This version of the form is not currently in use and is provided for reference only. Download this version of

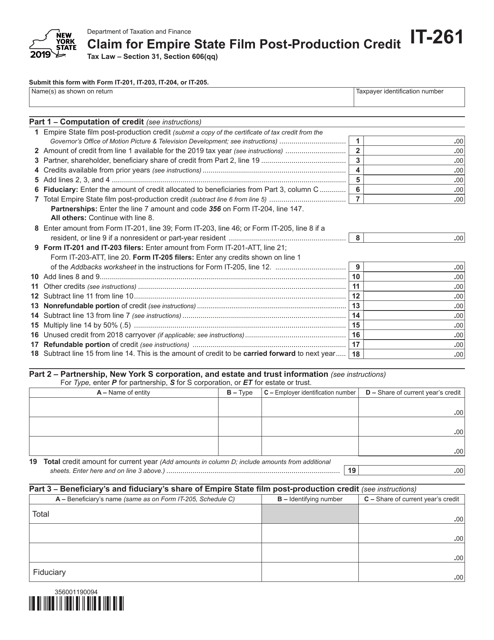

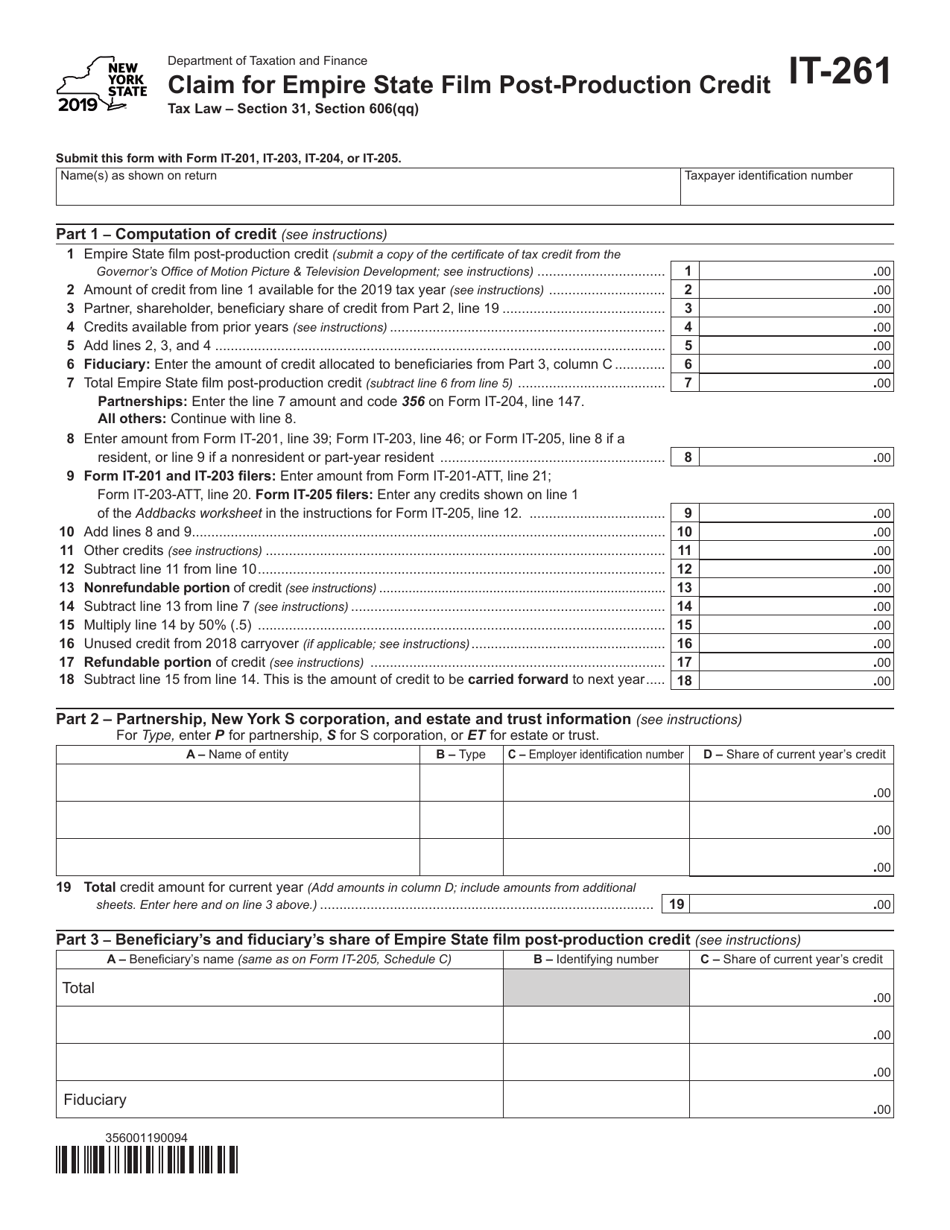

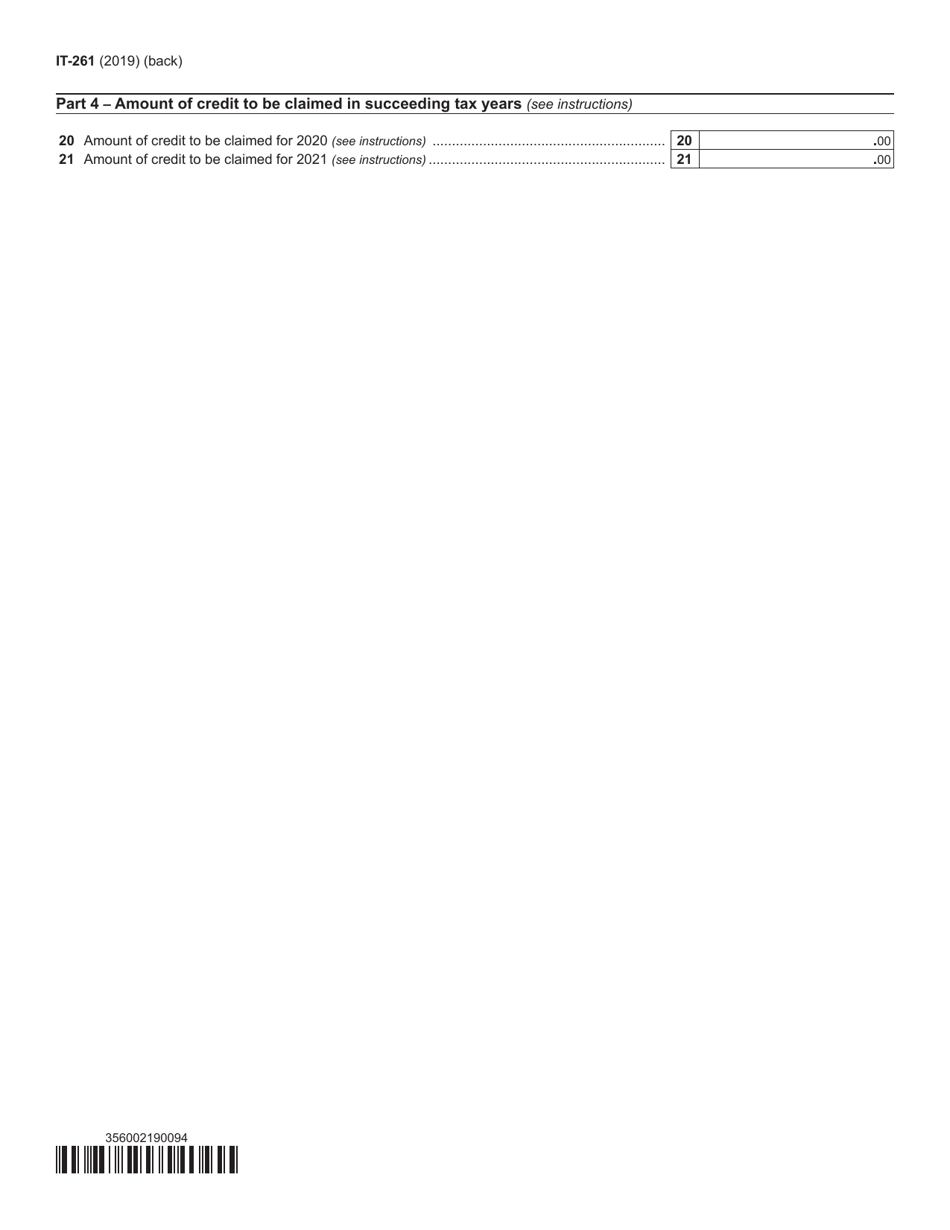

Form IT-261

for the current year.

Form IT-261 Claim for Empire State Film Post-production Credit - New York

What Is Form IT-261?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-261?

A: Form IT-261 is a tax form used to claim the Empire State Film Post-production Credit in New York.

Q: Who can use Form IT-261?

A: Filmmakers and production companies that meet the eligibility requirements can use Form IT-261 to claim the Empire State Film Post-production Credit in New York.

Q: What is the Empire State Film Post-production Credit?

A: The Empire State Film Post-production Credit is a tax credit available to film and television production companies that do post-production work in New York.

Q: What expenses are eligible for the credit?

A: Expenses related to post-production work done in New York, such as editing, sound mixing, and visual effects, are eligible for the credit.

Q: What is the benefit of claiming the credit?

A: Claiming the Empire State Film Post-production Credit can reduce the taxes owed by film and television production companies in New York.

Q: How do I claim the credit?

A: To claim the Empire State Film Post-production Credit, you need to complete and submit Form IT-261 along with any required supporting documentation to the New York State Department of Taxation and Finance.

Q: Are there any deadlines for filing Form IT-261?

A: Yes, the deadline for filing Form IT-261 is generally the same as the deadline for filing your New York State tax return, which is April 15th.

Q: Do I need to include any supporting documentation with Form IT-261?

A: Yes, you need to include supporting documentation that proves your eligibility for the credit, such as copies of contracts, invoices, and receipts.

Q: Can I claim the credit if I did post-production work in another state?

A: No, the Empire State Film Post-production Credit is specifically for post-production work done in New York, so you can only claim the credit if your work was done in the state.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-261 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.