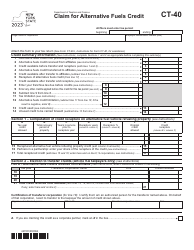

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-253

for the current year.

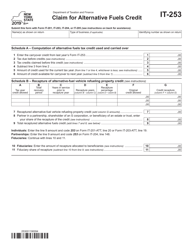

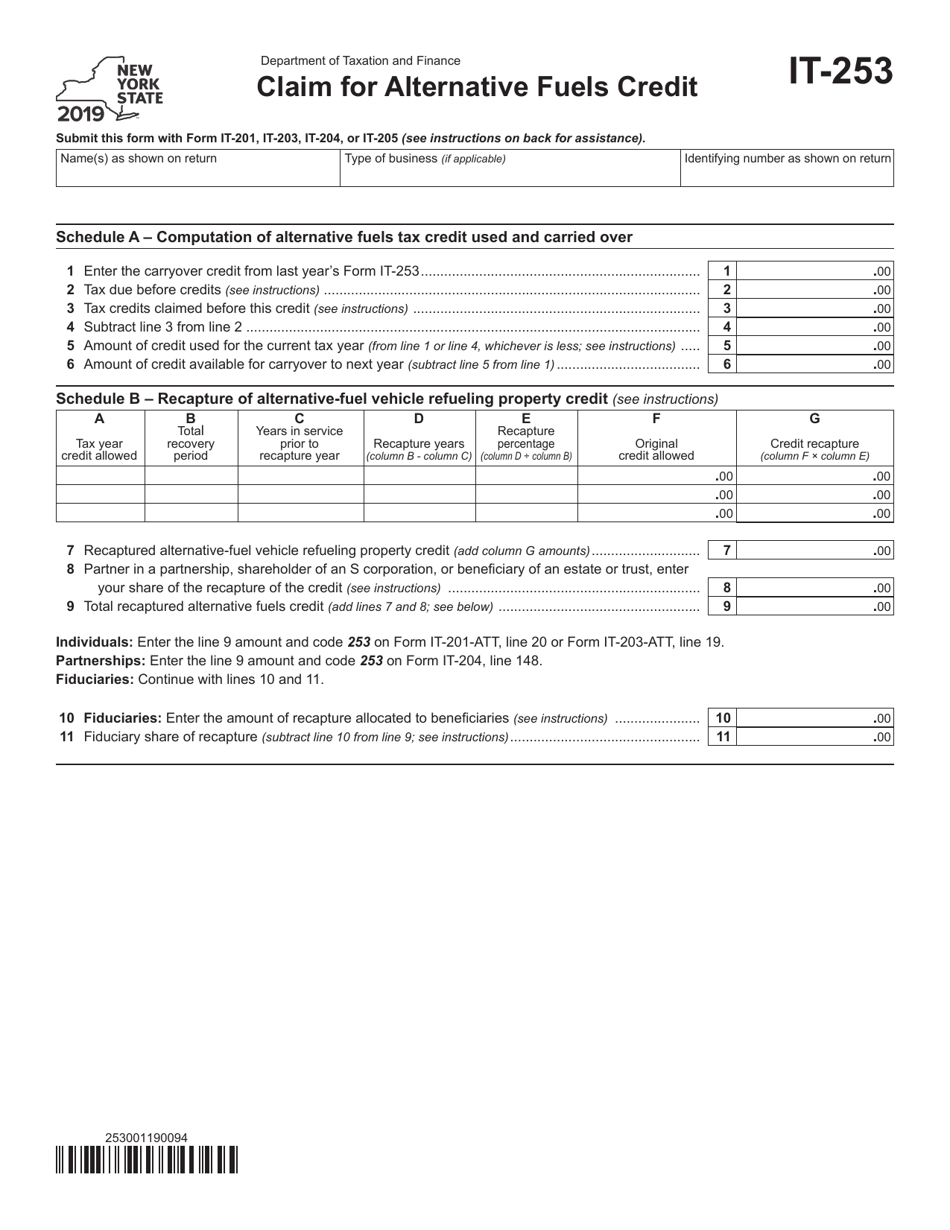

Form IT-253 Claim for Alternative Fuels Credit - New York

What Is Form IT-253?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-253?

A: Form IT-253 is the Claim for Alternative Fuels Credit form used in the state of New York.

Q: What is the Alternative Fuels Credit?

A: The Alternative Fuels Credit is a tax credit provided to individuals and businesses that use alternative fuels to power their vehicles.

Q: Who is eligible to claim the Alternative Fuels Credit?

A: Both individuals and businesses in New York who use alternative fuels for their vehicles may be eligible to claim the credit.

Q: What types of alternative fuels are eligible for the credit?

A: Common alternative fuels eligible for the credit include electricity, natural gas, propane, and hydrogen.

Q: How do I claim the Alternative Fuels Credit?

A: To claim the credit, you must fill out Form IT-253 and submit it with your New York state tax return.

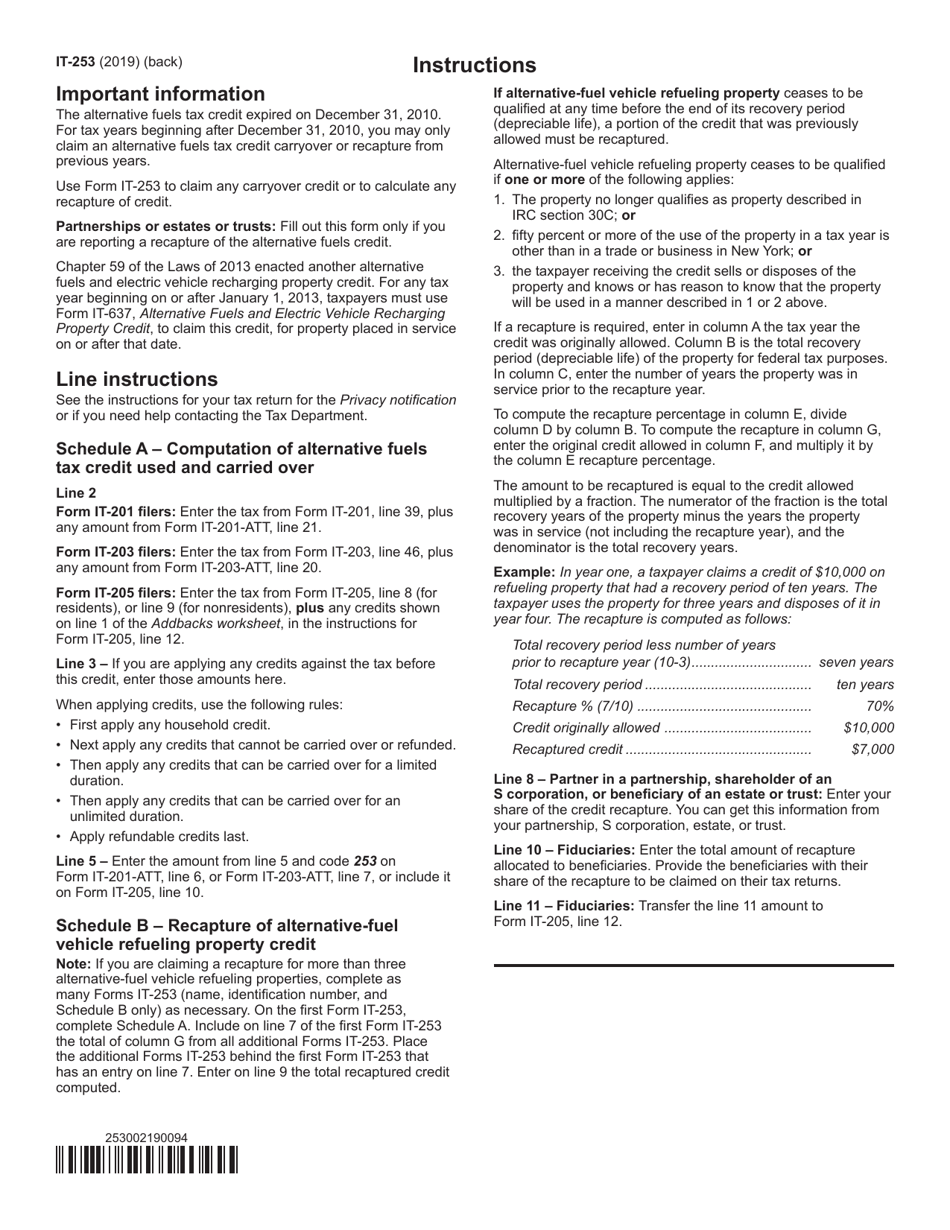

Q: Are there any limitations on the Alternative Fuels Credit?

A: Yes, there are limitations on the credit, such as maximum credit amounts and income restrictions. It is recommended to refer to the instructions and guidelines provided with the form.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-253 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.