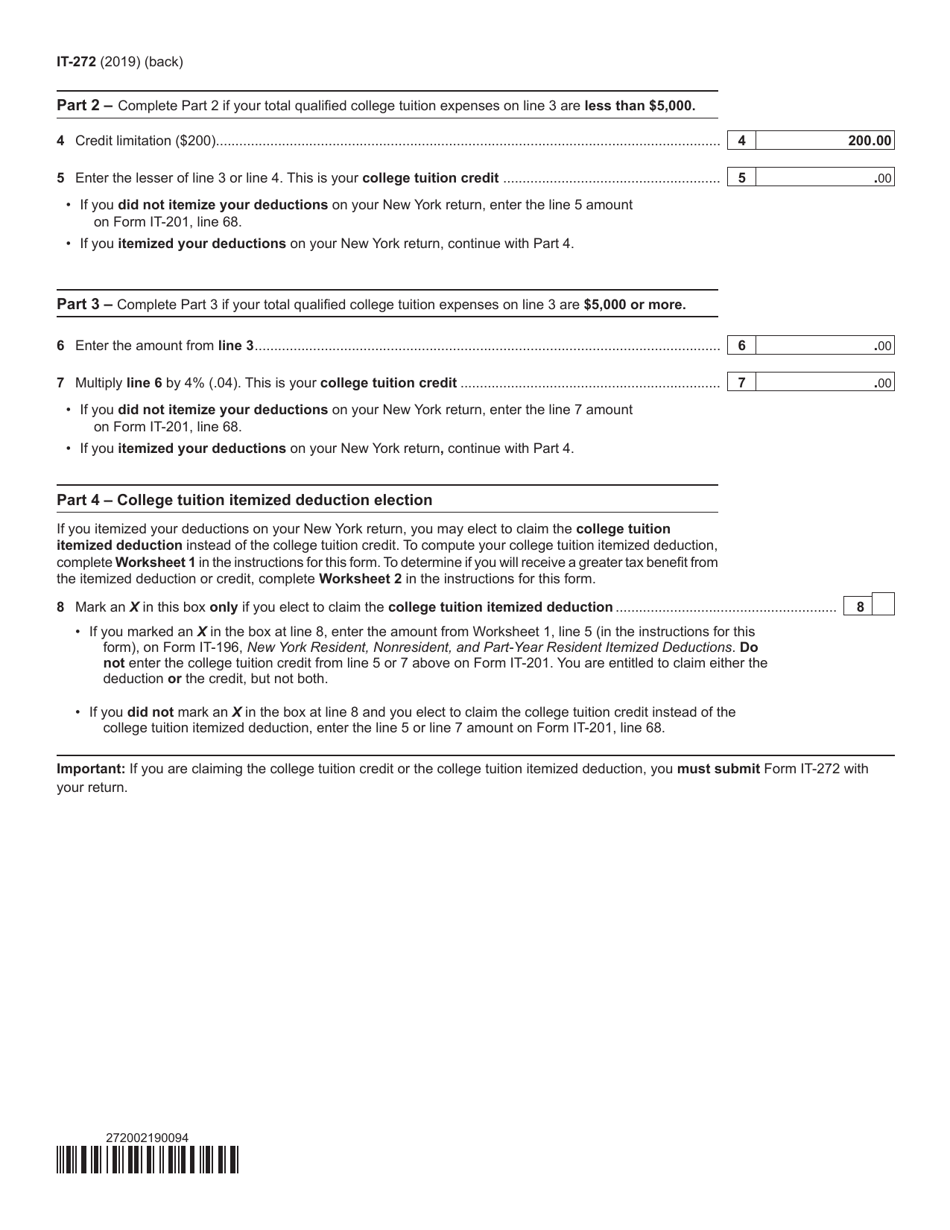

Q: What is Form IT-272?

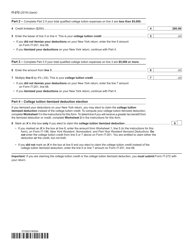

A: Form IT-272 is a form used in New York to claim the College Tuition Credit or Itemized Deduction.

Q: Who can claim the College Tuition Credit?

A: New York residents who paid qualified higher education expenses for themselves, their spouse, or their dependents.

Q: What is the purpose of the College Tuition Credit?

A: The College Tuition Credit provides a tax credit to help offset the cost of qualified higher education expenses.

Q: What are qualified higher education expenses?

A: Qualified higher education expenses include tuition and certain related expenses paid to eligible educational institutions.

Q: Can I claim both the College Tuition Credit and the Itemized Deduction?

A: No, you can only claim one or the other.

Q: How do I determine if I should claim the College Tuition Credit or the Itemized Deduction?

A: You should compare the benefits of each option and choose the one that provides the most tax savings.

Q: When is the deadline to file Form IT-272?

A: The deadline to file Form IT-272 is the same as the deadline to file your New York State income tax return, typically April 15th.

Q: What documents should I include when filing Form IT-272?

A: You should include copies of your college tuition statements and any other supporting documentation.

Q: Can I e-file Form IT-272?

A: No, Form IT-272 cannot be e-filed and must be submitted by mail.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-272 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.