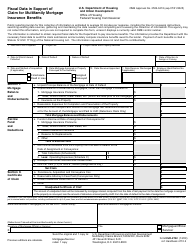

This version of the form is not currently in use and is provided for reference only. Download this version of

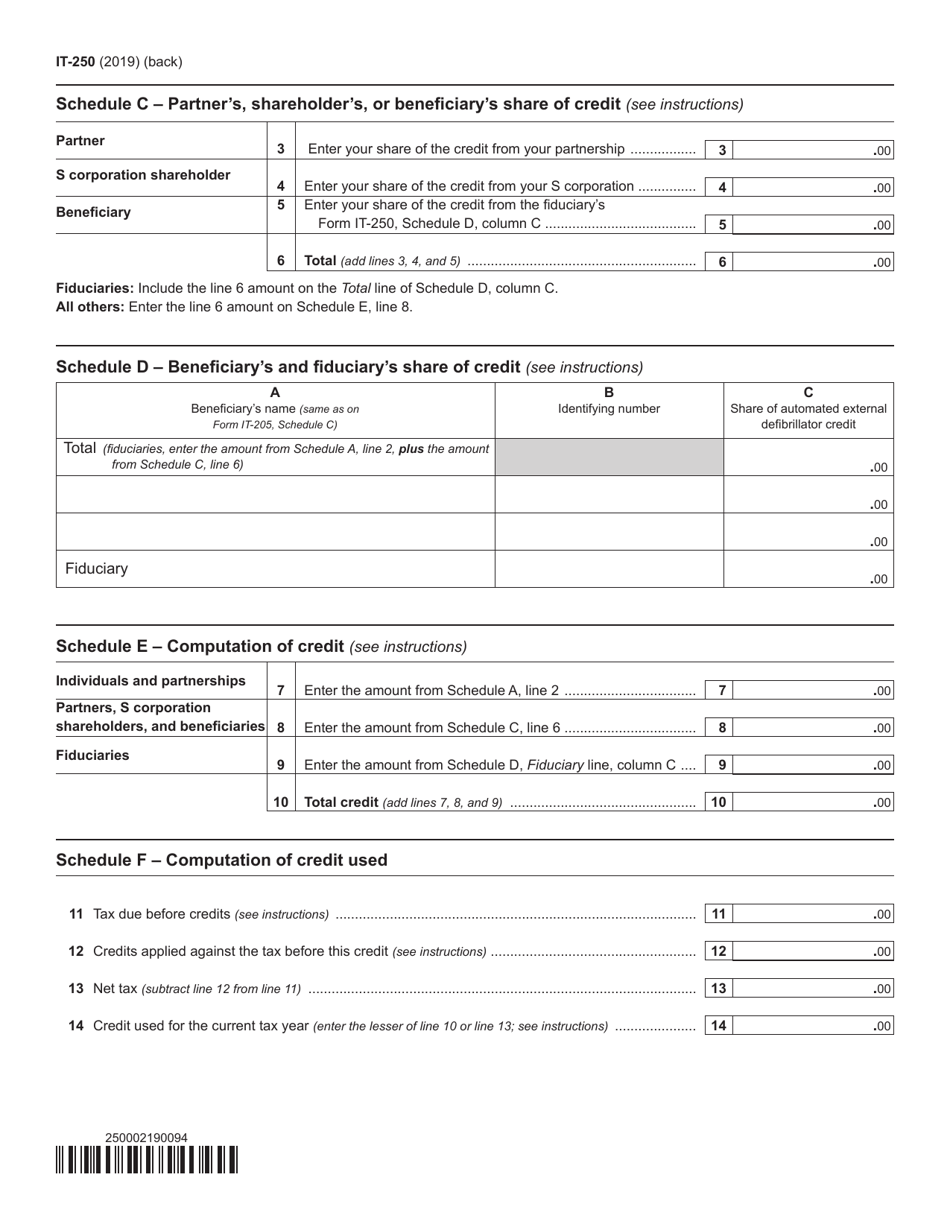

Form IT-250

for the current year.

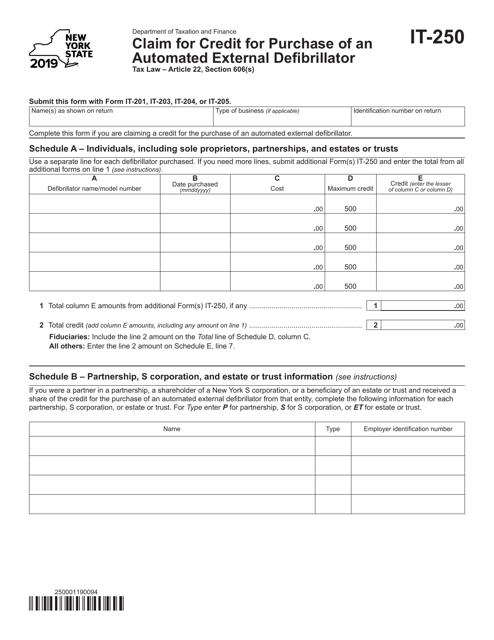

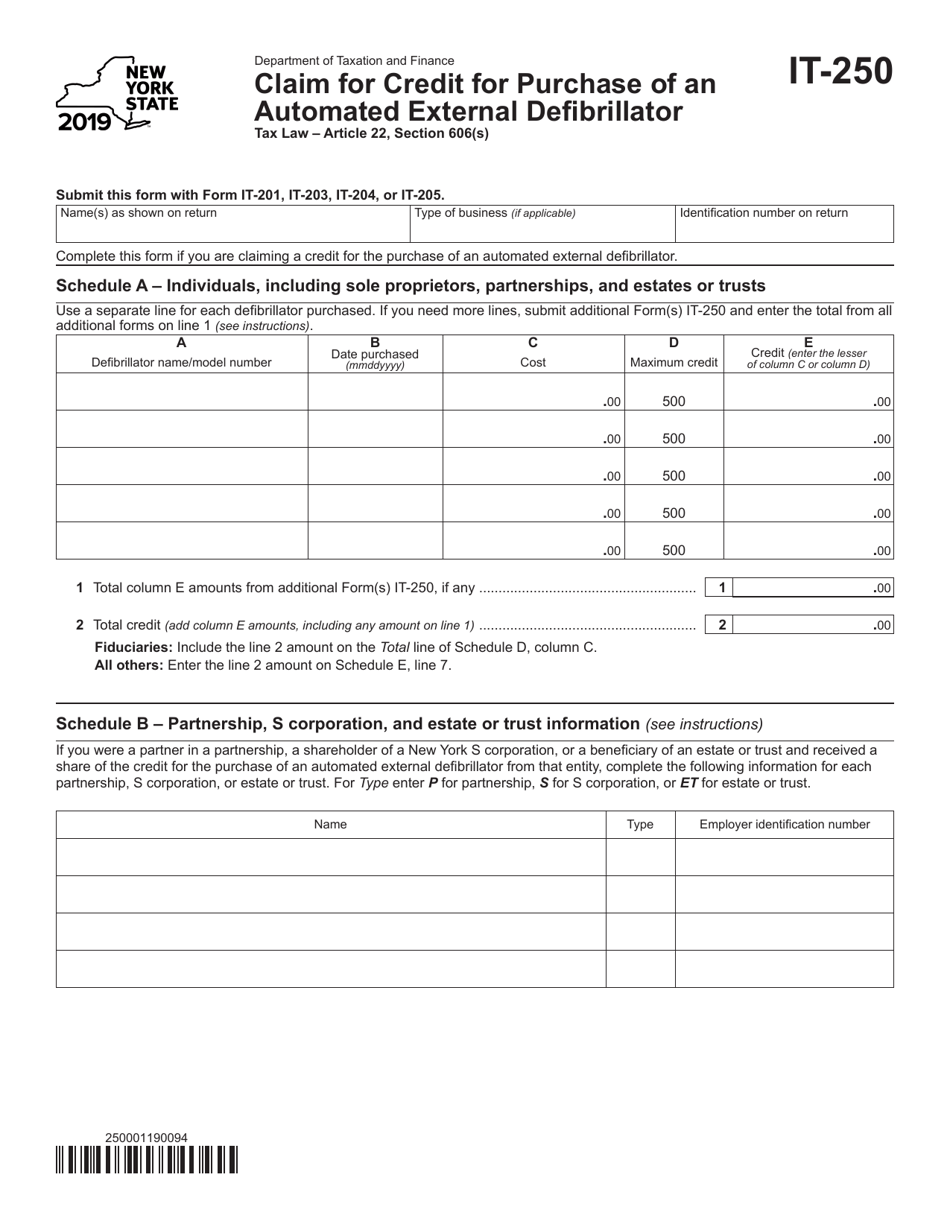

Form IT-250 Claim for Credit for Purchase of an Automated External Defibrillator - New York

What Is Form IT-250?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-250?

A: Form IT-250 is a claim for credit for the purchase of an Automated External Defibrillator (AED) in New York.

Q: Who is eligible to claim this credit?

A: Individuals, corporations, partnerships, and LLCs that have purchased an AED for use in New York are eligible to claim this credit.

Q: What is the purpose of this credit?

A: The purpose of this credit is to encourage the purchase of AEDs to help in emergency situations and save lives.

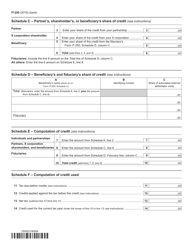

Q: How much is the credit?

A: The credit is equal to 50% of the purchase price of the AED, up to a maximum credit of $500.

Q: What are the requirements to claim the credit?

A: To claim the credit, you must have purchased and placed the AED in service during the tax year for which you are claiming the credit.

Q: How do I claim the credit?

A: To claim the credit, you must complete and file Form IT-250 with your New York State tax return.

Q: Are there any limitations to the credit?

A: Yes, the total credit allowed for all taxpayers in New York is limited to $10 million per year.

Q: What supporting documentation is required?

A: You must attach a copy of the receipt or other documentation showing the purchase of the AED and the date it was placed in service.

Q: Is there a deadline for claiming the credit?

A: Yes, the deadline for claiming the credit is the same as the due date for filing your New York State tax return, usually April 15th.

Q: Can the credit be carried forward or back?

A: No, the credit cannot be carried forward or back, so it must be claimed in the year the AED was purchased.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-250 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.