This version of the form is not currently in use and is provided for reference only. Download this version of

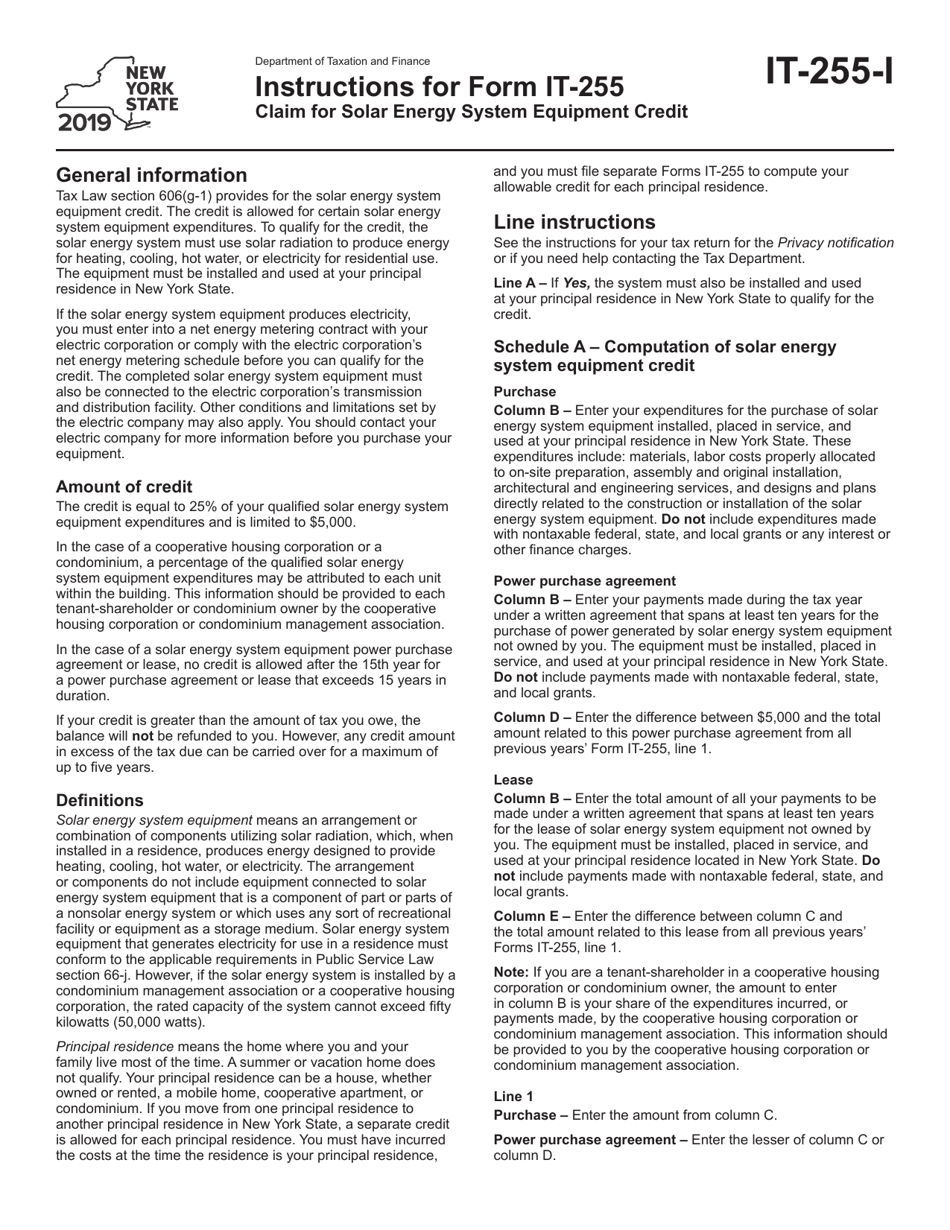

Instructions for Form IT-255

for the current year.

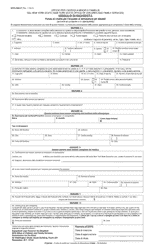

Instructions for Form IT-255 Claim for Solar Energy System Equipment Credit - New York

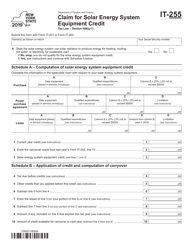

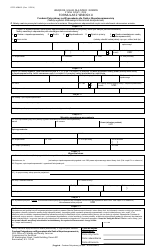

This document contains official instructions for Form IT-255 , Claim for Solar Energy System Equipment Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-255 is available for download through this link.

FAQ

Q: 1. Who can claim the solar energy system equipment credit?

A: The credit can be claimed by individuals and businesses that have installed eligible solar energy equipment in New York State.

Q: 2. What is the maximum amount of the credit?

A: The maximum amount of the credit is $5,000 or 25% of the cost of the equipment, whichever is less.

Q: 3. What is the eligibility period for claiming the credit?

A: The equipment must be installed and placed in service between January 1, 2006, and December 31, 2024.

Q: 4. Can the credit be carried forward?

A: Yes, any unused portion of the credit can be carried forward for up to five years.

Q: 5. What documentation is required to claim the credit?

A: Documentation such as receipts, invoices, and proof of payment must be provided to support the claim.

Q: 6. Are residential solar energy systems eligible for the credit?

A: Yes, residential solar energy systems are eligible for the credit.

Q: 7. Are there any limitations on the credit?

A: Yes, the credit is subject to certain limitations based on the taxpayer's tax liability and the equipment cost.

Q: 8. Can the credit be claimed for leased equipment?

A: No, the credit can only be claimed for equipment that is owned by the taxpayer.

Q: 9. Are there any other requirements to claim the credit?

A: Yes, the taxpayer must also meet the requirements of the federal residential energy efficient property credit.

Q: 10. Are there any additional forms to be filed to claim the credit?

A: Yes, the taxpayer must also file Form IT-255 and include it with their New York State income tax return.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.