This version of the form is not currently in use and is provided for reference only. Download this version of

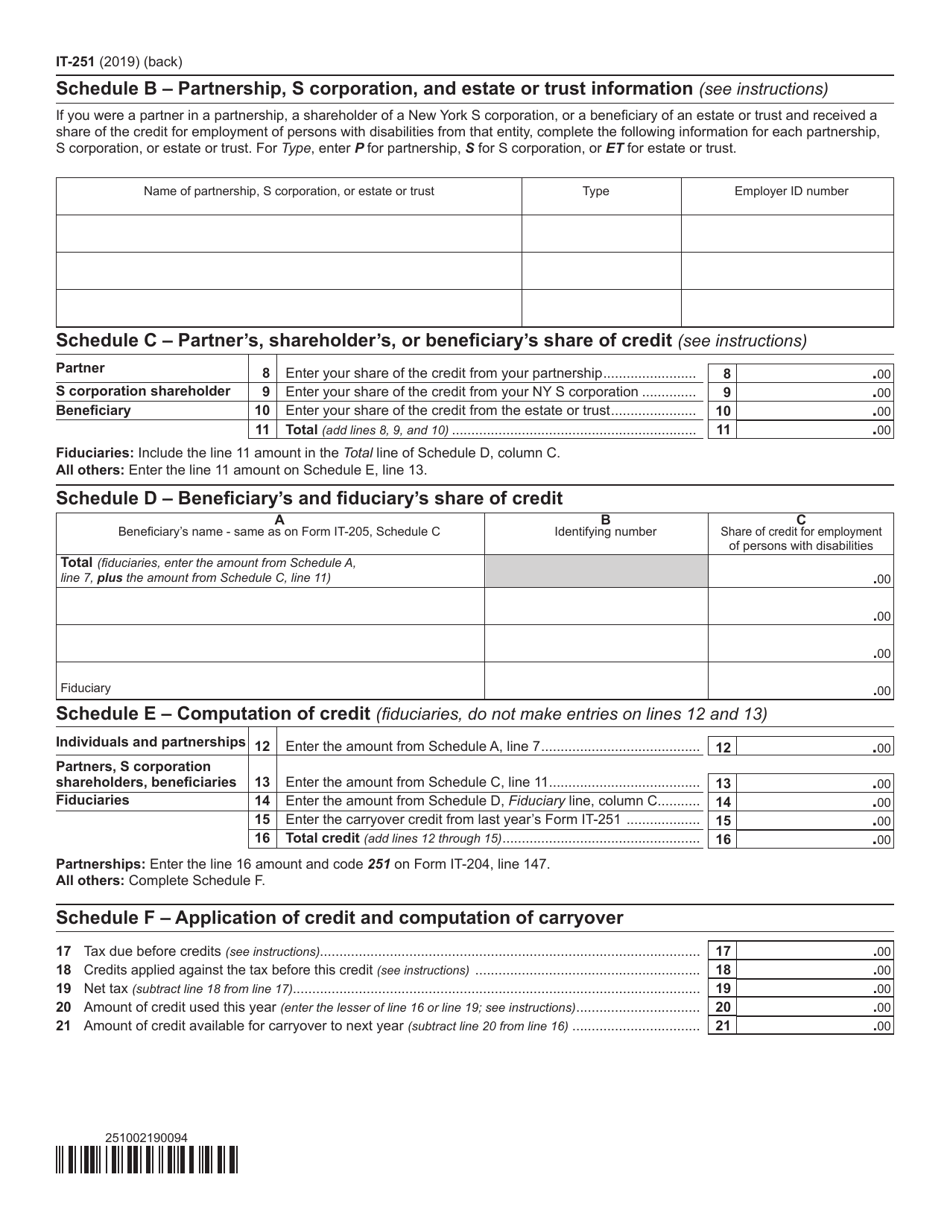

Form IT-251

for the current year.

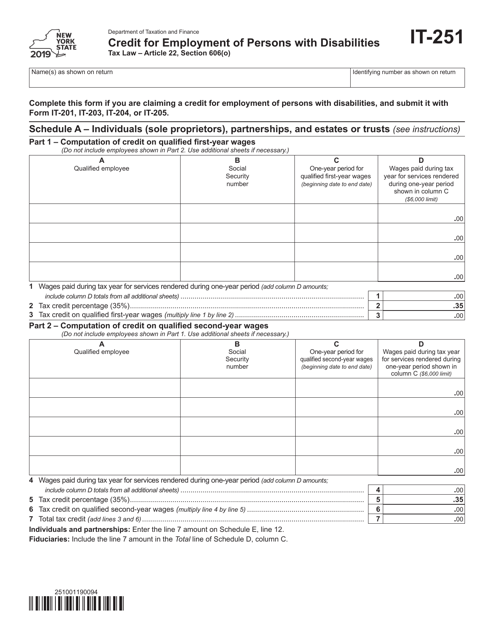

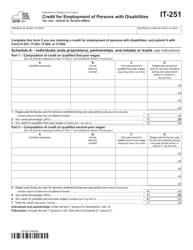

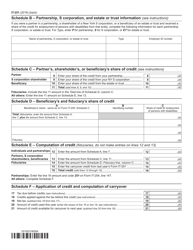

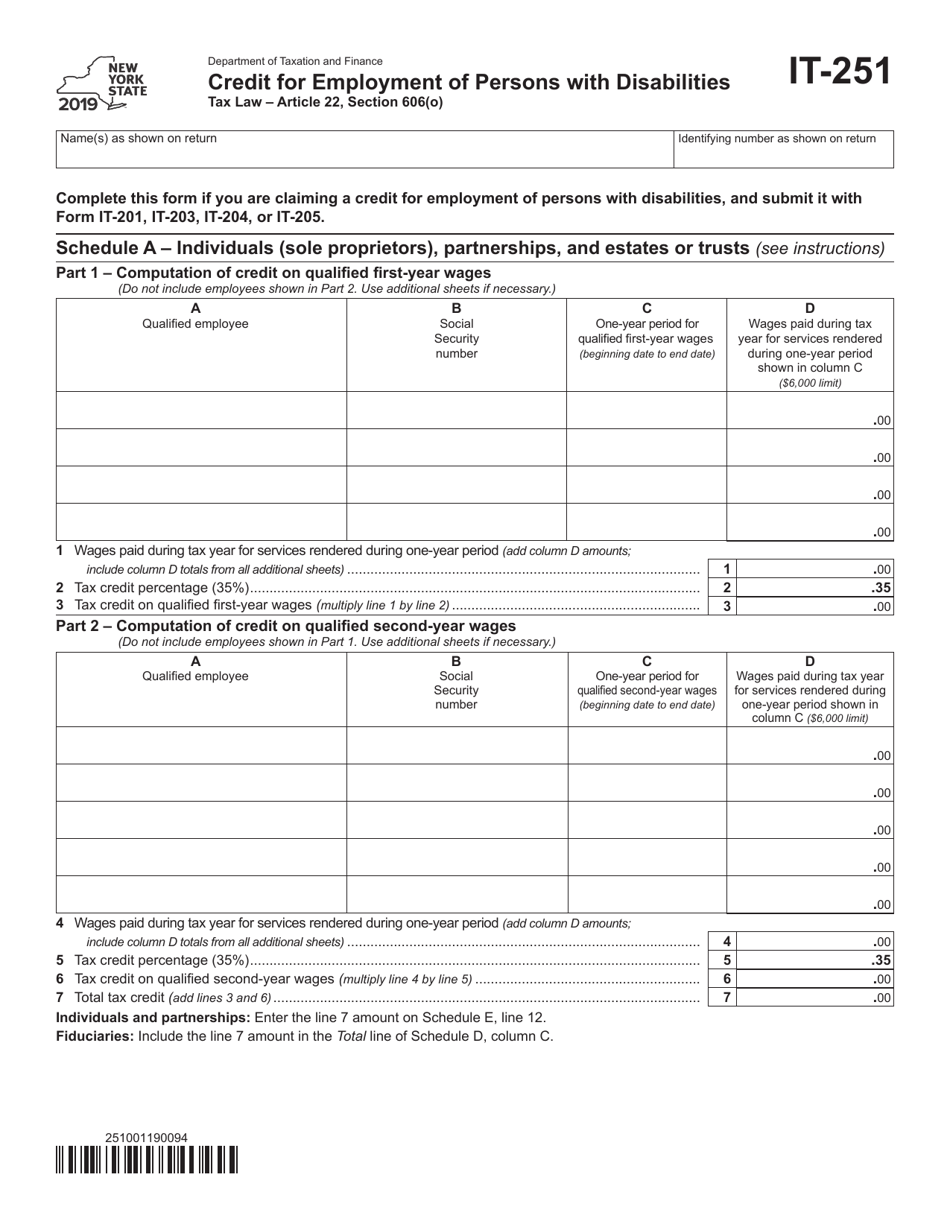

Form IT-251 Credit for Employment of Persons With Disabilities - New York

What Is Form IT-251?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-251?

A: Form IT-251 is the Credit for Employment of Persons With Disabilities form in New York.

Q: Who is eligible for the Credit for Employment of Persons With Disabilities?

A: Employers in New York who hire individuals with disabilities are eligible for this credit.

Q: What is the purpose of Form IT-251?

A: Form IT-251 is used to claim the credit for employing individuals with disabilities in New York.

Q: What information is needed to complete Form IT-251?

A: You will need to provide details about the employees with disabilities you have hired, including their names and Social Security numbers.

Q: When is Form IT-251 due?

A: Form IT-251 is generally due on or before April 15th, following the tax year for which the credit is being claimed.

Q: Is there a limit on the amount of credit that can be claimed?

A: Yes, there is a maximum credit amount that can be claimed per employee with a disability.

Q: Can the credit be carried forward or backward?

A: The credit cannot be carried forward or backward; it must be claimed in the tax year in which the employees were hired.

Q: Are there any additional requirements for claiming the credit?

A: Yes, there are specific requirements that must be met for an employer to claim the Credit for Employment of Persons With Disabilities. These requirements include keeping proper documentation and meeting certain wage criteria.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-251 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.